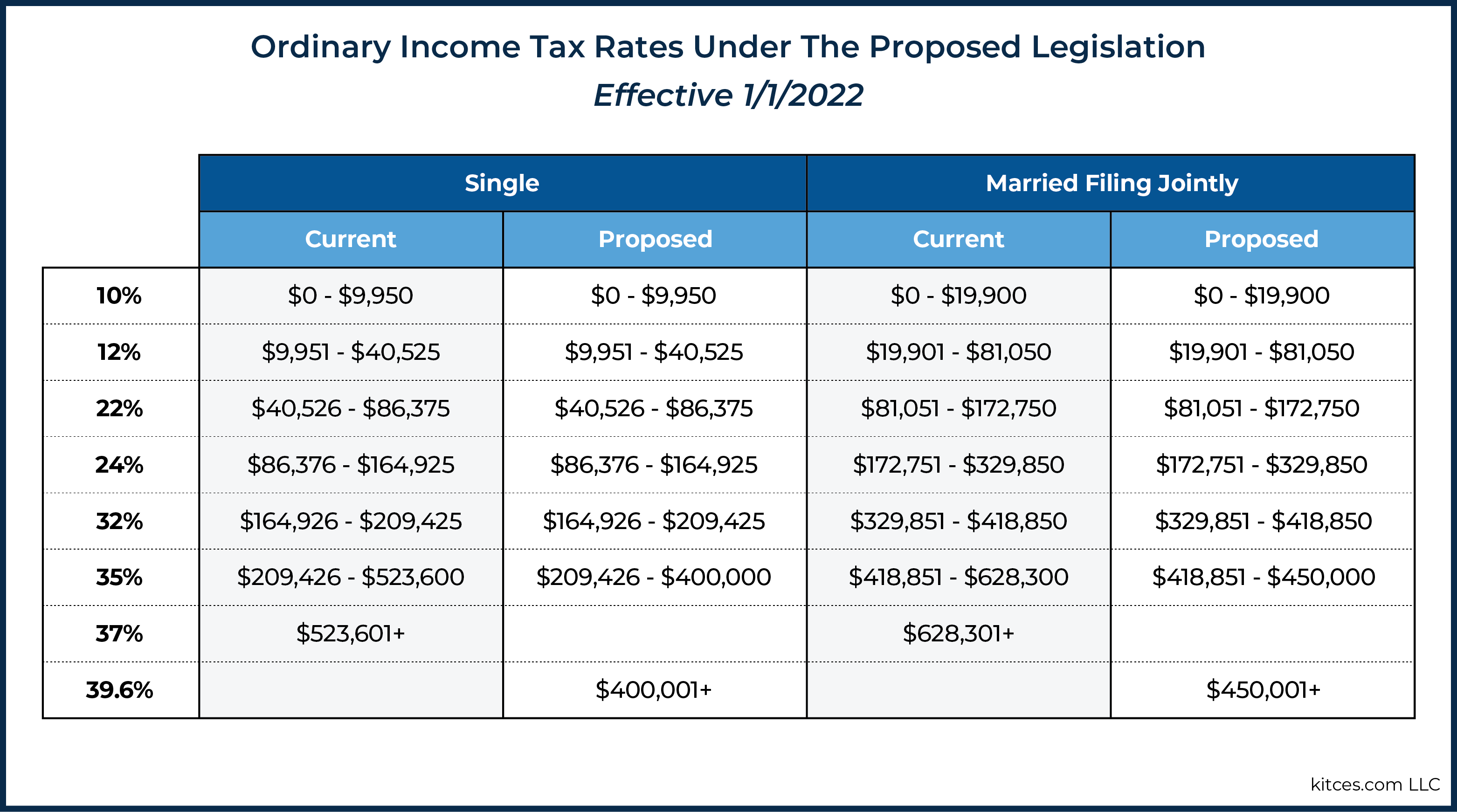

Irs Tax Rates For 2022 WEB Nov 11 2021 nbsp 0183 32 Marginal tax rates for 2022 will not change but the level of taxable income that applies to each rate is going up The top rate of 37 will apply to income over 539 900 for individuals

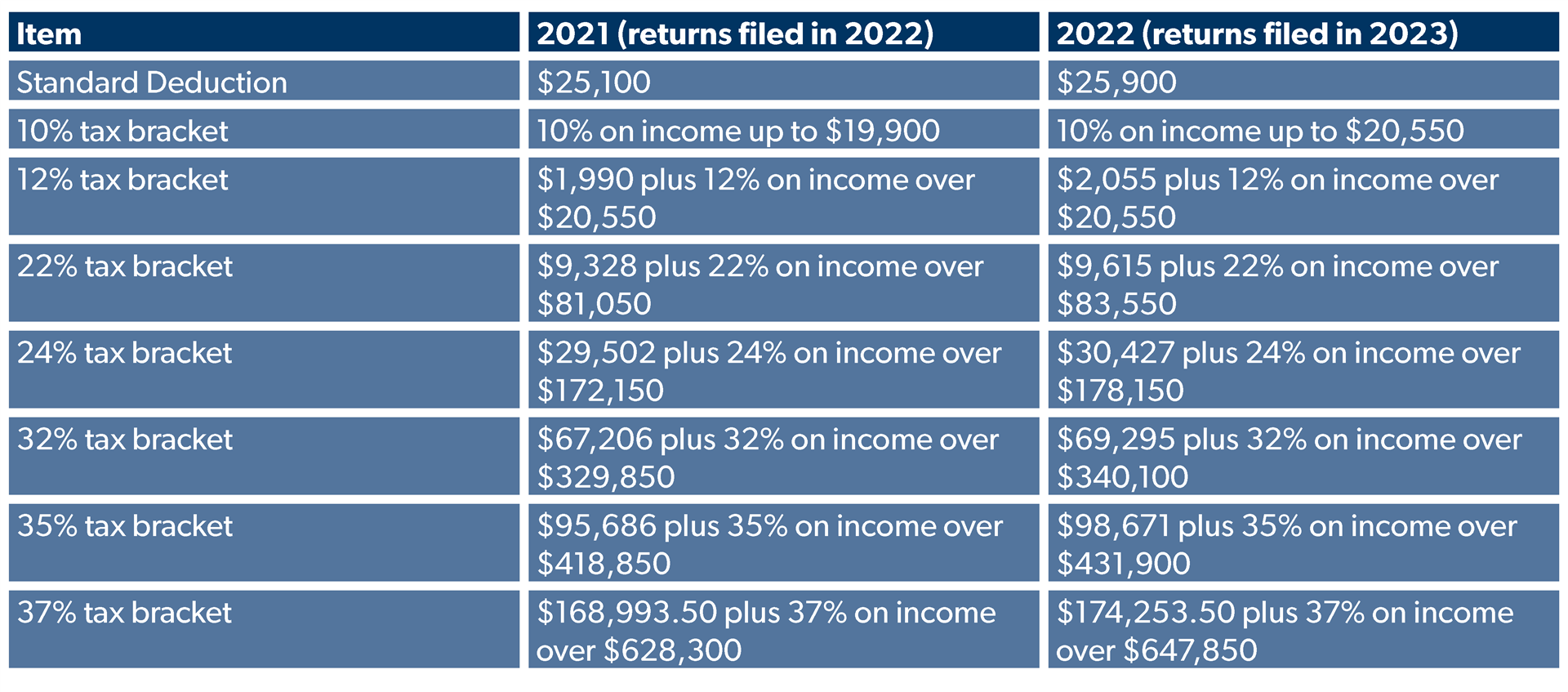

WEB Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for

Irs Tax Rates For 2022

Irs Tax Rates For 2022

Irs Tax Rates For 2022

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your

Pre-crafted templates offer a time-saving service for producing a diverse range of files and files. These pre-designed formats and designs can be utilized for different personal and professional tasks, including resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the content creation procedure.

Irs Tax Rates For 2022

Capital Gains Tax Rate 2021 And 2022 Latest News Update

2021 Tax Brackets Irs Married Filing Jointly

2022 Federal Tax Brackets And Standard Deduction Printable Form

2022 Tax Brackets Irs Calculator

2022 Tax Brackets Married Filing Jointly Irs Printable Form

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

https:// taxfoundation.org /data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income

https://www. irs.gov /newsroom/irs-provides-tax...

WEB Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www. irs.gov /pub/irs-prior/i1040tt--2022.pdf

WEB Sep 27 2022 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile

https://www. irs.gov /applicable-federal-rates

WEB Aug 8 2023 nbsp 0183 32 Home Our Agency Freedom of Information Act Applicable Federal Rates AFRs Rulings Each month the IRS provides various prescribed rates for federal income tax purposes These rates known as Applicable Federal Rates AFRs are regularly published as revenue rulings

https://www. forbes.com /sites/ashleaebeling/2021/11/...

WEB Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

WEB IR 2022 203 November 22 2022 WASHINGTON The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal tax return easier WEB Jan 27 2023 nbsp 0183 32 2022 2023 Federal Income Tax Rates Tax Rates for Your 2022 Taxes Filed in 2023 By William Perez Updated on January 27 2023 Reviewed by David Kindness Fact checked by Daniel Rathburn In This Article View All Photo lechatnoir Getty Images Sources Tax brackets are used to determine how much tax you ll pay on

WEB Dec 2 2021 nbsp 0183 32 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023