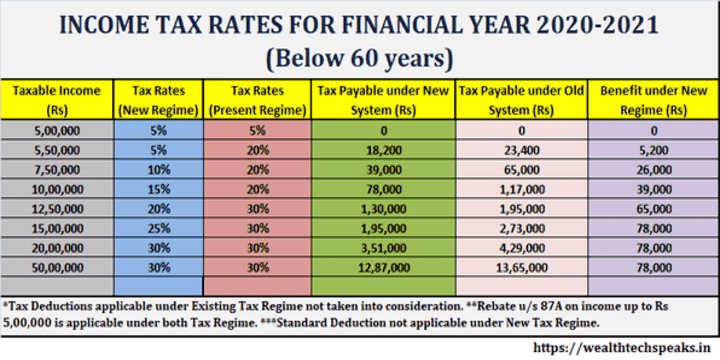

Income Tax India Slab Rates For Fy 2023 24 Web Feb 1 2023 nbsp 0183 32 Income tax slabs and rates for FY 2022 23 Old tax regime With deductions and exemptions Total income New tax regime without deductions and exemptions Nil Up to Rs 2 5 lakh NIL 5 From Rs 2 50 001 to Rs 5 lakh 5 20 From Rs 5 00 001 to Rs 7 5 lakh 10 From Rs 7 50 001 to Rs 10 lakh 15 30 From Rs 10 00 001 to Rs

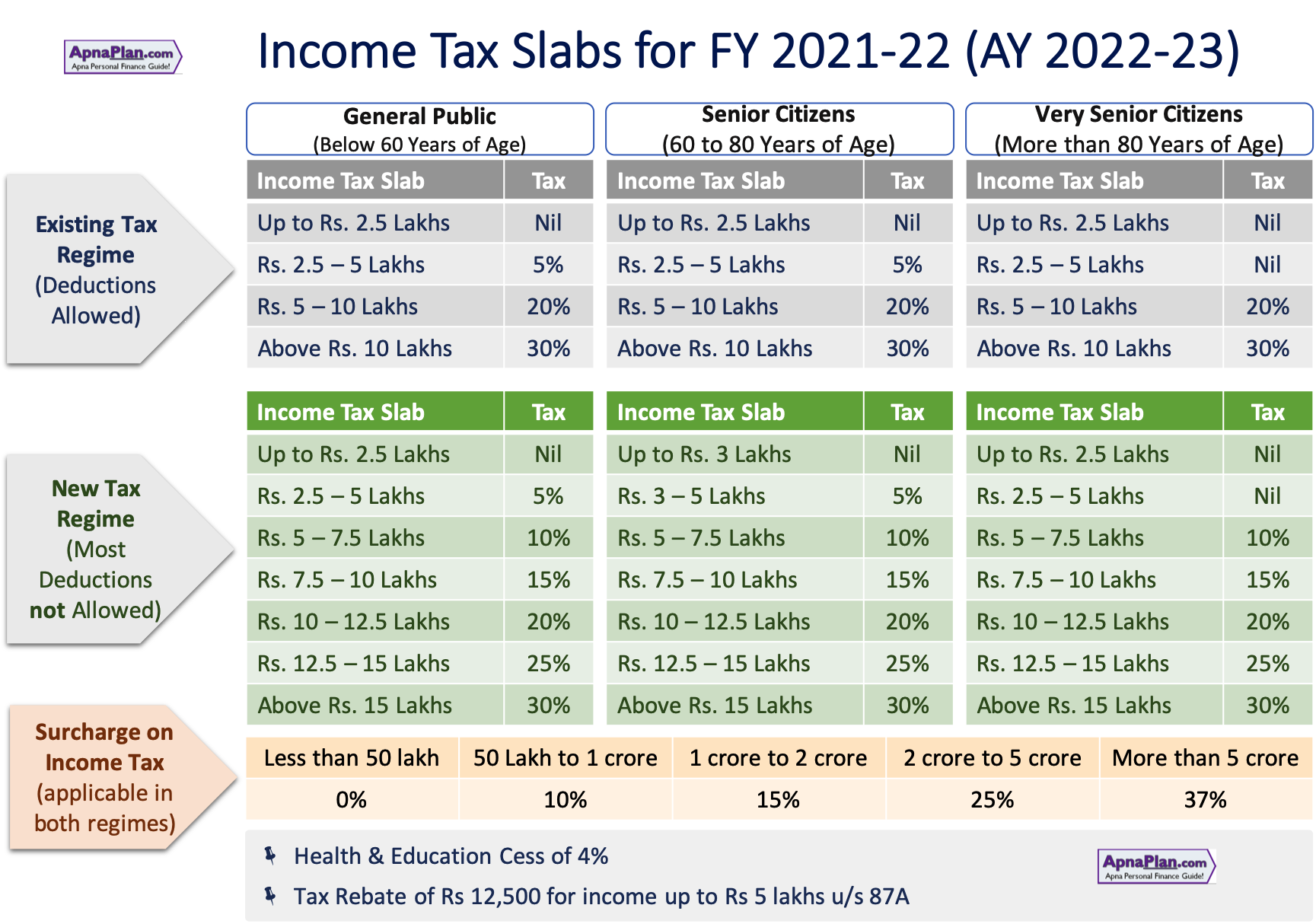

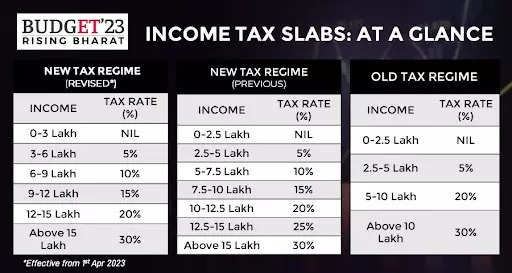

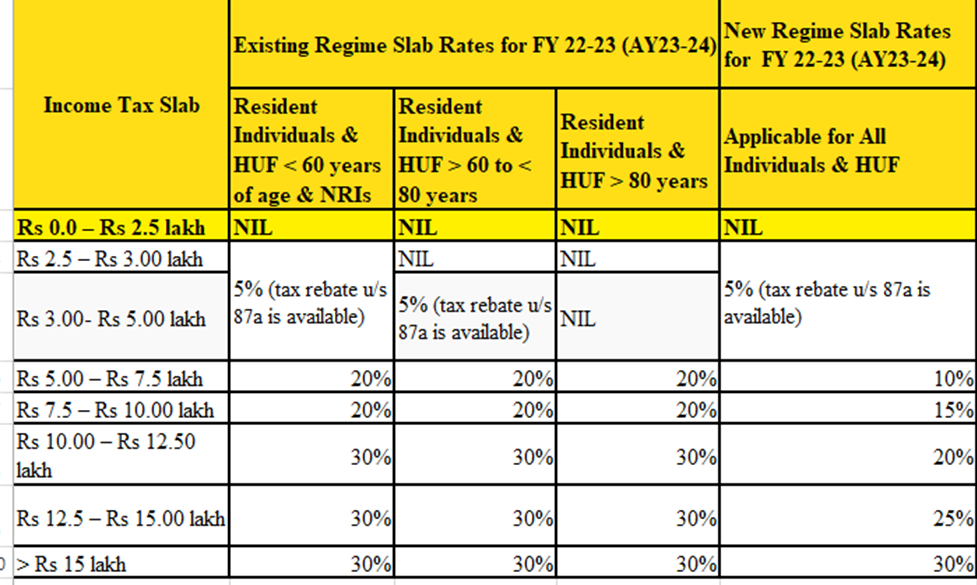

Web Old Tax Regime is the default tax regime for the taxpayers for the Assessment year 2023 24 However for the Assessment Year 2024 25 the taxpayer has to exercise the option under section 115BAC 6 to avail the benefit of old tax regime The normal tax rates applicable to a resident individual will depend on the age of the individual Web Jan 16 2024 nbsp 0183 32 New Income Tax Slabs For FY 2023 24 AY 2024 25 As per the Union Budget 2023 a few key changes have been introduced under the new tax regime The tax slab under the new tax regime has been reduced from 6 to 5 and the basic exemption limit has been raised to Rs 3 lakh from Rs 2 5 lakh

Income Tax India Slab Rates For Fy 2023 24

Income Tax India Slab Rates For Fy 2023 24

Income Tax India Slab Rates For Fy 2023 24

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

Web And instead of six tax slabs with the lowest starting with INR 2 5 lakh now there will be five new tax slabs with the lowest starting with INR 3 lakh What are old and new tax regimes

Templates are pre-designed files or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and design for producing different sort of material. Templates can be utilized for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Income Tax India Slab Rates For Fy 2023 24

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

Income Tax Slab Rates For FY 2019 20 AY 2020 21 Budget 2019 20 Key

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

https://economictimes.indiatimes.com/wealth/tax/...

Web Feb 4 2023 nbsp 0183 32 Income tax slabs under the new tax regime for FY 2023 24 Income tax slabs In Rs Income tax rate Between 0 and 3 00 000 0 Between 3 00 001 and 6 00 000 5 Between 6 00 001 and 9 00 000 10 Between 9 00 001 and 12 00 000 15 Between 12 00 001 and 15 00 000 20 Above 15 00 001 30

https://taxguru.in/income-tax/income-tax-rates-fy...

Web Feb 7 2023 nbsp 0183 32 a Change in tax slab of New Tax Regime b Increase in the rebate limit to Rs 7 lakh in the New Tax Regime c Extend the benefit of standard deduction to the New Tax Regime d Reduce the Highest surcharge rate from 37 to 25 in New Tax Regime e Making New Tax Regime as default tax regime option

https://incometaxindia.gov.in/Charts Tables/Tax rates.htm

Web Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Super Senior Citizen who is 80 years or more at any time during the previous year Net Income Range Rate

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 2 50 000 Nil 2 50 001 5 00 000 5 above 2 50 000 2 50 001 5 00 000 5 above 2 50 000 5 00 001 10 00 000 12 500 20 above 5 00 000 5 00 001 7 50 000

https://economictimes.indiatimes.com/wealth/income-tax-slabs

Web Highest surcharge rate of 37 has been reduced to 25 under the new tax regime Income tax slabs under the new tax regime till FY 2022 23 AY 2023 24 For FY 2022 23 ending on March 31 2023 and prior to that the income tax slabs under the new tax regime are different from those mentioned above

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family Including AOP BOI and Artificial Juridical Person Net Income Range Rate of Income tax Assessment Year Web May 17 2023 nbsp 0183 32 20 of the total income 4 cess Above Rs 10 Lakhs 30 of the total income Rs 1 00 000 4 cess Now that we know of the nuances of both the old and new tax regime slabs after Budget 2023 24

Web Feb 1 2023 nbsp 0183 32 Income tax slabs under the new income tax regime Rs 0 to Rs 3 lakh 0 tax rate Rs 3 lakh to 6 lakh 5 Rs 6 lakh to 9 lakh 10 Rs 9 lakh to Rs 12 lakh 15 Rs 12 lakh to Rs 15 lakh 20 Above Rs 15 lakh 30 Latest tax slabs Latest slab rates Default tax regime Further the new income tax regime becomes the default tax regime