Income Tax Table 2023 Calculator Verkko 20 lokak 2023 nbsp 0183 32 Overall your tax liability for the 2023 tax year will be 15 107 50 1 100 4047 9 960 50 This means that although you fall under the 22 tax rate your

Verkko The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax Verkko 18 lokak 2022 nbsp 0183 32 The tax year 2023 maximum Earned Income Tax Credit amount is 7 430 for qualifying taxpayers who have three or more qualifying children up from

Income Tax Table 2023 Calculator

Income Tax Table 2023 Calculator

Income Tax Table 2023 Calculator

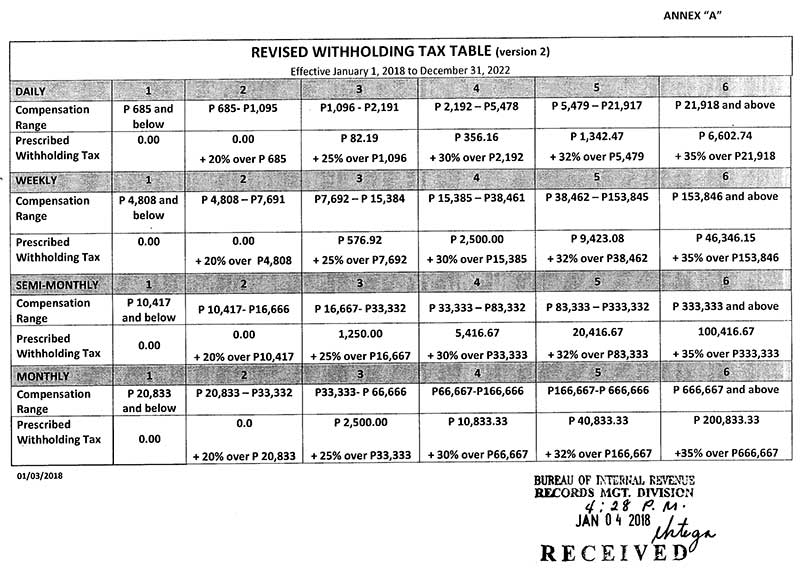

https://taxcalculatorphilippines.com/images/bir-tax-table-for-tax-calculator-philippines.jpg

Verkko 24 182 100 01 231 250 00 32 231 250 01 578 100 00 35 578 100 01 and above 37 You may also be interested in using our free online 2023 Tax

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save time and effort by providing a ready-made format and layout for developing different kinds of material. Templates can be utilized for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Income Tax Table 2023 Calculator

2022 Tax Brackets Irs Calculator

Federal Withholding Tax Table 2022 Vs 2021 Tripmart

Payroll Withholding Calculator 2023 MonaDeimante

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Cukai Pendapatan How To File Income Tax In Malaysia

https://taxfoundation.org/data/all/federal/2023-tax-brackets

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit N 228 yt 228 lis 228 228

https://www.irs.gov/newsroom/this-irs-online-tool-simplifies...

Verkko 16 helmik 2023 nbsp 0183 32 This online tool helps employees withhold the correct amount of tax from their wages It also helps self employed people who have wage income estimate

https://www.nerdwallet.com/taxes/tax-calculator

Verkko 25 hein 228 k 2019 nbsp 0183 32 Estimate how much you ll owe in federal income taxes for tax year 2023 using your income deductions and credits all in just a few steps with our tax

https://turbotax.intuit.com/tax-tools/calculator…

Verkko 8 rivi 228 nbsp 0183 32 Use our Tax Bracket Calculator to understand what tax

https://www.morganstanley.com/.../en/themes/tax/2023-inc…

Verkko 17 tammik 2023 nbsp 0183 32 All net unearned income over a threshold amount of 2 500 for 2023 is taxed using the marginal tax and rates of the child s parents 11 000 44 725

Verkko IR 2023 210 Nov 13 2023 With the nation s tax season rapidly approaching the Internal Revenue Service reminds taxpayers there are important steps they can take Verkko 10 marrask 2023 nbsp 0183 32 The rates currently are set at 10 12 22 24 32 35 and 37 For 2024 the lowest rate of 10 will apply to individual with taxable income up

Verkko Publication 15 T 2023 Federal Income Tax Withholding Methods Internal Revenue Service Worksheet 1A Employer s Withholding Worksheet for Percentage Method