Income Tax Slab Rates For Ay 2021 22 Tax Slab AY 2021 22 Individual HUF BOI AOP AJP India ITR In case of an Individual resident or non resident or HUF or Association of Person or Body of Individual or any other

Income tax slab rate for Individual resident or non resident who is age of less than 60 years on the last day of the relevant previous year i e individual who is age of less than 60 years as on 31 st March 2021 INCOME TAX RATES ASSESSMENT YEAR 2021 2022 RELEVANT TO FINANCIAL YEAR 2020 2021 The normal tax rates applicable to a resident individual will depend on the age of

Income Tax Slab Rates For Ay 2021 22

Income Tax Slab Rates For Ay 2021 22

Income Tax Slab Rates For Ay 2021 22

https://static.wixstatic.com/media/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg/v1/fill/w_627,h_284,al_c,q_90/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg

As per New Tax Payers Regime a taxpayer can now choose to opt for the new tax slab for FY 2020 21 AY 2021 22 or Existing old Tax Slabs for FY 2019 20 AY 2020 21 1 Income Tax

Pre-crafted templates offer a time-saving solution for producing a varied variety of files and files. These pre-designed formats and layouts can be used for different personal and professional projects, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the content production process.

Income Tax Slab Rates For Ay 2021 22

Income Tax Slab Income Tax Slab For Ay 2021 22 Pdf Download

Income Tax Slab Rates FY 2021 22 I AY 2022 23 I CA Satbir Singh YouTube

Income Tax Slabs For Ay 2021 22 Under New And Old Tax Regime Business

Standard Business Deduction 2022 Home Business 2022

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

https://www.simpletaxindia.net/2021/07/income-tax...

Jul 12 2021 nbsp 0183 32 INCOME Tax Slabs for AY 2021 22 SIMPLE TAX INDIA 00RAJ KUMARIMonday July 12 2021 Individuals and HUFs can opt for the Existing Tax Regime or the New Tax

https://www.taxmann.com/post/blog/inc…

Feb 1 2020 nbsp 0183 32 Income Tax Slab Rate for AY 2021 22 for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year Net income range

http://taxindiaupdates.in/income-tax-rates

Nov 30 2021 nbsp 0183 32 The income Tax Act 1961 provides different tax rates for various categories of taxpayers and for different sources of income Individuals HUFs AOP BOI are taxed as per the

https://cleartax.in/s/income-tax-slabs

4 days ago nbsp 0183 32 Income tax in India follows a progressive slab rate system under the Income tax Act 1961 with old and new regimes offering different tax rates and deductions For FY 2024 25 the tax slabs have been revised providing

http://www.taxmani.in/income-tax/income-tax-slab.html

Mar 28 2022 nbsp 0183 32 The income tax slab for AY 2021 22 below applies to individuals resident or non resident HUF Association of Person or Body of Individual companies partnership firms and

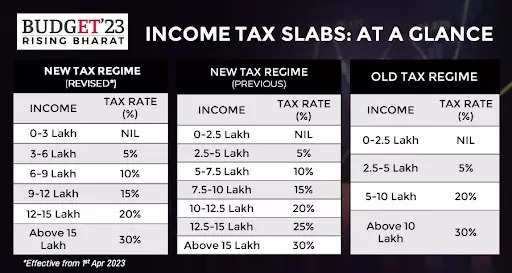

Jul 22 2022 nbsp 0183 32 We will be comparing income tax slabs and rates under the new and old tax regimes for individuals senior citizens and super senior citizens for FY 2021 22 and FY 2022 23 Feb 9 2022 nbsp 0183 32 Income tax slabs for AY 2021 22 Old and new regimes The Government has introduced a new tax regime and has given the option to taxpayers to choose from the old

Feb 2 2021 nbsp 0183 32 In respect of income of all categories of assessee liable to tax for the assessment year 2021 22 the rates of income tax have either been specified in specific sections like