Income Tax Return Statistics Assessment Year 2022 23 WEB Feb 1 2022 nbsp 0183 32 Income tax rates for assessment year 2022 23 Financial Year 2021 22 Editor4 01 Feb 2022 27 900 Views 2 comments Print Income Tax Articles DIRECT TAXES A RATES OF INCOME TAX I Rates of income tax in respect of income liable to tax for the assessment year 2022 23

WEB Q1 What are the due dates for filing of Income tax Returns for the Assessment Year 2022 23 The due dates for filing of ITRs for various types of assessees are as follows Situations Original due date If assessee is required to furnish a report of transfer pricing TP Audit in Form No 3CEB 30 11 2022 If the assessee is a partner in a WEB Call Us e filing and Centralized Processing Center e Filing of Income Tax Return or Forms and other value added services amp Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025 91 80 46122000 91 80 61464700 08 00 AM 20 00 PM Mon to Fri

Income Tax Return Statistics Assessment Year 2022 23

Income Tax Return Statistics Assessment Year 2022 23

Income Tax Return Statistics Assessment Year 2022 23

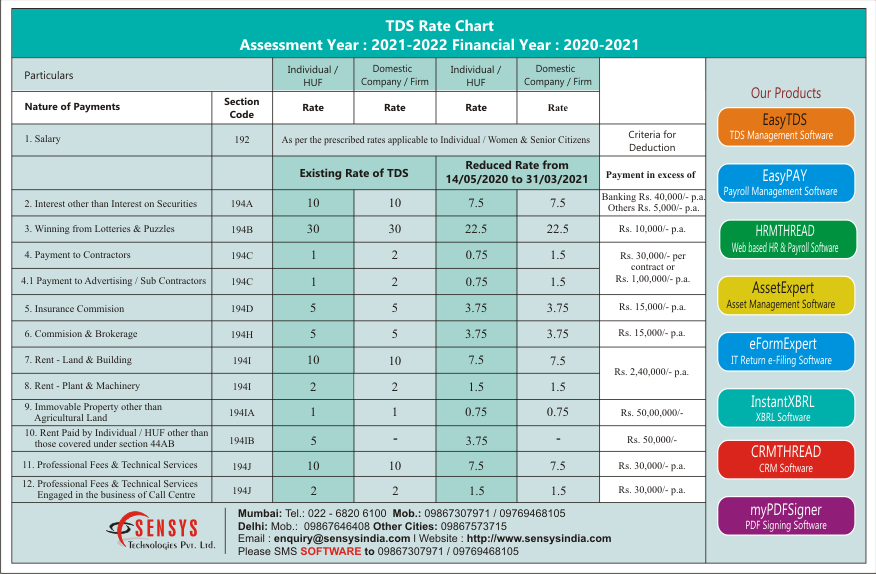

http://www.sensystechnologies.com/blog/wp-content/uploads/2020/04/Rate-Chart-AY-2021-22_Sensys_New.png

WEB Feb 2 2021 nbsp 0183 32 Rates of income tax in respect of income liable to tax for the assessment year 2022 23 i e Financial Year 2021 22

Templates are pre-designed files or files that can be used for different purposes. They can save effort and time by providing a ready-made format and layout for producing different type of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Tax Return Statistics Assessment Year 2022 23

UK Tax Return Statistics 2019 Flickr

Tax Return Data For 2011 Taxing Subjects

Income Tax Return Statistics Taxscan Simplifying Tax Laws

Cashtrak Self Assessment Tax Return Advice And Help

Income Tax Return Statistics Taxscan Simplifying Tax Laws

CRA 1700 2000

https://indianexpress.com/article/explained/...

WEB Aug 10 2023 nbsp 0183 32 Trends in Income Tax returns for 2022 23 Which states and income categories filed the most returns Spike in ITR filings by the biggest earners in 2022 23 low growth in the lowest income bracket 6 81 crore returns filed in current year until August 6 Maharashtra top state in filing of returns during last four years

https://incometaxindia.gov.in/Pages/Direct-Taxes-Data.aspx

WEB Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly

https://taxguru.in/income-tax/income-tax-insights...

WEB Dec 5 2023 nbsp 0183 32 1 Filing and Payment Statistics In response to a the Minister of State in the Ministry of Finance Shri Pankaj Chaudhary reveals that in the Financial Year 2022 23 10 09 crore PAN holders paid taxes As of December 2 2023 7 76 crore returns have been filed with more expected before the year end deadline

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1944821

WEB Aug 1 2023 nbsp 0183 32 The total number of ITRs for AY 2023 24 filed till 31 st July 2023 are more than 6 77 crore which is 16 1 more than the total ITRs for AY 2022 23 5 83 crore filed till 31 st July 2022 The filing of ITRs peaked on 31 st July 2023 due date for salaried taxpayers and other non tax audit cases with over 64 33 lakh ITRs being filed on a

https://economictimes.indiatimes.com/topic/Income...

WEB Apr 18 2024 nbsp 0183 32 Income tax updated return March 31 2024 is the last date to file an updated income tax return ITR U for AY 2021 22 FY 2020 21 Do note that ITR U may be used to fix errors like under reporting or misreporting of income or any other errors in

WEB Oct 26 2023 nbsp 0183 32 The returns filed by individual taxpayers have increased from 3 36 crore in Assessment Year AY 2013 14 to 6 37 crore in AY 2021 22 registering an overall increase of 90 During the current fiscal too 7 41 crore returns have been filed for AY 2023 24 till date including 53 lakh new first time filers WEB Aug 7 2023 nbsp 0183 32 Of the total 6 77 crore individual income tax return ITR filers for the financial year 2022 23 4 65 crore people reportedly paid zero tax This means more than half of the people who filed ITR till July 31 2023 the deadline for filing ITR for FY22 23 without penalty were either not eligible to pay tax or paid no tax

WEB Feb 7 2024 nbsp 0183 32 OMB 1545 2212 The Individual Taxpayer Burden Survey is an important project that can benefit you and millions of other taxpayers We hear from taxpayers that preparing and filing tax returns are time consuming and expensive We are conducting a survey of randomly selected taxpayers to learn more about those costs