Income Tax Rates For Financial Year 2022 23 Web Jan 4 2024 nbsp 0183 32 Only the portion of the individual s taxable income from 100 526 to 191 950 would be taxed at the 24 rate Your effective tax rate is essentially a blended rate What are the current tax

Web For individuals opting for the concessional taxation regime under section 115BAC of the Act the rates are as under Total Income Rs Rate of income tax Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 From 5 00 001 to 7 50 000 10 From 7 50 001 to 10 00 000 15 From 10 00 001 to 12 50 000 20 From 12 50 001 to 15 00 000 25 Above 15 00 000 30 Web 4 days ago nbsp 0183 32 For the first 11 000 of that income you ll pay the lowest 2023 tax rate 10 on that tier of income For the tier of income between 11 001 and 44 725 you ll pay a 12 tax rate For all of

Income Tax Rates For Financial Year 2022 23

Income Tax Rates For Financial Year 2022 23

Income Tax Rates For Financial Year 2022 23

https://i0.wp.com/edutaxtuber.in/wp-content/uploads/2022/12/Income-Tax-Rates-for-Financial-Year-2022-23.webp?fit=1200%2C675&ssl=1

Web Feb 1 2022 nbsp 0183 32 The income tax department of India has notified new ITR forms for the financial year 2022 23 Finance Minister Nirmala Sitharaman presented Union Budget 2022 23 in Parliament today February 1 2021 The Finance Minister announced no change in personal income tax slabs and rates

Pre-crafted templates offer a time-saving option for developing a varied variety of documents and files. These pre-designed formats and designs can be utilized for different personal and expert projects, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the material development procedure.

Income Tax Rates For Financial Year 2022 23

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Income Tax Slabs Year 2022 23 Info Ghar Educational News

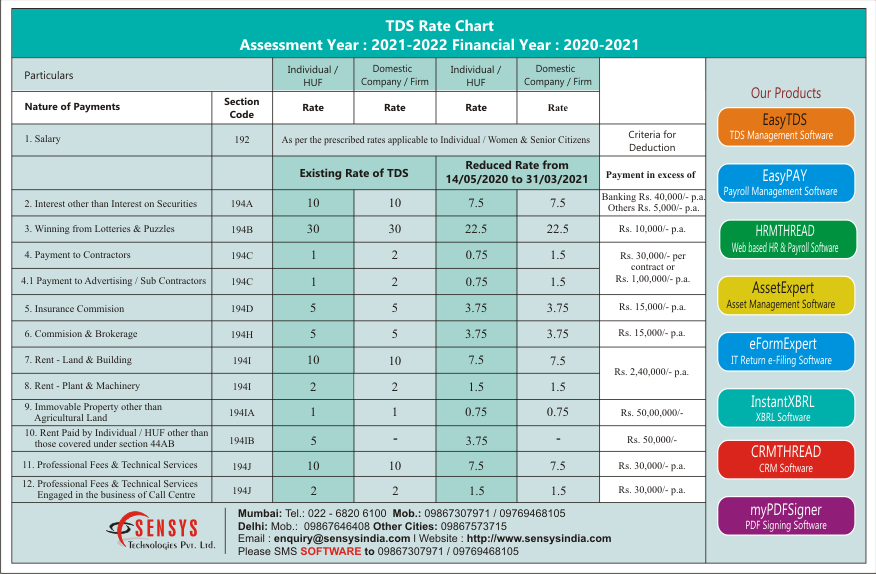

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Income Tax Rates

Income Tax Slab Rates For FY 2021 22 Budget 2021 Highlights

https://taxguru.in/income-tax/income-tax-rates-financial-year-2024-25...

Web Sep 9 2023 nbsp 0183 32 Income Tax Rates For FY 2022 23 amp 2023 24 i e AY 2023 24 amp 2024 25 Editor Income Tax Articles Featured Download PDF 09 Sep 2023 44 496 Views 2 comments Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company

https://taxguru.in/income-tax/income-tax-rates-assessment-year-2022-2…

Web Feb 1 2022 nbsp 0183 32 Income tax rates for assessment year 2022 23 Financial Year 2021 22 Editor4 Income Tax Articles Download PDF 01 Feb 2022 27 672 Views 2 comments DIRECT TAXES A RATES OF INCOME TAX I Rates of income tax in respect of income liable to tax for the assessment year 2022 23

https://www.fidelity.com/learning-center/personal-finance/tax-brackets

Web Jan 5 2024 nbsp 0183 32 For example assume a hypothetical taxpayer who is married with 150 000 of joint income in 2024 and claiming the standard deduction of 29 200 They would owe the following taxes 10 of the first 23 200 2 320 12 of the next 71 100 8 532 22 of the remaining 26 500 5 830

https://economictimes.indiatimes.com/wealth/tax/what-are-the-income...

Web Feb 28 2023 nbsp 0183 32 For the financial year 2022 23 ending on March 31 2023 the income tax slabs that will be applicable for your incomes earned between April 1 2022 and March 31 2023 will be the ones announced in the previous budget The Union Budget 2022 did not make any changes in the income tax slabs

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

Web Feb 1 2023 nbsp 0183 32 The tax rebate was available for taxable income up to Rs 5 lakh in new tax regime till FY 2022 23 Thus individuals opting for the new income tax regime in FY 2023 24 and having an income up to Rs 7 lakh will not pay any taxes Web Feb 25 2022 nbsp 0183 32 Basic rate Anything you earn from 163 12 571 to 163 50 270 is taxed at 20 Higher rate Anything you earn from 163 50 571 to 163 150 000 is taxed at 40 Additional rate Anything you earn over 163 150 000 is taxed at 45 Remember you only get taxed on the amount that falls within each rate For example if you earned 163 60 000

Web PLANNING YOUR TAXES FOR FY 22 23 Tax Planning for Individuals TAX PLANNING FOR FY 2022 23 CONTAINS 5 PARTS PART I HIGHLIGHTS OF CHANGES IN TAX RULES FOR FY 2022 223 READ THIS PART BELOW PART 2 TAX RATES SLABS FOR FY 2022 23 CLICK HERE PART 3 TAX REBATES FOR FY 22 23 CLICK HERE