Irs Tax Tables 2022 For Seniors Over 65 Mar 7 2024 nbsp 0183 32 Single taxpayers who are at least age 65 by the last day of 2023 can add 1 950 to their standard deduction when they file their 2023 tax return in 2024 Joint filers can claim an

Jan 4 2023 nbsp 0183 32 For tax year 2022 the base standard deductions before the bonus add on for older adults are 25 900 for married taxpayers who file jointly and qualifying widow er s 19 400 Jan 18 2022 nbsp 0183 32 MSWM 2022 Income Tax Tables 2022 Tax Rate Schedule TAXABLE INCOME OVER NOT OVER BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE OF THE

Irs Tax Tables 2022 For Seniors Over 65

Irs Tax Tables 2022 For Seniors Over 65

Irs Tax Tables 2022 For Seniors Over 65

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for

Pre-crafted templates offer a time-saving solution for developing a diverse variety of documents and files. These pre-designed formats and layouts can be used for various personal and professional jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material development process.

Irs Tax Tables 2022 For Seniors Over 65

Tax Tables 2021 Brandingnored

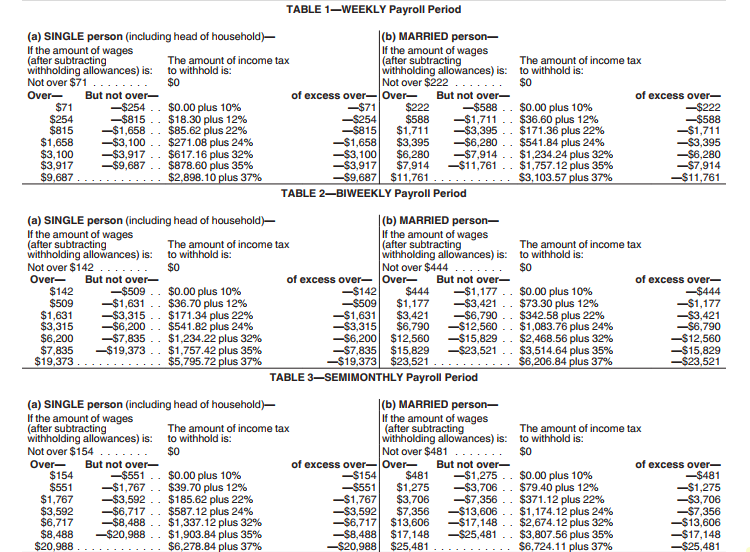

IRS Weekly Withholding Income Tax Table Federal Withholding Tables 2021

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

2022 Tax Brackets Irs Calculator

Sars Tax Tables 2022 Pocket Guidelines Brokeasshome

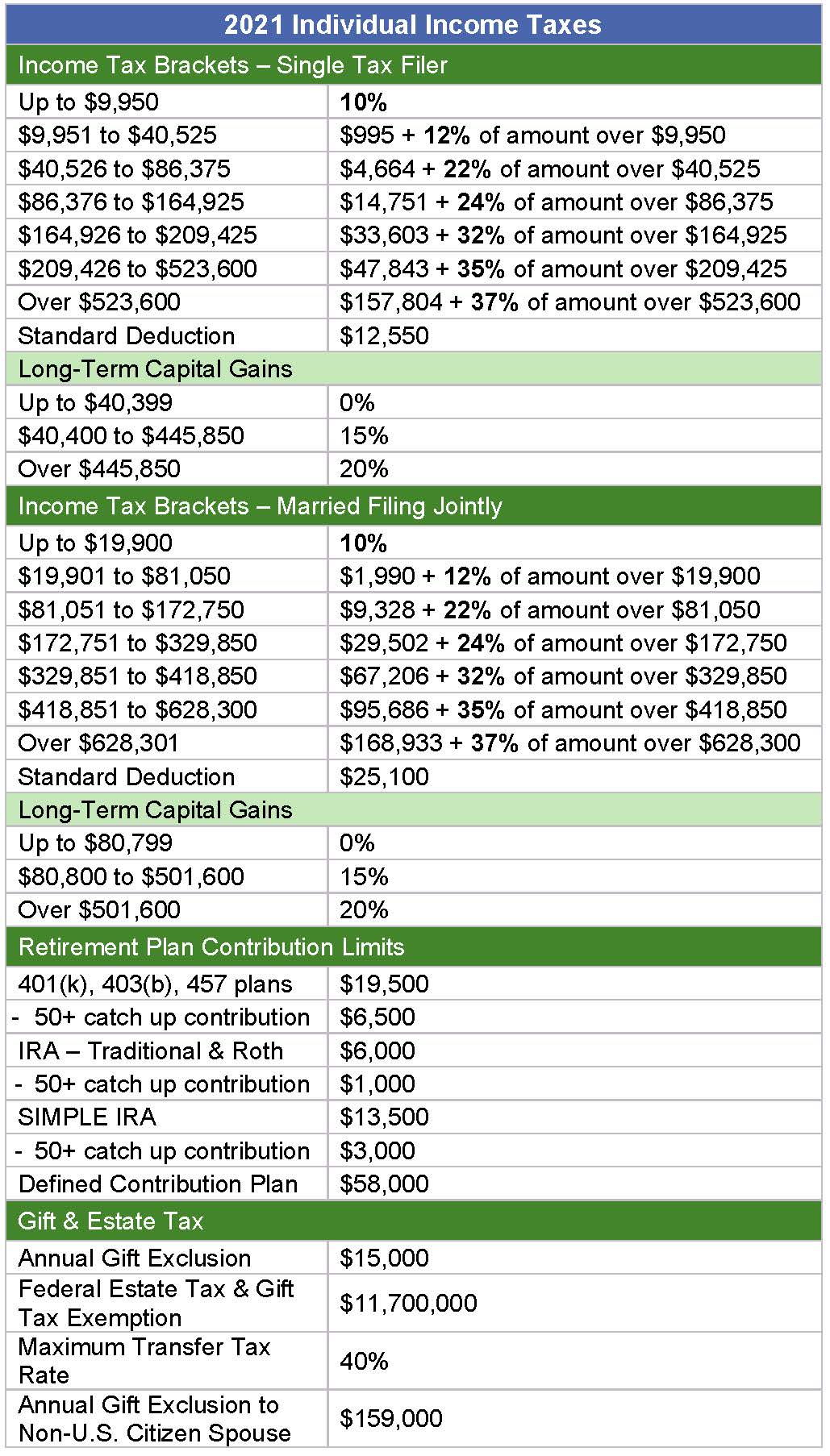

2021 IRS Tax Brackets Table Federal Withholding Tables 2021

https://www.irs.gov/forms-pubs/about-form-1040-sr

Information about Form 1040 SR U S Tax Return for Seniors including recent updates related forms and instructions on how to file Form 1040 SR is available as an optional alternative to

https://www.irs.com/en/2022-federal-income-tax...

Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax

https://www.purposefulfinance.org/hom…

Dec 2 2021 nbsp 0183 32 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate

https://www.kiplinger.com/taxes/extra-standard...

Feb 22 2024 nbsp 0183 32 For 2023 tax returns typically filed in April 2024 the standard deduction amounts are 13 850 for single and for those who are married filing separately 27 700 for those

Jan 31 2023 nbsp 0183 32 Citations Publication 554 2022 DOCUMENT ATTRIBUTES Institutional Authors Internal Revenue Service Subject Area Tax Topics Individual income taxation Jurisdictions Nov 8 2023 nbsp 0183 32 If you re age 65 or older at the end of the tax year or you re under age 65 and retired on permanent and total disability with disability income you may qualify for the Tax

Dec 22 2023 nbsp 0183 32 When you turn 65 the IRS offers you a tax benefit in the form of an extra standard deduction for people age 65 and older For example a single 64 year old taxpayer can claim a