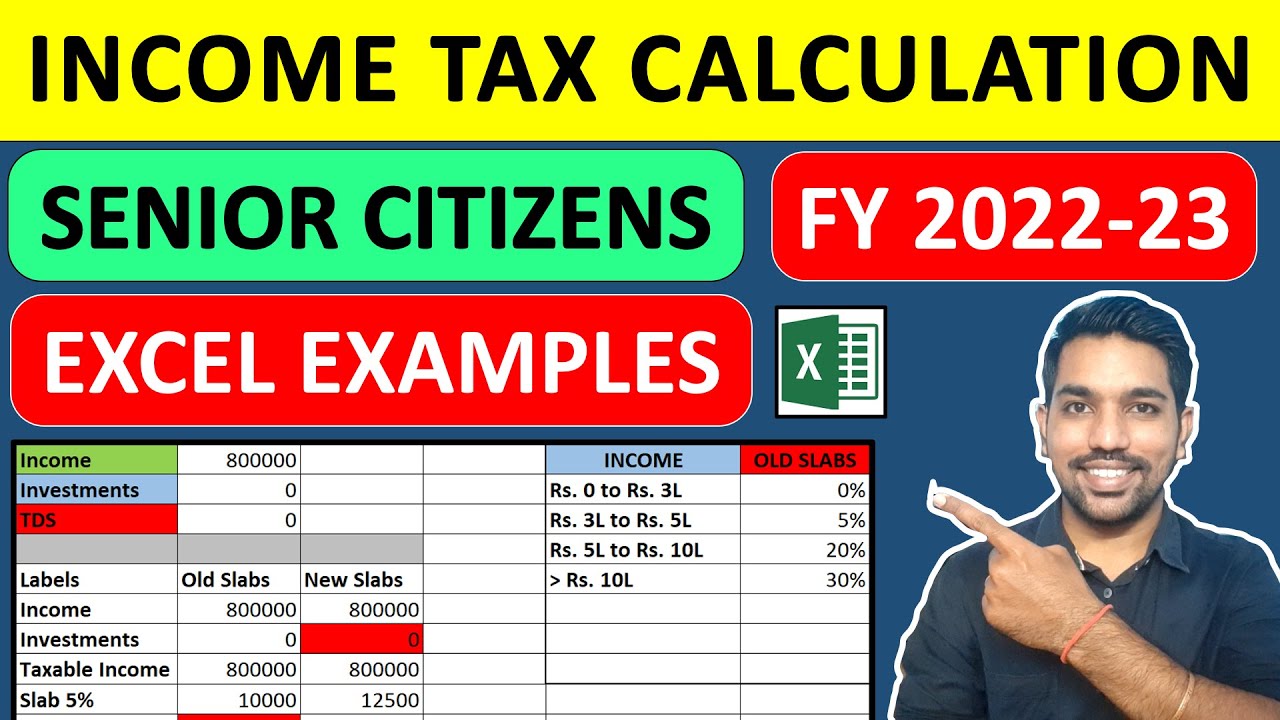

Income Tax Rates For Senior Citizens For Assessment Year 2022 23 Web Result Feb 2 2024 nbsp 0183 32 Discover the updated income tax slabs applicable to senior citizens and super senior citizens for the financial year 2023 24 and assessment year

Web Result Feb 7 2023 nbsp 0183 32 Income Tax b Surcharge Surcharge is levied on the amount of income tax at following rates if total income of an assessee exceeds specified limits Note 1 The enhanced Web Result Feb 13 2023 nbsp 0183 32 33 4 0 05 NSE Top Performing Index Nifty Bank 47835 8 129 6 0 27 Nifty Auto 21126 8 54 5 0 26 Nifty Midcap 100 48966 15

Income Tax Rates For Senior Citizens For Assessment Year 2022 23

Income Tax Rates For Senior Citizens For Assessment Year 2022 23

Income Tax Rates For Senior Citizens For Assessment Year 2022 23

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

Web Result Jan 11 2023 nbsp 0183 32 Income Tax Slab amp Tax Rates in India for FY 2022 23 Latest income tax slabs and rates as per the union Budget 2022 Check here

Templates are pre-designed files or files that can be used for various functions. They can save effort and time by offering a ready-made format and layout for developing different sort of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Income Tax Rates For Senior Citizens For Assessment Year 2022 23

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

2022 Tax Brackets Irs Calculator

List Of Banks That Hiked FD Interest Rates In The First Week Of January

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

PNB Raises FD Interest Rates For Senior Citizens Super Senior Citizens

New Vs Old Tax Slabs Fy 2022 23 Which Is Better Calculator Stable Www

https://taxguru.in/income-tax/income-tax-rates...

Web Result Sep 9 2023 nbsp 0183 32 This article aims to provide a comprehensive guide on the income tax rates applicable for the Assessment Years 2023 24 and 2024 25 It covers tax

https://www.incometax.gov.in/iec/foportal/help/...

Web Result Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for

https://tax2win.in/guide/income-tax-for-senior-citizens

Web Result Mar 5 2024 nbsp 0183 32 The basic exemption limit for senior citizens individuals aged 60 years or above is currently Rs 3 lakh for the financial year 2023 24 old tax

https://www.indiafilings.com/learn/incom…

Web Result Feb 27 2023 nbsp 0183 32 12 of the amount of income tax when the total income exceeds INR 1 Crore Check the Income tax rates for assessment in 2023 Know Income tax slab for individuals

https://taxguru.in/income-tax/income-tax-rates...

Web Result Jun 13 2022 nbsp 0183 32 Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs

Web Result Feb 11 2022 nbsp 0183 32 Articles gt How Senior Citizens are Taxed A Complete Guide Last updated Fri Feb 11 2022 The Income Tax Act of India clearly defines the tax Web Result Standard deduction amount increased For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing

Web Result Apr 22 2023 nbsp 0183 32 New Tax Regime for Senior Citizens Income Tax Calculator Slabs Rates and Rebates for FY 2023 24 Feedback New Tax Regime for Senior