Income Tax Rates 2022 23 Scotland Web Dec 21 2021 nbsp 0183 32 Scottish income tax rates 2022 23 Scottish income tax bands 2022 23 Scottish starter rate 19 163 12 571 163 14 732 163 2 162 Scottish basic rate 20 163 14 733 163 25 688 163 10 956 Scottish intermediate rate 21 163 25 689 163 43 662 163 17 974 Scottish higher rate 41 163 43 663 163 150 000 Scottish top rate 46

Web Apr 6 2023 nbsp 0183 32 The rate of Income Tax you pay depends on how much of your taxable income is above your Personal Allowance in the tax year Your Personal Allowance is the amount of income you do not pay tax on The current tax year is from 6 April 2023 to 5 April 2024 and most people s Personal Allowance is 163 12 570 Web Apr 1 2022 nbsp 0183 32 Scottish income tax rates in 2022 23 01 April 2022 Employees with a Scottish tax code beginning with S are taxed differently to the rest of the UK The table below shows the rates applicable on different bands of employee earnings in 2022 23 Tax Band Tax Due

Income Tax Rates 2022 23 Scotland

Income Tax Rates 2022 23 Scotland

Income Tax Rates 2022 23 Scotland

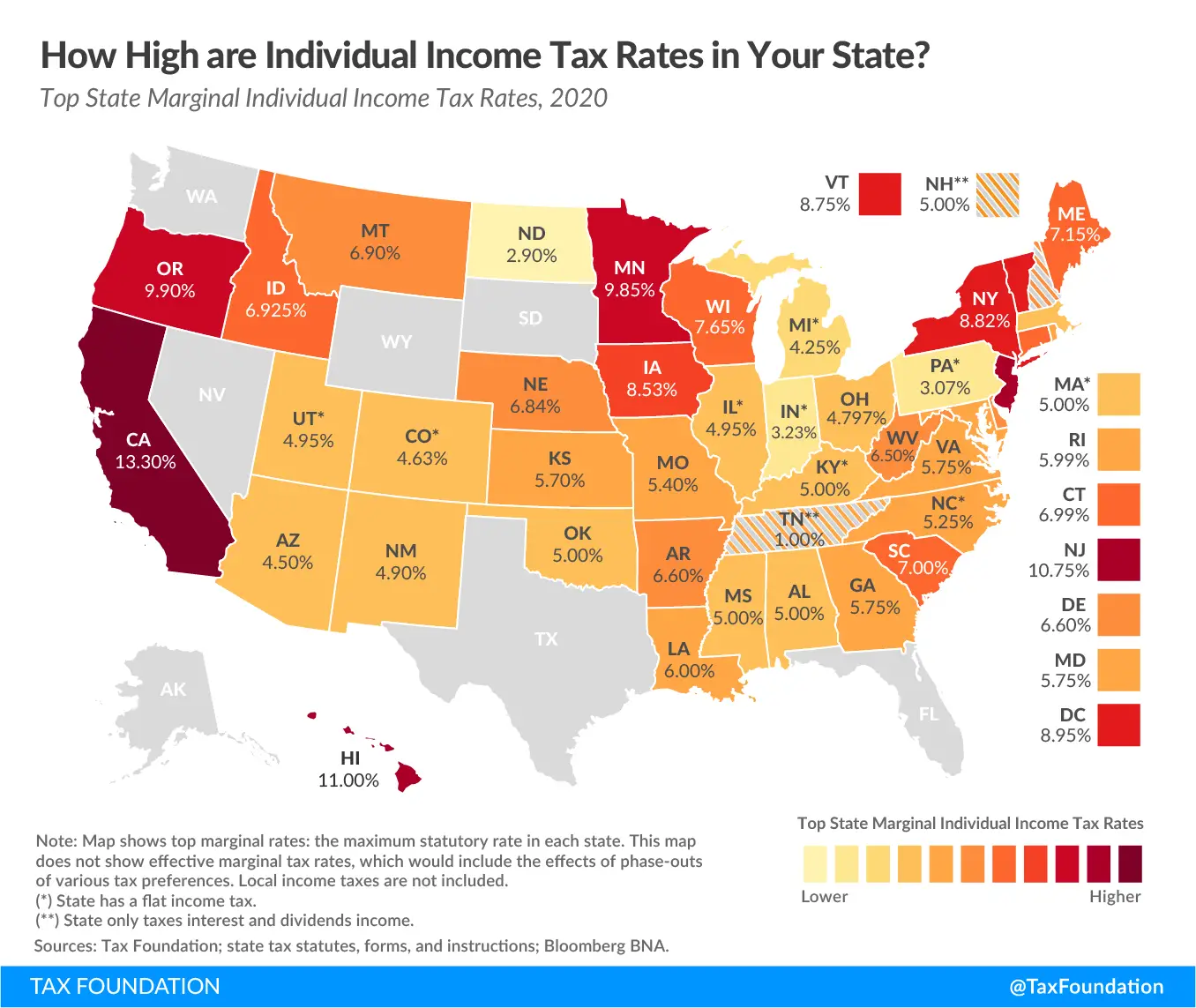

https://www.taxestalk.net/wp-content/uploads/state-individual-income-tax-rates-and-brackets-for-2020-the-online.png

Web Dec 15 2022 nbsp 0183 32 At the Scottish Budget on 15 December 2022 the Deputy First Minister set out the proposed Scottish Income Tax rates and bands for 2023 to 2024 The rates and bands in the table below are based on the UK Personal Allowance in 2023 to 2024 which is 163 12 570 as confirmed by the UK Government at their 2021 Autumn Budget

Pre-crafted templates offer a time-saving solution for producing a varied range of documents and files. These pre-designed formats and layouts can be utilized for different personal and professional tasks, including resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the content production process.

Income Tax Rates 2022 23 Scotland

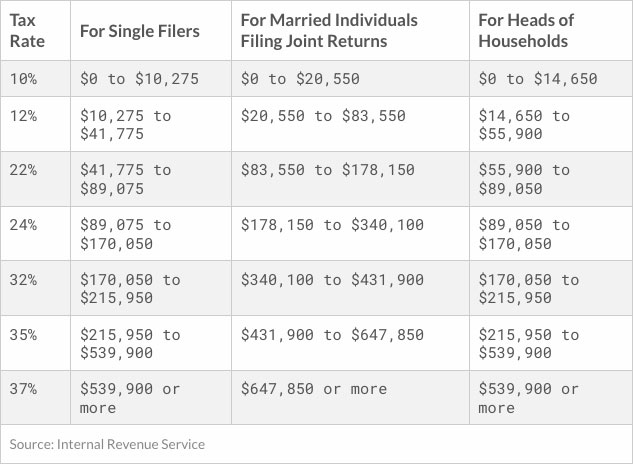

Irs Tax Rates 2022 Latest News Update

2022 Tax Brackets DhugalKillen

2022 Income Tax Rate California

2022 Tax Brackets DhugalKillen

2022 Federal Tax Brackets And Standard Deduction Printable Form

Dara Pack

https://www.gov.uk/scottish-income-tax/2022-to-2023-tax-year

Web Starter rate 163 12 571 to 163 14 732 19 Basic rate 163 14 733 to 163 25 688 20 Intermediate rate 163 25 689 to 163 43 662 21 Higher rate 163 43 663 to 150 000 41 Top rate over 163 150 000 46

https://www.gov.scot/publications/changes-scottish...

Web Dec 9 2021 nbsp 0183 32 Expected number and proportion of Scottish taxpayers by marginal rate 2022 23 Non taxpayers 1 866 000 41 Starter rate 275 000 6 Basic rate 1 111 000 24 Intermediate rate 835 000 18 Higher rate 453 000 10 and Top rate 20 000 less than 1 Impact on individual taxpayers of changes to Scottish Income Tax

https://www.gov.uk/scottish-income-tax

Web The table shows the 2023 to 2024 Scottish Income Tax rates you pay in each band if you have a standard Personal Allowance of 163 12 570 You do not get a Personal Allowance if you earn over

https://www.bbc.co.uk/news/uk-scotland-59600465

Web Dec 9 2021 nbsp 0183 32 If you are resident in Scotland your income tax calculation will be as follows Scottish starter rate 163 2 162 at 19 163 410 78 Scottish basic rate 163 268 at 20 163 53 60 Total

https://www.bbc.com/news/uk-scotland-59600465

Web Dec 9 2021 nbsp 0183 32 If you are resident in Scotland your income tax will be as follows Scottish starter rate 163 2 162 at 19 163 410 78 Scottish basic rate 163 10 956 at 20 163 2 191 20

Web Scottish Tax Rates 2022 23 Rate Income Band Tax rate Personal Allowance up to 163 12 570 1 0p Starter Rate 163 12 571 to 163 14 732 19p Basic Rate 163 14 732 to 163 25 688 20p Intermediate Rate 163 25 688 to 163 43 662 21p Higher Rate 163 43 662 to 163 150 000 41p Additional Rate 163 150 000 and above 46p Web Dec 9 2021 nbsp 0183 32 In 2022 23 the taxpayers who are better off than they would be under inflationary uprating include The lowest earning 60 of taxpayers The lowest earning 20 will see the largest decrease in tax relative to their gross income 0 3 92 of taxpayers aged under 25 years and 83 of taxpayers aged over 75 years

Web Jan 19 2024 nbsp 0183 32 For 2022 23 the amount of income subject to the starter and basic rates increased by 3 1 for Scottish taxpayers in line with CPI Consumer Prices Index inflation as at September 2021 while the thresholds for the higher and top rates were frozen HM Revenue amp Customs HMRC administers and collects Scottish income tax as part of