Income Tax Rates For Ay 2022 23 Uk Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23 these three rates are 20 40 and 45 respectively

The standard Personal Allowance for the tax year 2022 23 is 163 12 570 Personal Allowances can be bigger for some individuals and couples For example it will be higher if you claim the Blind Feb 25 2022 nbsp 0183 32 These are the current income tax rates for the UK and they ll stay the same for the financial year 2022 to 2023 The rates are as follows Basic rate Anything you earn from

Income Tax Rates For Ay 2022 23 Uk

Income Tax Rates For Ay 2022 23 Uk

Income Tax Rates For Ay 2022 23 Uk

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

From the same date a small profits rate of 19 will apply to profits up to 163 50 000 For businesses with profits between 163 50 000 and 163 250 000 tax will be charged at the main rate subject to marginal relief provisions which will

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by supplying a ready-made format and layout for producing various kinds of material. Templates can be used for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Income Tax Rates For Ay 2022 23 Uk

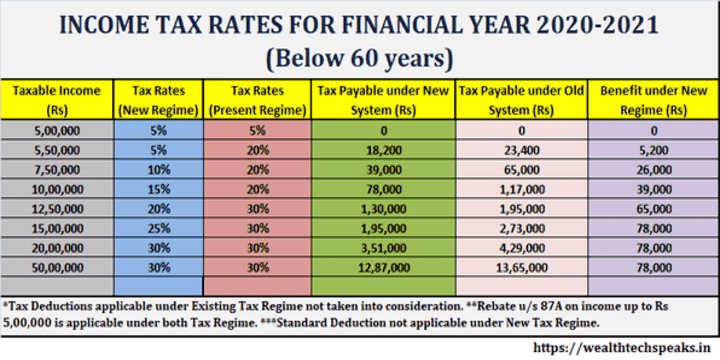

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling Otosection

Income Tax Slab Rates For AY 2022 23 Taxmann Blog

Income Tax Rates For FY 2021 22 FY 2022 23 AY 2022 23 2023 24

https://www.gov.uk › government › publications › rates...

Aug 14 2024 nbsp 0183 32 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025

https://www.gov.uk › ... › rates-and-allowances-income-tax

Jan 1 2014 nbsp 0183 32 Basic rate band values for England amp Northern Ireland and Wales have been corrected from 163 37 000 to 163 37 700 Rates allowances and duties have been updated for the

https://www.uktaxcalculators.co.uk › ta…

2022 2023 Tax Rates and Allowances Click to select a tax section Income Tax Use our Tax Calculator to Calculate Income Tax Tax Free Personal Allowance the amount of gross income you can earn before you are liable to paying

https://www.icalculator.com › tax-calcula…

The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more

https://taxscouts.com › the-tax-basics

Oct 9 2023 nbsp 0183 32 Watch on For the tax year 2022 2023 the UK basic income tax rate was 20 This increased to 40 for your earnings above 163 50 270 and to 45 for earnings over 163 150 000 Your earnings below 163 12 570 were tax free This is

Personal Income Tax Rates in England for the 2022 23 Tax Year The income tax rates and thresholds below are for employees in England EN you can use this income tax calculator for Sep 23 2022 nbsp 0183 32 From April 2023 there will be a single higher rate of Income Tax of 40 per cent rather than an additional 45 on annual income above 163 150 000 Why has the government

Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans Updated for the 2024 2025 tax year