Income Tax Slab Rates Fy 2022 23 New Tax Regime Web Aug 15 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A

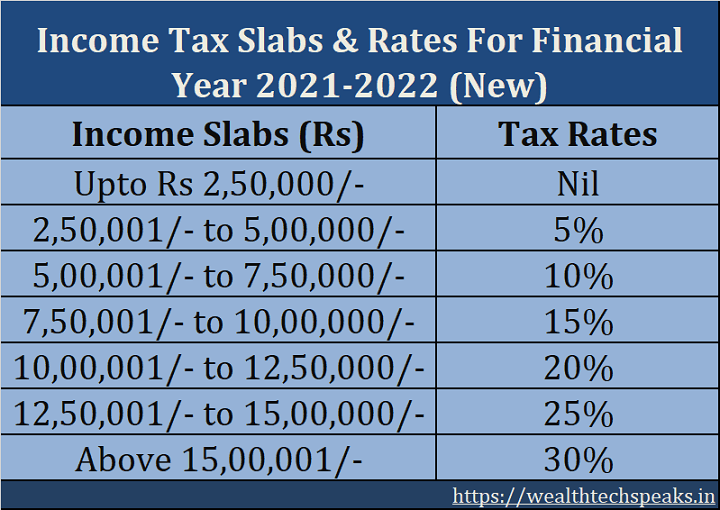

Web Oct 5 2023 nbsp 0183 32 New Income Tax Slabs For FY 2022 23 AY 2023 24 as per Budget 2023 As per the Union Budget 2023 a few key changes have been introduced under the new tax regime The tax slab under the new tax regime has been reduced from 6 to 5 and the basic exemption limit has been raised to Rs 3 lakh from Rs 2 5 lakh Web Apr 24 2023 nbsp 0183 32 New Tax Regime Slabs for Salaried FY 2022 23 1 Up to Rs 2 5 lakh 2 Rs 2 5L to Rs 5L 3 Rs 5L to Rs 7 5L 4 Rs 7 5L to Rs 10L 5 Rs 10L to Rs 12 5L 6 Rs 12 5L to Rs 15L 7 Above Rs 15 lakh

Income Tax Slab Rates Fy 2022 23 New Tax Regime

Income Tax Slab Rates Fy 2022 23 New Tax Regime

Income Tax Slab Rates Fy 2022 23 New Tax Regime

https://cdn.statically.io/img/i0.wp.com/wealthtechspeaks.in/wp-content/uploads/2020/07/Old-Income-Tax-Slab-Rates-FY-2021-22.png?resize=650,400

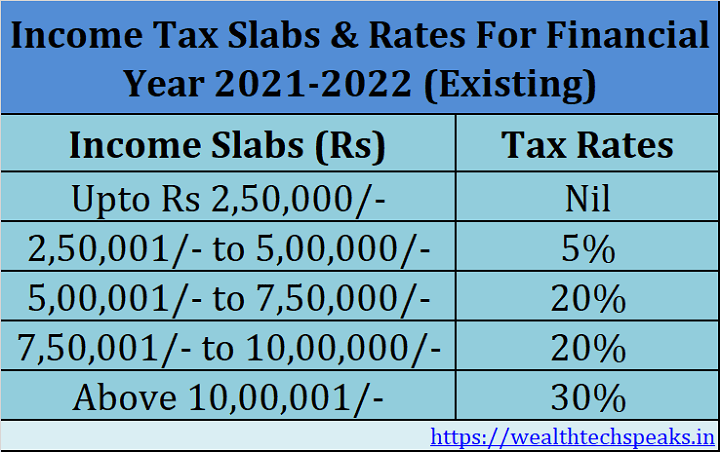

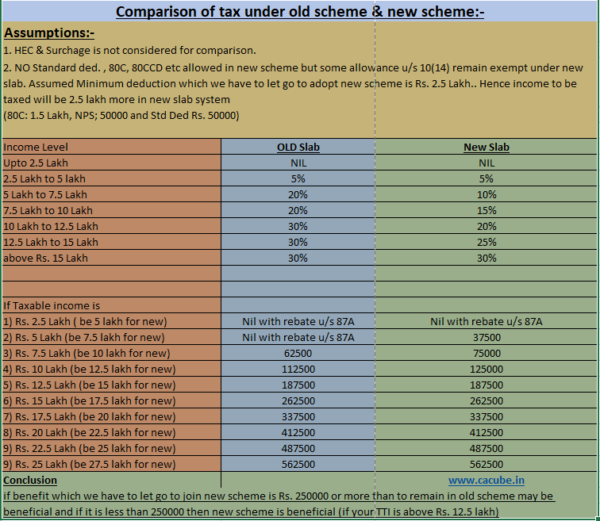

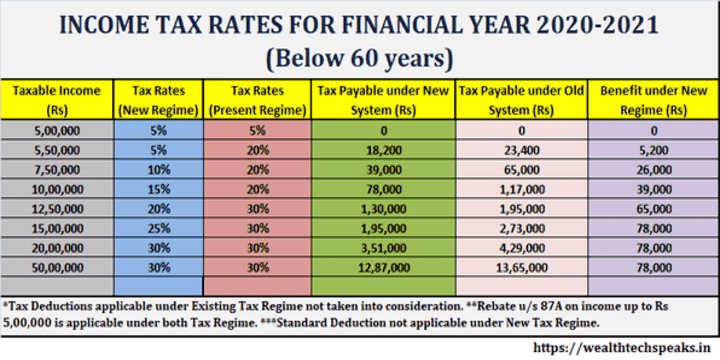

Web Jun 25 2022 nbsp 0183 32 A Income tax slab rate FY 2021 22 AY 2022 23 Applicable for New Tax regime EXEMPTION AND DEDUCTION ARE ALLOWED EXEMPTION AND DEDUCTION ARE NOT ALLOWED Income tax slab rate for Old Tax regime FY 2020 21 AY 2021 22 1 Age Group Below 60 years amp HUF Income tax slab for individuals aged above

Pre-crafted templates offer a time-saving solution for developing a varied variety of files and files. These pre-designed formats and layouts can be used for various personal and professional projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the material creation process.

Income Tax Slab Rates Fy 2022 23 New Tax Regime

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

New Income Tax Slab Regime For Fy 2021 22 Ay 2022 23 Zohal Bank2home

New Income Tax Slab Regime For Fy 2021 22 Ay 2022 23 ZOHAL

Income Tax Slabs For Assessment Year 2023 24 Kulturaupice

Income Tax Slab Rates FY 2020 21 Budget 2020 Highlights

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

https://cleartax.in/s/income-tax-slabs

Web Dec 14 2023 nbsp 0183 32 Income Slabs Income Tax Rates FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000 Rs 6 00 000 to Rs 900 000 Rs 15 000 10 on income more than Rs 6 00 000 Rs 9 00 000 to Rs 12 00 000 Rs 45 000 15 on income more than Rs 9 00 000 Rs 12 00 000 to

https://economictimes.indiatimes.com/wealth/tax/...

Web Jul 28 2022 nbsp 0183 32 Income tax slabs and rates for individuals for FY 2021 22 and FY 2022 23 Old tax regime With deductions and exemptions Total income New tax regime without deductions and exemptions Nil Up to Rs 2 5 lakh NIL 5 From Rs 2 50 001 to Rs 5 lakh 5 20 From Rs 5 00 001 to Rs 7 5 lakh 10 From Rs 7 50 001 to Rs 10 lakh 15

https://economictimes.indiatimes.com/wealth/income-tax-slabs

Web Income tax rates and slabs in new tax regime for FY 2021 22 FY 2022 23 Income tax slabs Income tax rates Up to Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 of total income minus Rs 2 50 000 Rs 5 00 001 to Rs 7 50 000 Rs 12 500 10 of total income minus Rs 5 00 000 Rs 7 50 001 to Rs 10 00 000 Rs 37 500 15 of total income

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

https://www.bankbazaar.com/tax/income-tax-slabs.html

Web Income Tax Rates FY 2022 23 Income Tax Slab FY 2023 24 Income Tax Slab NIL Rs 0 Rs 2 5 lakh Rs 0 Rs 3 lakh 5 Rs 2 5 lakh Rs 5 lakh Rs 3 lakh Rs 6 lakh 10 Rs 5 lakh Rs 7 5 lakh Rs 6 lakh Rs 9 lakh 15 Rs 7 5 lakh Rs 10 lakh Rs 9 lakh Rs 12 lakh 20 Rs 10 lakh Rs 12 5 lakh Rs 12 lakh Rs 15 lakh 25 Rs 12 5

Web Feb 6 2023 nbsp 0183 32 Stay up to date with the latest Income Tax Slab Rates for the financial year 2022 23 with this comprehensive guide from Tax2win Understand the new tax rates exemptions deductions and the impact of the changes on your tax liability Web Year 2024 25 If one to opt out from default new tax regime he has to exercise the option under section 115BAC 6 The tax rates under the new tax regime are as under a For Assessment Year 2023 24 Net Income Range Tax rate Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 From 5 00 001 to 7 50 000 10 From 7 50 001 to 10 00 000 15

Web Income Tax Slabs and Rates for FY 2022 23 All Salaried Taxpayers Need to Know from Budget 2022 Curated By Aparna Deb Last Updated February 02 2022 07 14 IST The income tax department of India has notified new ITR forms for the financial year 2022 23