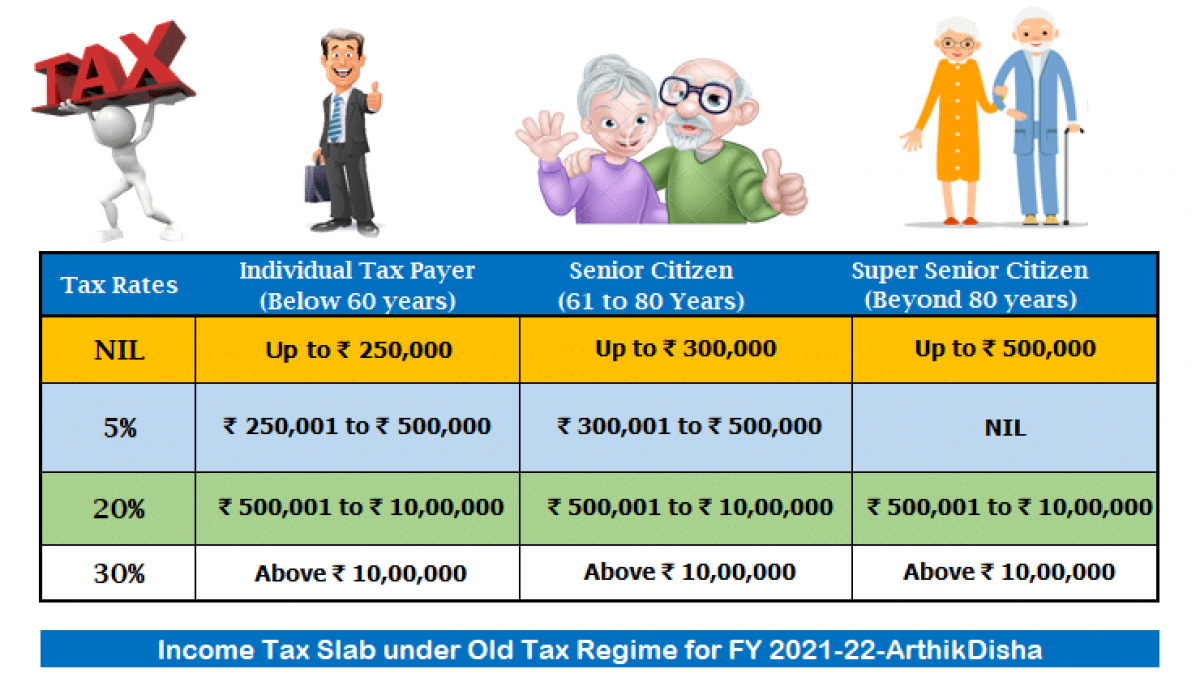

Income Tax Slab Rates For Senior Citizens Ay 2021 22 Web Mar 28 2022 nbsp 0183 32 A basic Income Tax exemption limit of up to Rs 2 50 000 is available for all age groups The tax rate is the same for all age groups Senior citizen tax exemption

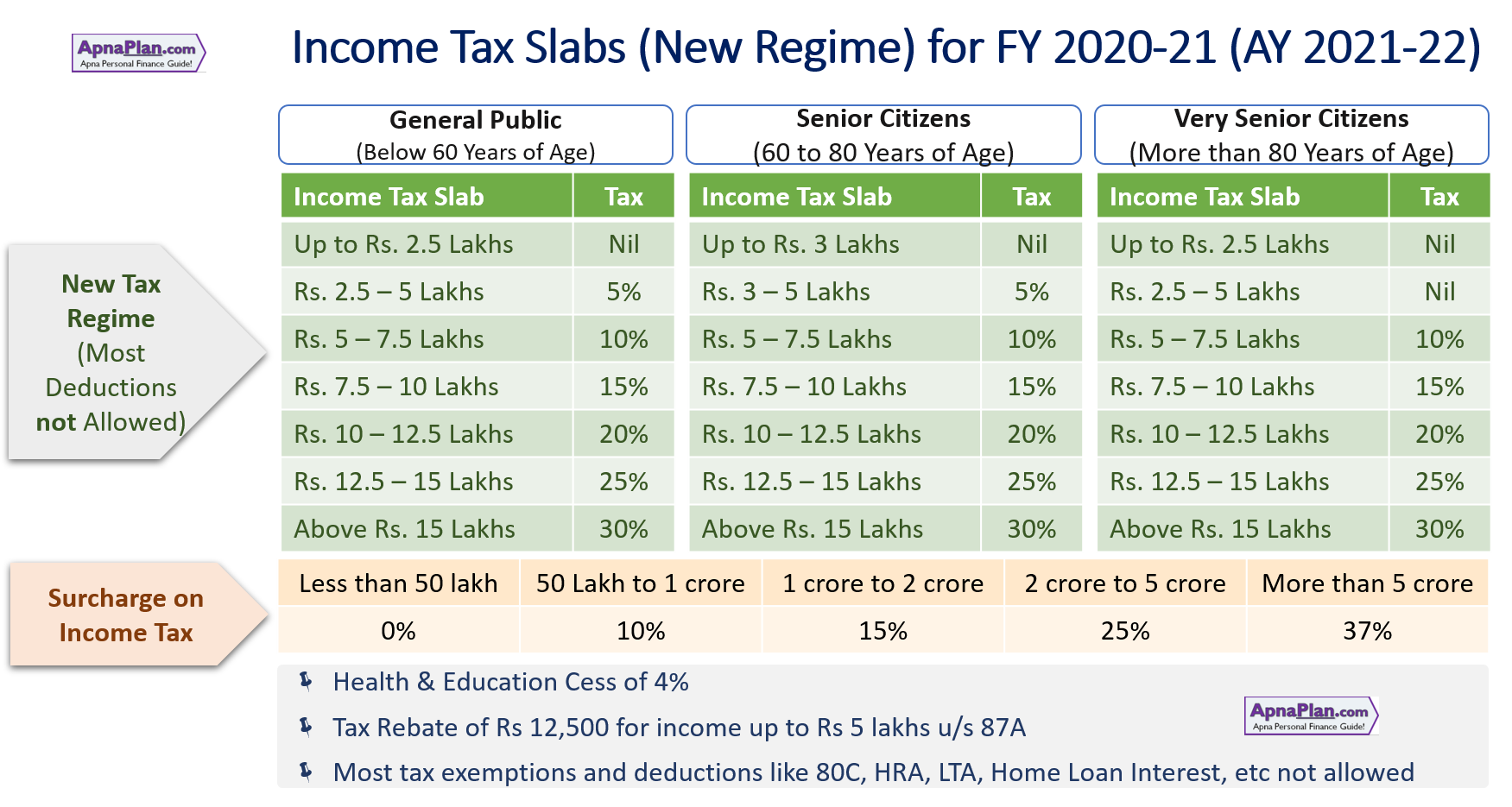

Web Jul 22 2022 nbsp 0183 32 Tax slabs The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR Web Budget 2021 Income Tax Slabs and Rates highlights Senior citizens NRIs get tax exemptions quot In the 75th year of Independence of our country we shall reduce compliance burden on senior citizens For senior

Income Tax Slab Rates For Senior Citizens Ay 2021 22

Income Tax Slab Rates For Senior Citizens Ay 2021 22

Income Tax Slab Rates For Senior Citizens Ay 2021 22

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-for-senior-citizens-FY-2022-23-1024x576.webp

Web Jul 15 2022 nbsp 0183 32 For senior citizens aged above 60 years but below 80 years exemption limit is Rs 3 lakh For super senior citizens aged above 80 years exemption limit is Rs 5 lakh

Pre-crafted templates provide a time-saving solution for creating a varied range of files and files. These pre-designed formats and designs can be utilized for different individual and expert projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material development procedure.

Income Tax Slab Rates For Senior Citizens Ay 2021 22

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download PELAJARAN

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay Mobile

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

https://paytm.com/.../income-tax-for-senior-citizens

Web Aug 17 2022 nbsp 0183 32 Income Tax Slab Rates FY 2021 22 amp AY 2022 23 for Senior Citizens Above 80 Years of Age As per The Old Tax Regime Surcharge 10 of income tax

https://cleartax.in/s/income-tax-slab-for-senior-citizen

Web 3 days ago nbsp 0183 32 As per the old tax regime the income tax slab rates for super senior citizen for FY 2023 24 AY 2024 25 are as follows The above calculated tax for senior and

https://tax2win.in/guide/income-tax-for-senior-citizens

Web Mar 5 2024 nbsp 0183 32 While seniors can still opt for the Old Tax Regime OTR with its progressive slabs let s talk about the tax provisions applicable to the resident senior citizen and

https://taxguru.in/income-tax/income-t…

Web Feb 12 2021 nbsp 0183 32 This article summarizes Tax Rates Surcharge Health amp Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident amp Non Resident HUF

https://taxguru.in/income-tax/income-t…

Web Apr 11 2021 nbsp 0183 32 Net income range Income Tax rate Up to Rs 5 00 000 Nil Rs 5 00 000 Rs 10 00 000 20 Above Rs 10 00 000 30 1 4 Add In addition to the Income Tax amount calculated based on the above

Web Dec 29 2020 nbsp 0183 32 Income tax slab for ay 2021 22 for senior citizens For the current year the income tax rate in the new tax regime is the same for all categories of individuals Web Apr 24 2021 nbsp 0183 32 Tax slabs under old regime 1 Individuals 2 Senior Citizens 3 Super Senior citizens 4 Surcharge Surcharge is levied on the amount of income tax at

Web Feb 9 2022 nbsp 0183 32 Note Under the new regime surcharges of 10 15 25 37 are applied on income when individual income exceeds Rs 50 lakh Rs 1 cr Rs 2 cr and Rs 5 cr