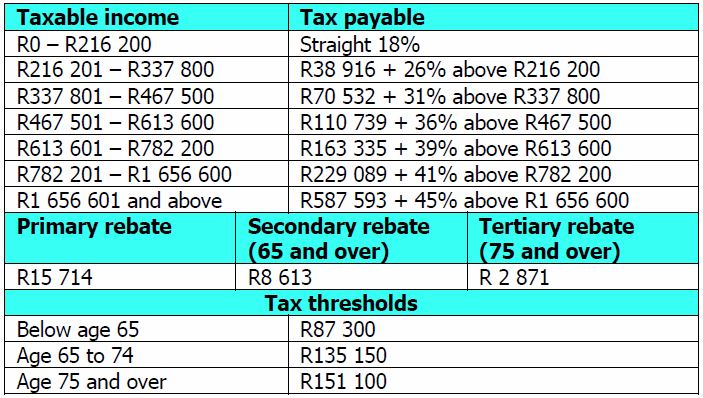

Income Tax Rates 2022 23 Uk Dividends Mar 1 2024 nbsp 0183 32 How to work out how much tax you will pay on your bonus manually Step 1 Determine your taxable income for the year by multiplying your monthly salary by 12 Step 2 Add your annual bonus to your taxable income Step 3 Using the SARS tax deduction tables for 2023 24 find out how much tax you will pay for your taxable income without bonus as per step

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper Find out the details on how to apply for the Canadian Dental Care Plan

Income Tax Rates 2022 23 Uk Dividends

Income Tax Rates 2022 23 Uk Dividends

Income Tax Rates 2022 23 Uk Dividends

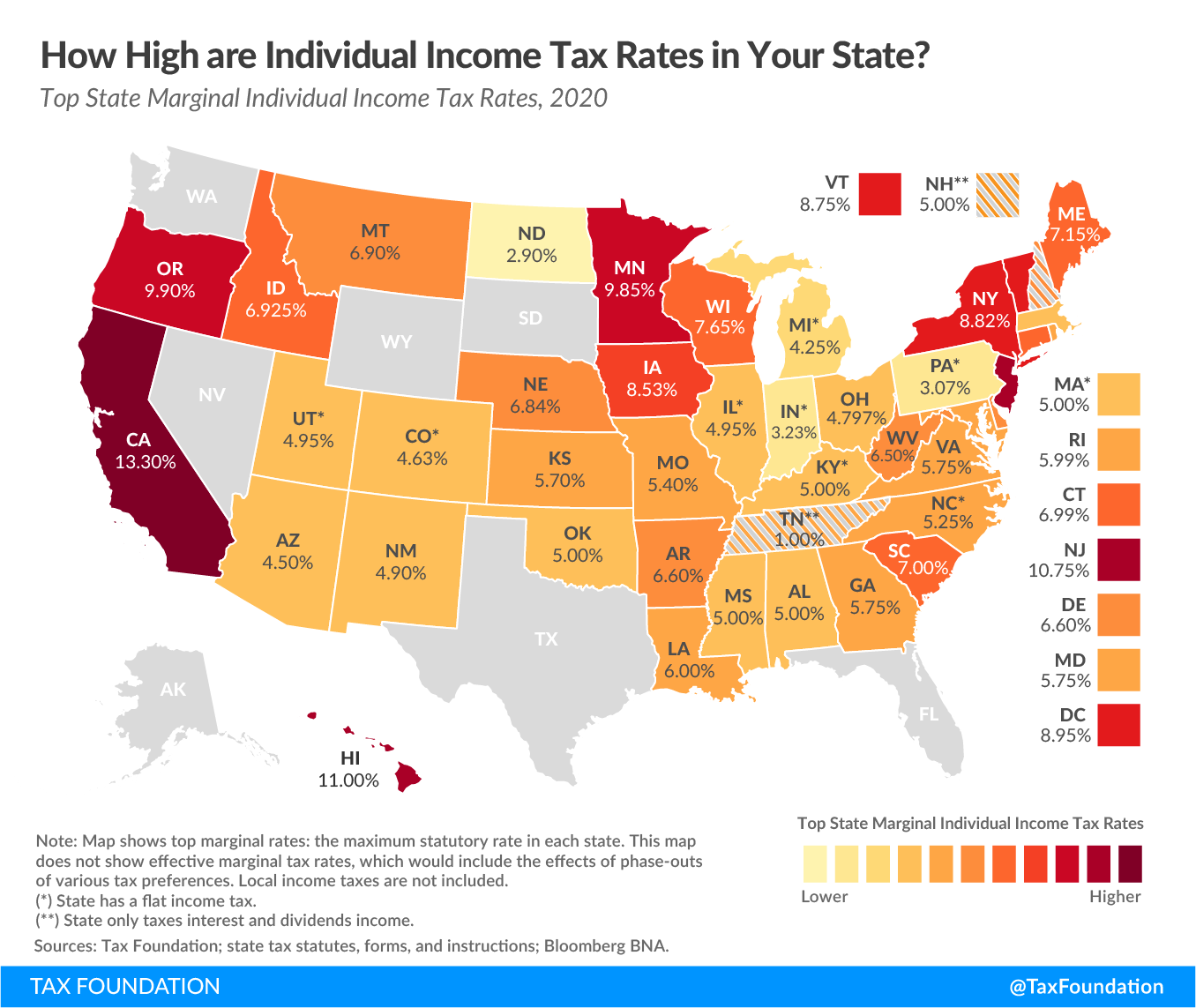

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

Dec 31 2024 nbsp 0183 32 You can get an income tax package online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes If your business income was from outside the province or territory

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by providing a ready-made format and layout for developing different sort of content. Templates can be used for personal or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Income Tax Rates 2022 23 Uk Dividends

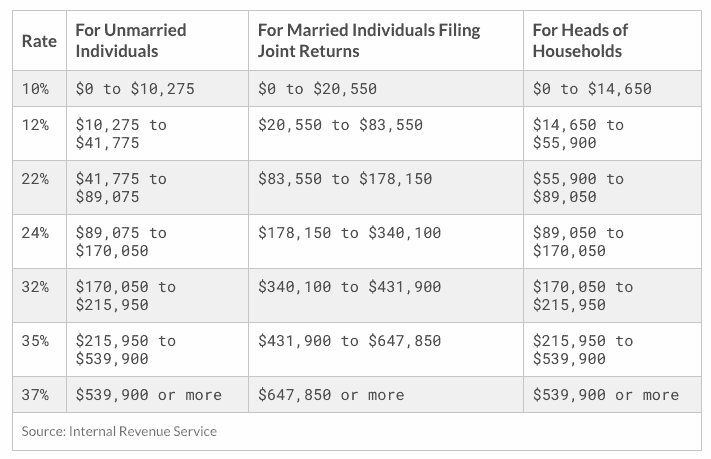

2022 Us Tax Brackets Irs

Dara Pack

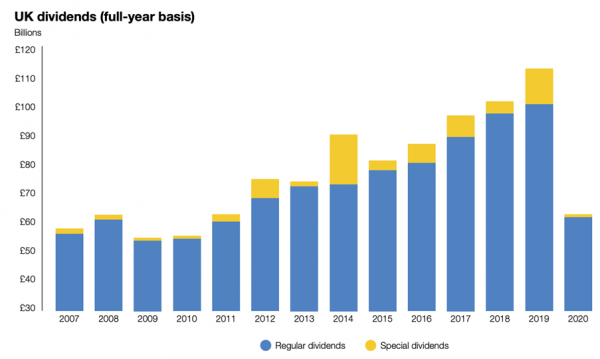

UK Dividends To Hit New Records In 2022 Bowmore Asset Management

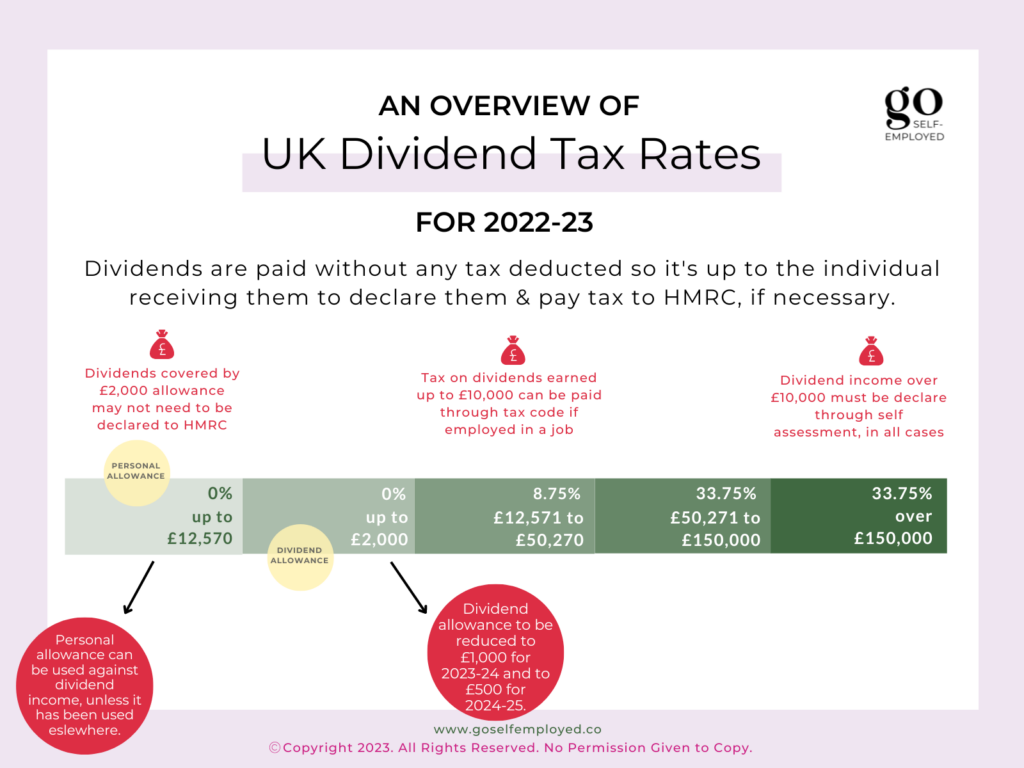

UK Dividend Tax Rates 2022 23 Goselfemployed co

UK Dividends A Bad 2020 But A Better 2021

2022 Tax Brackets JeanXyzander

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by this date By filing on time you will begin or continue to receive the benefit and credit payments you are eligible for and you

https://www.canada.ca › en › department-finance › news › delivering-a-…

May 27 2025 nbsp 0183 32 Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full year tax rate for 2025 will be 14 5 per cent and the full year rate for

https://howtaxworks.co.za › questions › income-tax-calculator

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

Jul 3 2025 nbsp 0183 32 Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

Jan 1 2025 nbsp 0183 32 Chart 2 2025 Federal claim codes Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions If your employees want you to adjust their tax deductions to allow for commission expenses they have to complete Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions

[desc-11] [desc-12]

[desc-13]