Income Tax Depreciation Rates For Fy 2022 23 Pdf Web Jun 9 2021 nbsp 0183 32 Depreciation means a reduction in the real value of tangible used by the assessee in the course of business or profession Depreciation can be claimed as a deduction by the assessee for investing in assets like furniture plant amp machinery or other such tangible assets for the previous year

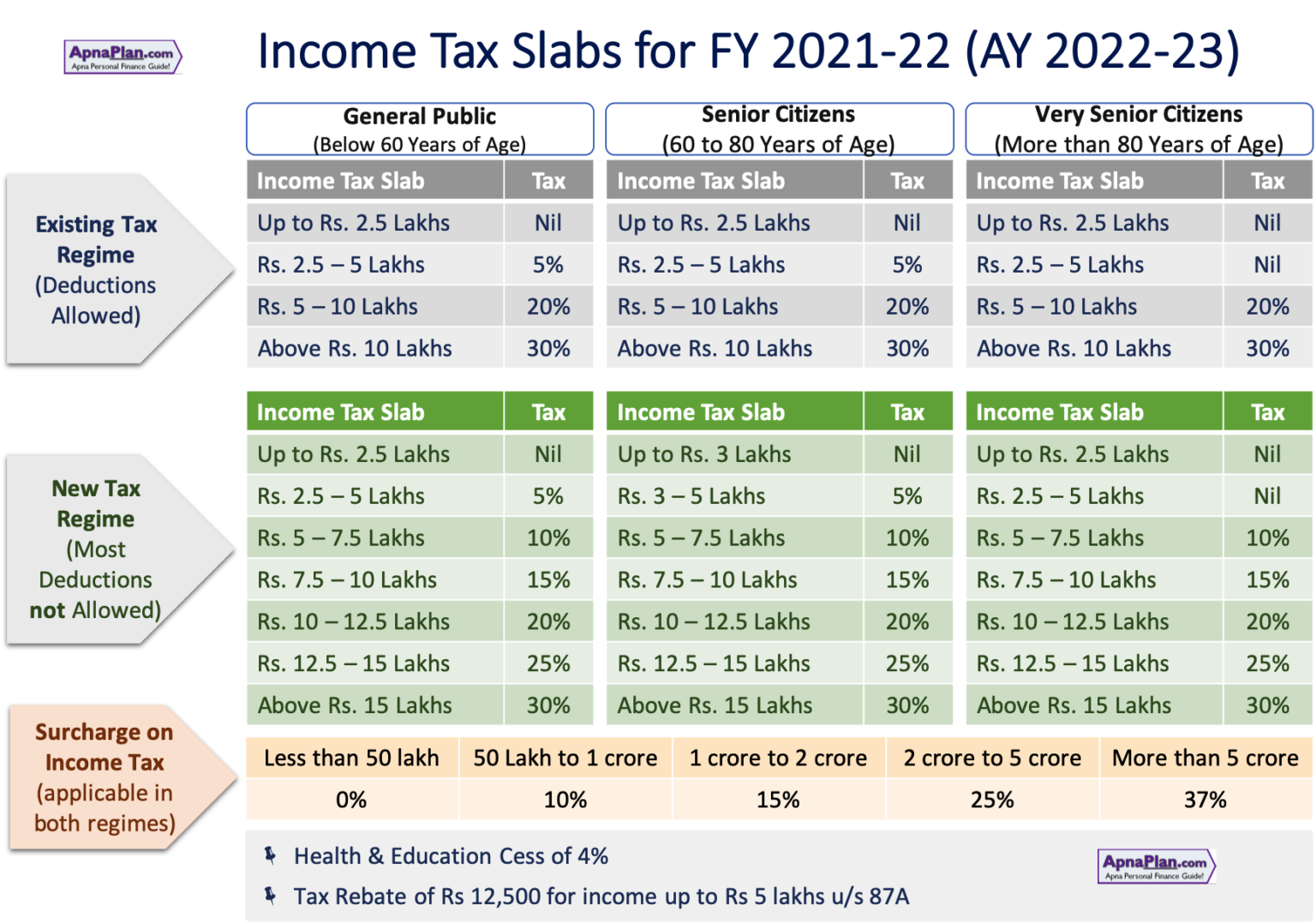

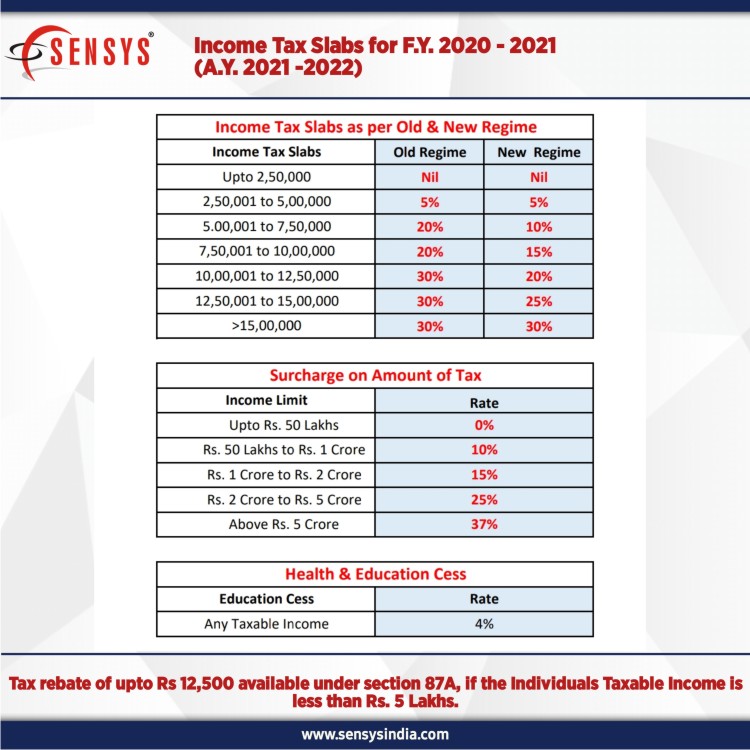

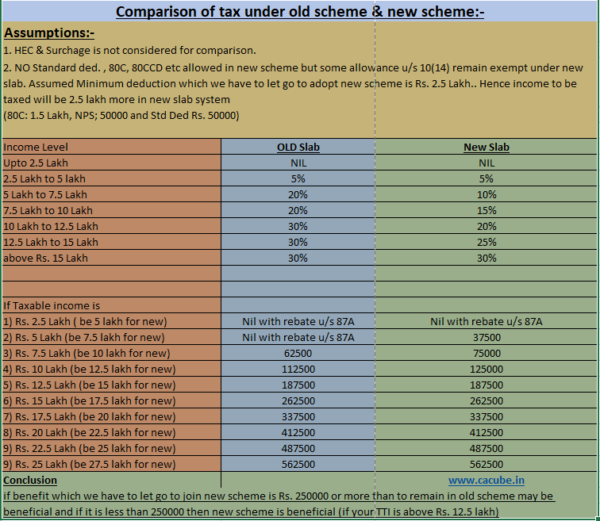

Web Total Income Rs Rate of income tax Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 From 5 00 001 to 7 50 000 10 From 7 50 001 to 10 00 000 15 From 10 00 001 to 12 50 000 20 From 12 50 001 to 15 00 000 25 Above 15 00 000 30 The amount of income tax so computed including in the case of an individual or an HUF Web Jun 29 2022 nbsp 0183 32 Income tax effective life of depreciating assets applicable from 1 July 2022 Please note that the PDF version is the authorised version of this ruling This Ruling which applies from 1 July 2022 replaces TR 2021 3 see paragraph 6

Income Tax Depreciation Rates For Fy 2022 23 Pdf

Income Tax Depreciation Rates For Fy 2022 23 Pdf

Income Tax Depreciation Rates For Fy 2022 23 Pdf

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Web Jul 17 2023 nbsp 0183 32 The rates of depreciation vary depending on the type of asset its useful life and the method of depreciation used straight line method written down value method etc Depreciation rate applicable for FY 2023 24

Templates are pre-designed files or files that can be utilized for different functions. They can save effort and time by providing a ready-made format and design for creating various sort of material. Templates can be used for personal or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Income Tax Depreciation Rates For Fy 2022 23 Pdf

2022 Tax Brackets Irs Calculator

Income Tax Ay 2022 23 Latest News Update

Form 16 Calculator Ay 2023 24 Excel Format Printable Forms Free Online

Income Tax Calculator Fy 2023 24 Excel Free Download Taxguru

Income Tax Return Due Date Fy 2021 22 Ay 2022 23will Itr Due Date

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Mobile

https://incometaxindia.gov.in/charts tables/depreciation rates.htm

Web Based on this the charge for first year would be Rs 4 16 Crore approximately i e Rs 5 Rs 600 215 Rs 500 Crores which would be charged to profit and loss and 0 83 i e Rs 4 16 Crore Rs 500 Crore 215 100 is the amortisation rate for the first year

https://taxguru.in/income-tax/rates-depreciation-income-tax-act.html

Web Jun 25 2023 nbsp 0183 32 Rates of Depreciation as Per Income Tax Act 1961 TG Team Income Tax Articles Download PDF 25 Jun 2023 2 542 729 Views 148 comments This comprehensive guide provides information on the rates of depreciation applicable for income tax purposes from the assessment year 2003 04 onwards

https://assets.ey.com/content/dam/ey-sites/ey-com/...

Web Jun 30 2023 nbsp 0183 32 The tax legislation only provides a 2 rate of tax depreciation per year for immovable property except for land Calculations must be performed quarterly For other assets the tax legislation does not provide any lives or rates

https://tax2win.in/guide/depreciation-rates-under-income-tax-act

Web Dec 28 2023 nbsp 0183 32 Depreciation Rates for FY 2023 24 Under Income Tax Act Updated on 28 Dec 2023 03 15 PM One of the allowable deductions under the Income Tax Act is depreciation This is a way of accounting for the decrease in the actual worth of a taxpayer s tangible or intangible asset over time

https://incometaxindia.gov.in/Tutorials/2 Tax Rates.pdf

Web in case where net income exceeds Rs 5 crore marginal relief shall be available from surcharge in such a manner that the amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of Rs 5 crore by more than the amount of income that exceeds Rs 5 crore

Web May 2 2021 nbsp 0183 32 Depreciation Rate as per Income Tax Act For AY 2022 23 Here is the complete chart which shows the rate of depreciation on fixed assets as per Income Tax Act Web May 25 2021 nbsp 0183 32 The rate of additional depreciation is 20 of the actual cost if asset is acquired and put to use for 180 days or more The rate shall be 10 if period is less than 180 days but a sum of 10 is allowed in the immediate next previous year

Web Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime Refer to the above image for the rates applicable to FY 2023 24 AY 2024 25 for the upcoming tax filing season b Old Tax regime Select your Age Group Income tax slabs for individual aged below 60 years amp HUF NOTE