Income Tax Slab Rates For Senior Citizens Ay 2022 23 If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility

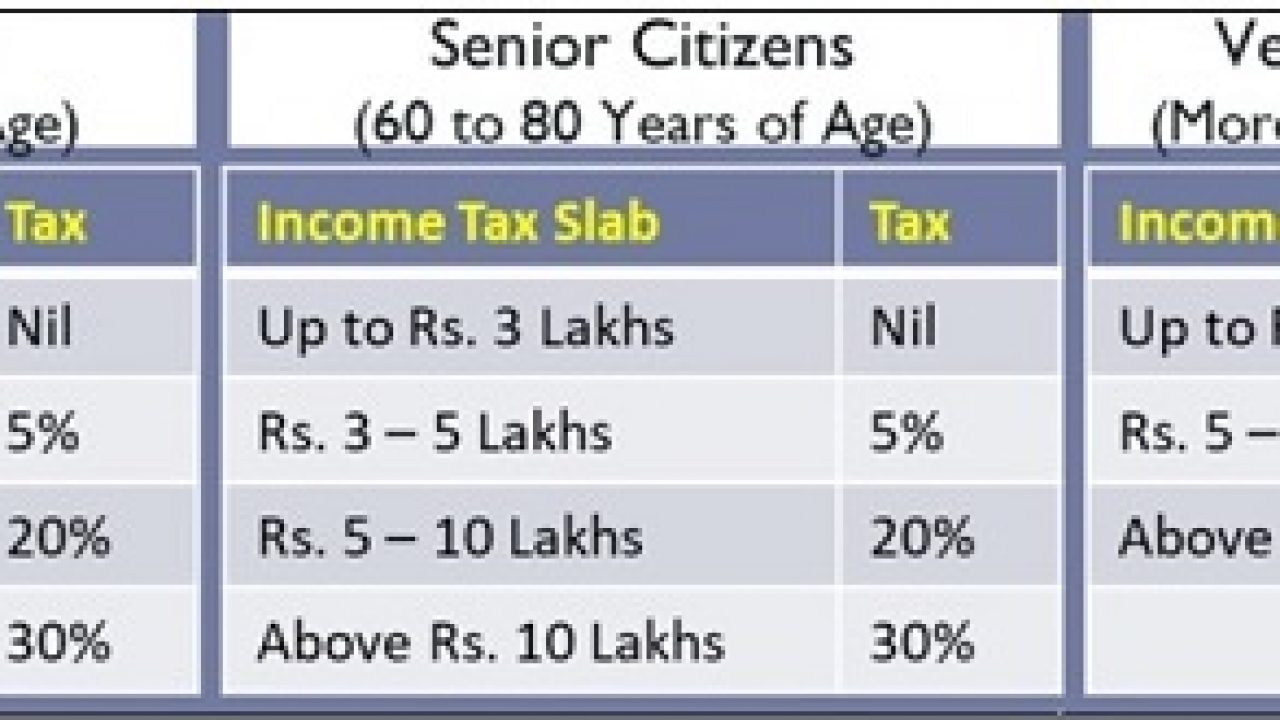

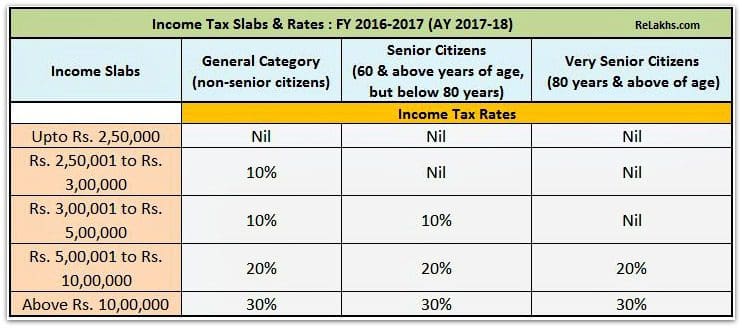

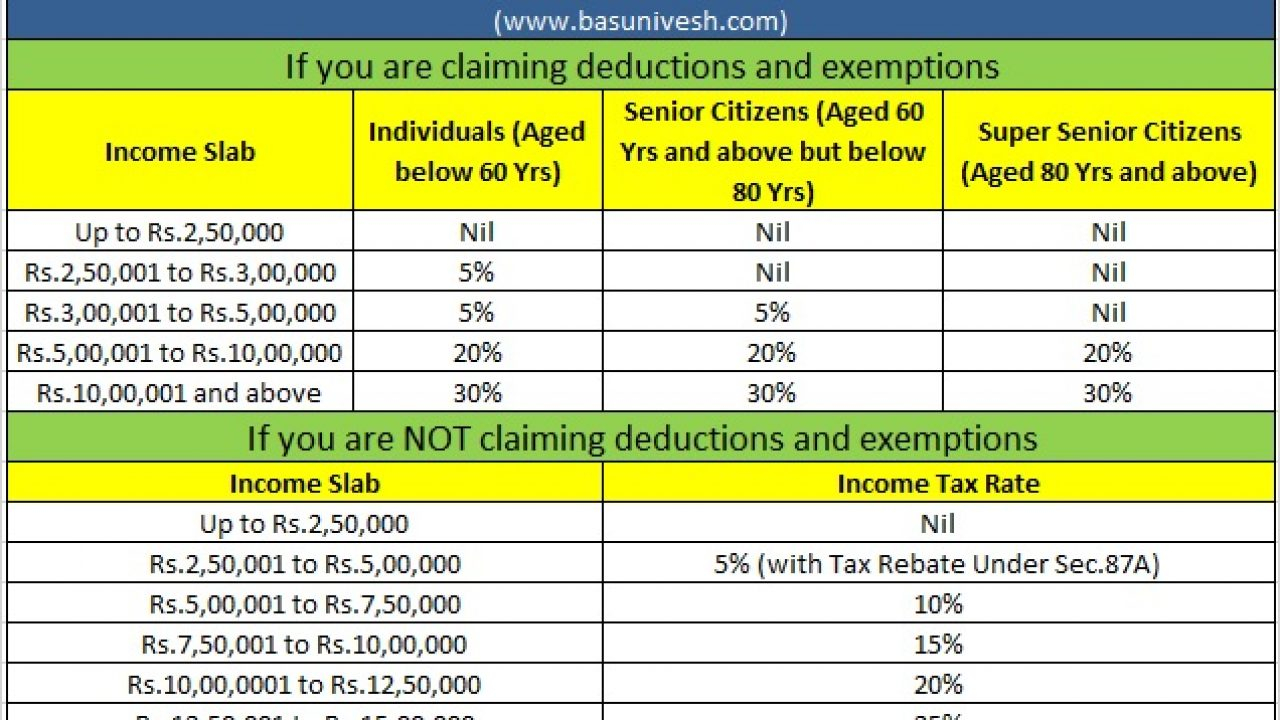

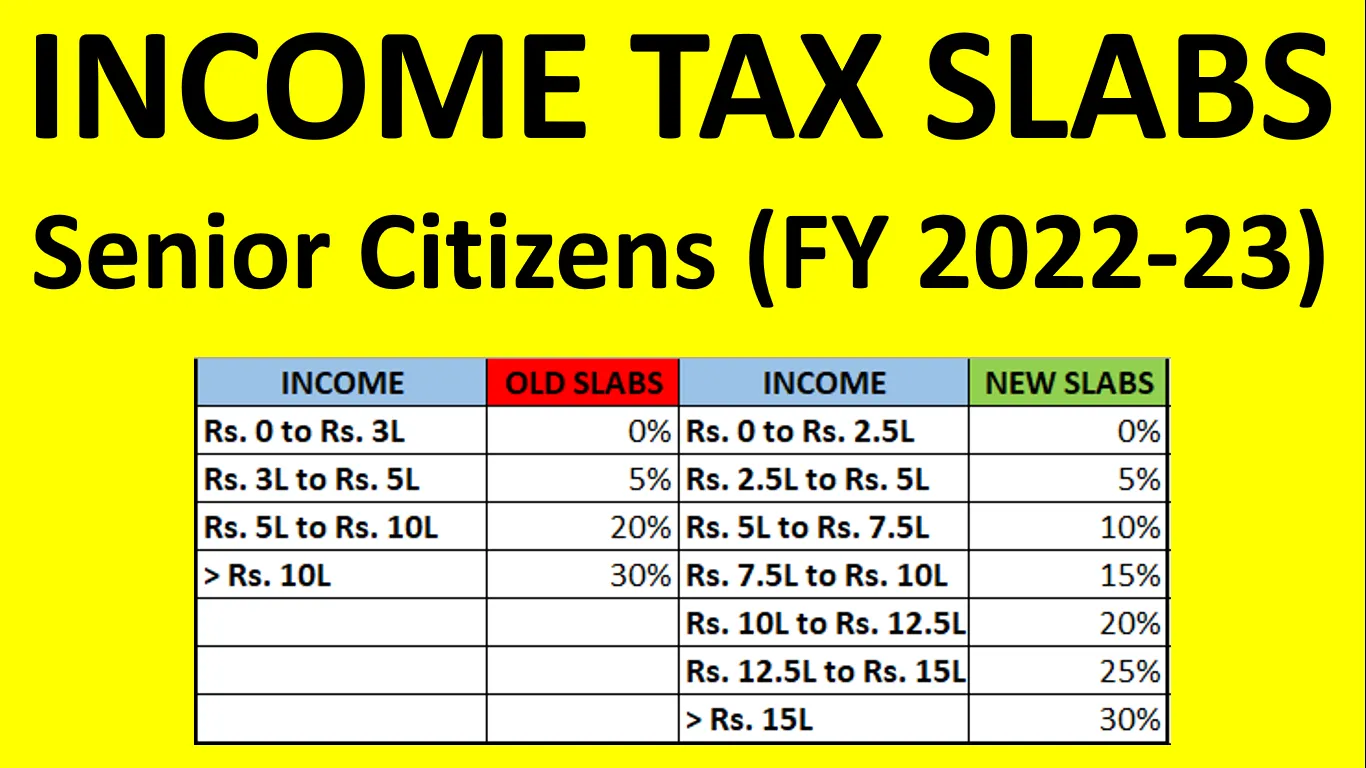

Income Tax Slab Rates For Senior Citizens Ay 2022 23

Income Tax Slab Rates For Senior Citizens Ay 2022 23

Income Tax Slab Rates For Senior Citizens Ay 2022 23

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by offering a ready-made format and layout for creating different kinds of material. Templates can be used for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Income Tax Slab Rates For Senior Citizens Ay 2022 23

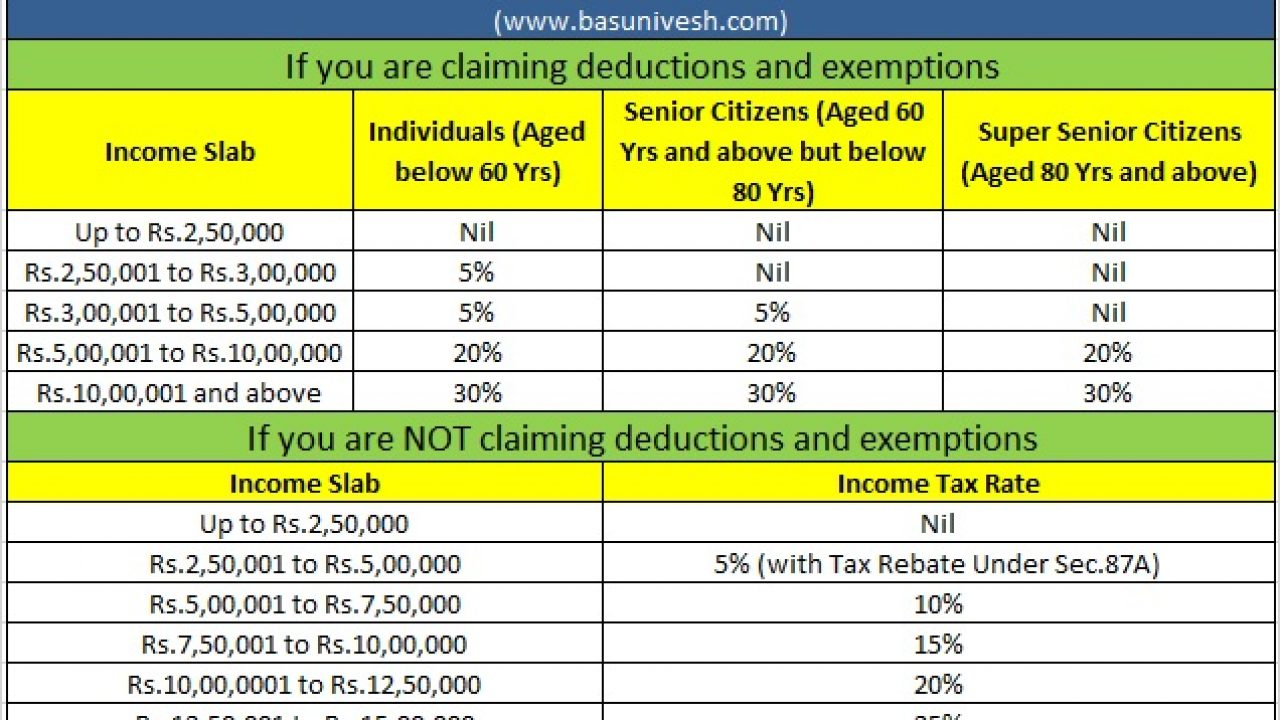

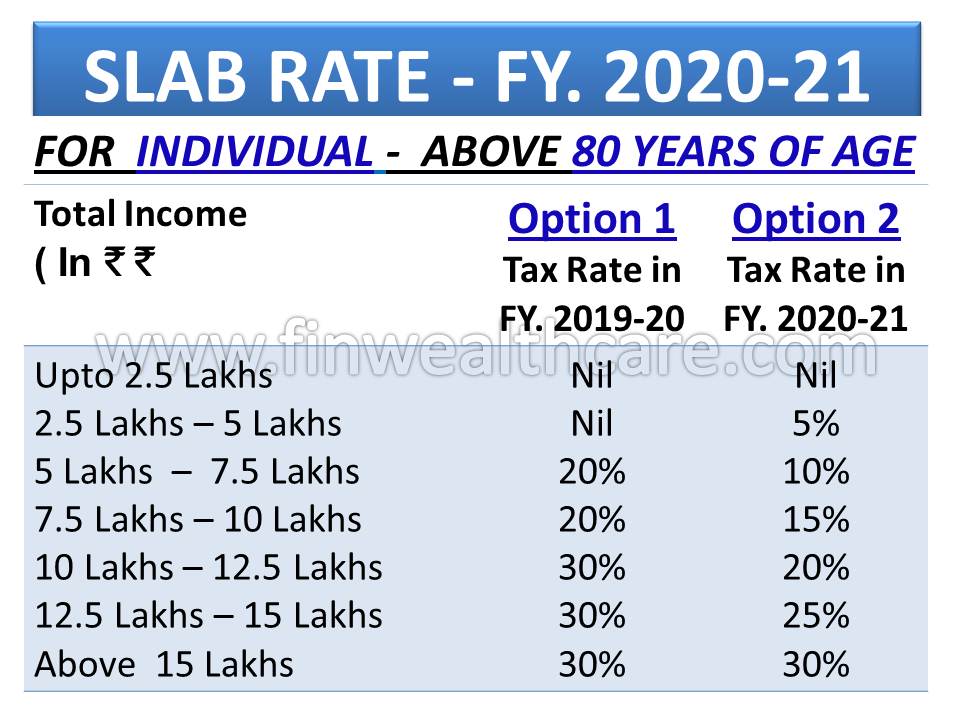

New Income Tax Slab FY 2020 21 India Vs Old

Income Tax Slab Rates For A Y 2024 25 F Y 2023 24

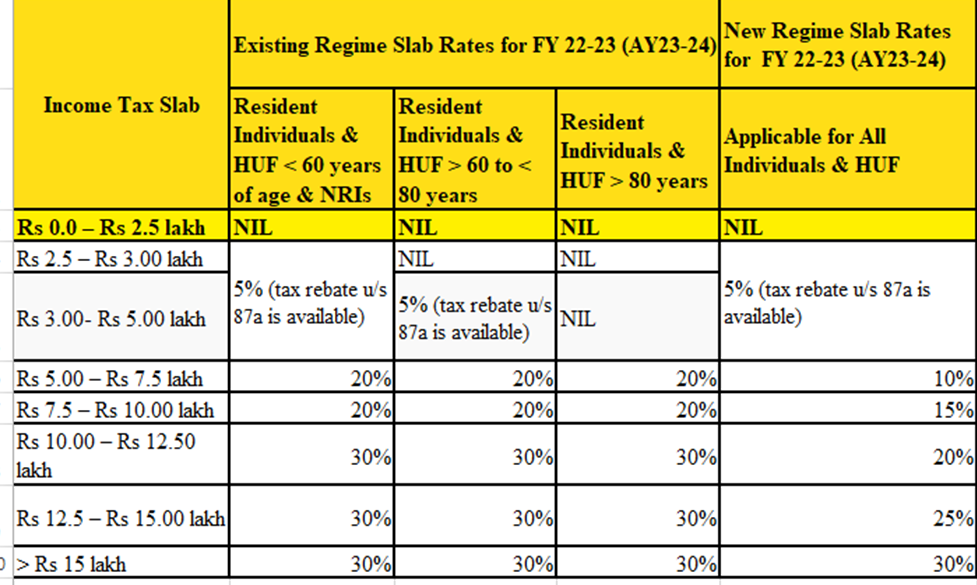

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

Income Tax Slab Rates FY 2020 21 Budget 2020 Highlights

https://www.canada.ca › ...

Include a statement showing your rental income and expenses for the year with your return Complete Form T776 Statement of Real Estate Rentals to help you calculate your net rental

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Feb 24 2025 nbsp 0183 32 Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

NETFILE is a fast and convenient option for filing your income tax and benefit return online You ll be asked to enter an access code when using NETFILE certified tax software Your eight

https://www.canada.ca › ... › publications › non-residents-income-tax.html

If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from

https://www.canada.ca › en › department-finance › news › government-o…

May 14 2025 nbsp 0183 32 Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

[desc-11] [desc-12]

[desc-13]