Irs Due Date Calendar 2022 Web Oct 19 2023 nbsp 0183 32 Sept 15 2022 Sept 1 Dec 31 Jan 17 2023 The IRS may charge a tax penalty if you don t pay enough or fail to pay on time If you fail to pay your taxes by the due date the IRS will

Web Dec 29 2021 nbsp 0183 32 The only due date for individuals is the monthly tip report Workers who received tips in July must report them to their employer by August 10 September 2022 Tax Due Dates Web 2022 E filing Dates January 24 IRS begins accepting and processing e filed returns and extensions April 18 Tax Day Last day to e file returns and extensions Maine and Massachusetts have until April 19 due to Patriot s Day October 17 Last day to e file returns with a 6 month extension

Irs Due Date Calendar 2022

Irs Due Date Calendar 2022

Irs Due Date Calendar 2022

https://dl-us.com/wp-content/uploads/2021/03/image-1536x1024.jpg

Web Jan 12 2024 nbsp 0183 32 April 15 2024 Tax day unless extended due to local state holiday The tax deadline typically falls on April 15 each year but can be delayed if it falls on a weekend or holiday Missing the tax deadline can have consequences like penalties and interest April 15 2024 Deadline to File Form 4868 and request an extension

Pre-crafted templates use a time-saving service for producing a varied variety of documents and files. These pre-designed formats and layouts can be made use of for numerous individual and expert tasks, including resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the content creation procedure.

Irs Due Date Calendar 2022

irs gov IRS Tax Due Date 2022 When Is The Last Day To File Taxes

4 Things You Need To Know When Filing Your 2020 21 HVUT Form 2290

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg?strip=all)

Irs Calendar 2023 January Calendar 2023

Tax Due Date 2022 Irs Image Ideas

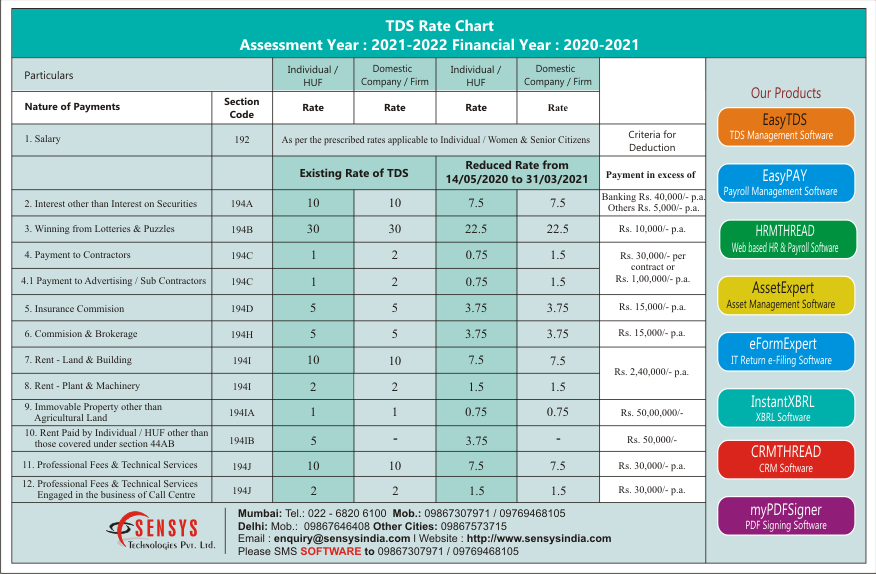

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Tax Refund Calendar 2021 Direct Deposit Printable March

https://www.irs.gov/newsroom/2022-tax-filing...

Web Jan 10 2022 nbsp 0183 32 WASHINGTON The Internal Revenue Service announced that the nation s tax season will start on Monday January 24 2022 when the tax agency will begin accepting and processing 2021 tax year returns The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring

https://www.irs.com/en/2022-federal-tax-calendar

Web Feb 21 2022 nbsp 0183 32 IRS Tax Deadlines for 2022 This is the IRS General Tax Calendar which includes the 2022 due dates that most taxpayers will need to know for their federal taxes IRS Tax Deadlines for the 2022 Calendar Year The tax dates below apply to taxpayers who file based on the calendar year

https://www.irs.gov/filing/individuals/when-to-file

Web Calendar year filers most common File on April 15 2024 Fiscal year filers File on The fourth month after your fiscal year ends day 15 If day 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day

https://www.tax.gov/calendar

Web The Tax Calendar displays tax deposit and filing due dates A form to be filed or a deposit to be made by a particular date is called an quot event quot on that date There are several display modes which allow you to tailor the Tax Calendar display Full month

https://news.bloombergtax.com/payroll/irs-releases-tax-calendars-for-2022

Web Dec 13 2021 nbsp 0183 32 Tax calendars for 2022 were released The publication noted a new federal holiday and deadlines for paying deferred Social Security tax The finalized 2022 version of Publication 509 Tax Calendars was released Dec 10 by the Internal Revenue Service

Web Oct 5 2023 nbsp 0183 32 Deadline for filing a 2022 calendar year C corporation or calendar year estates trusts tax return or extension Due date for first installment of 2023 estimated tax payments Deadline to claim a 2019 tax year refund June 15 2023 Deadline for filing a 2022 personal return for U S citizens or residents living and working abroad including Web Apr 13 2022 nbsp 0183 32 For most taxpayers the main income tax return deadline for 2021 tax returns is April 18 aka IRS Tax Day 2022 The deadline was changed from the usual April 15 because that s the date of

Web A section on how to use the tax calendars Excise Tax Calendar A table showing the semiweekly deposit due dates for payroll taxes for 2024 Most of the due dates discussed in this publication are also included in the online IRS Tax Calendar for Businesses and Self Employed available at IRS gov TaxCalendar