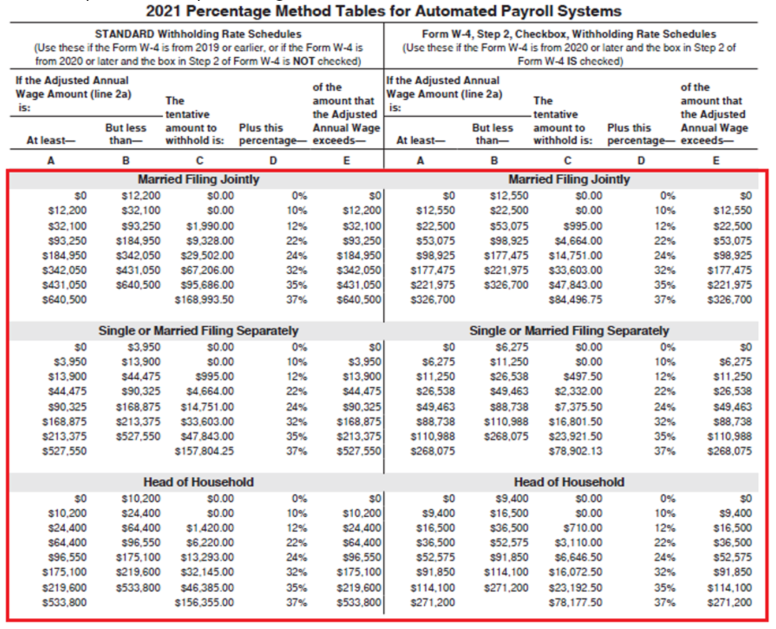

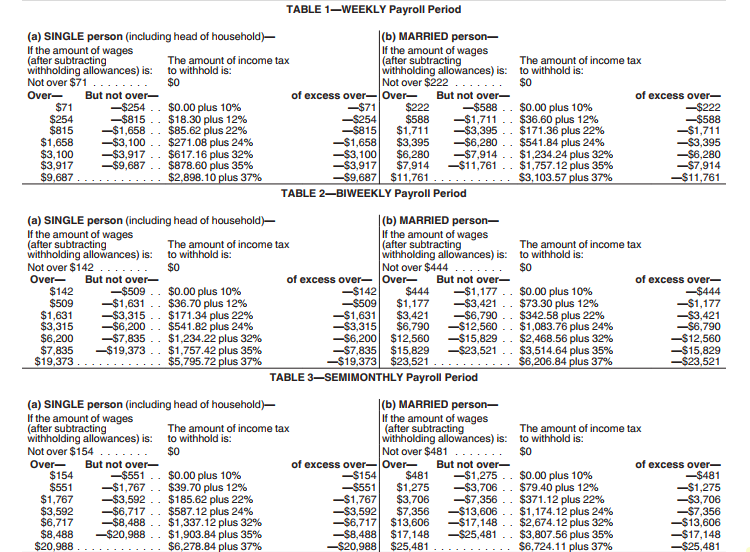

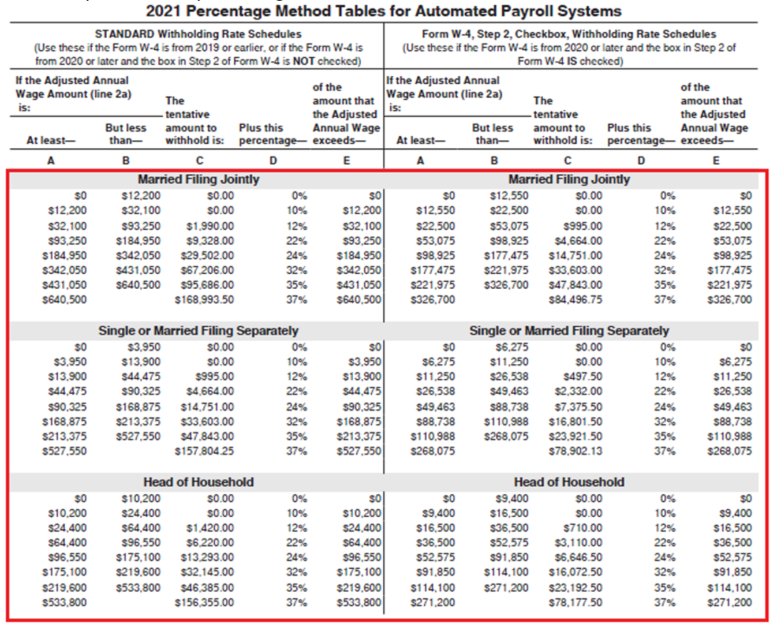

Irs Tax Tables 2022 For Payroll Web Dec 23 2021 nbsp 0183 32 On Dec 3 2021 IRS released a draft version of the publication which contains seven federal income tax withholding methods They are Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities Wage Bracket Method Tables for Manual Payroll Systems With Forms W

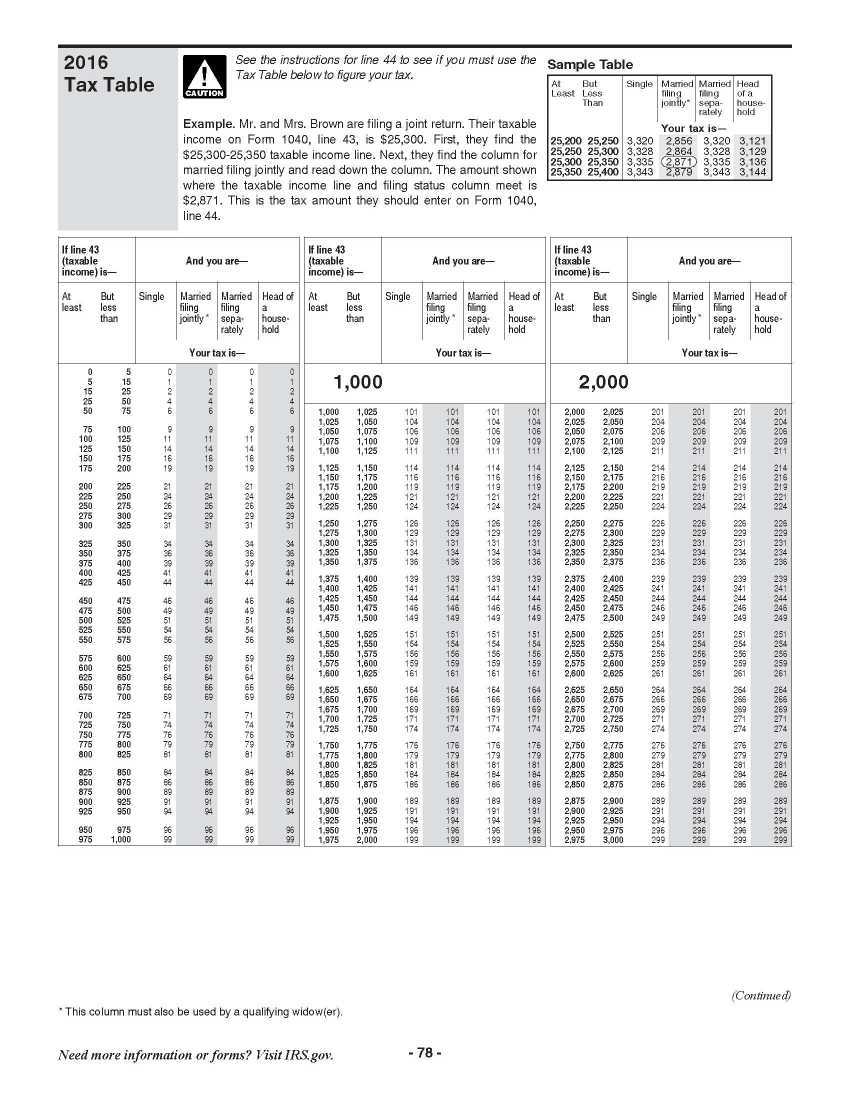

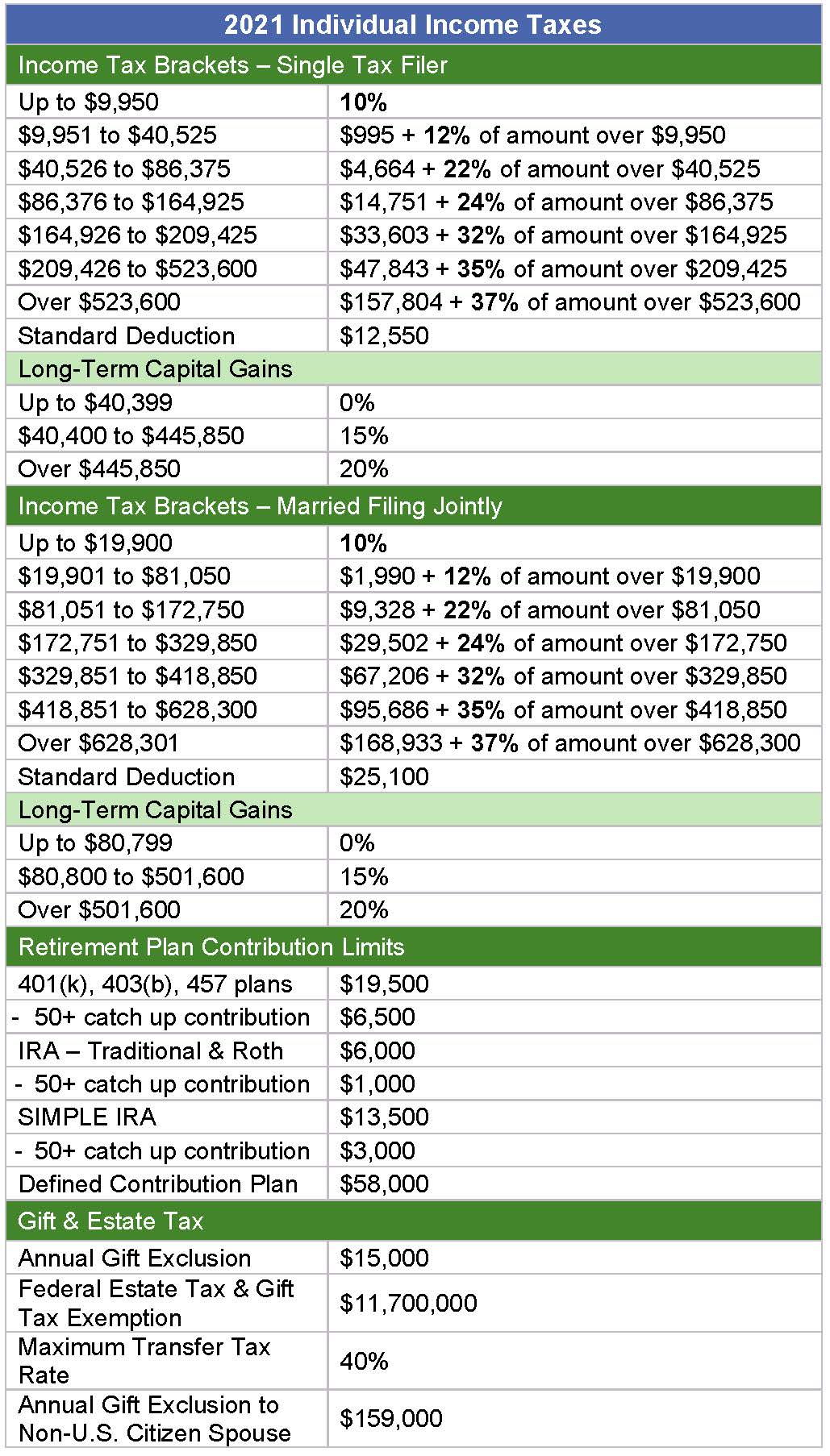

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation Web Tax Tables 2022 Edition 2022 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2022 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax all net unearned income over a threshold amount of 2 300 for 2022 is taxed using the brackets and rates of the

Irs Tax Tables 2022 For Payroll

Irs Tax Tables 2022 For Payroll

Irs Tax Tables 2022 For Payroll

https://federalwithholdingtables.net/wp-content/uploads/2021/07/what-s-coming-9.png

Web Dec 1 2021 nbsp 0183 32 Draft federal income tax withholding tables for 2022 were issued Nov 30 by the Internal Revenue Service The draft tables which generally were adjusted for inflation are to be included in the draft 2022 Publication 15 T Federal Income Tax Withholding Methods The document includes percentage and wage bracket withholding method

Templates are pre-designed documents or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and layout for creating different kinds of material. Templates can be used for personal or expert jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Irs Tax Tables 2022 For Payroll

IRS EZ Tax Table 2023 2024 EduVark

Irs Tax Tables 2021 Calculator Federal Withholding Tables 2021

IRS Weekly Withholding Income Tax Table Federal Withholding Tables 2021

Tax Tables 2021 Brandingnored

Tax Withholding Calculator 2020 MarieBryanni

2022 Tax Table Philippines Latest News Update

https://www.irs.gov/publications/p15t

Web Worksheet 1A Employer s Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems Worksheet 1B Payer s Worksheet for Figuring Withholding From Periodic Pension or Annuity Payments 2 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later 3

https://www.irs.gov/pub/irs-prior/p15t--2022.pdf

Web 1 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities 2 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later 3 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2019 or Earlier 4

https://www.irs.gov/pub/irs-pdf/p15t.pdf

Web 1 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities 2 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later 3 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2019 or Earlier 4

https://www.irs.gov/payments/tax-withholding

Web Nov 24 2023 nbsp 0183 32 Find tax withholding information for employees employers and foreign persons The withholding calculator can help you figure the right amount of withholdings For employees withholding is the amount of federal income tax

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

Web 3 days ago nbsp 0183 32 As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are Web Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

Web Dec 22 2021 nbsp 0183 32 The finalized 2022 Publication 15 T Federal Income Tax Withholding Methods was issued Dec 21 by the Internal Revenue Service Publication 15 T contains withholding methods that are to be used with Forms W 4 Employee s Withholding Certificate completed before 2020 and with forms completed in 2020 and later The