How Is Capital Gains Tax Calculated On Sale Of Land The Internal Revenue Service assesses capital gains tax on almost anything you sell at a profit Land whether developed as inhabitable space or left as a barren parcel falls under the

If you sold a UK residential property on or after 6 April 2020 and you have tax on gains to pay you can report and pay using a Capital Gains Tax on UK property account Jul 4 2014 nbsp 0183 32 Find out about the treatment of Capital Gains Tax for land valuation disposals and land leases including freehold and selling short leases This guide explains your Capital Gains

How Is Capital Gains Tax Calculated On Sale Of Land

How Is Capital Gains Tax Calculated On Sale Of Land

How Is Capital Gains Tax Calculated On Sale Of Land

https://info.realrenta.com.au/hs-fs/hubfs/How-to-calculate-your-capital-gains-tax.png?width=2310&height=1488&name=How-to-calculate-your-capital-gains-tax.png

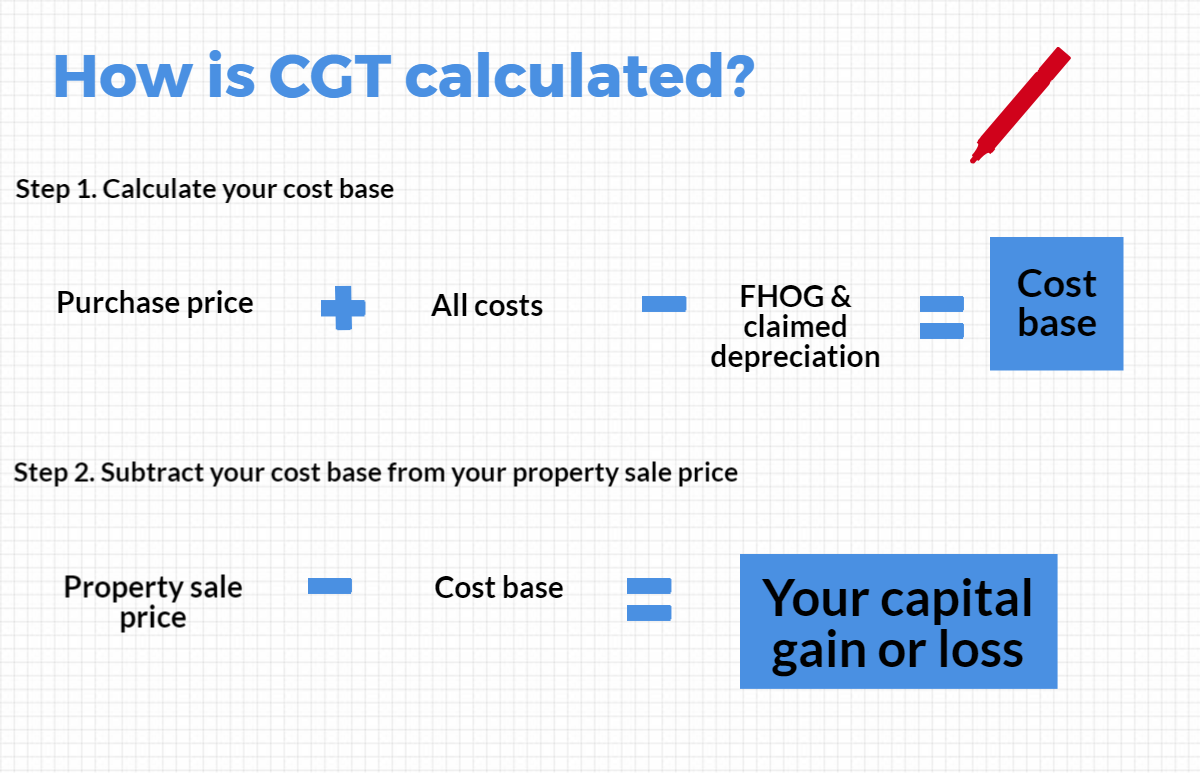

Apr 6 2025 nbsp 0183 32 The Capital Gain computation for land is calculated as follows the consideration of 163 20 million minus the wasted apportioned cost of 163 38 2 million 163 40 million 215 100 95 457 247

Templates are pre-designed documents or files that can be used for various functions. They can save effort and time by supplying a ready-made format and layout for producing different type of material. Templates can be utilized for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

How Is Capital Gains Tax Calculated On Sale Of Land

Long Term Capital Gains Tax Calculator 2025 Lillian G Cline

Long Term Capital Gains Tax Calculator 2025 Lillian G Cline

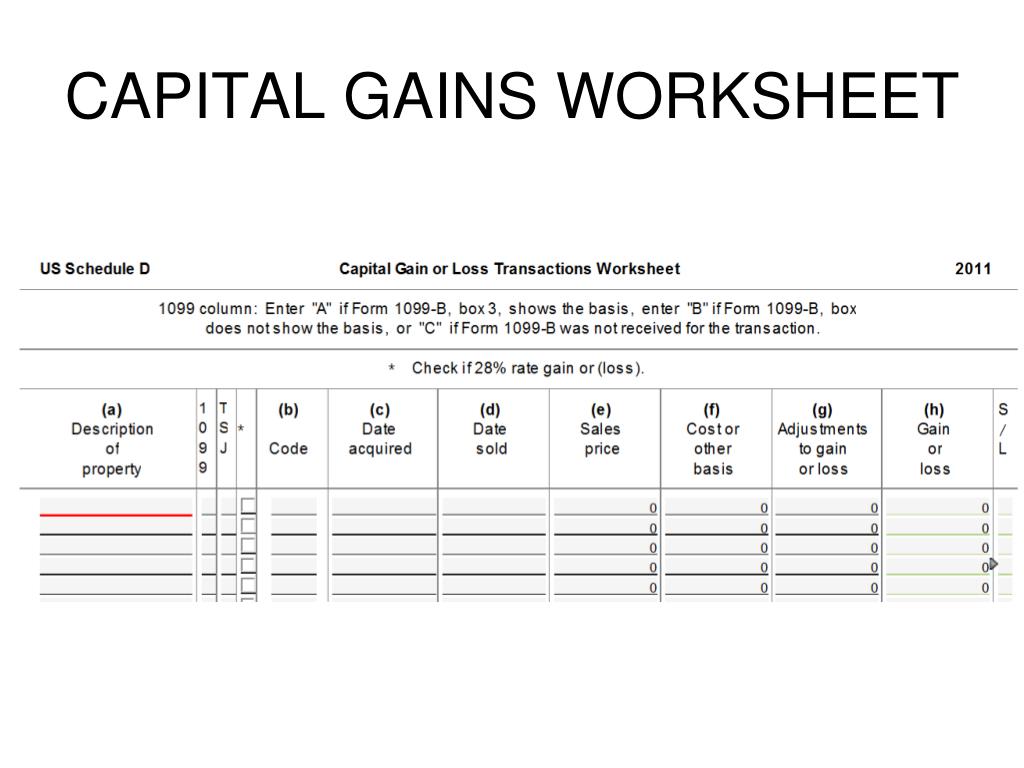

Capital Gains Worksheet 2023 Dividend And Capital Gains Tax

Calculate Schedule C Income Tax

2024 Income Tax Brackets For Single Filers Magda Nancie

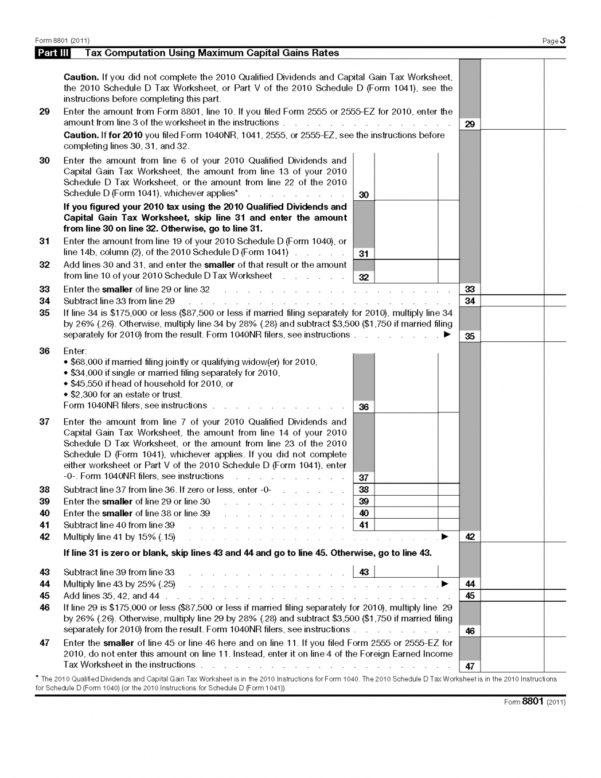

Qualified Dividends And Capital Gains 2021

https://www.adityabirlacapital.com › abc-of …

Mar 15 2023 nbsp 0183 32 Find out how much tax you need to pay when you sell land Gain insights into capital gains tax on land sale applicable tax rates and ways to

https://cleartax.in › capital-gains-exemptio…

Know about capital gains exemption on sale of land and find out how to save capital gains tax Check out the tax rates and calculate your capital gains

https://www.askbamland.com › post › taxe…

Nov 30 2022 nbsp 0183 32 The tax that you pay when selling land is called capital gains tax which requires you to pay tax on the profit margins of the land transaction The amount of tax that you pay will vary depending on your income bracket and

https://www.geraldedelman.com › insights › …

May 6 2022 nbsp 0183 32 If you make a gain on the sale you may have to pay Capital Gains Tax CGT This depends on the type of land or property that you are selling and in what manner

https://www.protaxaccountant.co.uk › post › avoid-cgt-on-land-sale

Jan 22 2025 nbsp 0183 32 Capital Gains Tax is a tax on the profit or quot gain quot you make when selling or disposing of an asset that has increased in value It s important to note that CGT is charged

Sep 17 2024 nbsp 0183 32 Individuals and Hindu Undivided Families HUFs have two options for calculating their long term capital gains LTCG tax on sale of property either pay a 12 5 tax on LTCG Dec 19 2024 nbsp 0183 32 How do you calculate a capital gain or loss What costs are deductible How can losses be utilised against capital gains

The long term capital gains chargeable to tax formula is LTCG chargeable to tax Net sale consideration Cost of Acquisition Cost of Improvement Exemptions under Section