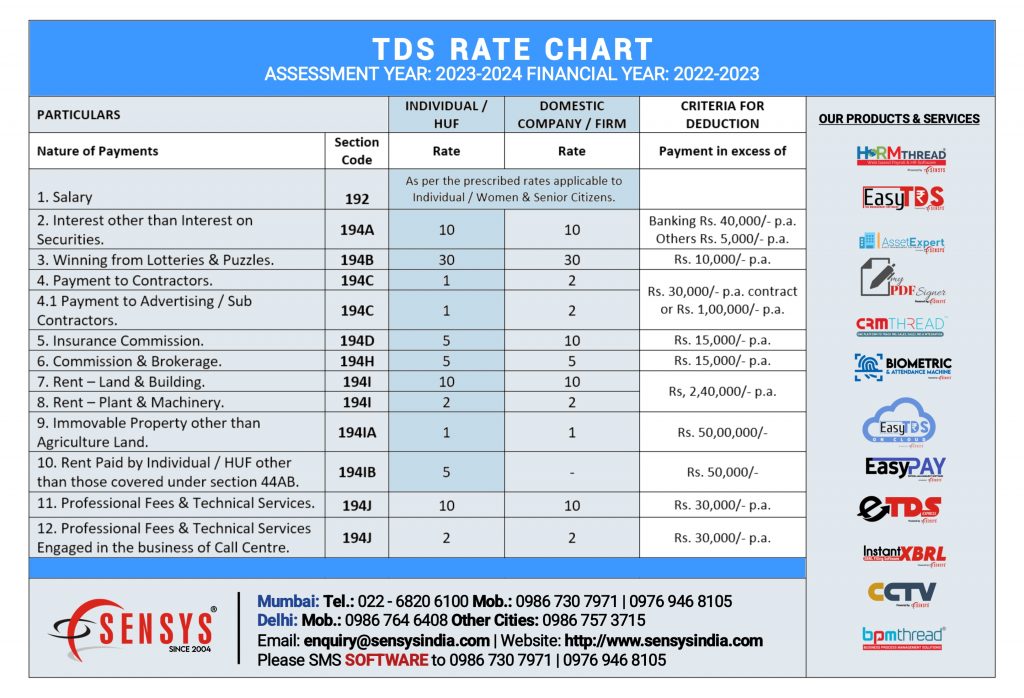

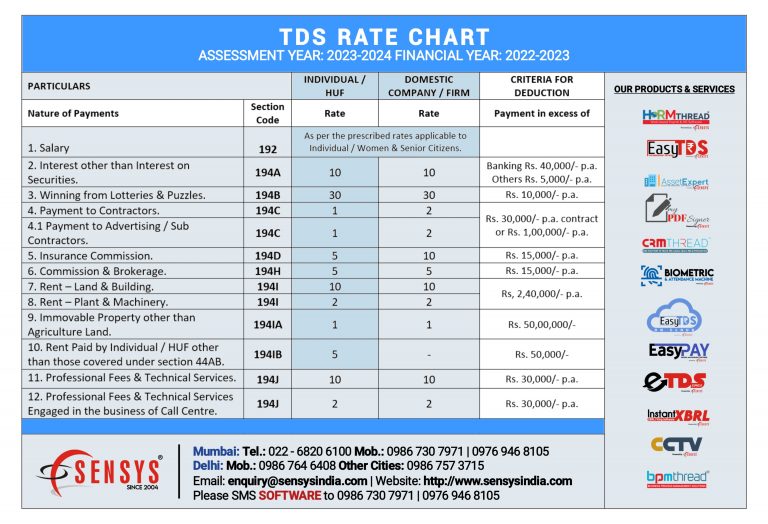

Income Tax Rates For Fy 2022 23 Pdf Download TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent commission professional fees salary interest etc by the

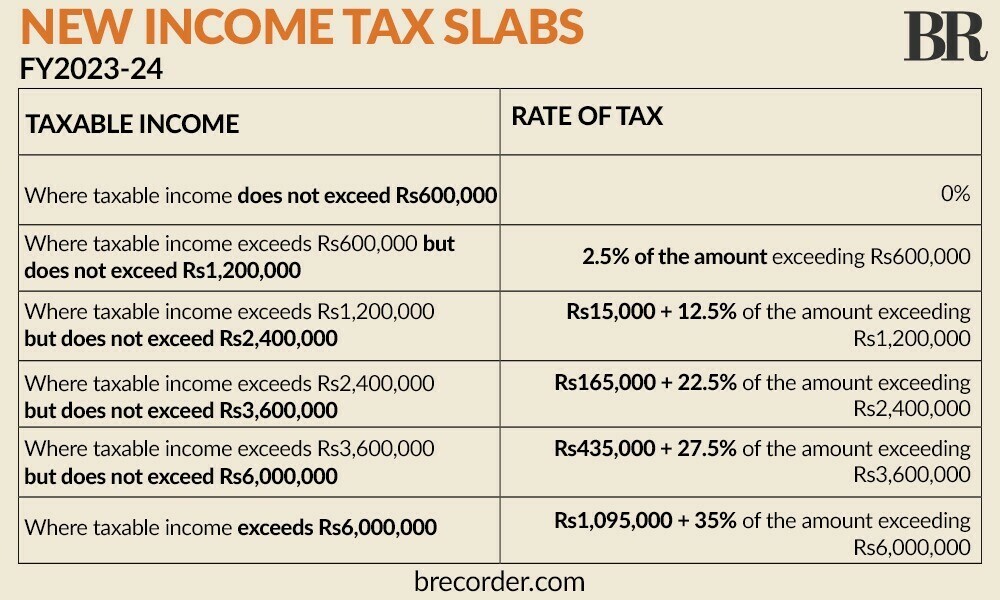

FY 2022 23 AY 2023 24 taxguru in Free download as PDF File pdf Text File txt or read online for free The document discusses the proposed new income tax slabs for fiscal years Dec 13 2022 nbsp 0183 32 As per the Finance Act 2022 the rates of income tax for the FY 2022 23 i e Assessment Year 2023 24 are as follows Rates of tax A Normal Rates of tax In the case of every individual other than the individuals

Income Tax Rates For Fy 2022 23 Pdf Download

Income Tax Rates For Fy 2022 23 Pdf Download

Income Tax Rates For Fy 2022 23 Pdf Download

https://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210-768x524.jpg

Dec 10 2022 nbsp 0183 32 The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022 23 and

Pre-crafted templates use a time-saving option for creating a diverse range of documents and files. These pre-designed formats and designs can be utilized for numerous individual and professional tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content creation process.

Income Tax Rates For Fy 2022 23 Pdf Download

Budget 2023 24 high Earners To Pay A Higher Income Tax As Govt

Ay Sales 2025 Leon Tanner

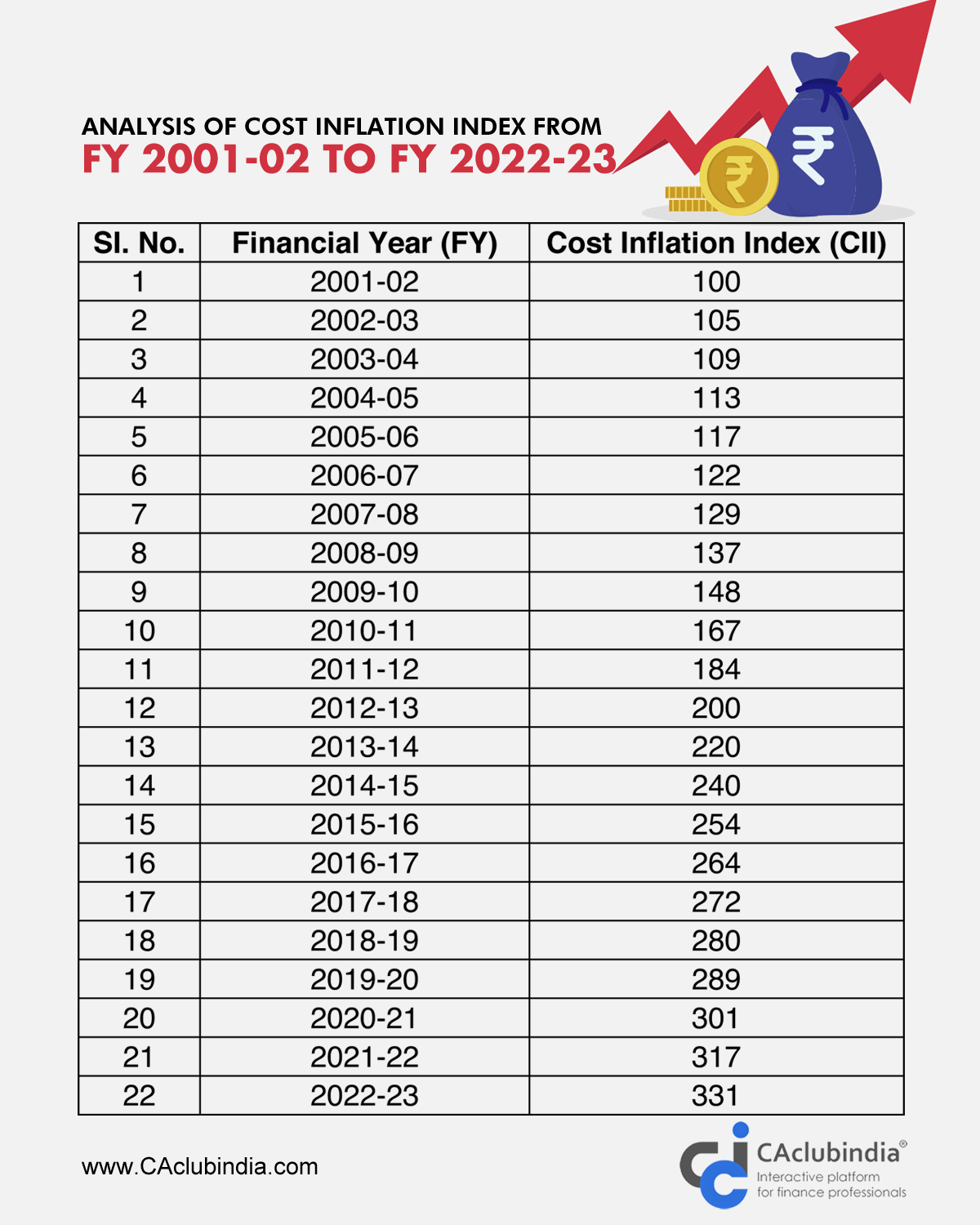

2024 Frontier Cost Inflation Manya Idaline

Income Tax Calculator Ay 2025 26 Excel Charlotte H Bishop

Tds Chart Fy 2023 24 Pdf Download Image To U

TDS RATE Chart Tds Bcom Computer Notes Studocu

https://rtsprofessionalstudy.com › ...

a Surcharge The amount of income tax shall be increased by a surcharge at the rate of 7 of such tax where total income exceeds one crore rupees but not exceeding ten crore rupees

https://www.scribd.com › document

The document provides information about income tax slab rates in India for the financial year 2022 23 It details the tax rates and slabs for individual taxpayers HUFs firms and companies It also discusses rebates surcharges and cess

https://d3u7ubx0okog7j.cloudfront.net › documents

In this part you can gain knowledge about the normal tax rates applicable to different taxpayers For special tax rates applicable to special incomes like long term capital gains winnings from

https://taxguru.in › income-tax

Feb 4 2022 nbsp 0183 32 Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc

https://incometaxindia.gov.in › Pages › tax-rates.aspx

Tax Rates AY 2023 24 and AY 2024 25 Tax rates for last 10 years Tax Rates DTAA v Income tax Act Withholding Tax Rates TDS Rates Quick Access

IF you are searching TDS Rate Chart FY 2022 23 AY 2023 24 in PDF format then you have arrived at the right website and you can directly download the TDS Rate Chart For Ay 2023 24 May 30 2022 nbsp 0183 32 This post will help you in knowing the latest TDS Rate Chart FY 2022 23 and AY 2023 24 You will find a synopsis of the latest TDS Rate Chart FY 2022 23 along with a little

Feb 1 2022 nbsp 0183 32 Income Tax Slab Rates as per Financial Year 2022 23 Assessment Year 2023 24