Hmrc Trust Tax Rates 2022 23 Mar 26 2025 nbsp 0183 32 Today s Spring Statement included a number of surprise Making Tax Digital announcements including confirmation that the income threshold will be lowered to 163 20 000 from April 2028 Emma Rawson looks at what was announced and what it might mean in practice

Mar 12 2025 nbsp 0183 32 As part of a wide range of announcements HMRC is planning to offer large rewards to whistleblowers who report tax fraud It could make waiting for them to answer the phone worthwhile Jun 11 2024 nbsp 0183 32 HMRC I want to be very clear I am aware that contacting a source of income is a potential reason as to why the tax refund has not been made What I m actually asking is to know who was contacted so I can ensure that HMRC received a response to their inquiry in a timely fashion Can this information be provided to me

Hmrc Trust Tax Rates 2022 23

Hmrc Trust Tax Rates 2022 23

Hmrc Trust Tax Rates 2022 23

https://www.whyattaccountancy.com/wp-content/uploads/2022/01/HMRC-tax-return.jpg

Jun 11 2025 nbsp 0183 32 HMRC will likely be relieved to receive this extra money rather than scrambling to make cuts but as ICAEW s Haskew pointed out funnelling more investment into more compliance and debt management staff to close the tax gap is a missed opportunity to actually improve the services for taxpayers especially with HMRC looking to rely on

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by supplying a ready-made format and design for producing various kinds of content. Templates can be used for individual or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Hmrc Trust Tax Rates 2022 23

2022 Irs Tax Table Chart

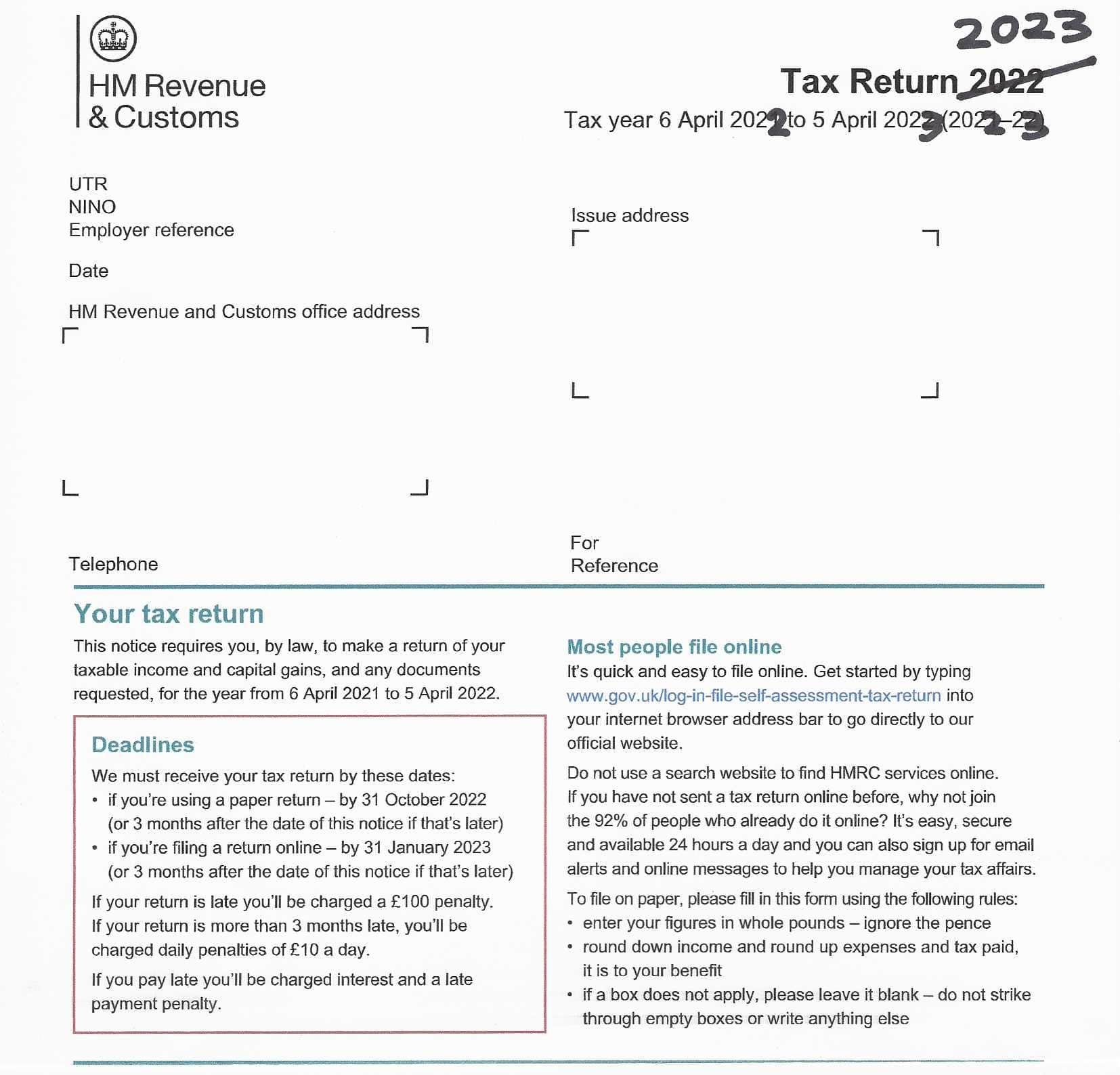

Hmrc Tax Return Self Assessment Form PrintableRebateForm

Trying To Locate The 2023 HMRC Paper Tax Return Form Online

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

Certificate Of Trust Blank Printable Template In PDF Word Trust

Trust Tax Rates KTS Chartered Accountants

https://www.accountingweb.co.uk › community › industry-insights

May 20 2025 nbsp 0183 32 However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a complete guide on everything you need to know regarding HMRC mileage reimbursement rates in 2025 What is HMRC s mileage allowance

https://www.accountingweb.co.uk › any-answers

Apr 17 2025 nbsp 0183 32 From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 163 3 45 a week or 163 4 10 for share fishermen for 2024 to 2025 If your profits D12 are below 163 6 725 for 2024 to 2025 you can elect to pay Class 2 NICs voluntarily

https://www.accountingweb.co.uk › tax › hmrc-policy

Mar 11 2025 nbsp 0183 32 Entrepreneurial spirit Murray said the way HMRC works is changing in a bid to make it easier for Brits to make the very most of their entrepreneurial spirit Taking hundreds of thousands of people out of filing tax returns means less time filling out forms and more time for them to grow their side hustle he added

https://www.accountingweb.co.uk › tax › hmrc-policy › hmrc-unlocks-mul…

Apr 16 2025 nbsp 0183 32 HMRC previously released guidance for software developers in October last year to support multi agent access as part of the MTD IT programme It s now the turn for everyone else

https://community.hmrc.gov.uk › customerforums › sa

Sep 18 2023 nbsp 0183 32 Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access my UTR number I start work next week thank you

[desc-11] [desc-12]

[desc-13]