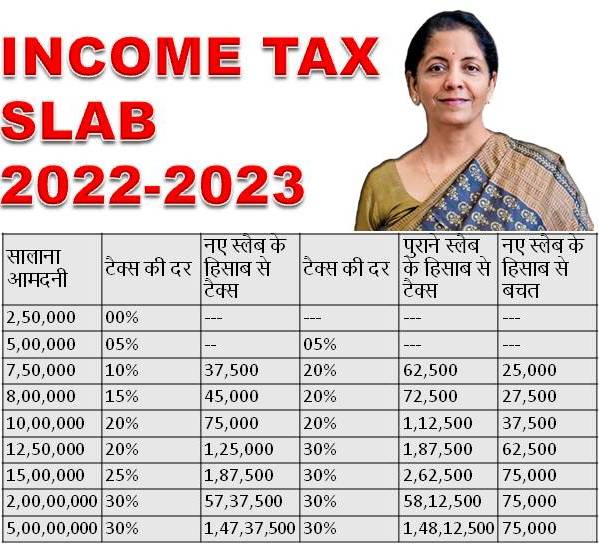

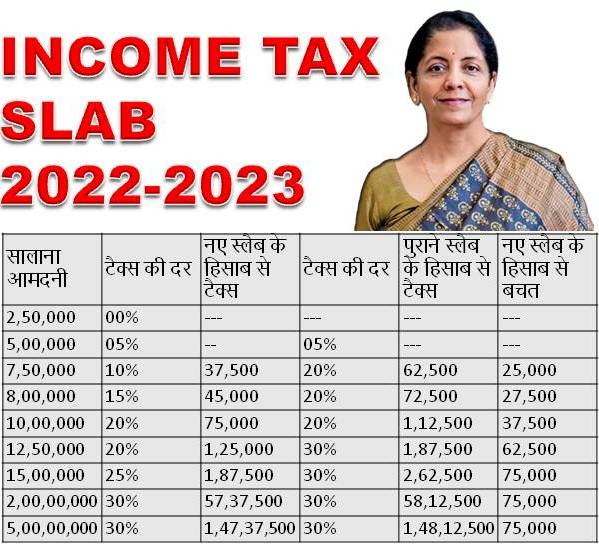

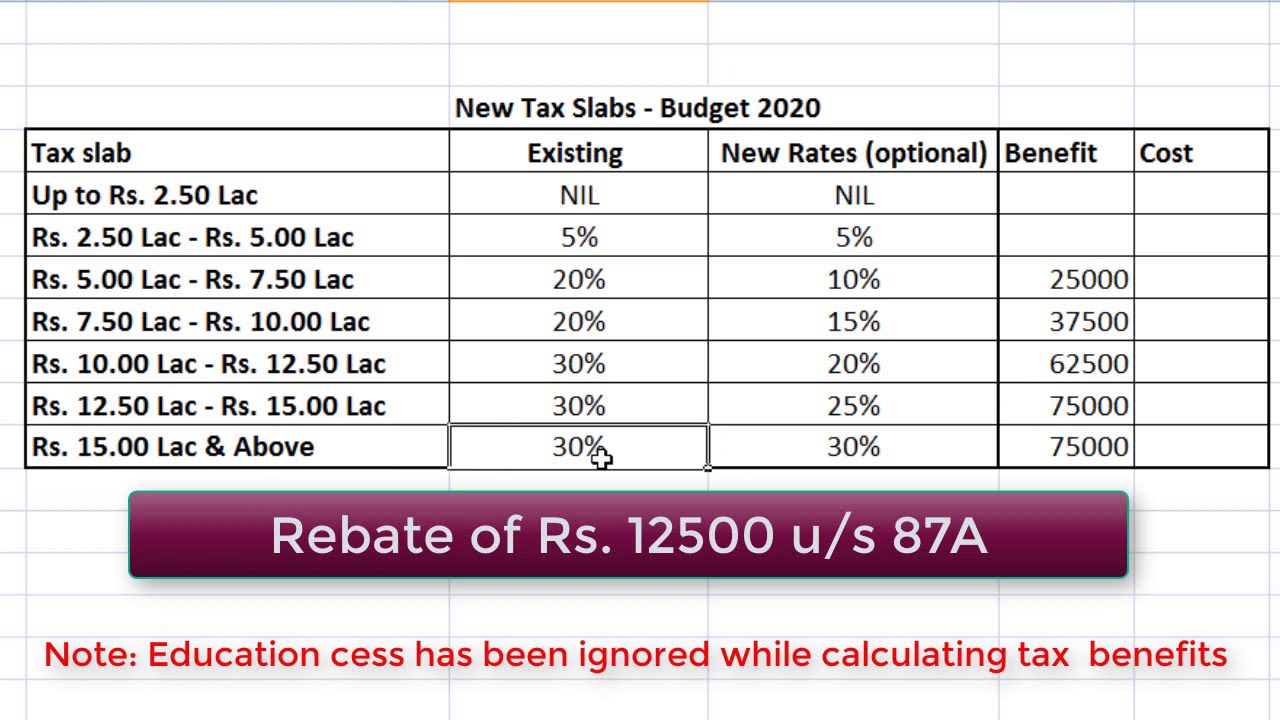

Income Tax Slab Rate For Ay 2021 22 For Senior Citizens WEB Jul 15 2022 No change in rates There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022 23 in Union Budget 2022 The

WEB Dec 29 2020 nbsp 0183 32 Old Regime To continue to pay taxes under the existing tax rates The assessee can avail of rebates and exemptions by staying in the old regime and paying tax at a higher rate Here you find the chart of WEB 1 3 Resident super senior citizen i e every individual being a resident in India who is of the age of 80 years or more at any time during the previous year Income Tax rate AY

Income Tax Slab Rate For Ay 2021 22 For Senior Citizens

Income Tax Slab Rate For Ay 2021 22 For Senior Citizens

Income Tax Slab Rate For Ay 2021 22 For Senior Citizens

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

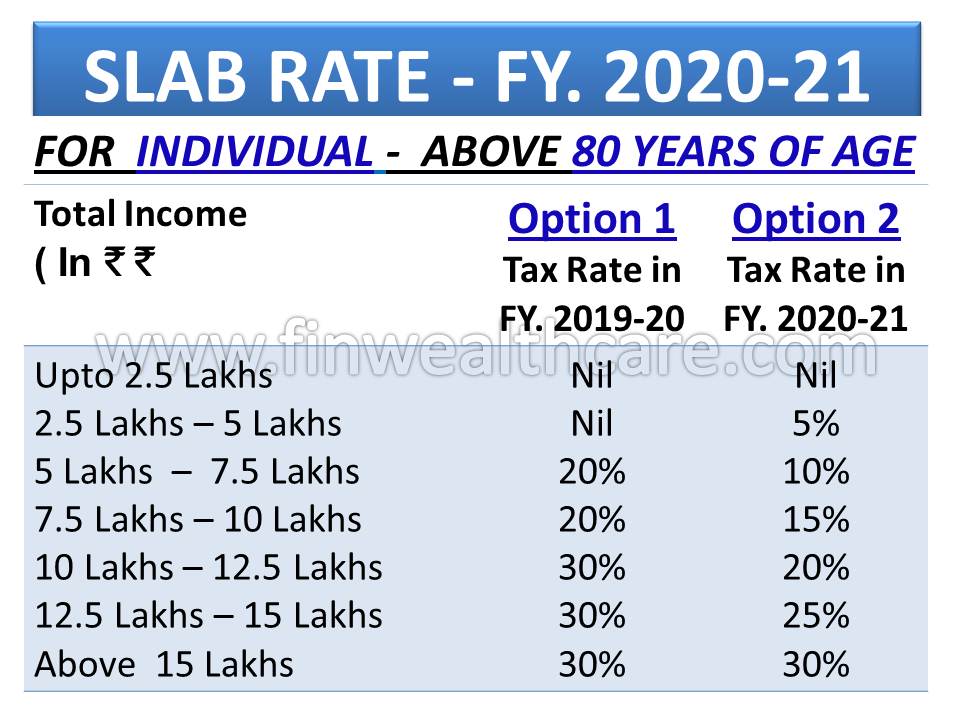

WEB Apr 8 2024 nbsp 0183 32 Get Started Super Senior Citizen Income Tax Slab FY 2021 22 Quite similar to liabilities on senior citizens the taxes for individuals who are above 80 years of age is

Templates are pre-designed files or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and design for developing different sort of material. Templates can be utilized for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Income Tax Slab Rate For Ay 2021 22 For Senior Citizens

Income Tax Slab Rates For AY 2023 24

New Income Tax Slab FY 2020 21 India Vs Old

2022 Tax Brackets Irs Calculator

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

Income Tax Rates Slab For FY 2021 22 Or AY 2022 23 Ebizfiling

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 Mobile

https:// taxguru.in /income-tax/income-t…

WEB Feb 12 2021 nbsp 0183 32 Rates of Income Tax for Financial year FY 2020 21 i e Assessment Year AY 2021 22 and FY 2021 22 AY 2022 23 applicable to various categories of persons viz Individuals Firms companies etc

https:// paytm.com /.../income-tax-for-se…

WEB Aug 17 2022 nbsp 0183 32 Income Tax Slab Rates FY 2021 22 amp AY 2022 23 for Senior Citizens Above 80 Years of Age As per The Old Tax Regime Surcharge 10 of income tax where total income exceeds Rs

https:// cleartax.in /s/income-tax-slabs

WEB Apr 1 2024 nbsp 0183 32 up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but less than 80 years up to Rs

https:// taxguru.in /income-tax/income-t…

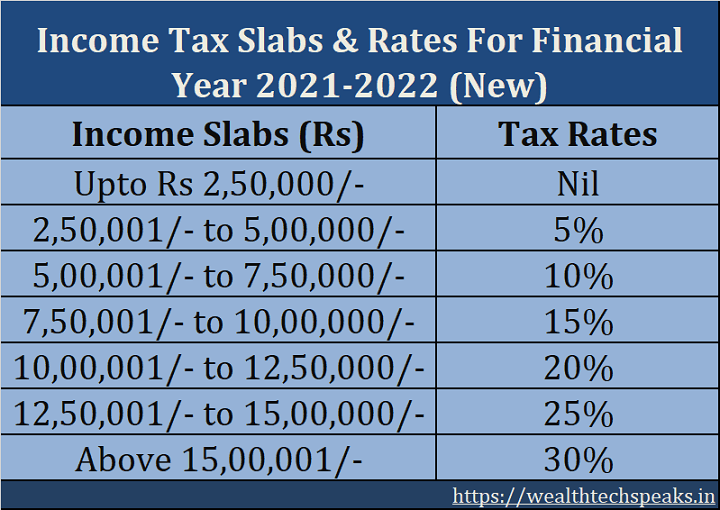

WEB Apr 11 2021 nbsp 0183 32 Income Tax Slab Rate for AY 2021 22 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year or HUF or AOP or

https:// economictimes.indiatimes.com…

WEB Jul 22 2022 nbsp 0183 32 Old tax regime vs new tax regime In the Union Budget 2022 no changes were announced in the income tax slabs both for old and new tax regimes for FY 2022 23 The income tax slabs and rates have

WEB Feb 1 2020 nbsp 0183 32 1 Income Tax Slab Rate for AY 2021 22 for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on WEB Mar 28 2022 nbsp 0183 32 Income tax slab for Senior Citizens FY 2020 21 Above 60 years and below 80 years The below income tax slab for ay 2021 22 for senior citizens applies

WEB Jun 10 2020 nbsp 0183 32 Income Tax Slab For AY 2021 22 in case of Individual and HUF as per old regime Income Tax rates for Senior Citizen Age 60 years to 80 years Deduction Limit