How Much Money Can Be Gifted To Children WEB Mar 22 2024 nbsp 0183 32 Taxable gifts can include cash checks property and even interest free loans It also applies to anything you sell below fair market value For instance if you sell

WEB For 2024 the annual gift tax limit is 18 000 That s up 1 000 from last year s limit since the gift tax is one of many tax amounts adjusted annually for inflation For married couples the WEB How much money can you gift a family member in 2023 If you want to gift money to a family member that s fantastic Rather than just give the children you love a cheap toy that ll end up at a garage sale gifting

How Much Money Can Be Gifted To Children

How Much Money Can Be Gifted To Children

How Much Money Can Be Gifted To Children

https://live.staticflickr.com/65535/50698308722_fa70a56887_b.jpg

WEB Aug 8 2024 nbsp 0183 32 The 2024 gift tax limit also known as the gift tax exclusion increased to 18 000 this year from 17 000 last year For married couples the limit is 18 000 each for a total of 36 000 This

Templates are pre-designed files or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and design for creating different kinds of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

How Much Money Can Be Gifted To Children

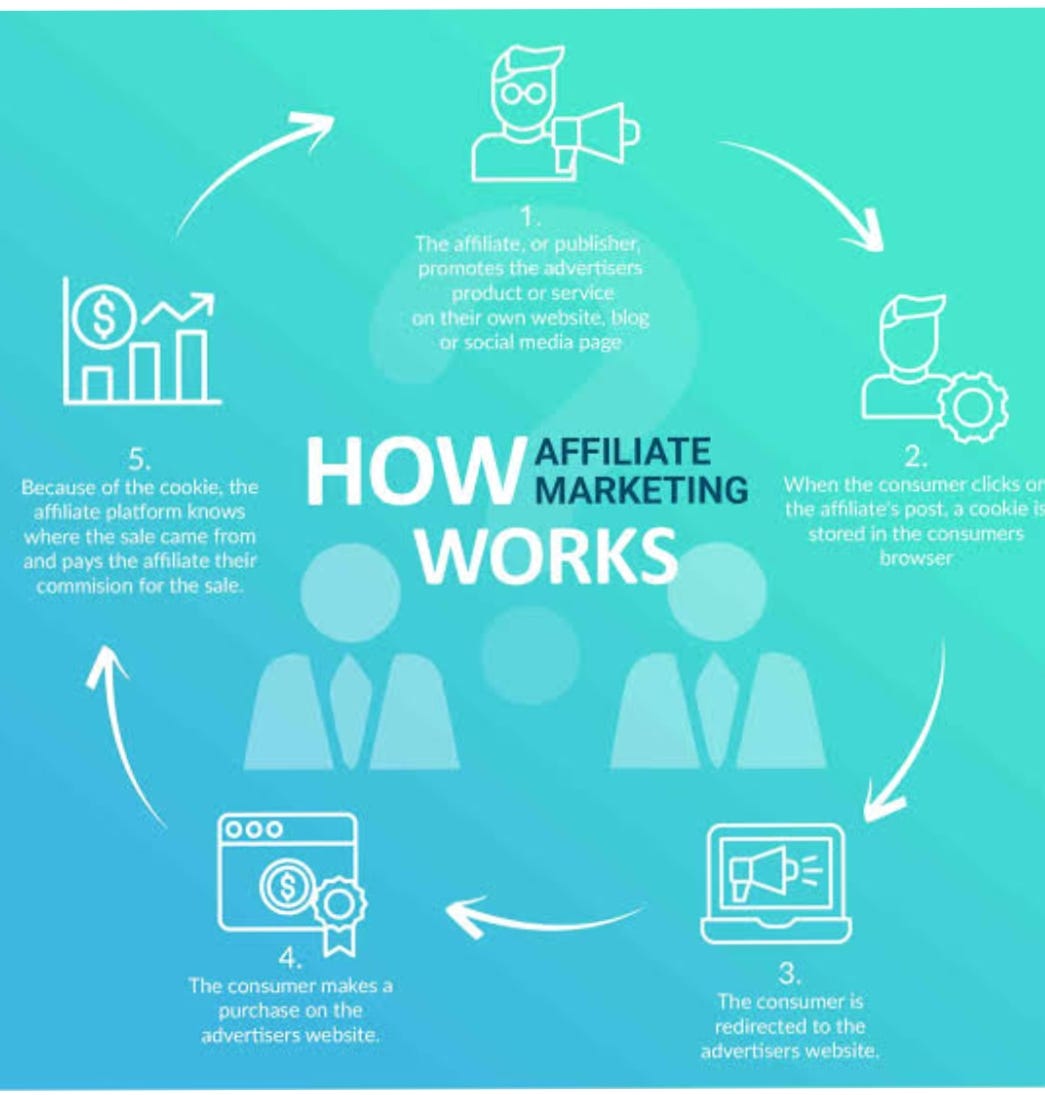

How Much Money Can You Make With Affiliate Marketing How Much Cash

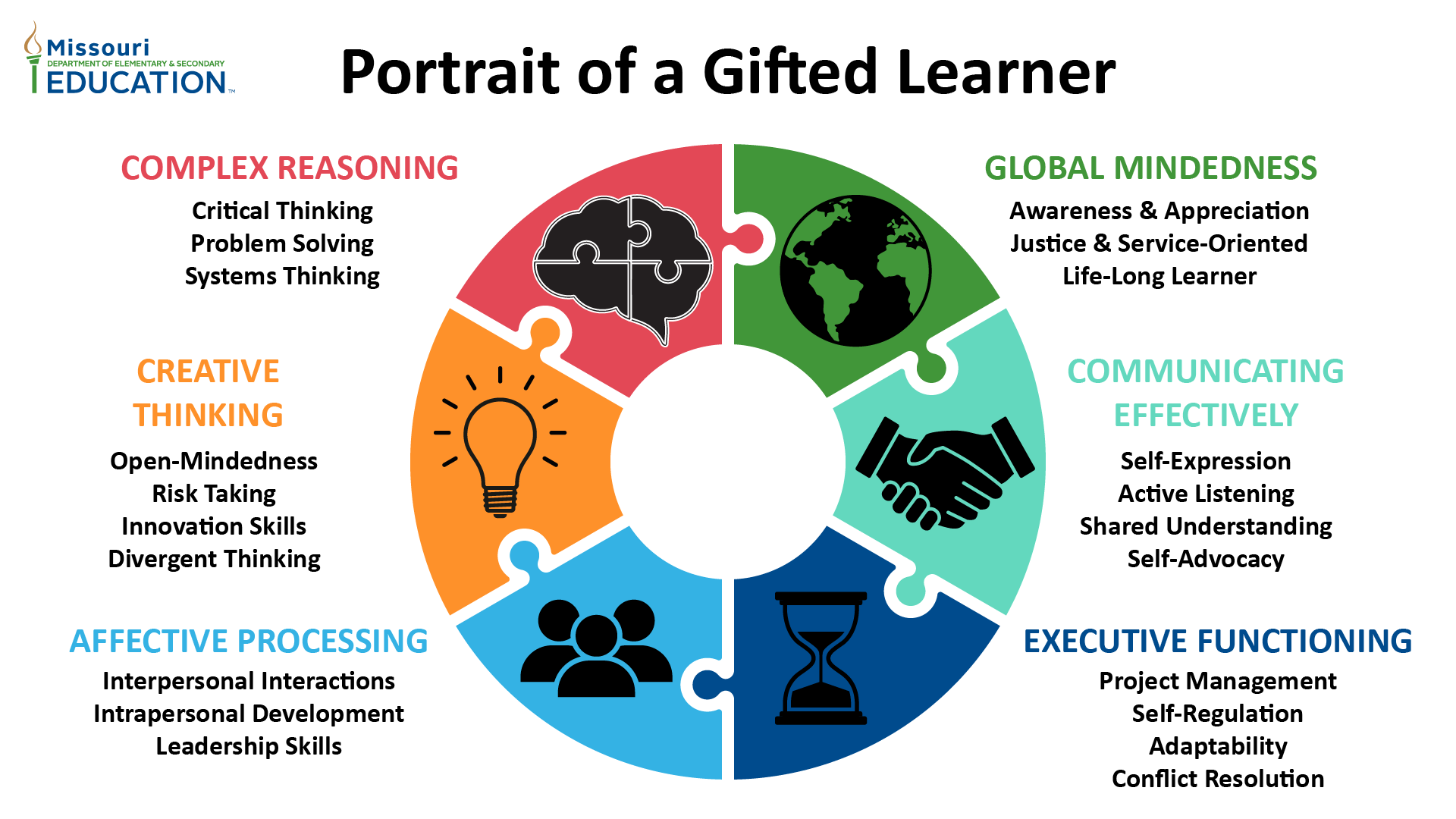

Gifted And Talented Children What You May NOT Know

95 Essential Links For The Parents Of Gifted Children Websites

How Much Money Can A Small Garden Save You An Update A Small Life

Gifted Education Missouri Department Of Elementary And Secondary

How Much Money Can You Really Save On Food Healthy And Lovin It

https://www.fidelity.com/.../giving-money

WEB In 2024 each person may gift up to 18 000 each year to any individual Any amount beyond that will involve using part of your lifetime federal gift tax exclusion which is

/GettyImages-497577473-56adcd235f9b58b7d00c366c.jpg?w=186)

https://www.usbank.com/financialiq/plan-your...

WEB Jan 13 2024 nbsp 0183 32 For smaller gifts the IRS rules for 2024 allow any individual to gift up to 18 000 per year to any recipient without having to consider the potential impact of a

https://money.usnews.com/money/per…

WEB Apr 8 2024 nbsp 0183 32 The smartest gifting method will depend on factors like the purpose of the money and when you want your child to have access to it Popular options include 529 plans Roth IRAs custodian

https://www.thebalancemoney.com/right-way-to-gift...

WEB Dec 7 2022 nbsp 0183 32 You must gift money thoughtfully keeping in mind everything from etiquette to tax implications Whether you are gifting money to children for the holidays birthdays

https://money.usnews.com/money/per…

WEB Jan 5 2024 nbsp 0183 32 For now the threshold is per person meaning a couple can give a combined gift of up to 36 000 to each of their children in 2024 for instance

WEB Jun 19 2024 nbsp 0183 32 Someone with three children can gift as much as 18 000 per child for a total of 54 000 without needing to pay a gift tax for the year The lifetime limit for gifting is WEB For 2024 the annual exclusion amount is 18 000 for individuals and 36 000 for married couples A couple with two children and three grandchildren would be able to make

WEB Dec 16 2022 nbsp 0183 32 Gifting money to children can be tax free but the IRS sets a limit each year on how much you can give The maximum gift tax exclusion sets the amount you can