How To Create A Monthly Depreciation Schedule In Excel Dec 15 2020 nbsp 0183 32 We ll examine the functions available for calculating depreciation and why they re not up to scratch build a simple schedule ourselves and also look at how the new dynamic arrays could help Depreciation functions in Excel

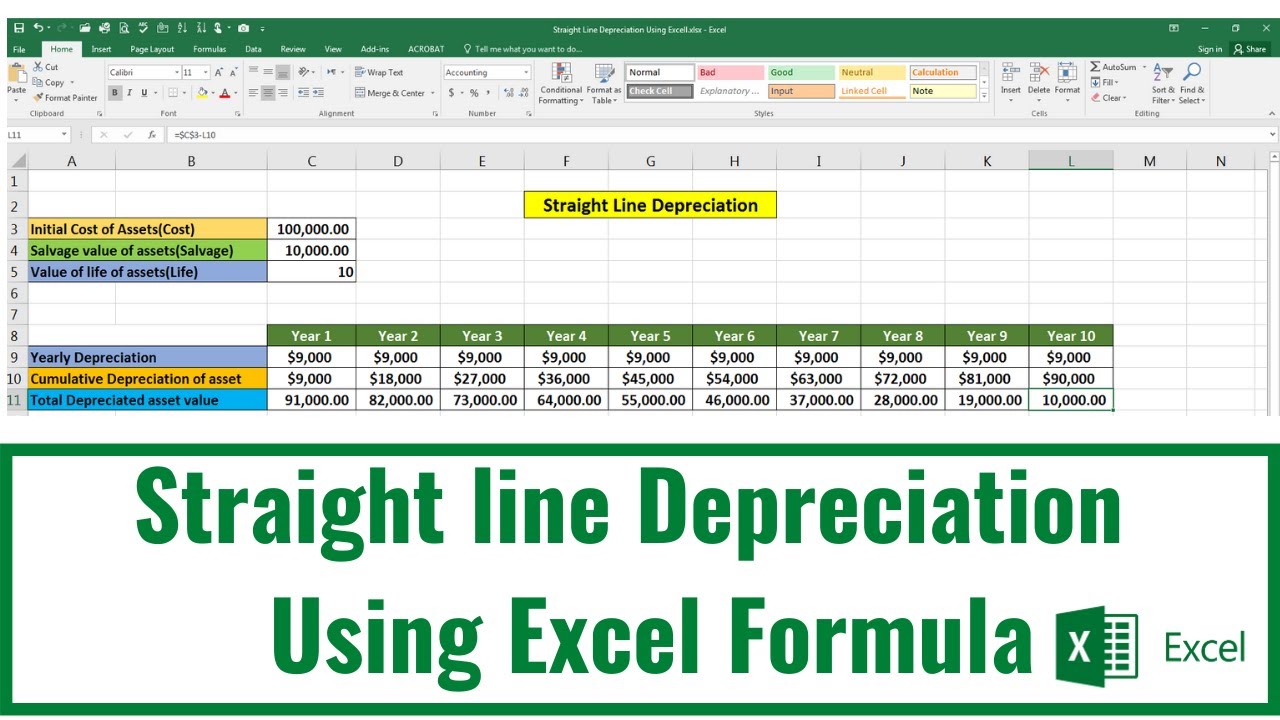

Excel offers five different depreciation functions We consider an asset with an initial cost of 10 000 a salvage value residual value of 1000 and a useful life of 10 periods years May 28 2024 nbsp 0183 32 How to calculate depreciation for fixed assets with the straight line method the sum of the year s digits method and others using Microsoft Excel

How To Create A Monthly Depreciation Schedule In Excel

How To Create A Monthly Depreciation Schedule In Excel

How To Create A Monthly Depreciation Schedule In Excel

https://i.ytimg.com/vi/jf5JhKFh0Zg/maxresdefault.jpg

Dec 27 2021 nbsp 0183 32 Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period data by default

Pre-crafted templates provide a time-saving option for developing a varied range of files and files. These pre-designed formats and designs can be made use of for various individual and expert jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the content development procedure.

How To Create A Monthly Depreciation Schedule In Excel

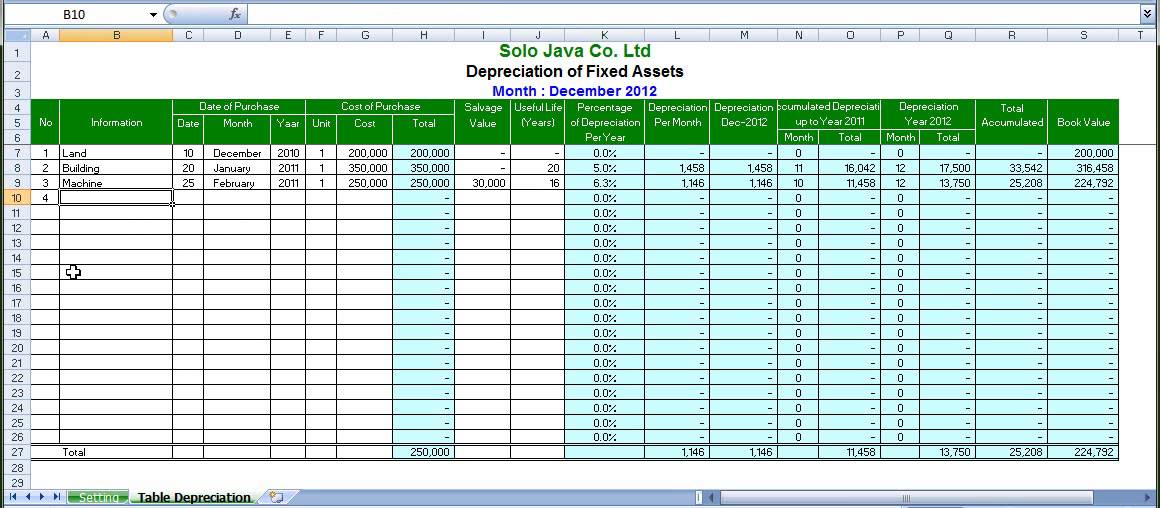

Depreciation Excel Template Excel Templates

Depreciation Schedule Excel Emmamcintyrephotography

How To Create A Monthly Depreciation Schedule In Excel Ideas Of

Depreciation Schedule Excel Emmamcintyrephotography

Depreciation Schedule 2022

Depreciation Schedule Template Depreciation Schedule Excel

https://www.businessaccountingbasics.co.uk/depreciation-schedule

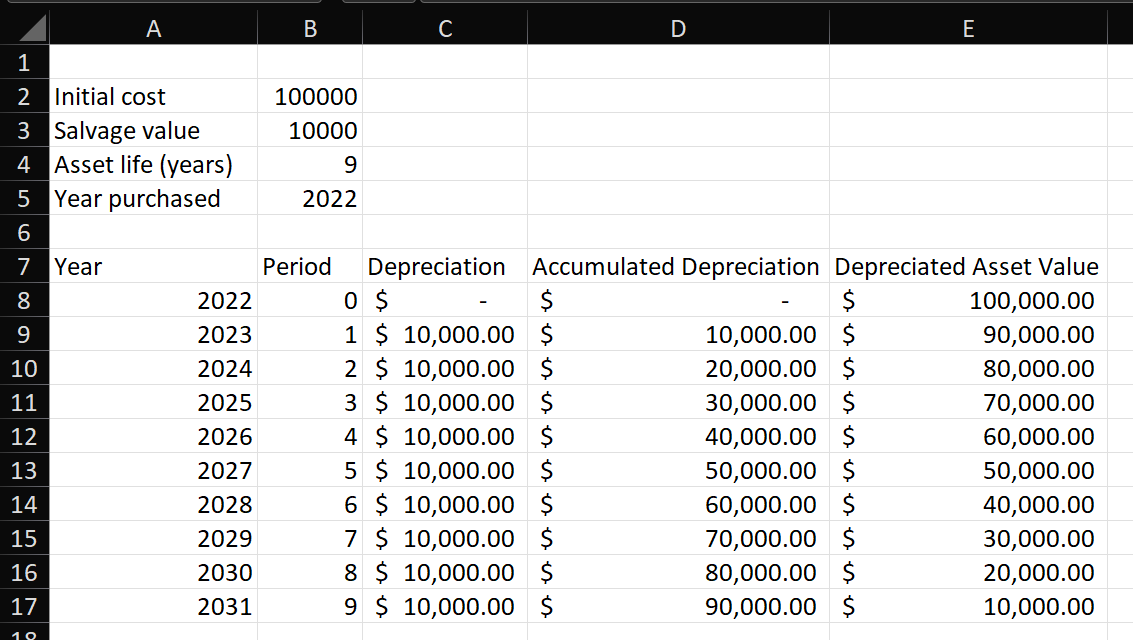

The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method

https://www.journalofaccountancy.com/issues/2021/...

Our job is to create a depreciation schedule for the asset using all four types of depreciation Let s create the formula for straight line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along

https://www.vertex42.com/ExcelTemplates/depreciation-schedule.html

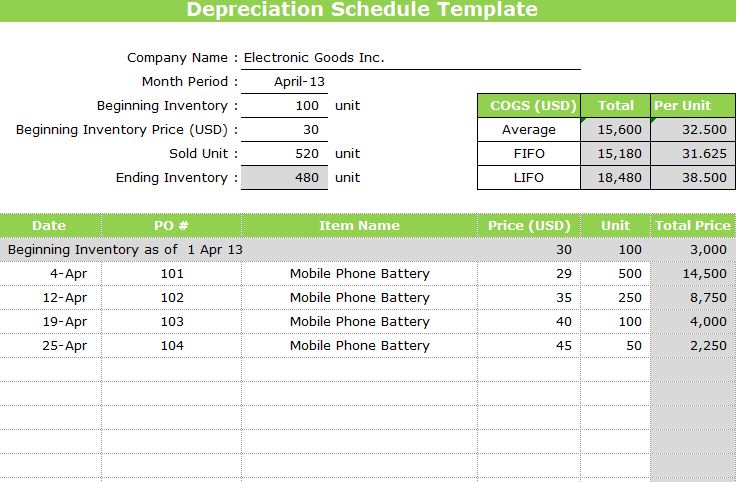

Download a Depreciation Schedule Template for Excel Includes straight line depreciation and declining balance depreciation methods for financial reporting

https://www.youtube.com/watch?v=nyQcdIjeI3M

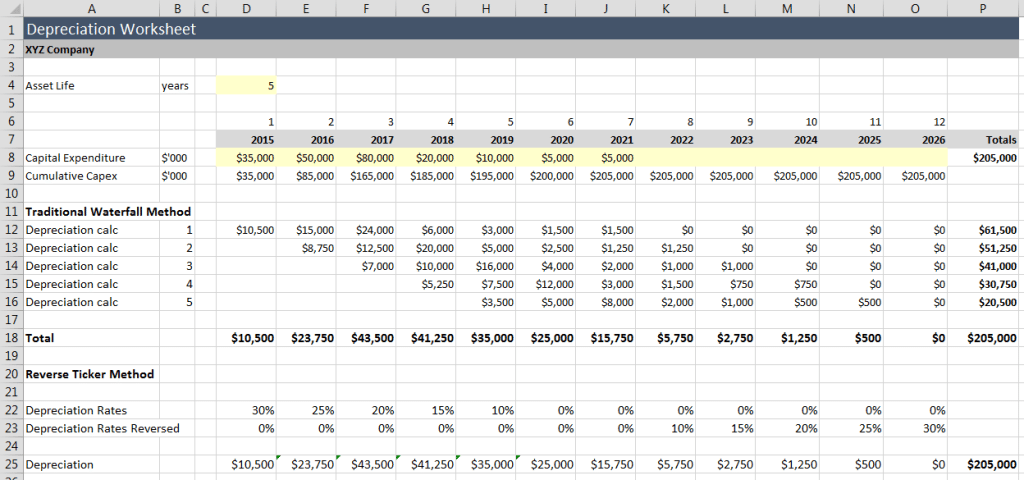

Jun 1 2021 nbsp 0183 32 I demonstrate two methods for creating the depreciation schedule the first method works in any version of Excel The second method only works in Excel 365 and uses dynamic array formulas

https://corporatefinanceinstitute.com/resources/...

A depreciation schedule is required in financial modeling to link the three financial statements income balance sheet cash flow in Excel

Mar 5 2024 nbsp 0183 32 In this article we ll teach you how to make a depreciation worksheet in Excel from assembling column headers to entering formulas and explain the usage and arguments in each depreciation formula We ve also prepared a downloadable depreciation worksheet template that s Create a tax depreciation schedule using Microsoft Excel from scratch In addition use the depreciation schedule for bookkeeping purposes These step by step instructions along with screenshots will walk you through the process

Creating a depreciation schedule Instructor Now that we ve calculated the depreciation on a monthly basis we ll be able to create the depreciation schedule below