Income Tax Depreciation Rates Ay 2022 23 3 days ago nbsp 0183 32 Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 Old Tax Regime For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed Rs

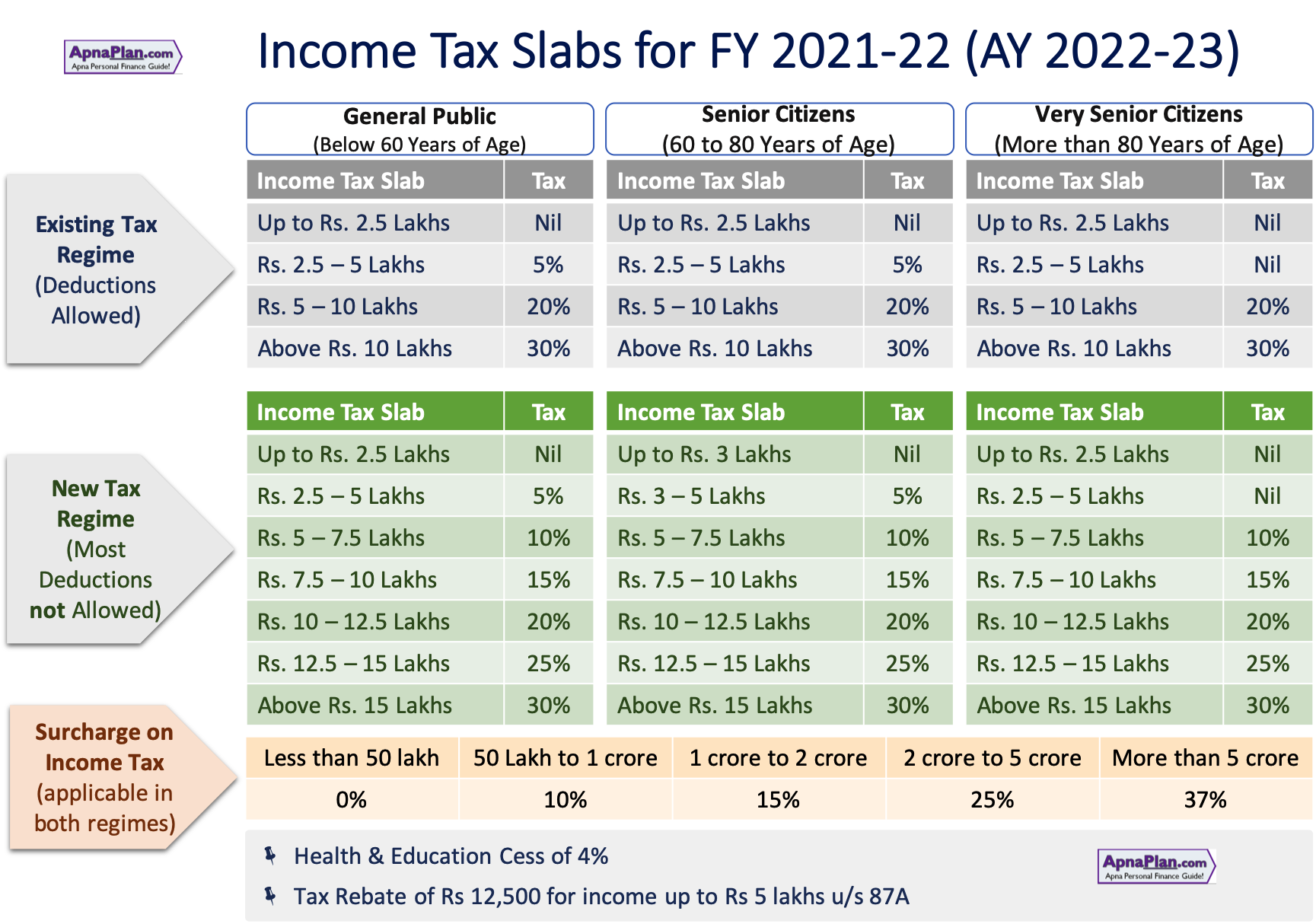

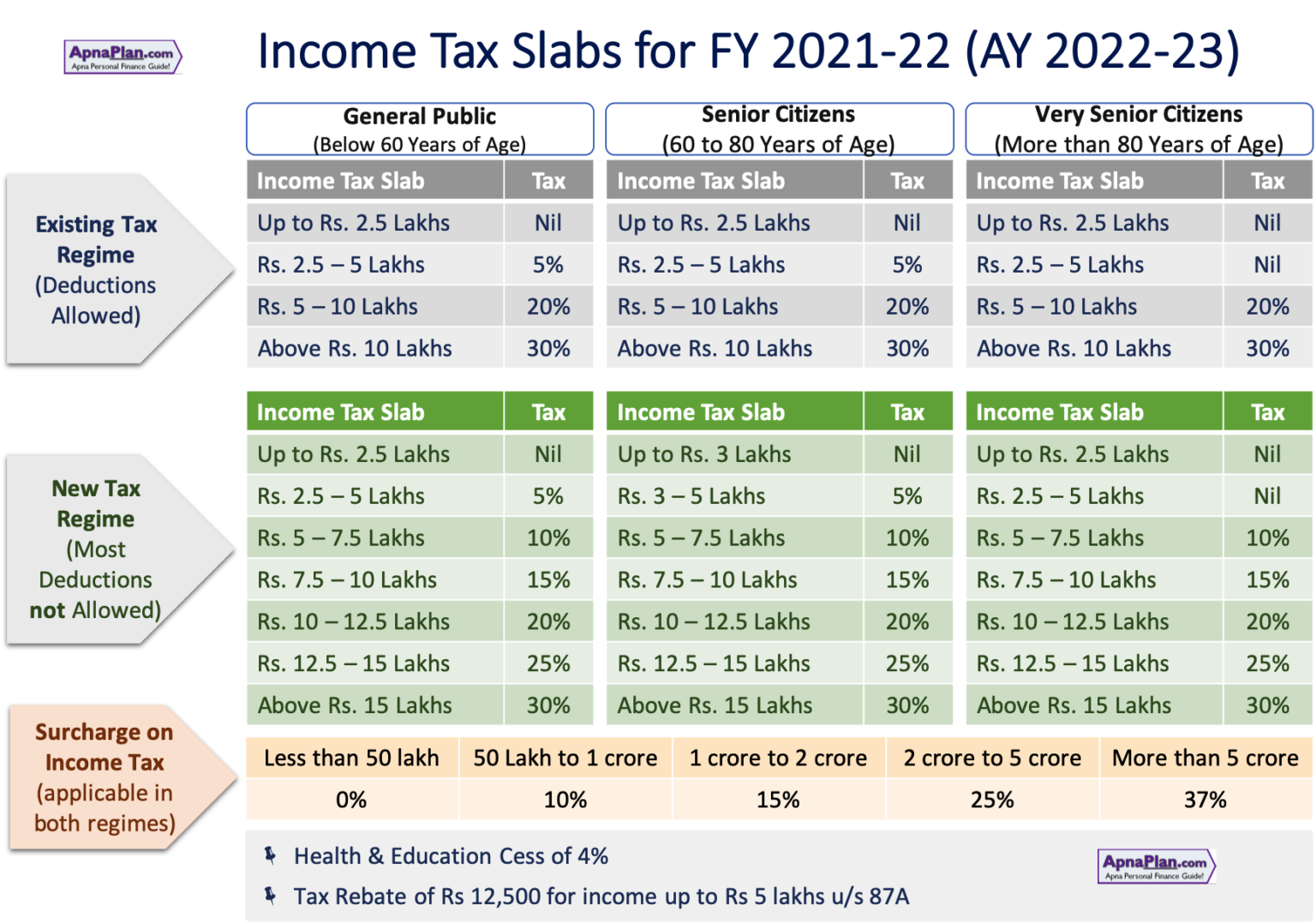

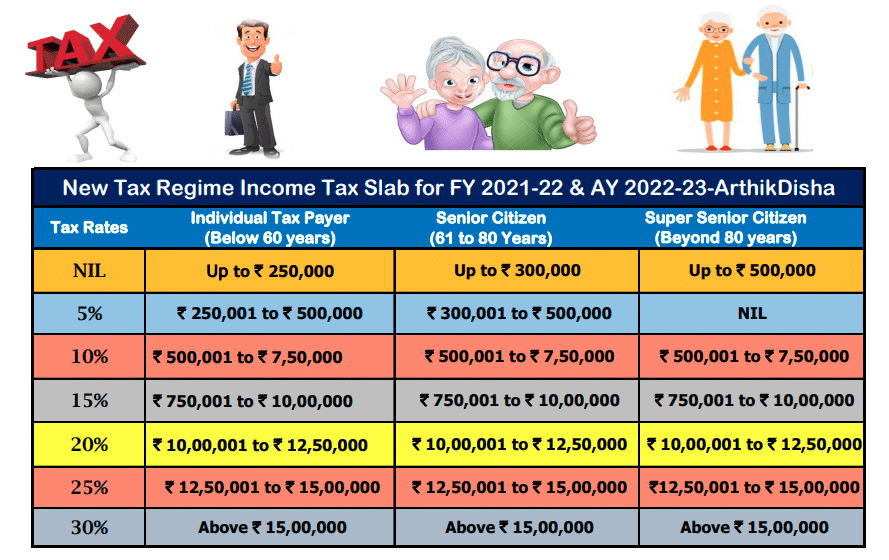

Oct 14 2024 nbsp 0183 32 Section 115BAC the new tax regime system came into force from FY 2020 21 AY 2021 22 The new tax regime introduced concessional tax rates with reduced deductions The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with respect to income s

Income Tax Depreciation Rates Ay 2022 23

Income Tax Depreciation Rates Ay 2022 23

Income Tax Depreciation Rates Ay 2022 23

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

Mar 30 2021 nbsp 0183 32 Read about Income Tax Slab Rates for AY 2022 23 for Individuals opting for old tax regime for Partnership Firm Companies in this article

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by providing a ready-made format and layout for developing different sort of material. Templates can be used for individual or expert jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Income Tax Depreciation Rates Ay 2022 23

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download 2023

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Form 16 Calculator Ay 2023 24 Excel Format Printable Forms Free Online

Income Tax Calculator Fy 2021 22 Major Changes In Income Tax Rules FY

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download

https://studycafe.in/rates-of-depreciatio…

167 rows nbsp 0183 32 May 18 2021 nbsp 0183 32 Depreciation is the systematic allocation of the

https://tax2win.in/guide/depreciation-rates-under-income-tax-act

May 20 2024 nbsp 0183 32 Explore the depreciation rates applicable for the financial year 2023 24 under the Income Tax Act Understand how these rates affect the calculation of depreciation expenses

https://www.caclubindia.com/articles/de…

Mar 7 2024 nbsp 0183 32 Under the Income Tax Act depreciation is allowed as a deductible expense for assets used in business or profession subject to certain conditions and limitations The amount of depreciation that can be claimed

https://taxguru.in/income-tax/income-tax-rates...

Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs companies and

https://taxguru.in/income-tax/rates-dep…

Sep 5 2024 nbsp 0183 32 Rates of depreciation applicable for income tax purposes from assessment year 2003 04 to 2025 26 This guide includes rates for tangible and intangible assets providing valuable insights for taxpayers

Sep 9 2023 nbsp 0183 32 Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims May 15 2024 nbsp 0183 32 Air conditioners are fixed assets whose depreciation rate is determined under the Income Tax and Companies Acts The calculation involves methods like WDV and SLM

Jun 1 2023 nbsp 0183 32 Tax Slabs for AY 2022 23 Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax