Income Tax Rates 2022 23 Uk Calculator Verkko UK Income Tax Rates 2022 You are here iCalculator United Kingdom Income Tax Rates United Kindgdom Income Tax Rates and Personal Allowances in 2022 Please

Verkko Our easy to use tax calculator allows you to complete your self assessment tax return and submit directly to HMRC for the 2022 23 tax year and previous years Verkko For the 2023 24 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your

Income Tax Rates 2022 23 Uk Calculator

Income Tax Rates 2022 23 Uk Calculator

Income Tax Rates 2022 23 Uk Calculator

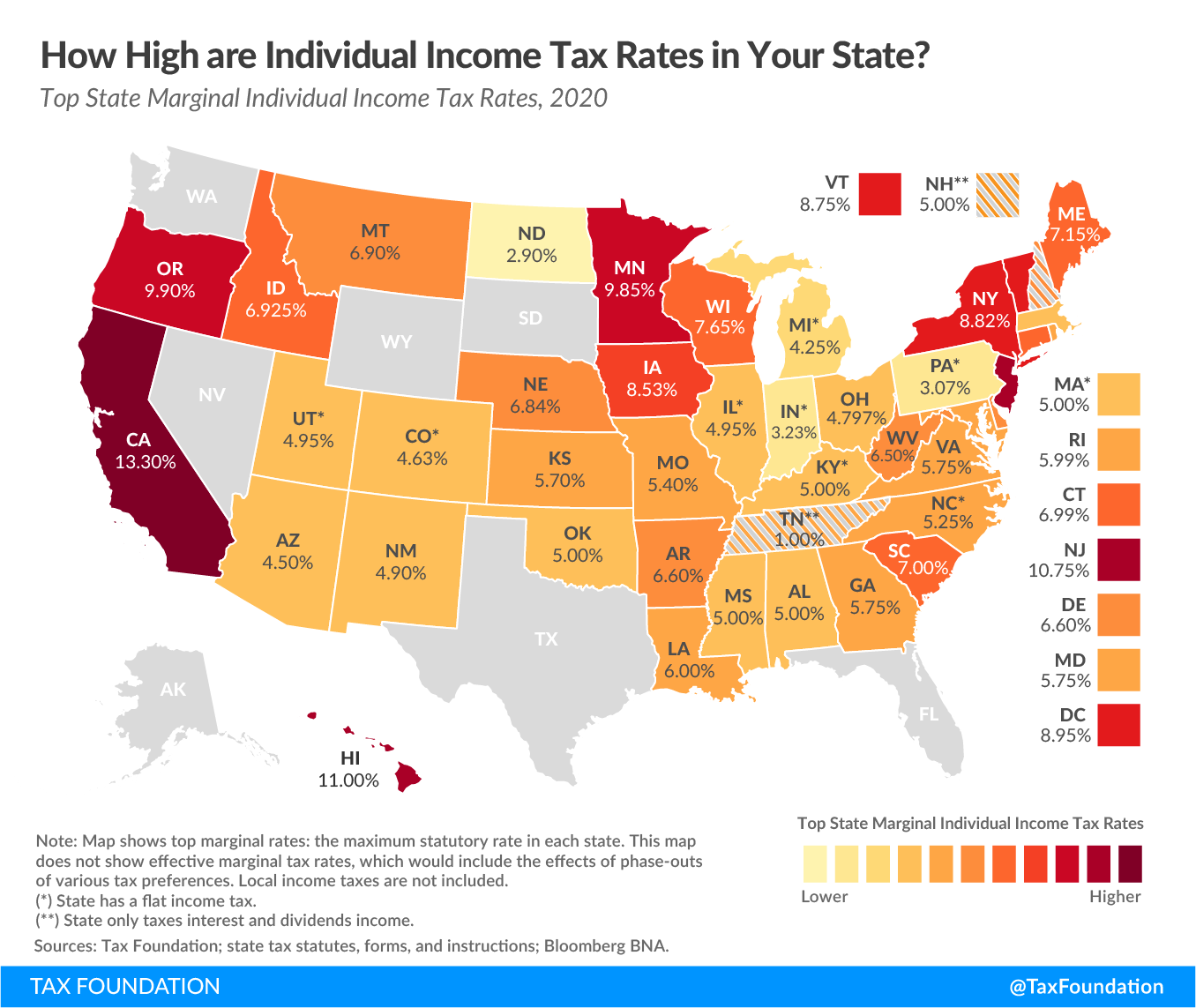

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

Verkko 6 huhtik 2023 nbsp 0183 32 This tax calculator will be able to automatically calculate any refund due in the above scenario Tax calculators and tax tools to check your income and salary after deductions such as UK

Pre-crafted templates use a time-saving option for creating a varied variety of files and files. These pre-designed formats and layouts can be used for numerous personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material production process.

Income Tax Rates 2022 23 Uk Calculator

Budget 2022 Your Tax Tables And Tax Calculator Roelof Oosthuizen

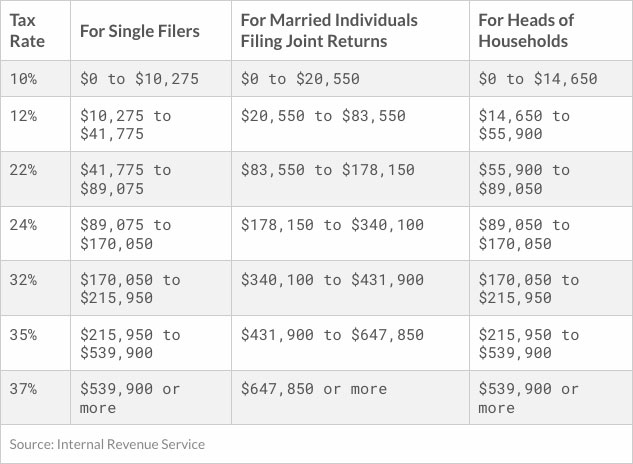

2022 Tax Brackets DhugalKillen

2022 Federal Tax Brackets And Standard Deduction Printable Form

Corporation Tax Rate Uk 2022

Income Tax Slabs 2022 23 Pakistan Salary Tax Calculator

California Individual Tax Rate Table 2021 2022 Brokeasshome

https://www.gov.uk/income-tax-rates

Verkko Taxable income Tax rate Personal Allowance Up to 163 12 570 0 Basic rate 163 12 571 to 163 50 270 20 Higher rate 163 50 271 to 163 125 140 40 Additional rate over

https://www.gov.uk/guidance/hmrc-tools-and-calculators

Verkko 13 September 2023 See all updates Get emails about this page Contents Income Tax PAYE Self employed National Insurance Tax credits Self Assessment Employment

https://www.icalculator.com/tax-calculator/2022.html

Verkko Tax Calculator for 2022 23 Tax Year The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC

https://www.uktaxcalculators.co.uk/tax-rates/2022-2023

Verkko the amount of gross income you can earn before you are liable to paying income tax Personal Allowance 163 12 570 Dividend Allowance 163 2 000 Personal Savings

https://goodcalculators.com/tax-calculator

Verkko This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 2023 24 Enter your Salary and

Verkko 2022 to 2023 2021 to 2022 2020 to 2021 Personal Allowance 163 12 570 163 12 570 163 12 570 163 12 500 Income limit for Personal Allowance 163 100 000 163 100 000 Verkko 7 helmik 2022 nbsp 0183 32 PAYE tax rates and thresholds 2022 to 2023 Employee personal allowance 163 242 per week 163 1 048 per month 163 12 570 per year English and Northern

Verkko 2022 salaries from 163 500 to 163 300 000 currently displaying salaries from 163 220 500 to 163 230 000 Jump to Salary NB All calculations below are for a 30 year old male