How Is Federal Tax Calculated On Paycheck Canada WEB TurboTax s free Canada income tax calculator Estimate your 2023 tax refund or taxes owed and check federal and provincial tax rates

WEB Free simple online income tax calculator for any province and territory in Canada 2023 Use it to estimate how much provincial and federal taxes you need to pay WEB You must use the Canada Revenue Agency s CRA tax calculator to compute your Ontario income tax To calculate how much tax you owe the calculator will consider your taxable income tax deductions and tax credits

How Is Federal Tax Calculated On Paycheck Canada

How Is Federal Tax Calculated On Paycheck Canada

How Is Federal Tax Calculated On Paycheck Canada

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/how-to-calculate-federal-tax-withholding-per-paycheck-1.png

WEB Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces Find out your tax brackets and how much Federal and Provincial taxes you will pay

Pre-crafted templates offer a time-saving option for producing a diverse range of files and files. These pre-designed formats and designs can be used for various personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the content production process.

How Is Federal Tax Calculated On Paycheck Canada

Salary Tax Calculator 2023 2024 PELAJARAN

9 99 Plus Tax TusharaMarya

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

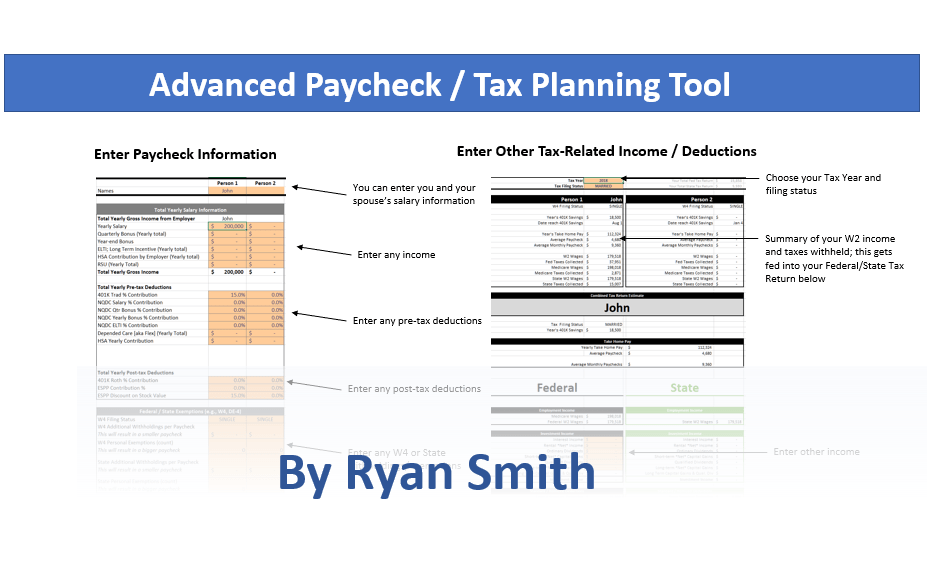

How Is Federal Withholding Calculated PaycheckCity

Federal Income Tax FIT Payroll Tax Calculation YouTube

Visualizing Taxes Deducted From Your Paycheck In Every State

https://www.canada.ca/.../how-to-calculate.html

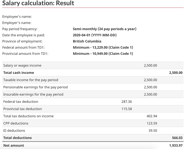

WEB Jan 1 2024 nbsp 0183 32 Use the PDOC to easily calculate federal provincial except for Quebec and territorial payroll deductions PDOC calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures

https://www.getsmarteraboutmoney.ca/learning-path/...

WEB Jul 5 2024 nbsp 0183 32 By law an employer must deduct certain amounts from your employment earnings Learn how these amounts are calculated and what you will pay

https://www.canada.ca/en/revenue-agency/services/...

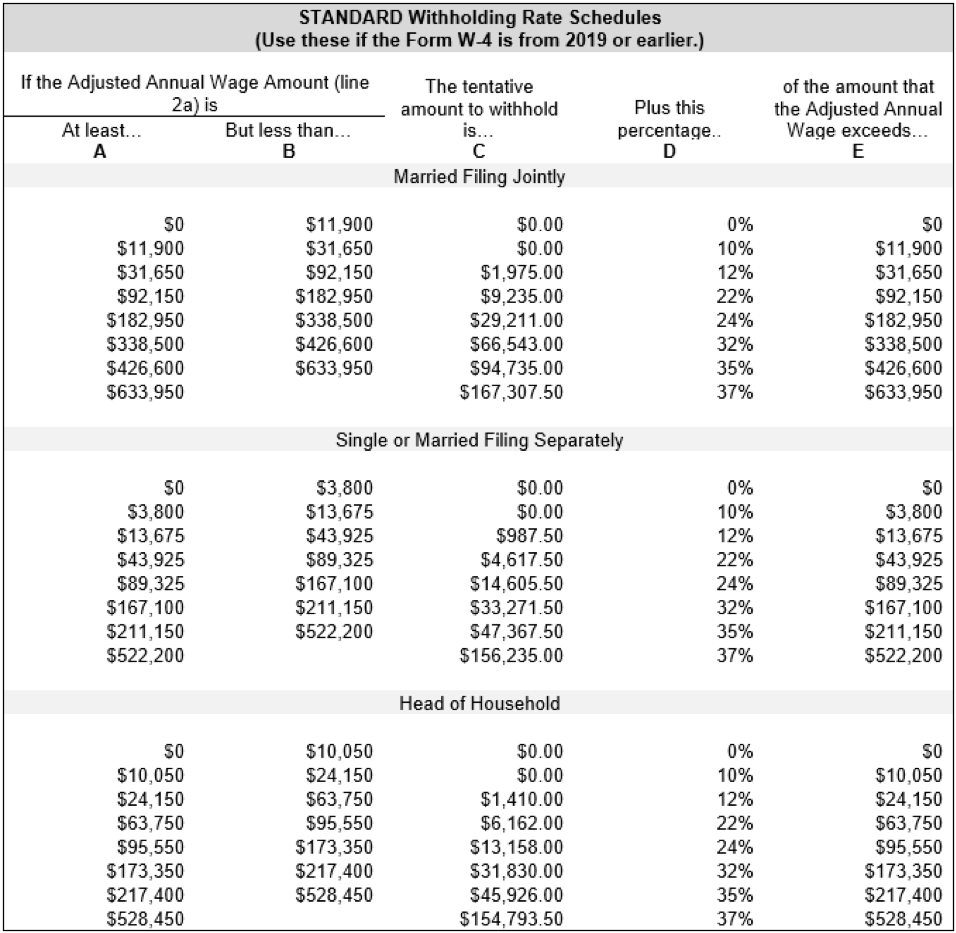

WEB To determine the total tax you deduct for the pay period you must add the federal and provincial tax amounts Even if the period of employment for which you pay a salary is less than a full pay period you must continue to use the tax deductions table that corresponds to your regular pay period

https://www.taxtips.ca/taxrates/calculating...

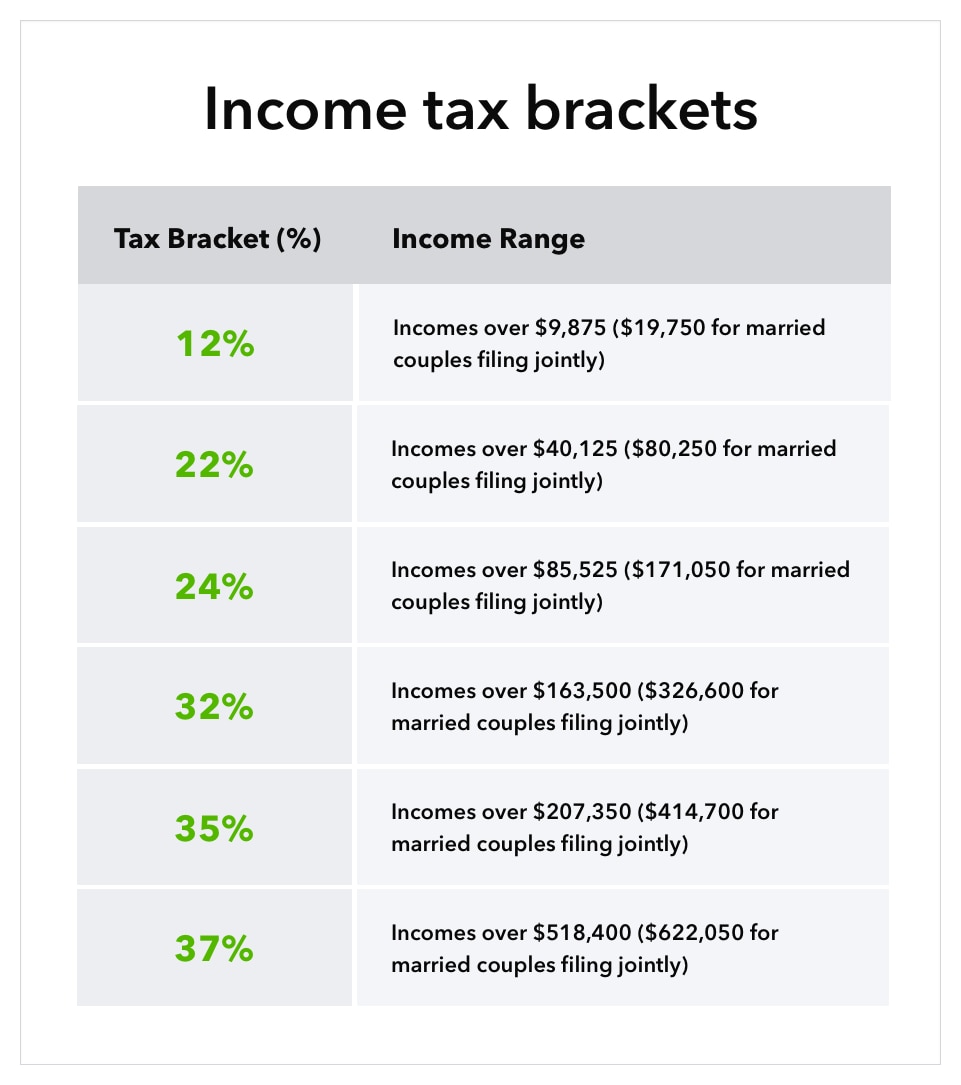

WEB Canadian federal income tax is calculated separately from provincial territorial income tax However both are calculated on the same tax return except for Quebec When using tax software the Quebec and federal returns can be calculated together

https://www.wealthsimple.com/en-ca/tool/tax-calculator

WEB 2023 Canada Income Tax Calculator Plug in a few numbers and we ll give you visibility into your tax bracket marginal tax rate average tax rate and payroll tax deductions along with an estimate of your tax refunds and taxes owed in 2023

WEB Use our Canada Salary Calculator to find out your take home pay and how much tax federal tax provincial tax CPP QPP EI premiums QPIP you owe WEB Feb 24 2024 nbsp 0183 32 Use this calculation to verify an employee s CPP contributions at year end or for multiple pay periods at any time of year This verification is used to determine if you have deducted properly under deducted or over deducted CPP contributions

WEB Summary If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per month Your average tax rate is 27 0 and your marginal tax rate is 35 3