Hmrc Tax Rates 2023 24 Uk Nov 26 2024 nbsp 0183 32 For the 2024 25 tax year the UK has a broad range of tax brackets allowances and earnings thresholds Review our comprehensive summary of the UK s personal and company tax regulations for 2024 25 and the previous 2023 24 tax year to get a head start

HM revenue amp customs tax rates and allowances for 2023 24 We share our expert analysis and commentary on tax aspects of the UK Spring Budget 2023 Tax rate tables for 2023 24 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates

Hmrc Tax Rates 2023 24 Uk

Hmrc Tax Rates 2023 24 Uk

Hmrc Tax Rates 2023 24 Uk

https://amortgagenow.co.uk/wp-content/uploads/2016/03/FC_tyoprintyourtaxyo.png

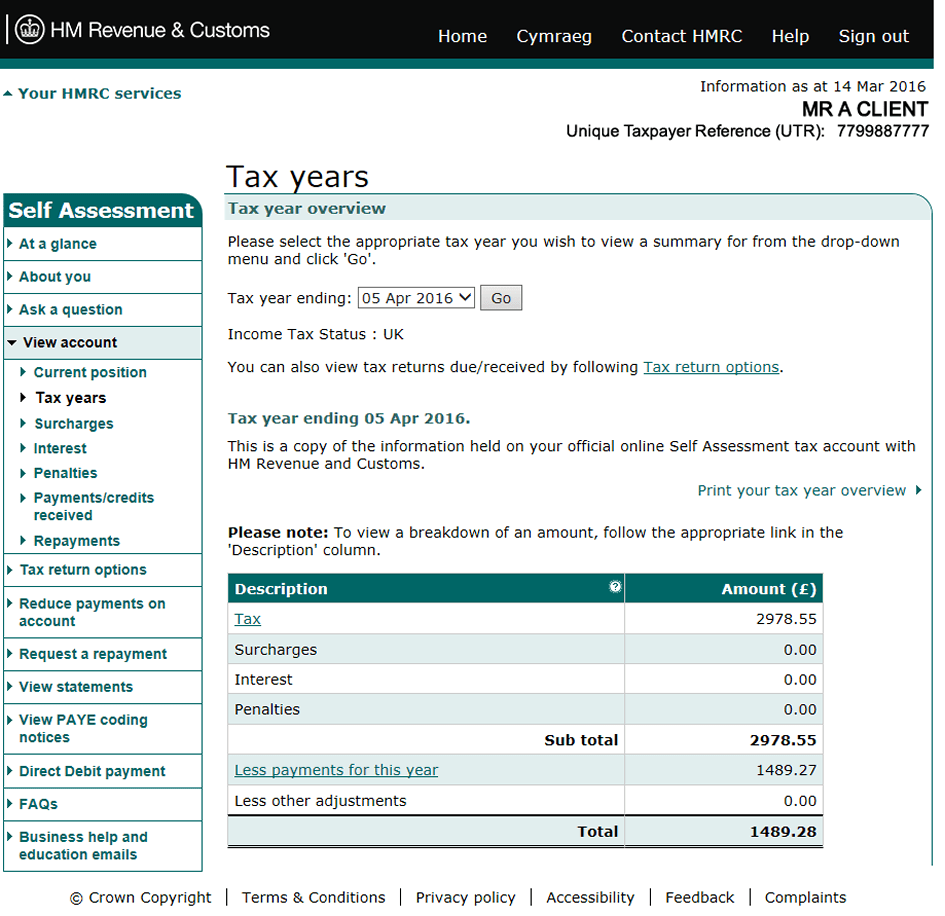

Jun 30 2022 nbsp 0183 32 If you earn over 163 12 570 in the UK you pay tax on your income There are three Income Tax rates in the UK beyond the tax free Personal Allowance Income Tax bands demarcate the thresholds at which you begin to pay a higher or lower rate of Income Tax

Pre-crafted templates use a time-saving option for creating a varied range of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and expert projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the content creation process.

Hmrc Tax Rates 2023 24 Uk

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-11]

[img_title-12]

https://www.gov.uk › government › publications › rates...

Aug 14 2024 nbsp 0183 32 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025 tax year and the

https://www.gov.uk › government › publications

Mar 6 2024 nbsp 0183 32 Following the publication of Consumer Price Index CPI figures for September 2023 the government announced at Autumn Statement 2023 the new benefits rates for 2024 to 2025 Working Tax Credit

https://www.which.co.uk › money › tax › income-tax › tax...

Dec 5 2024 nbsp 0183 32 Here are the current tax bands rates and thresholds for England Wales and Northern Ireland for the tax year 2023 24 and 2024 25 Those earning more than 163 100 000 will see their personal allowance reduced by 163 1 for every 163 2 they earn over the threshold meaning that anyone who earns more than 163 125 140 will pay tax on all the income they earn

https://www.theaccountancy.co.uk › tax › uk-tax-rates...

Jan 13 2025 nbsp 0183 32 Read our guide to UK tax rates and thresholds for sole traders limited companies partners and partnerships employers and other businesses When do tax rates change What is the tax free Personal Allowance How much is the Personal Allowance in 2024 25 How do income tax thresholds rates and allowances work

https://www.uktaxcalculators.co.uk › tax-rates

0 starting rate is for savings income only if your non savings income is above the starting band level the 0 rate will NOT apply and the basic rate percentage will be used instead Answer a few questions below and we will list relevant tax calculators and tools that can help you organise budget and ultimately save you money

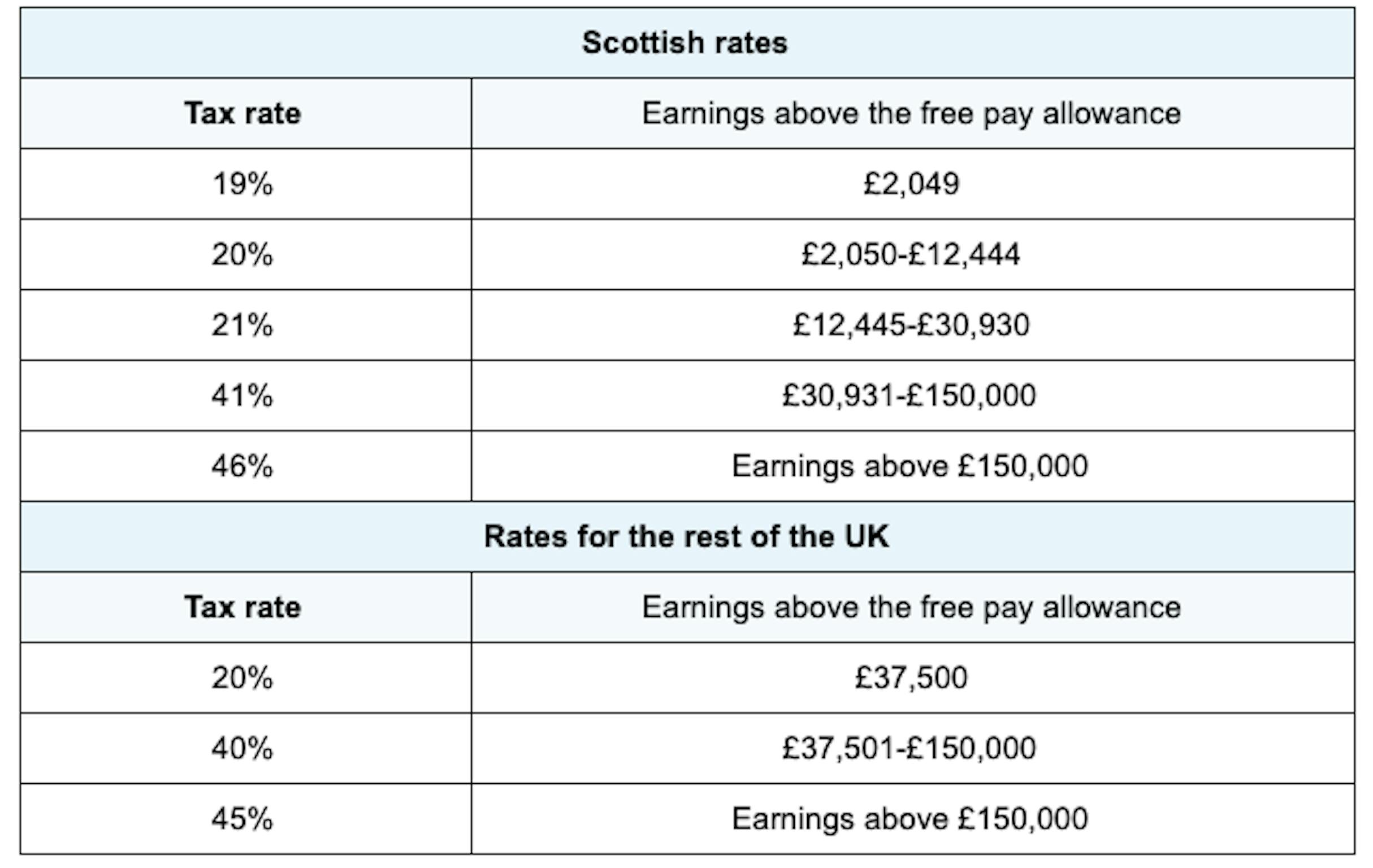

Jan 8 2024 nbsp 0183 32 This briefing sets out direct tax rates and principal tax allowances for the 2023 24 tax year as confirmed in the Spring Budget 2023 on 15 March 2023 It also includes changes to the rates of National Insurance contributions announced at Autumn Statement 2023 Jan 1 2014 nbsp 0183 32 Scotland tax rates and bands table has been updated to confirm that the 42 higher rate and the 47 top rate for Income Tax is for the 2023 to 2024 tax year Corrected England

For the tax year 2023 2024 the UK basic income tax rate was 20 This increased to 40 for your earnings above 163 50 270 and to 45 for earnings over 163 150 000 Your earnings below 163 12 570 were tax free This is called the Personal Allowance However for every 163 2 you earned over 163 100 000 this allowance is reduced by 163 1