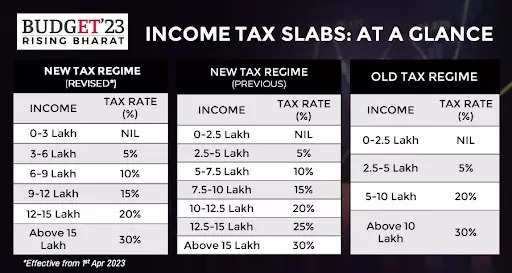

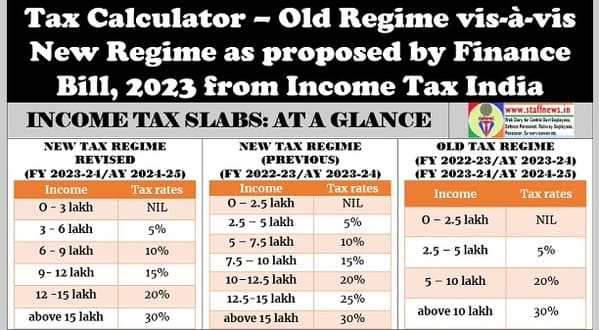

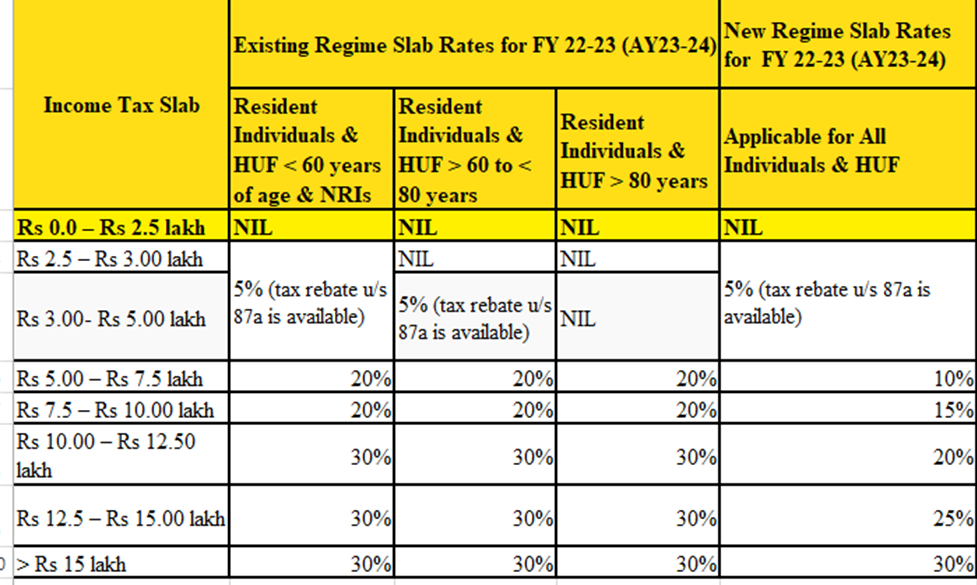

Income Tax Slab For Ay 2022 23 Old And New Regime Web In Budget 2023 the income tax slabs under the new tax regime have been revised The new tax slabs and tax rates under the new tax regime for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 are shown in the table below The tax rates under the new tax regime and the old tax regime for FY 2022 23 AY 2023 24 are compared below

Web Jan 16 2024 nbsp 0183 32 Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 16 Jan 2024 05 49 PM New Tax Regime Slabs Rates Exemptions amp Deductions Availability analysis New income tax regime for Individuals and HUF has been proposed under Section 115BAC in the budget 2020 Web Mar 30 2021 nbsp 0183 32 Income Tax Slab Rate for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year Resident senior citizen i e every individual being a resident in India who is of the age of 60 years or more but less than 80 years at any time during

Income Tax Slab For Ay 2022 23 Old And New Regime

Income Tax Slab For Ay 2022 23 Old And New Regime

Income Tax Slab For Ay 2022 23 Old And New Regime

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

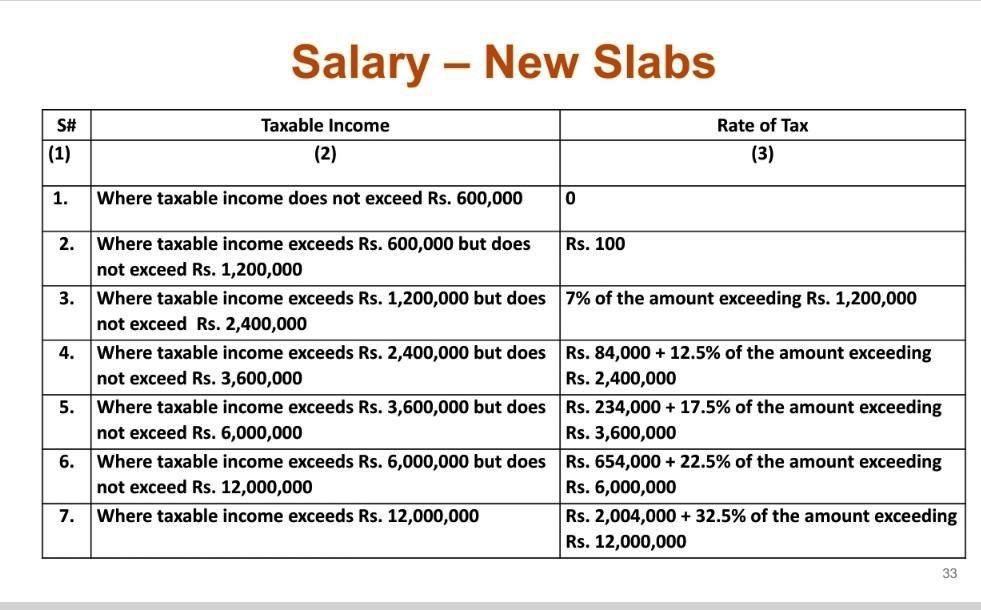

Web Aug 17 2022 nbsp 0183 32 New Income Tax Slab Regime for FY 2021 22 amp AY 2022 23 Last Updated August 17 2022 Every salaried individual needs to pay income tax based on the slab system they fall under The income tax is imposed on the income earned by all individuals HUF partnership firms corporates and LLPs as per the Income Tax Act of India

Templates are pre-designed documents or files that can be utilized for different purposes. They can conserve effort and time by providing a ready-made format and design for creating various type of material. Templates can be utilized for personal or professional tasks, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Income Tax Slab For Ay 2022 23 Old And New Regime

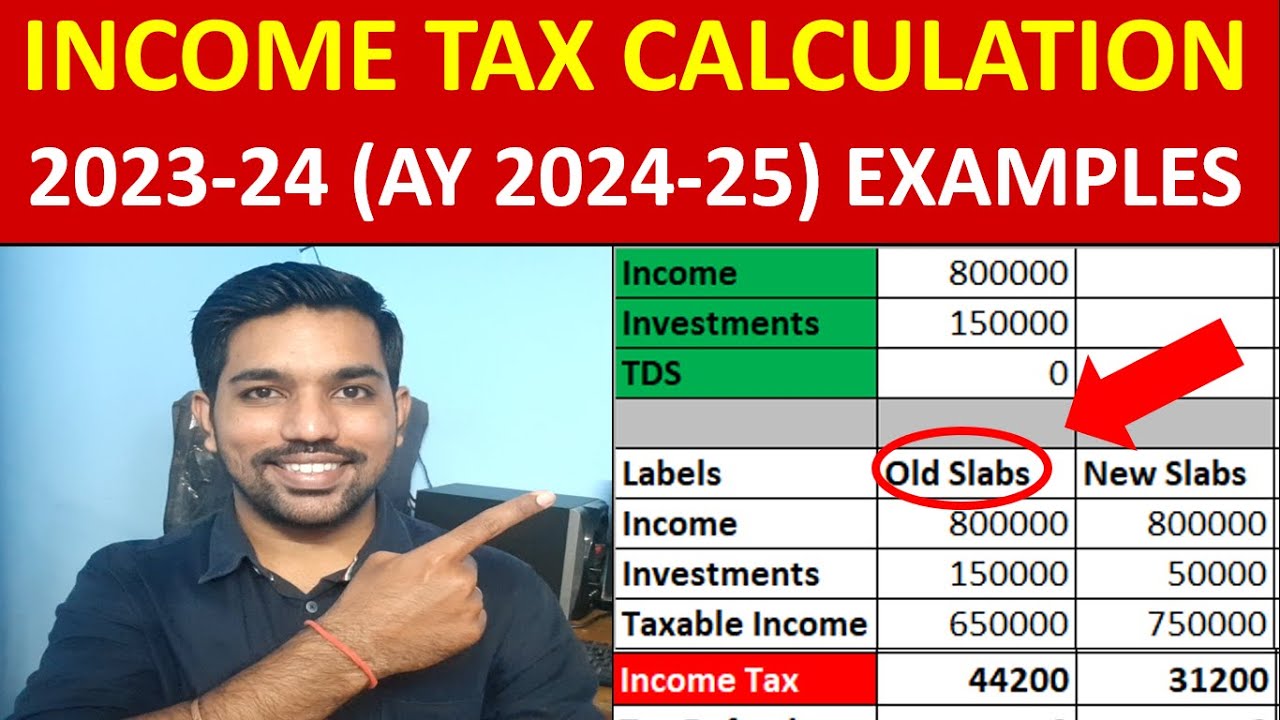

How To Calculate Income Tax 2023 24 AY 2024 25 Tax Calculation

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

How To Calculate Income Tax Slab For Ay 2022 2023 Airlift za

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.myitronline.com/blog-post/old-and-new...

Web Comparison Of Old And New Tax Regime Rates For AY 2022 23 New Income Tax Slab Rates introduced in the Budget 2020 for AY 2021 22 onwards is kept optional for the taxpayers where they are open to choose the tax slabs of old regime FY 2021 22

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 updated income tax rates for individuals HUFs partnerships and companies for AY 2023 24 amp 2024 25 ie FY 2022 23 amp 2023 24

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Web Income Slab Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 0 2 50 000 2 50 000 3 00 000 5 5 3 00 000 5 00 000 5 5 5 5 00 000 6 00 000 20 10 5 6 00 000 7 50 000 20 10 10 7 50 000 9 00 000 20 15 10 9 00 000 10 00 000

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

https://www.news18.com/news/business/tax/income...

Web first published July 13 2022 15 41 IST last updated July 13 2022 17 00 IST Income Tax Return AY 22 23 There are over 70 exemptions and deductions available under the old tax regime to lower the tax burden of the individuals New tax regime has lower tax rates compared to old system

Web Dec 19 2022 nbsp 0183 32 Income Tax Slabs In India For FY 2022 23 Rates New and Old Tax Regime 19 December 2022 Income Tax Any reforms in income tax or income tax slabs are announced by the Finance Minister of India usually during the Union Budget Right now there are two income tax slabs or regimes in India the new and the old tax regime Web Apr 24 2023 nbsp 0183 32 1 Up to Rs 2 5 lakh 2 Rs 2 5L to Rs 5L 3 Rs 5L to Rs 10L 4 Above Rs 10 lakh The last date to file ITR for income earned in FY 2022 23 is July 31 As ITR filing is

Web Aug 15 2023 nbsp 0183 32 Income Slab Old Regime New Regime FY 2022 23 AY 2023 24 New Regime FY 2023 24 AY 2024 25 Up to Rs 2 5 lakh NIL NIL NIL Rs 2 5 lakh Rs 3 lakh 5 5 NIL Rs 3 lakh Rs 5 lakh 5 5 5 Rs 5 lakh Rs 6 lakh 20 10 5 Rs 6 lakh Rs 7 5 lakh 20 10 10 Rs 7 5 lakh Rs 9 lakh 20 15 10 Rs 9 lakh