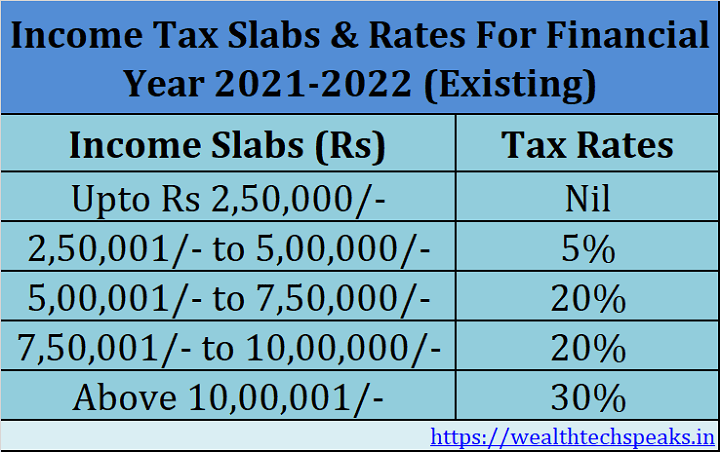

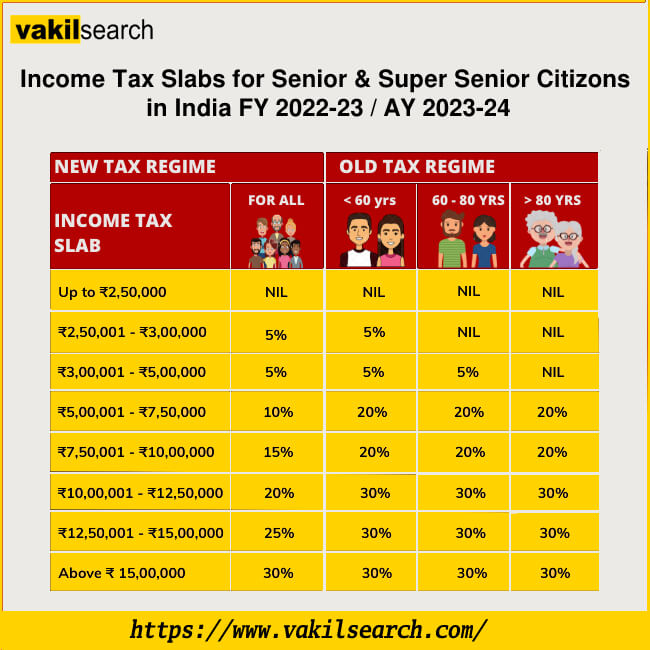

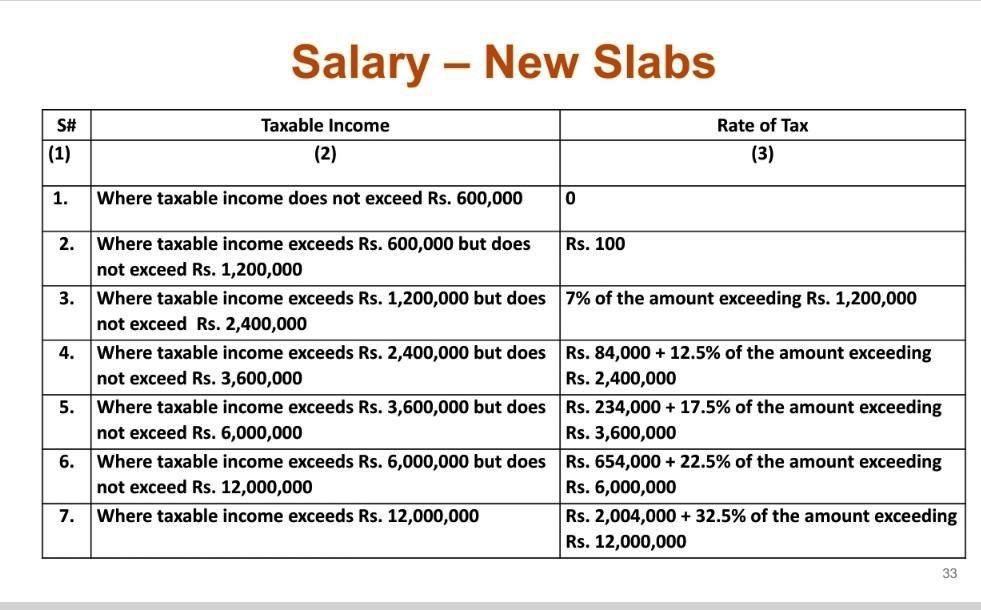

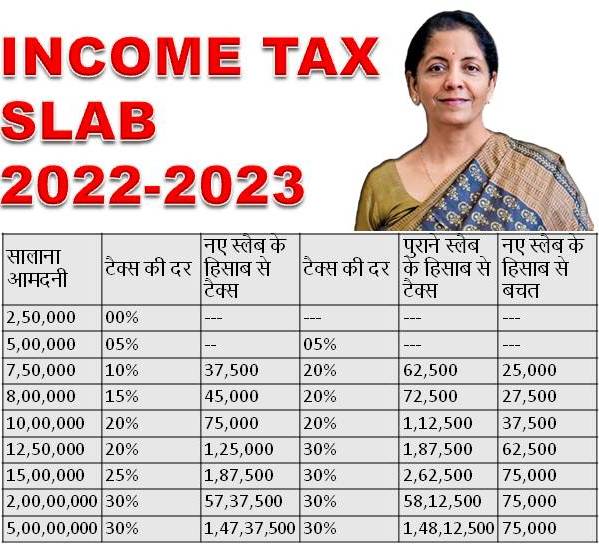

Income Tax Slab For Fy 2022 23 Old Regime WEB Feb 4 2022 nbsp 0183 32 Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc

WEB Comparison IT Calculator Financial Year 2022 23 Age Select Age Below 60 Years Normal Citizen Between 60 Years to 79 Years Senior Citizen Above 79 Years Super WEB Mar 30 2021 nbsp 0183 32 Read about Income Tax Slab Rates for AY 2022 23 for Individuals opting for old tax regime for Partnership Firm Companies in this article

Income Tax Slab For Fy 2022 23 Old Regime

Income Tax Slab For Fy 2022 23 Old Regime

Income Tax Slab For Fy 2022 23 Old Regime

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

WEB Check Income Tax Slab amp Rates in India for FY 2022 23 and FY 2023 24 This blog will be your guidebook to understanding the different tax slabs rates and their applicability

Templates are pre-designed documents or files that can be utilized for various functions. They can conserve time and effort by offering a ready-made format and layout for producing different sort of material. Templates can be used for personal or expert tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Tax Slab For Fy 2022 23 Old Regime

Agriculture Income Slab Rate Fy 2021 22 Pay Period Calendars 2023

Income Tax Slab For FY 2021 22 AY 2022 23 YouTube

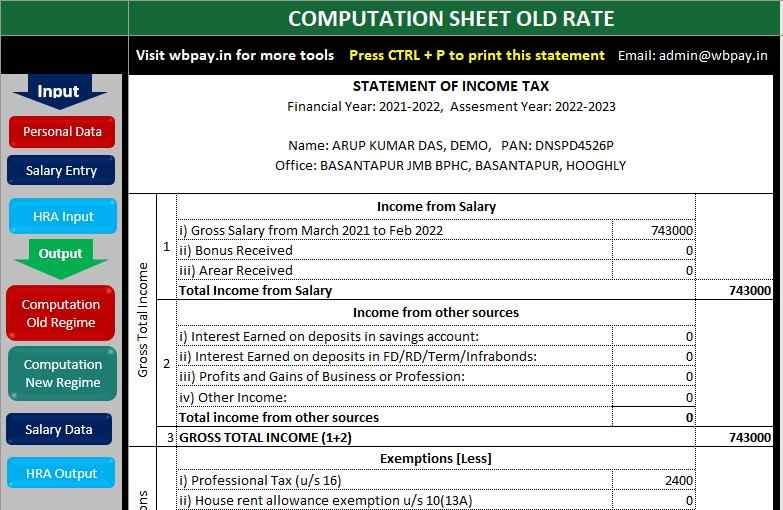

All In One Income Tax Calculator For FY 2021 22 Old New

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

What s Beneficial Tax Under Old Or New Regime Tax Slabs FY 2020 2021

https://cleartax.in/s/income-tax-slabs

WEB Apr 14 2017 nbsp 0183 32 Latest Income Tax Slab amp Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

https://taxguru.in/income-tax/income-t…

WEB Sep 9 2023 nbsp 0183 32 Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims to provide a

https://charteredindia.com/income-tax-s…

WEB Aug 15 2023 nbsp 0183 32 Income Tax Slabs amp Rates for FY 2022 23 2023 24 New Tax Regime vs Old Tax Regime Which Tax Regime Should I opt Deductions in new regime

https://economictimes.indiatimes.com/wealth/tax/...

WEB With regards to income tax slabs the old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six income tax slabs Here is a

https://taxguru.in/income-tax/income-tax-rates...

WEB Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs

WEB Income Tax Calculator How to calculate Income taxes online for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 with ClearTax Income Tax Calculator Refer WEB Jul 23 2024 nbsp 0183 32 Calculate income tax for an individual or HUF based on the given total income and deductions Applicable for last five years FY 2024 25 FY 2023 24 FY 2022

WEB Aug 6 2022 nbsp 0183 32 The taxpayer opting for concessional rates in the New Tax regime will have to forgo certain exemptions and deductions available in the existing old tax regime In