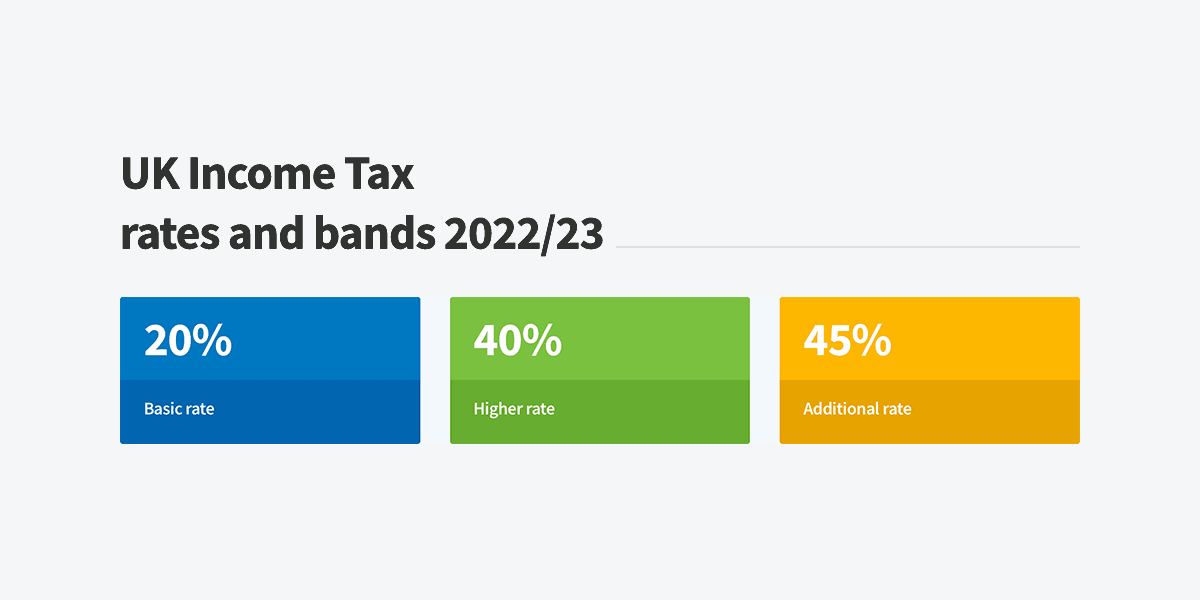

Income Tax Rates 2022 23 Uk Web Jan 24 2024 nbsp 0183 32 the basic rate 20 on taxable income between 163 12 571 and 163 50 270 the higher rate 40 on taxable income between 163 50 271 163 125 140 and the additional rate

Web Jun 15 2023 nbsp 0183 32 Basic rate taxpayers pay 8 75 in the 2023 24 and 2022 23 tax years Higher rate taxpayers pay 33 75 in the 2023 24 and 2022 23 tax years Additional rate Web the amount of gross income you can earn before you are liable to paying income tax Personal Allowance 163 12 570 Dividend Allowance 163 2 000 Personal Savings

Income Tax Rates 2022 23 Uk

Income Tax Rates 2022 23 Uk

Income Tax Rates 2022 23 Uk

https://www.millerkaplan.com/wp-content/uploads/2021/11/Ordinary-Income-Tax-Brackets_2022-1024x914.png

Web 5 days ago nbsp 0183 32 For the 2023 24 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also

Templates are pre-designed files or files that can be utilized for different purposes. They can save time and effort by providing a ready-made format and design for creating various kinds of material. Templates can be used for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Income Tax Rates 2022 23 Uk

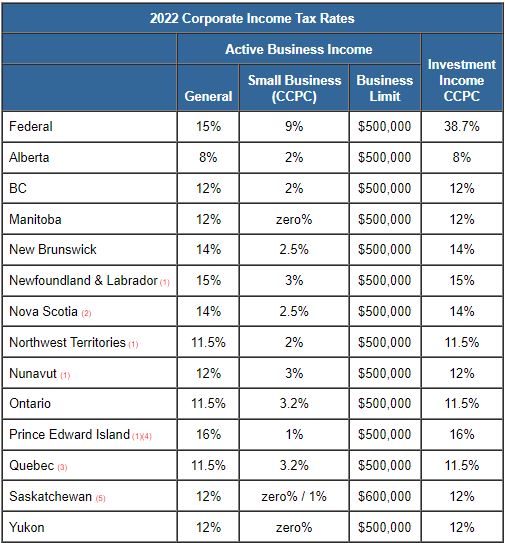

TaxTips ca Business 2022 Corporate Income Tax Rates

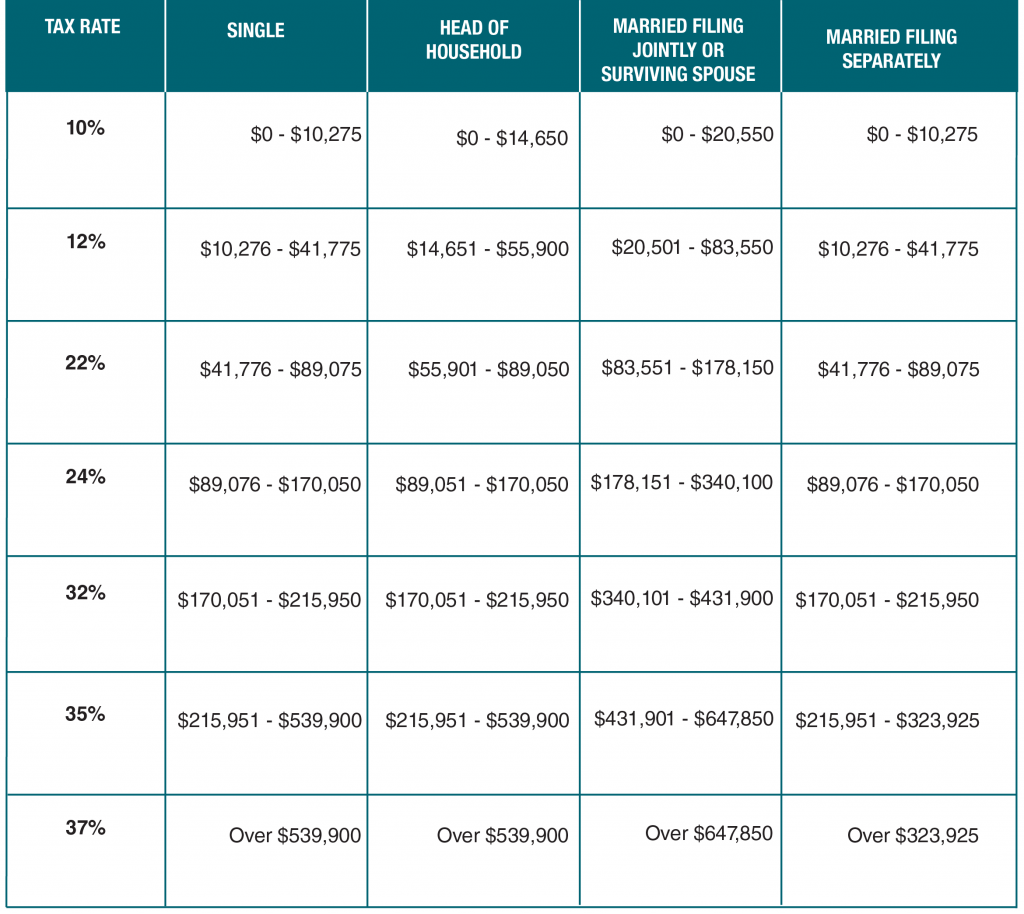

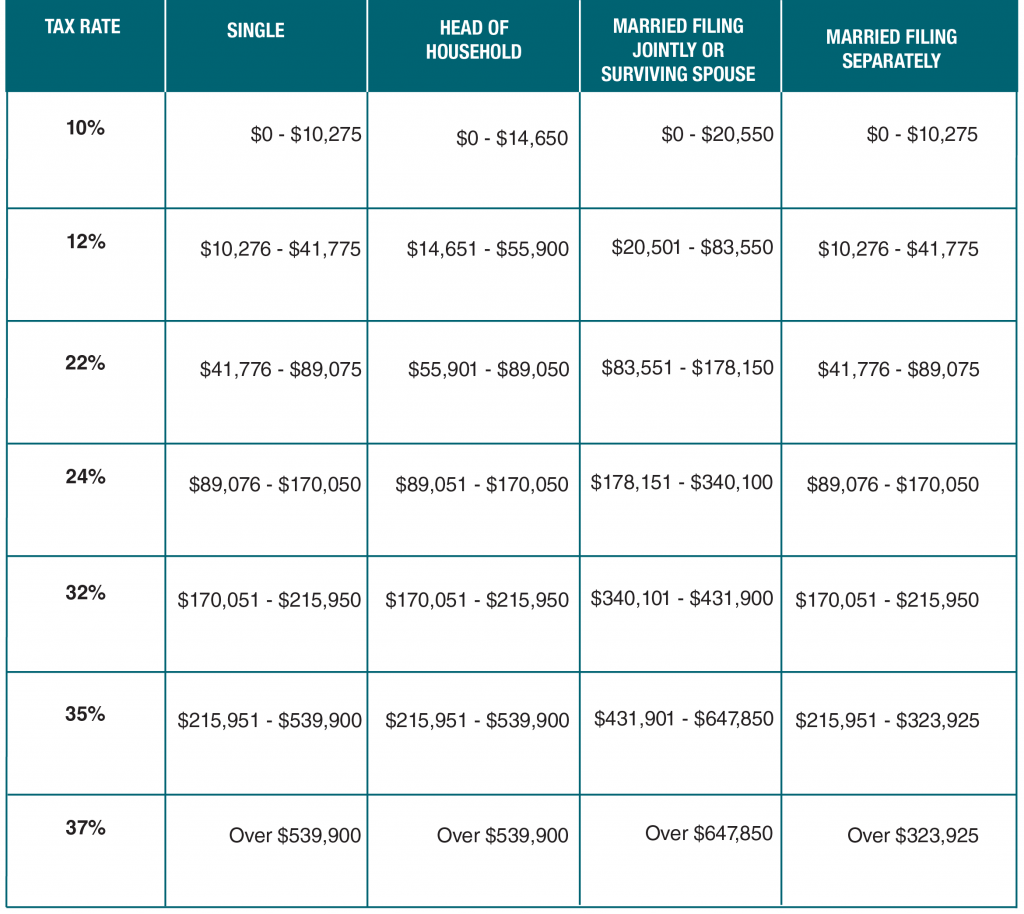

Irs Tax Rates 2022 Latest News Update

State Corporate Income Tax Rates And Brackets For 2020 The Online Tax Guy

2022 Tax Brackets Irs Calculator

2022 Tax Brackets DhugalKillen

2022 Income Tax Rate California

https://www.gov.uk/government/publications/rates...

Web Jan 15 2024 nbsp 0183 32 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 163 30 931 to 163 150 000 Top rate for tax year 2023 to

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 7 2022 nbsp 0183 32 Find out the PAYE tax and Class 1 National Insurance contributions tax thresholds rates and codes Class 1 National Insurance thresholds rates and codes

https://commonslibrary.parliament.uk/research...

Web Nov 7 2022 nbsp 0183 32 Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23 these three rates are 20 40 and 45 respectively Tax is charged on taxable

https://alexander.co.uk/news/tax-brackets-20…

Web Apr 6 2022 nbsp 0183 32 The employer rate is 0 for employees under 21 and apprentices under 25 on earnings up to 163 967 per week this is 163 242 starting 6 June 2022 Stamp Duty Land Tax Please note Land and buildings in

https://www.which.co.uk/money/tax/income-tax/tax...

Web 2 days ago nbsp 0183 32 Updated 25 Jan 2024 UK income tax rates 2023 24 Find out how much income tax you ll pay in England Wales Scotland and Northern Ireland Matthew Jenkin

Web For easy reference the UK tax rates over the last 19 years Tax Rates 2022 23 updated for Spring Statement NICs announcements on 23 March 2022 Download Tax Rates Web Review the 2022 United Kingdom income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions already

Web Oct 9 2023 nbsp 0183 32 For the tax year 2022 2023 the UK basic income tax rate was 20 This increased to 40 for your earnings above 163 50 270 and to 45 for earnings over