Ltcg Tax Rate For Ay 2022 23 Web Result Nov 21 2023 nbsp 0183 32 The 2023 2024 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Unlike the long term capital gains tax rate there is no 0 percent rate or 20

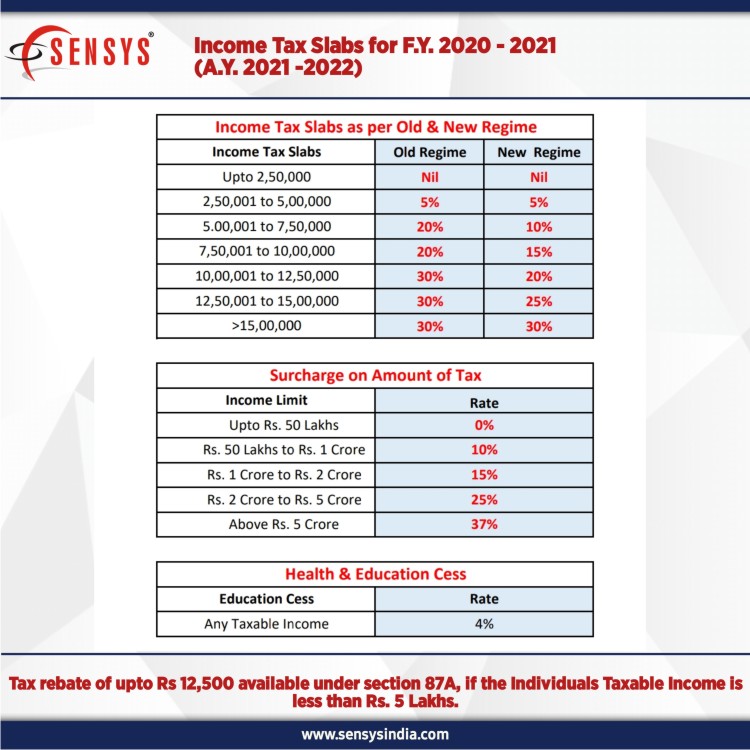

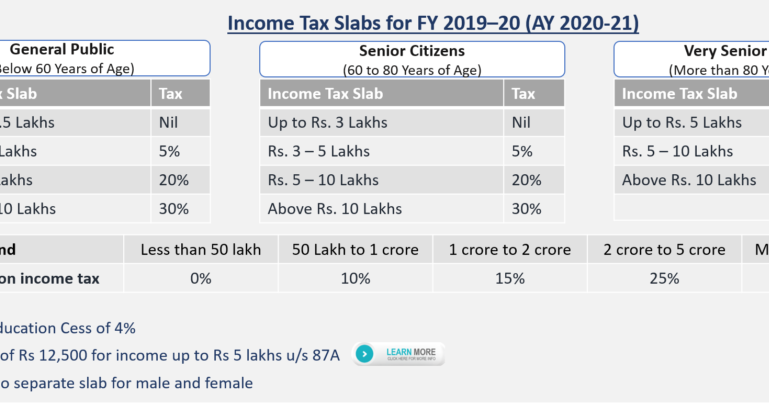

Web Result May 11 2023 nbsp 0183 32 You don t incur LTCG tax on capital gains from ELSS up to Rs 1 lakh However you have to pay long term capital gains tax on Rs 1 50 000 Rs 1 00 000 Rs 50 000 at 10 You will incur an LTCG tax of Rs 5 000 10 of Rs 50 000 on your capital gains from ELSS Web Result Oct 3 2022 nbsp 0183 32 At present for an individual assesse the LTCG tax rate surcharge on assets is 10 if the income is between Rs 50 lakh and Rs 1 crore If the income is more than Rs 1 crore but less than Rs 2 crores the rate is 15 and if the income is between Rs 2 crores and Rs 5 crores the surcharge is 25

Ltcg Tax Rate For Ay 2022 23

Ltcg Tax Rate For Ay 2022 23

Ltcg Tax Rate For Ay 2022 23

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2021/02/New-Tax-Regime-Income-Tax-Slab-FY-2021-22-AY-2022-23-ArthikDisha.png

Web Result Feb 7 2021 nbsp 0183 32 Income Tax Rates applicable for Individuals Hindu Undivided Family HUF Association of Persons AOP and Body of Individuals BOI in India is as under Assessment Year 2022 23 Relevant to Financial Year 2021 22 Kindly note there is no change in Income Tax slabs Income Tax rates and surcharge rates in

Templates are pre-designed files or files that can be utilized for numerous functions. They can save effort and time by providing a ready-made format and design for developing different type of material. Templates can be utilized for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Ltcg Tax Rate For Ay 2022 23

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

What Is Capital Gains Tax Rate 2022 Latest News Update

Income Tax Return Due Date Fy 2021 22 Ay 2022 23will Itr Due Date

How To Disclose Capital Gains In Your Income Tax Return Livemint

Income Tax Useful Information In Gujarati For AY 2020 21

https://cleartax.in/s/ltcg-calculator

Web Result The long term capital gains tax is charged at the rate of 10 on the gains above Rs 1 lakh in a financial year Short term capital gains tax is charged at the rate of 15 What is an LTCG Calculator Long Term Capital Gains Tax Calculator

https://www.livemint.com/money/personal-finance/...

Web Result Apr 3 2022 nbsp 0183 32 Income tax rules for levying surcharge on LTCG Long Term Capital Gain tax is one of them From 1st April 2022 15 per cent surcharge on LTCG on sale of listed stocks or mutual funds has

https://m.economictimes.com/wealth/tax/budget-2023...

Web Result Feb 1 2023 nbsp 0183 32 This would effectively mean that taxation of long term capital gain LTCG and short term capital gain STCG made on assets would continue to be the same in the upcoming financial year 2023 24 as

https://economictimes.indiatimes.com/wealth/tax/...

Web Result Feb 1 2022 nbsp 0183 32 Story outline At present the surcharges on long term capital gain for an individual assessee on assets is 10 if the income is above Rs 50 lakh but upto Rs 1 crore It is 15 if the income is between Rs 1 crore to Rs 2 crore and 25 if the income is above Rs 2 crore and upto Rs 5 crore In case the income is above Rs 5

https://cleartax.in/s/capital-gains-income

Web Result May 22 2023 nbsp 0183 32 Capital Gains Tax Any profit or gain that arises from the sale of a capital asset is a capital gain This gain is charged to tax in the year in which the transfer of the capital asset takes place Know about LTCG amp STCG assets calculation exemption amp how to save tax on agricultural land

Web Result Jun 15 2022 nbsp 0183 32 The Central Board of Direct Taxes CBDT notified the cost inflation index for FY 2022 23 via a notification dated June 14 2022 The Cost Inflation Index for FY 2022 23 relevant to AY 2023 24 is 331 For the previous year i e FY 2021 22 the CII was notified as 317 Web Result Feb 4 2022 nbsp 0183 32 This article summarizes Tax Rates Surcharge Health amp Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident amp Non Resident Hindu undivided family Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical

Web Result Feb 1 2022 nbsp 0183 32 The minister said the government would cap long term capital gains tax on all equity investments at 15 percent which is expected to benefit unlisted companies in India