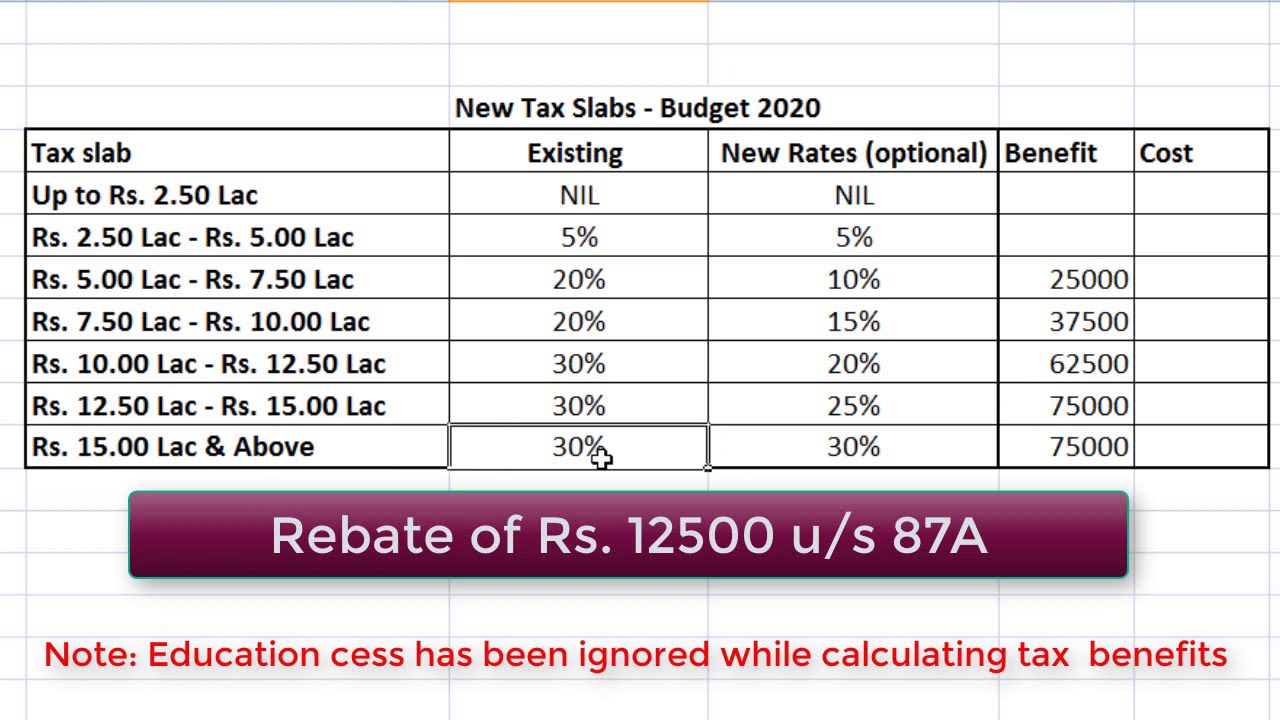

Income Tax Rates 2022 23 India Web 5 days ago nbsp 0183 32 Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 21 May 2024 01 11 PM New Tax Regime Slabs Rates Exemptions amp Deductions Availability analysis New income tax regime for Individuals and HUF has been proposed under Section 115BAC in the budget 2020

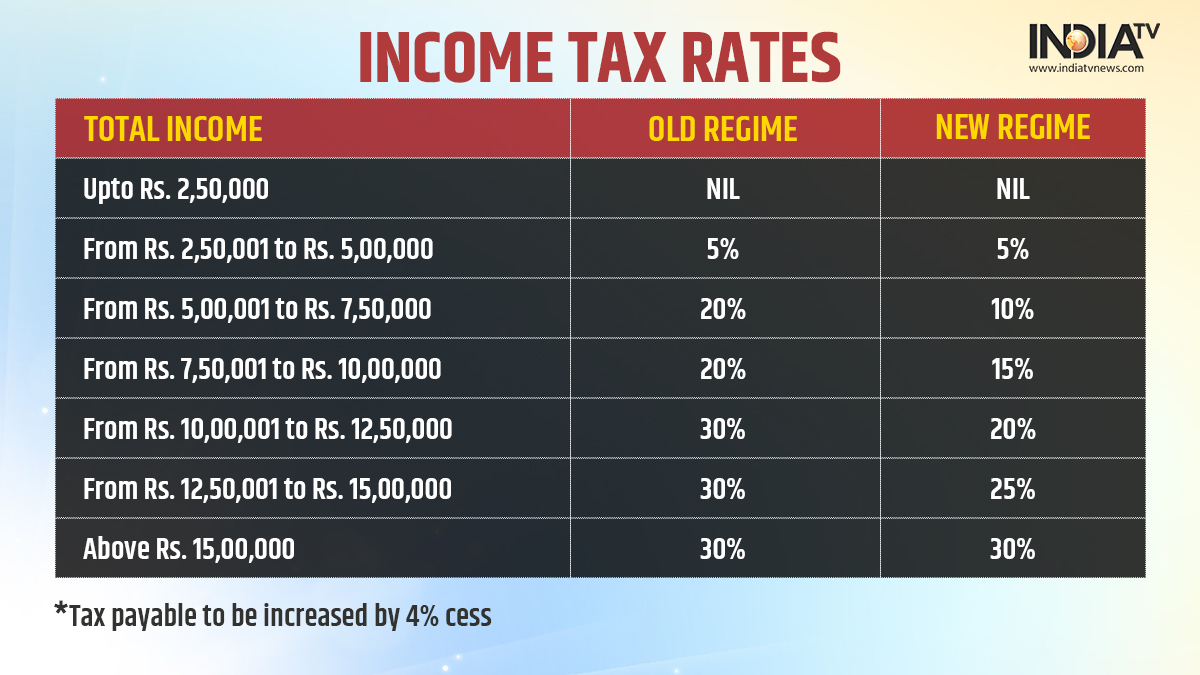

Web 5 days ago nbsp 0183 32 Updated on 21 May 2024 01 08 PM India s income tax system is progressive meaning tax rates increase with higher income levels The income tax slabs specify the applicable rates for different income brackets and vary based on residential status age and type of taxpayer There are two tax regimes the new tax regime and the Web Income tax rates and slabs in new tax regime for FY 2020 21 FY 2021 22 FY 2022 23 Income tax slabs Income tax rates Up to Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 of total income minus Rs 2 50 000 Rs 5 00 001 to Rs 7 50 000 Rs 12 500 10 of total income minus Rs 5 00 000 Rs 7 50 001 to Rs 10 00 000

Income Tax Rates 2022 23 India

Income Tax Rates 2022 23 India

Income Tax Rates 2022 23 India

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Web Income Tax Slabs and Rates for FY 2022 23 All Salaried Taxpayers Need to Know from Budget 2022 Curated By Aparna Deb Last Updated February 02 2022 07 14 IST The income tax department of India has notified new ITR forms for the financial year 2022 23

Pre-crafted templates provide a time-saving option for producing a varied series of files and files. These pre-designed formats and designs can be utilized for various individual and expert tasks, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the content production procedure.

Income Tax Rates 2022 23 India

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

TaxTips ca Business 2022 Corporate Income Tax Rates

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

State Corporate Income Tax Rates And Brackets For 2020 The Online Tax Guy

2022 Income Tax Rate California

2022 Tax Brackets FatimaMarcie

https://taxguru.in/income-tax/income-tax-rates...

Web Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family Including AOP BOI and Artificial Juridical Person Net Income Range Rate of Income tax Assessment Year

https://incometaxindia.gov.in/Charts Tables/Tax rates.htm?ID=46&ID=46

Web Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at any time during the previous year Net Income

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family Including AOP BOI and Artificial Juridical Person Net Income Range Rate of Income tax Assessment Year

https://economictimes.indiatimes.com/wealth/tax/...

Web Jul 28 2022 nbsp 0183 32 With regards to income tax slabs the old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six income tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes and FY 2022 23 for tax saving purposes

https://taxguru.in/income-tax/income-tax-rates-fy...

Web Feb 4 2022 nbsp 0183 32 Since there is no change in Tax Rates in the Finance Bill Budget 2022 hence Tax Rates applicable to both the assessment year are same except few changes proposed in Budget 2022 mentioned separately in article Following amendments related to tax rates have been proposed in Budget 2022 a To reduce surcharge on long term capital gains

Web Jun 9 2022 nbsp 0183 32 In this Article we updates about the normal and Special Income tax rates applicable to different types of taxpayers for Financial Year 2021 22 and 2022 23 i e for assessment year 2022 23 and 2023 24 Web The Income Tax Department NEVER asks for your PIN numbers Tax rates as per Income tax Act vis 224 vis tax treaties Utility on DTAA Withholding Tax Department of Revenue Ministry of Finance Government of India India Code INDIA STQC Visitor counter 0 1 5 5 2 1 6 7 6 7

Web The following India income tax slabs tax tables are valid for the 2022 23 tax year which is also knows as Financial Year 22 23 and Assessment Year 2022 23 The 2022 tax tables are provided in support of the 2024 India Tax Calculator