Income Tax Rates Assessment Year 2022 23 Web Apr 5 2024 nbsp 0183 32 This handy calculator will show you how much income tax and National Insurance you ll pay in the 2024 25 2023 24 2022 23 and 2021 22 tax years as well as

Web Tax Calculator for 2022 23 Tax Year The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC payments Web Apr 5 2024 nbsp 0183 32 If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance the basic rate 20 the higher

Income Tax Rates Assessment Year 2022 23

Income Tax Rates Assessment Year 2022 23

Income Tax Rates Assessment Year 2022 23

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Calculation-Financial-Year-2022-23.png

Web Jun 15 2023 nbsp 0183 32 Tax rates and thresholds for the 2022 23 and 2023 24 tax years are shown below We ve split them into Personal and Company tax rates you can use the links to

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can conserve effort and time by supplying a ready-made format and layout for producing various kinds of content. Templates can be used for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Income Tax Rates Assessment Year 2022 23

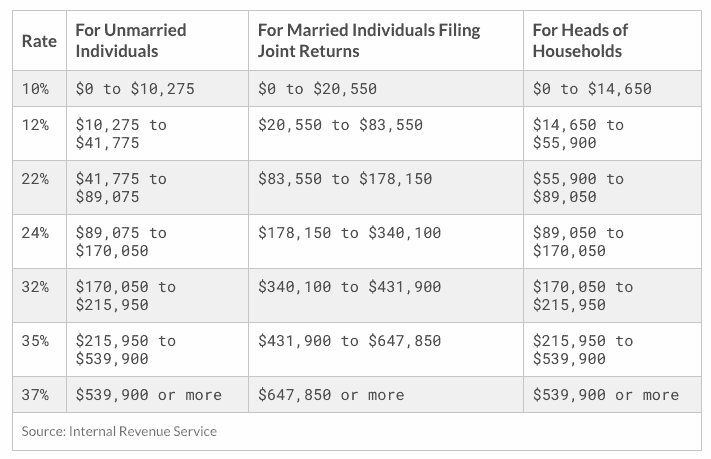

2022 Tax Brackets JeanXyzander

Income Tax Rates 2023 To 2024 PELAJARAN

Income Tax Calculator Old Regime 2023 24 Excel Pay Period Calendars 2023

Income Tax Rates Slab For FY 2021 22 Or AY 2022 23 Ebizfiling

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

2022 Tax Brackets JeanXyzander

https:// taxguru.in /income-tax/income-tax-rates...

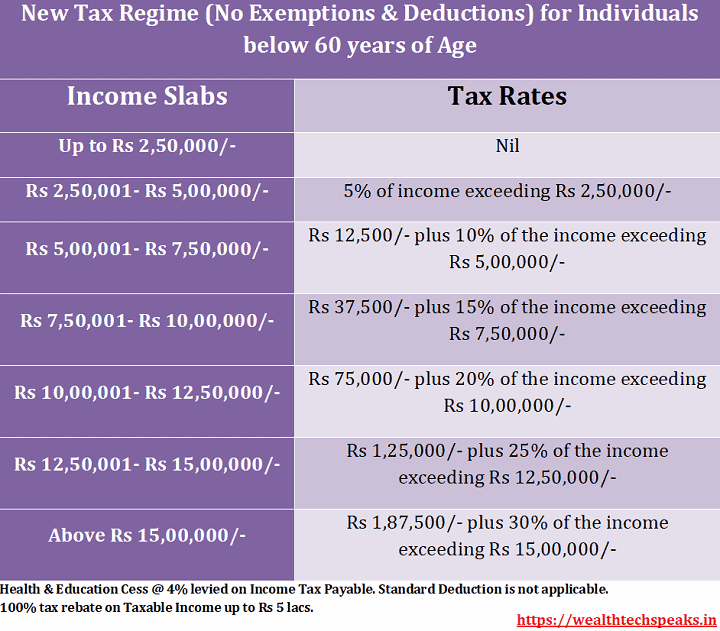

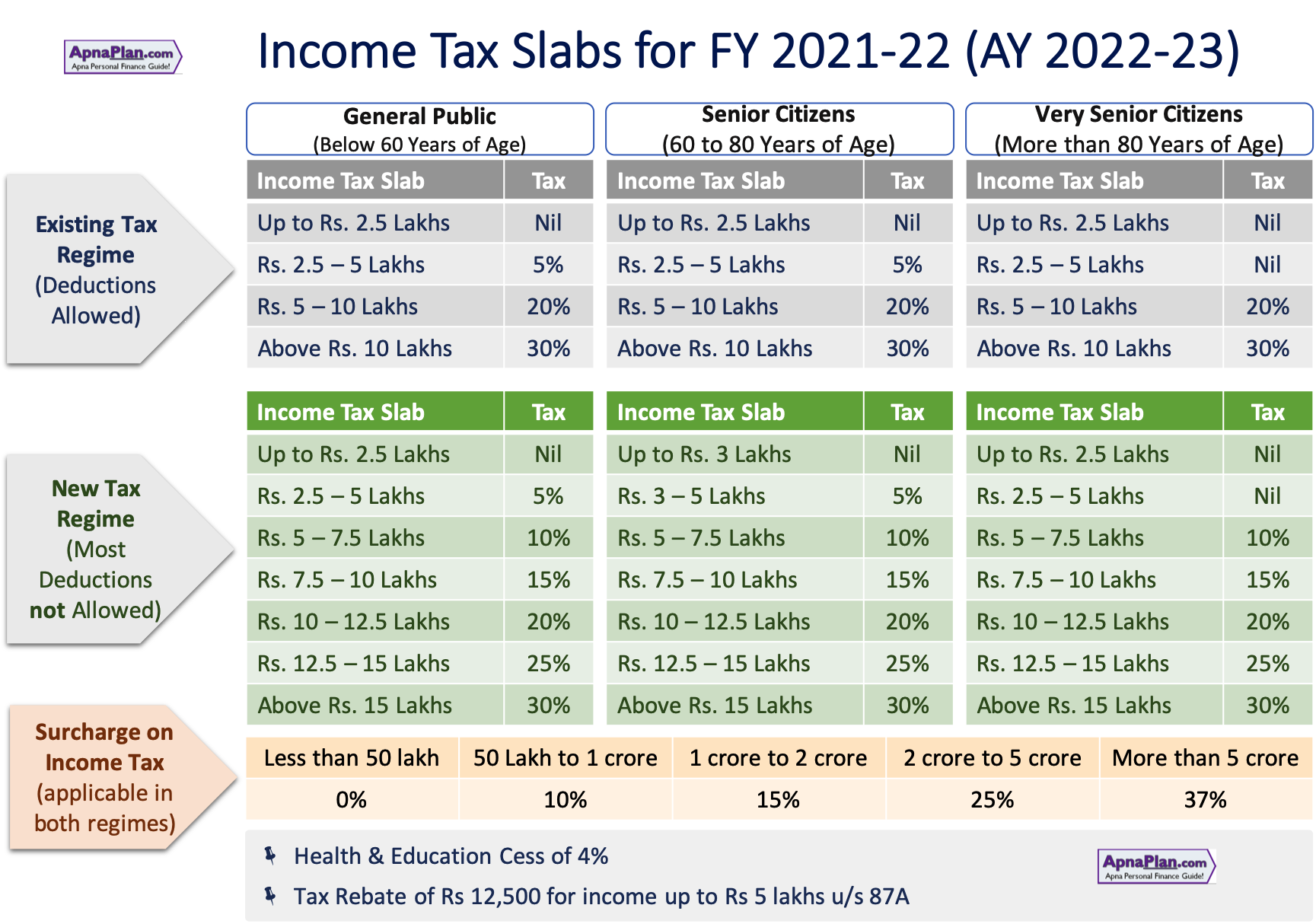

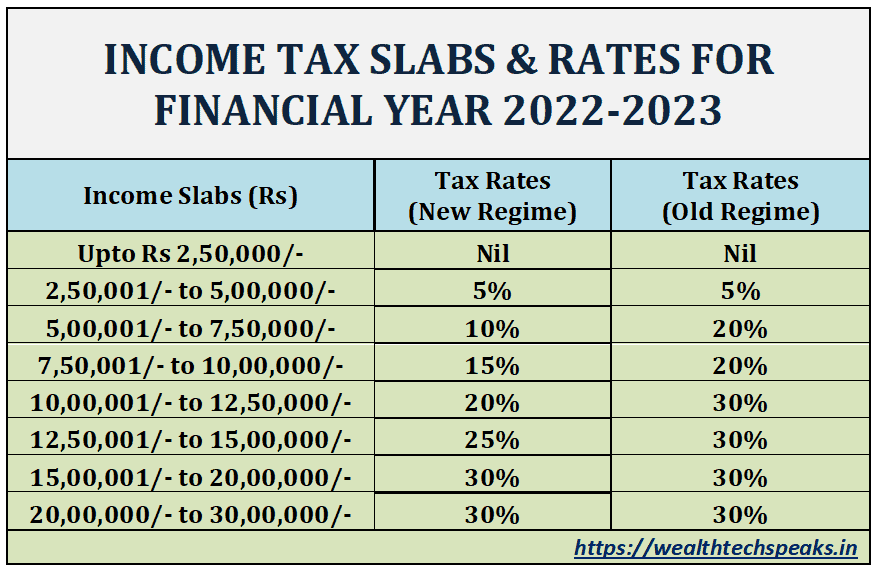

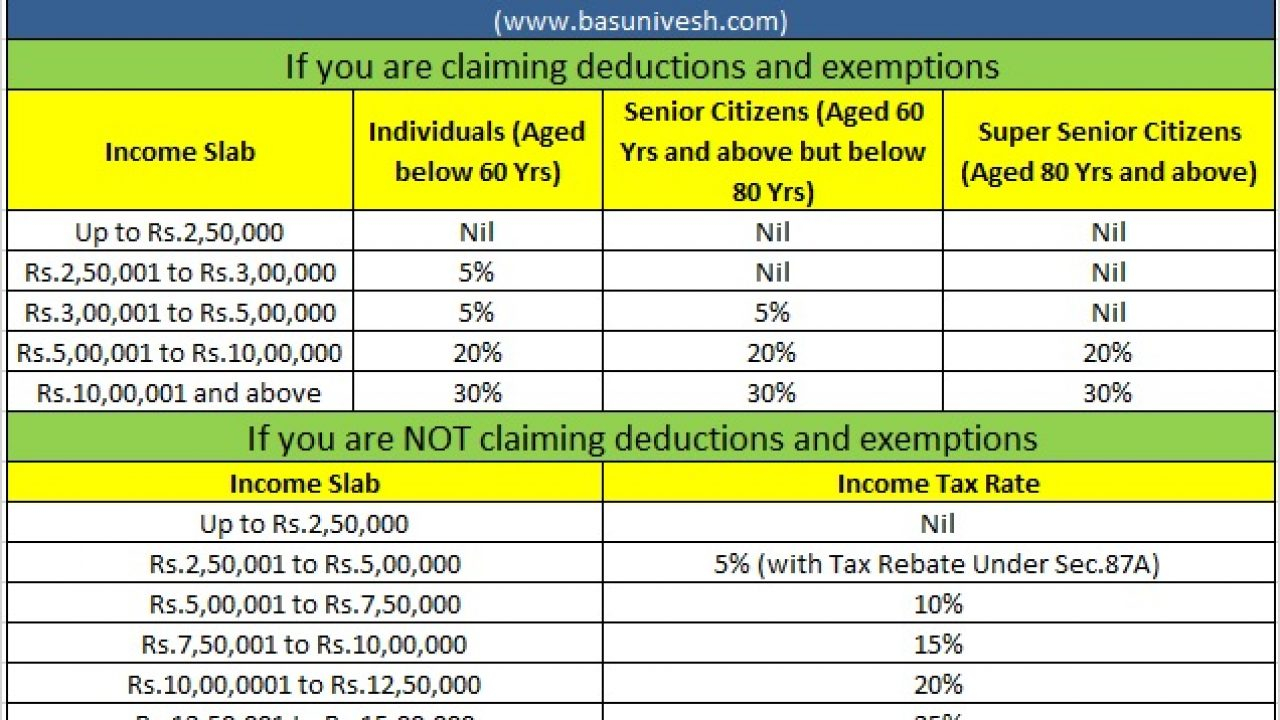

Web Feb 2 2021 nbsp 0183 32 From 10 00 001 to 12 50 000 20 per cent From 12 50 001 to 15 00 000 25 per cent Above 15 00 000 30 per cent B Income tax Rates for assessment year 2022 23

https:// cleartax.in /s/income-tax-slabs

Web Apr 1 2024 nbsp 0183 32 Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime until 31st March 2023

https:// taxguru.in /income-tax/income-tax-rates...

Web Feb 1 2022 nbsp 0183 32 Above 15 00 000 30 per cent Similarly a co operative society resident in India has the option to pay tax at 22 per cent for assessment year 2021 22 onwards as

https:// commonslibrary.parliament.uk /res…

Web Nov 7 2022 nbsp 0183 32 Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23 these three rates are 20 40 and 45 respectively Tax is charged on taxable

https://www. hasil.gov.my /.../tax-rate

Web Certificate of Residence e Residence Advance Pricing Arrangement Foreign Exchange Rate Incentives Average Lending Rate Bank Negara Malaysia Schedule Section 140B

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Financial Year 2023 24 Assessment Year 2023 24 Financial Year 2022 23 Up to Rs Web Feb 18 2022 nbsp 0183 32 Posted By Amritesh On February 18th 2022 Comments 5 responses Income Tax Slabs amp Rates remain unaltered for Financial Year 2022 23 AY 2023 24

Web ASSESSMENT YEAR 2022 2023 RELEVANT TO FINANCIAL YEAR 2021 2022 The normal tax rates applicable to a resident individual will depend on the age of the