Income Tax Rates 2023 24 Australia Web May 9 2023 nbsp 0183 32 The ATO will receive 89 6m and the Treasury 1 2m to extend the Personal Income Tax Compliance Program for two years from 1 July 2025 and expand its scope from 1 July 2023 The ATO is to use the extension to continue delivering a combination of proactive preventative and corrective activities in key areas of non compliance

Web Dec 12 2023 nbsp 0183 32 The following tables set out the PIT rates that currently apply to resident and non resident individuals for the year ending 30 June 2023 Web Jun 9 2023 nbsp 0183 32 The Australian Taxation Office June 6 posted online the 2023 24 individual income tax rates and thresholds for 1 residents 2 nonresidents and 3 holiday visa workers Australia Australian Taxation Office 06 06 23

Income Tax Rates 2023 24 Australia

Income Tax Rates 2023 24 Australia

Income Tax Rates 2023 24 Australia

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1200/dpr_auto,f_auto/website-images/netlify/rates_income-tax-rates-and-bands_2022-23.png

Web 2023 24 Tax Expenditures and Insights Statement 10 15 per cent income tax rate generally applies to the Australian sourced taxable income of most working holiday makers up to 45 000 with ordinary tax rates applying to all are exempt from Australian income tax where the income is subject to tax in the United

Templates are pre-designed files or files that can be used for numerous functions. They can save time and effort by offering a ready-made format and design for creating different sort of content. Templates can be used for personal or expert tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Tax Rates 2023 24 Australia

The 2023 Tax Brackets By Income Modern Husbands Home Interior Design

60 000 After Tax 2022 2023 Income Tax UK

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Louisiana Tax Free 2020 Template Calendar Design

State Local Sales Tax Rates 2023 Sales Tax Rates Tax Foundation

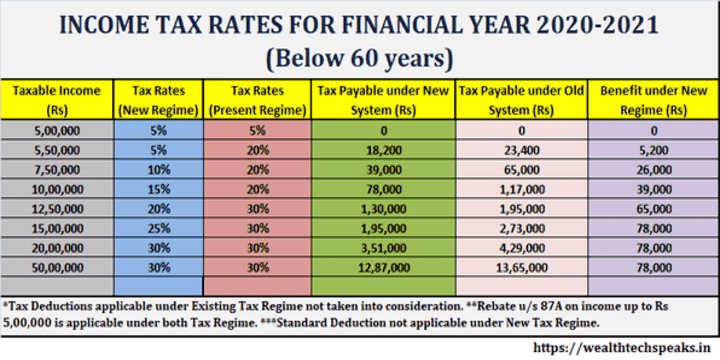

Income Tax Slabs Ahead Of Budget 2023 Know Existing Tax Rates Under

https://www.superguide.com.au/how-super-works/income-tax-rates

Web For Australian residents the tax free threshold is currently 18 200 meaning the first 18 200 of your income is tax free but you are taxed progressively on income above that amount The tax free schedule is due to stay at 18 200 until at least 2024 25

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

Web Jul 1 2023 nbsp 0183 32 There are no changes to other withholding schedules and tax tables for the 2023 24 income year The legislated stage 3 income tax cuts are not due to commence until 1 July 2024 the 2024 25 income year Tax tables quick links The following tax tables apply from 1 July 2023 Regular payments

https://www.forbes.com/advisor/au/personal-finance/...

Web Jan 25 2024 nbsp 0183 32 Income Tax Brackets Australia 2023 24 The tax brackets have remained unchanged between the financial years of 2019 20 to 2023 24 For this current financial year the tax

https://taxleopard.com.au/tax-brackets-2023-24

Web Thresholds and Changes In 2023 24 the Australian Taxation Office adjusts tax rates and thresholds Key changes include revised income tax rates and tax bracket modifications reflecting the government s approach to economic conditions The taxable income of Australians will determine their tax bracket impacting their tax return calculations

https://www.ato.gov.au/about-ato/new-legislation/...

Web On 25 January 2024 the government announced proposed changes to Individual income tax rates and thresholds from 1 July 2024 These changes are not yet law increase the threshold above which the 37 per cent tax rate applies from 120 000 to 135 000 increase the threshold above which the 45 per cent tax rate applies from 180 000 to 190 000

Web Apr 26 2023 nbsp 0183 32 For the 2023 24 income year the following income tax brackets apply to foreign residents Taxable income Tax on Income 0 120 000 32 5 of the total Income 120 001 180 000 39 000 plus 37 of the excess over 120 000 180 001 and over 61 200 plus 45 of the excess over 180 000 Web Jul 1 2018 nbsp 0183 32 Taxable Income Tax On This Income 0 to 18 200 Nil 18 201 to 45 000 19c for each 1 over 18 200 45 001 to 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 to 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

Web Updated with 2023 2024 ATO Tax rates DON T FORGET For salary and wage payments made on or after 1 July 2023 the new superannuation guarantee contribution rate of 11 will apply So check your payslip employer is paying you the correct amount of super Quick poll Do you support the Government s REVISED stage 3 tax cuts