Income Tax Brackets For 2022 Married Filing Jointly WEB 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately Jan 18 2022 4th installment deadline to pay 2021 estimated taxes due

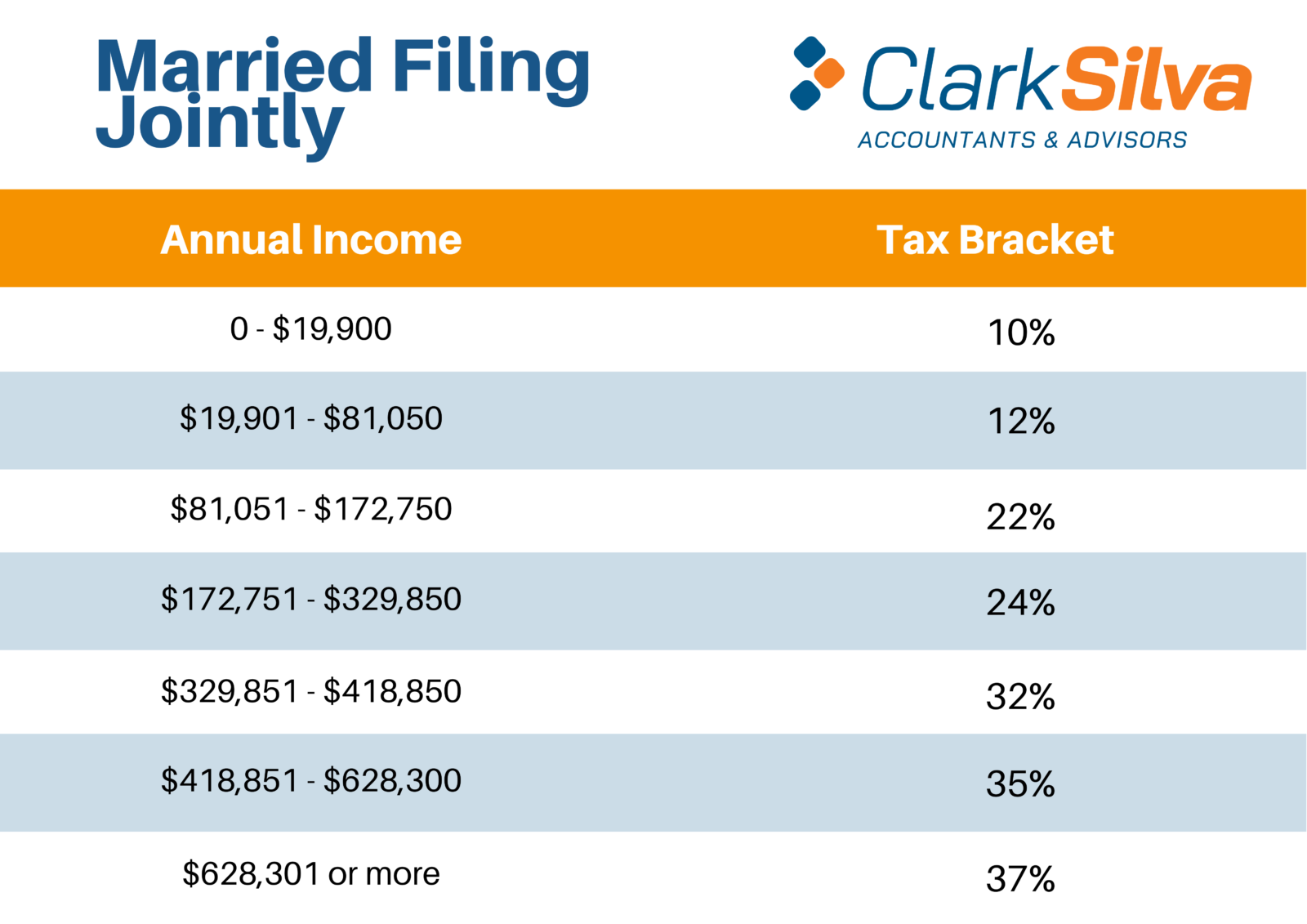

WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for inflation The WEB Married filing jointly or Qualifying surviving spouse 27 700 and Head of household 20 800

Income Tax Brackets For 2022 Married Filing Jointly

Income Tax Brackets For 2022 Married Filing Jointly

Income Tax Brackets For 2022 Married Filing Jointly

https://hkglcpa.com/wp-content/uploads/2022/10/2022-Tax-Brackets-for-Single-Filers-and-Married-Couples-Filing-Jointly.png

WEB Apr 8 2022 nbsp 0183 32 Married couples filing separately should follow the brackets for single filers but note that the top tax bracket of 37 kicks in at income over 314 150 Income tax brackets for married

Pre-crafted templates offer a time-saving solution for developing a diverse range of files and files. These pre-designed formats and designs can be utilized for numerous individual and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the content creation procedure.

Income Tax Brackets For 2022 Married Filing Jointly

2022 Tax Tables Married Filing Jointly Printable Form Templates And

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets Married Filing Jointly California Kitchen Cabinet

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Tax Brackets PersiaKiylah

https://www.irs.gov/newsroom/irs-provides-tax...

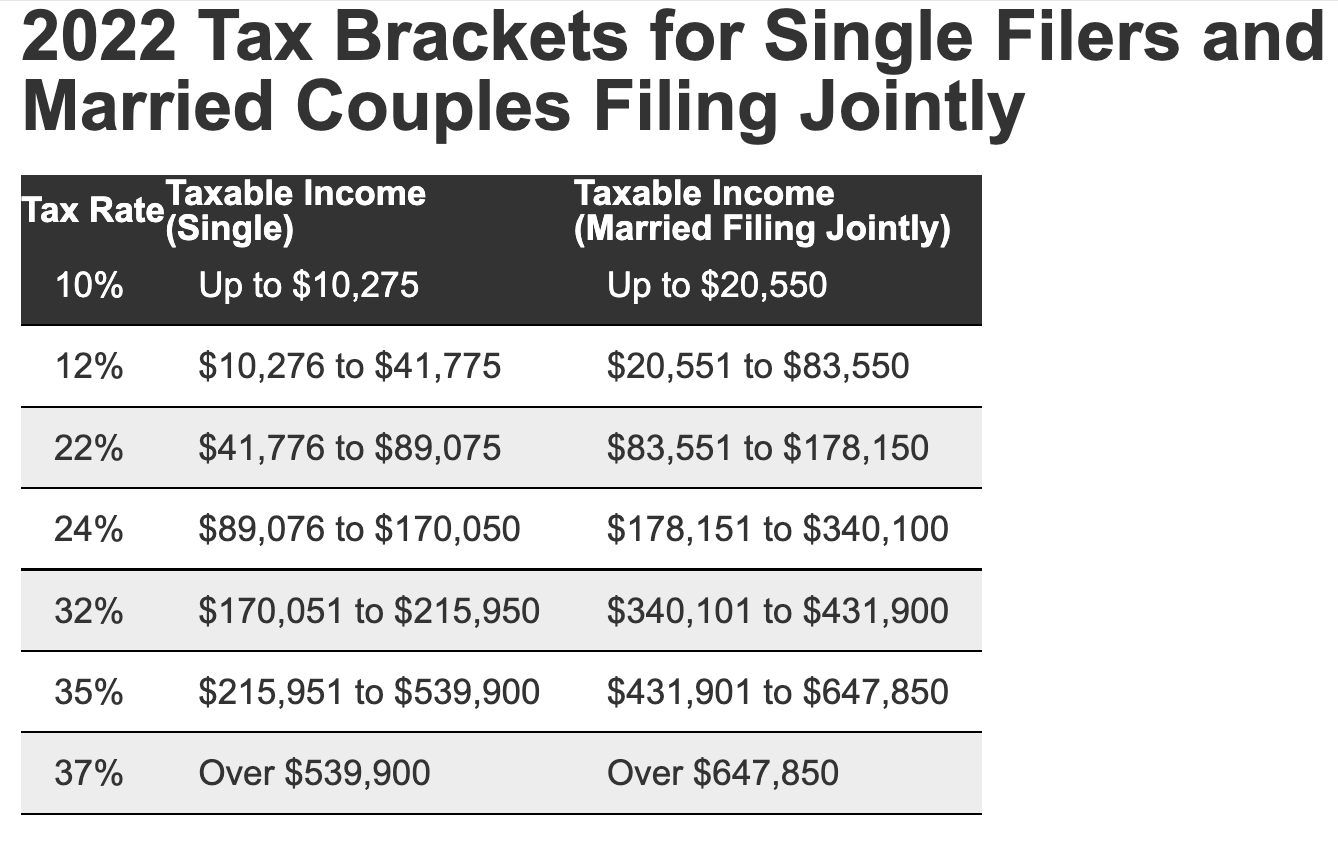

WEB Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the Related Page Last Reviewed or Updated 18 Mar 2024 Print See current federal tax brackets and

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads of Households 10 0 to 10 275 0 to 20 550 0 to 14 650

https://www.investopedia.com/irs-announces-tax...

WEB Nov 11 2021 nbsp 0183 32 The standard deduction which is claimed by the vast majority of taxpayers will increase by 800 for married couples filing jointly going from 25 100 for 2021 to 25 900 for 2022 For single

https://turbotax.intuit.com/tax-tools/calculators/tax-bracket

WEB The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and federal income tax rates View all filing statuses Use the federal tax rate calculator to make sure you re using the right rate to estimate how much you ll owe

WEB Nov 22 2021 nbsp 0183 32 The difference is 20 35 15 Married Filing Jointly 2022 Income Tax Brackets Married Filing Separately 2022 Income Tax Brackets Head Of Household 2022 Income Tax Brackets Please be aware there are still ongoing talks with Joe Biden and most Democrats about increasing income tax rates and capital gains tax rates for 2022 WEB Apr 1 2024 nbsp 0183 32 Tax rate classifications for 2023 are the same as that of 2022 but taxable income brackets and total taxes owed are higher The IRS adjusts tax brackets every year based on inflation The table below can give you an idea of how much your federal income tax may be for the tax year 2023

WEB Apr 15 2024 nbsp 0183 32 In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates