Hmrc Tax Rates 2022 23 Scotland Mar 26 2025 nbsp 0183 32 Today s Spring Statement included a number of surprise Making Tax Digital announcements including confirmation that the income threshold will be lowered to 163 20 000

Mar 12 2025 nbsp 0183 32 As part of a wide range of announcements HMRC is planning to offer large rewards to whistleblowers who report tax fraud It could make waiting for them to answer the Jun 11 2024 nbsp 0183 32 HMRC I want to be very clear I am aware that contacting a source of income is a potential reason as to why the tax refund has not been made What I m actually asking is to

Hmrc Tax Rates 2022 23 Scotland

Hmrc Tax Rates 2022 23 Scotland

Hmrc Tax Rates 2022 23 Scotland

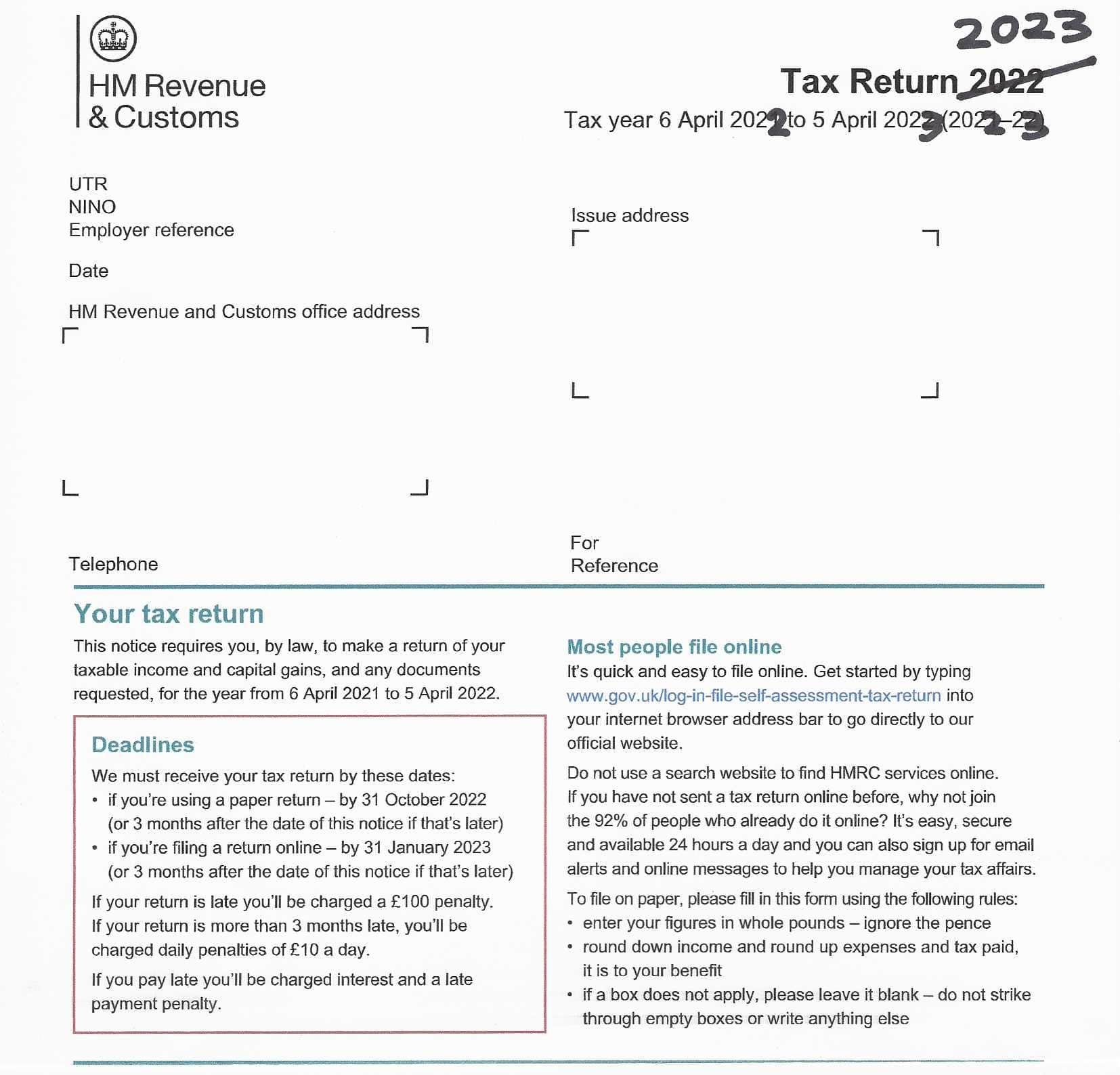

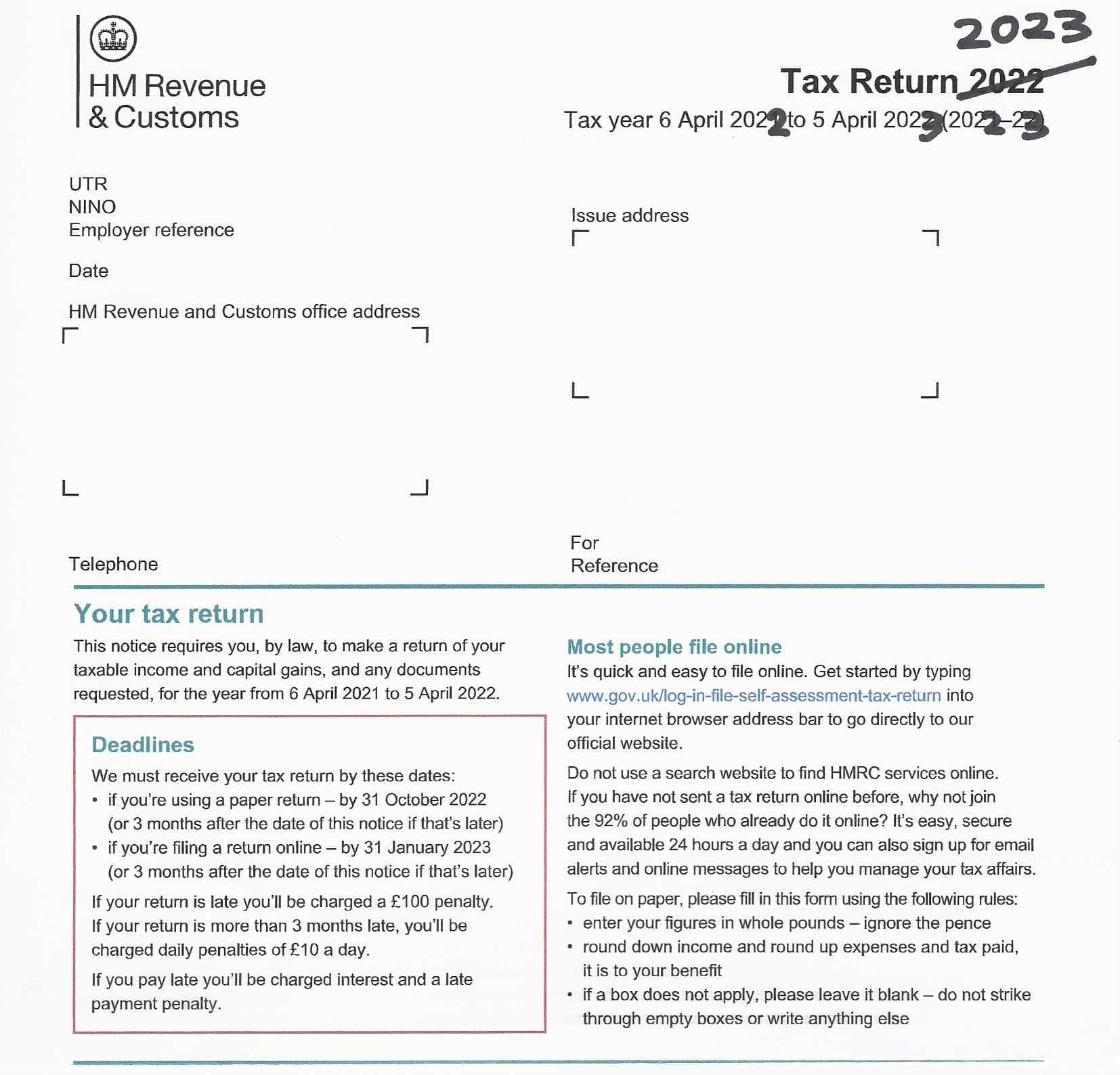

https://taxhelp.uk.com/wp-content/uploads/Where-is-the-2023-HMRC-SA100-Tax-Return-Form-m.jpg

Jun 11 2025 nbsp 0183 32 HMRC will likely be relieved to receive this extra money rather than scrambling to make cuts but as ICAEW s Haskew pointed out funnelling more investment into more

Pre-crafted templates provide a time-saving service for developing a varied range of documents and files. These pre-designed formats and designs can be made use of for various personal and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material production process.

Hmrc Tax Rates 2022 23 Scotland

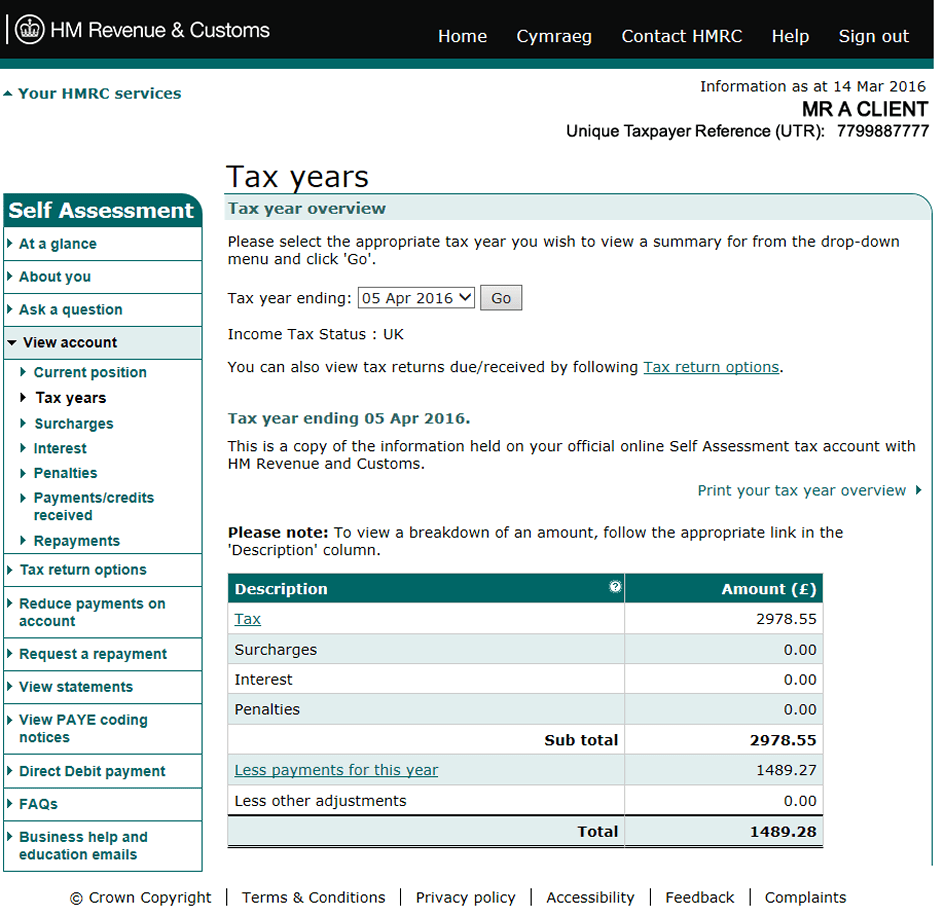

Hmrc Rates And Thresholds 2022 23 Image To U

How To Print Your Tax Calculations Better co uk formerly Trussle

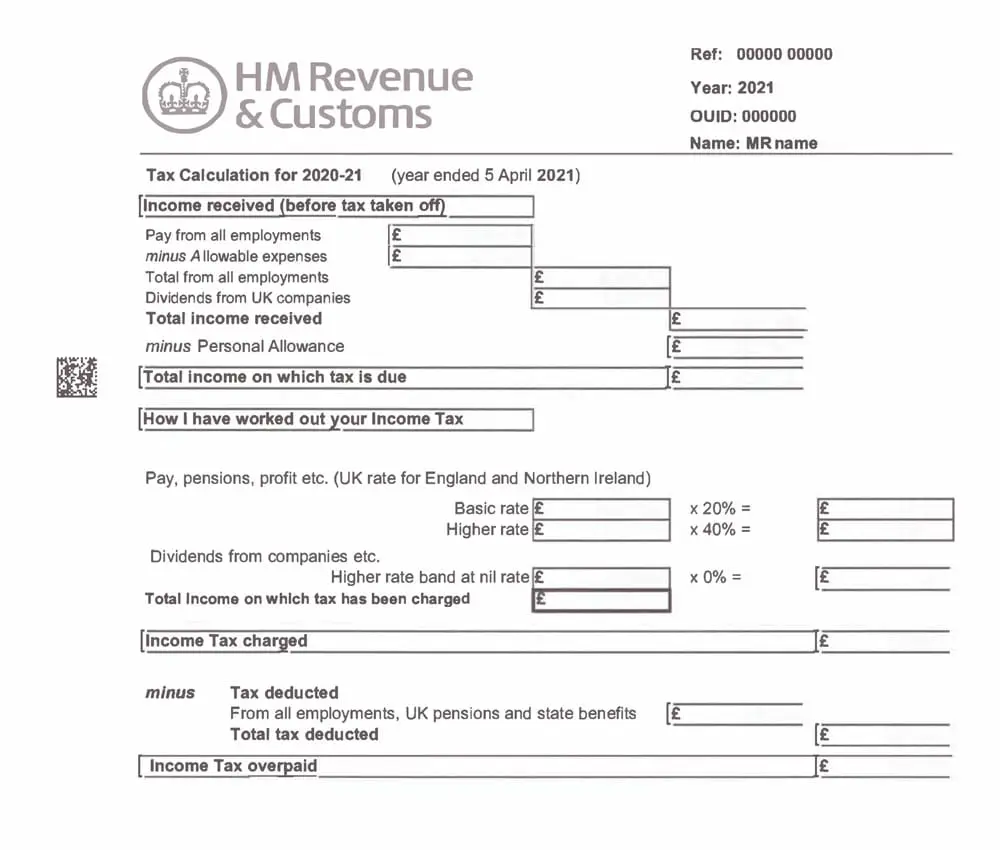

SA302 Mortgage Tax Calculation YesCanDo

Hmrc Paye Tax Codes 2023 24 Image To U

Hmrc Lifetime Allowance 2023 24 Image To U

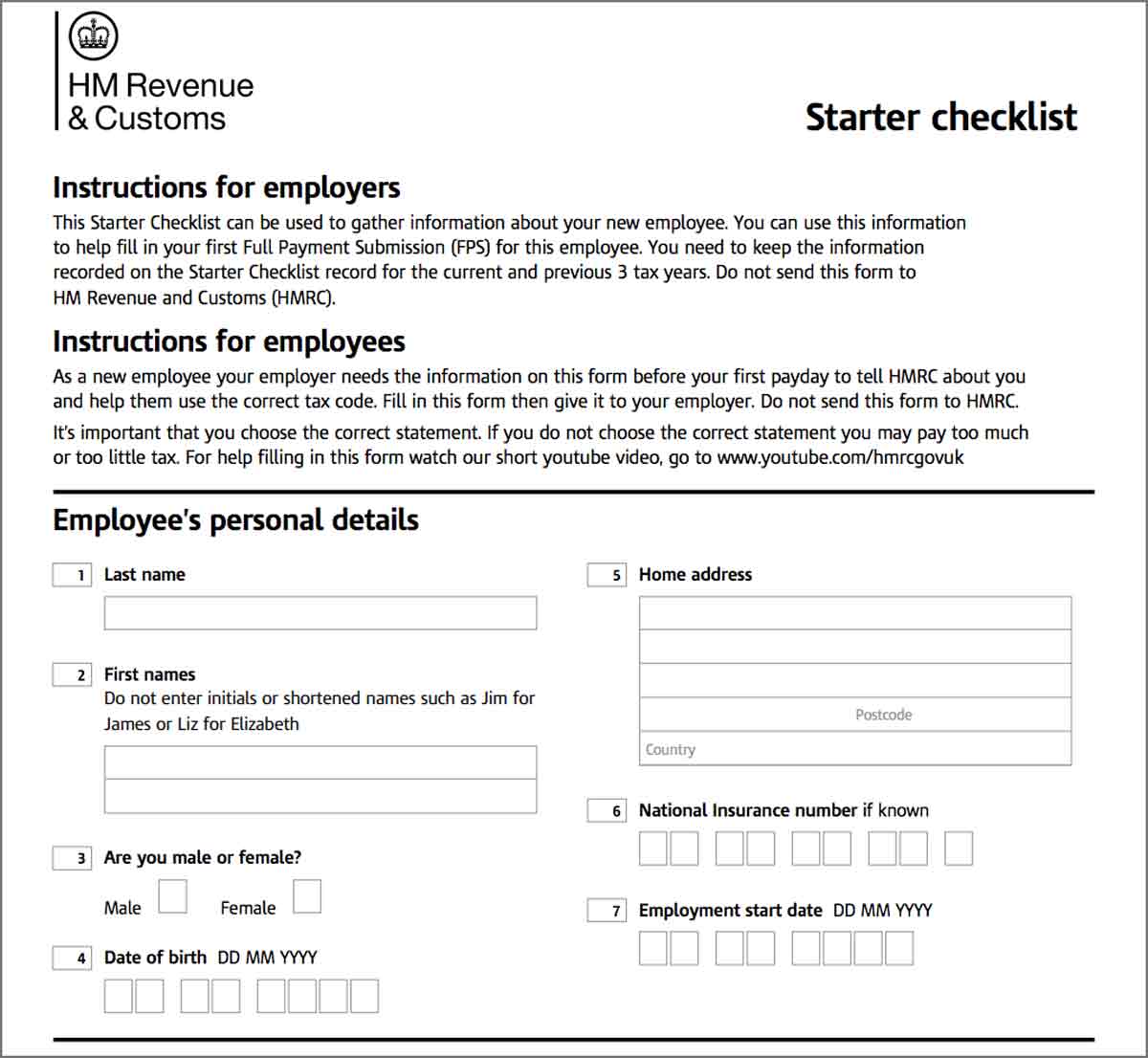

HMRC Starter Checklist Explained Guide FAQ For Employers

https://www.accountingweb.co.uk › community › industry-insights

May 20 2025 nbsp 0183 32 However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a complete

https://www.accountingweb.co.uk › any-answers

Apr 17 2025 nbsp 0183 32 From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 163 3 45 a week or

https://www.accountingweb.co.uk › tax › hmrc-policy

Mar 11 2025 nbsp 0183 32 Entrepreneurial spirit Murray said the way HMRC works is changing in a bid to make it easier for Brits to make the very most of their entrepreneurial spirit Taking hundreds

https://www.accountingweb.co.uk › tax › hmrc-policy › hmrc-unlocks-mul…

Apr 16 2025 nbsp 0183 32 HMRC previously released guidance for software developers in October last year to support multi agent access as part of the MTD IT programme It s now the turn for everyone

https://community.hmrc.gov.uk › customerforums › sa

Sep 18 2023 nbsp 0183 32 Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access

[desc-11] [desc-12]

[desc-13]