Hmrc Tax Ni Rates 2022 23 Mar 26 2025 nbsp 0183 32 Today s Spring Statement included a number of surprise Making Tax Digital announcements including confirmation that the income threshold will be lowered to 163 20 000 from April 2028 Emma Rawson looks at what was announced and what it might mean in practice

Mar 12 2025 nbsp 0183 32 As part of a wide range of announcements HMRC is planning to offer large rewards to whistleblowers who report tax fraud It could make waiting for them to answer the phone worthwhile Jun 11 2024 nbsp 0183 32 HMRC I want to be very clear I am aware that contacting a source of income is a potential reason as to why the tax refund has not been made What I m actually asking is to know who was contacted so I can ensure that HMRC received a response to their inquiry in a timely fashion Can this information be provided to me

Hmrc Tax Ni Rates 2022 23

Hmrc Tax Ni Rates 2022 23

Hmrc Tax Ni Rates 2022 23

https://oscarfairchild.com/wp-content/uploads/2022/02/HMRC-confirms-NI-rates-for-202223.png

Jun 11 2025 nbsp 0183 32 HMRC will likely be relieved to receive this extra money rather than scrambling to make cuts but as ICAEW s Haskew pointed out funnelling more investment into more compliance and debt management staff to close the tax gap is a missed opportunity to actually improve the services for taxpayers especially with HMRC looking to rely on

Pre-crafted templates offer a time-saving option for creating a diverse series of documents and files. These pre-designed formats and designs can be made use of for different individual and professional projects, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, improving the content production procedure.

Hmrc Tax Ni Rates 2022 23

Latest HMRC Tax Webinars Manufacturing NI

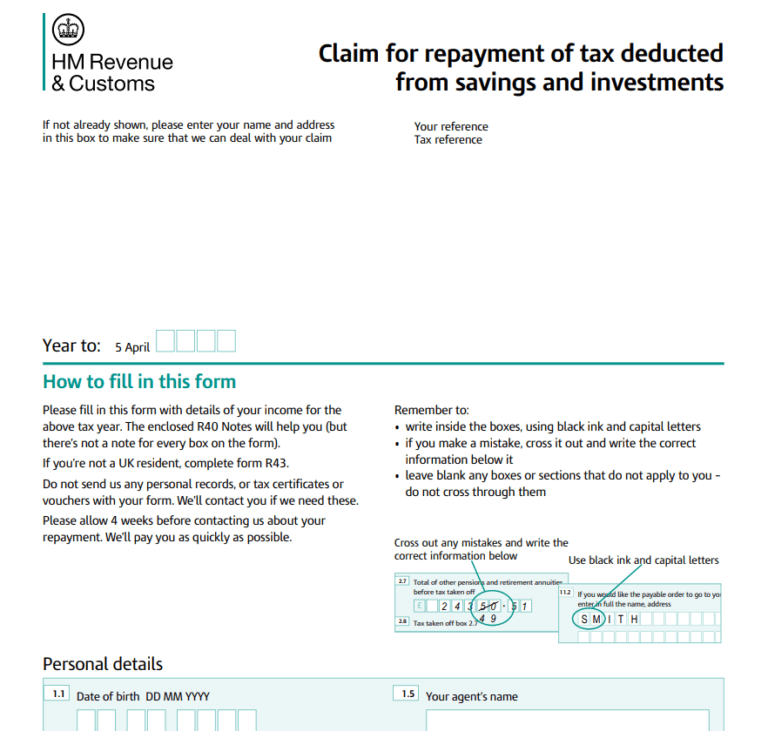

Hmrc Tax Rebate Form P55 Printable Rebate Form

UK HMRC Self Assessment Income Tax Return Form 2023 Stock Photo Alamy

Understanding The 257L Tax Code What You Need To Know 2024Watermill

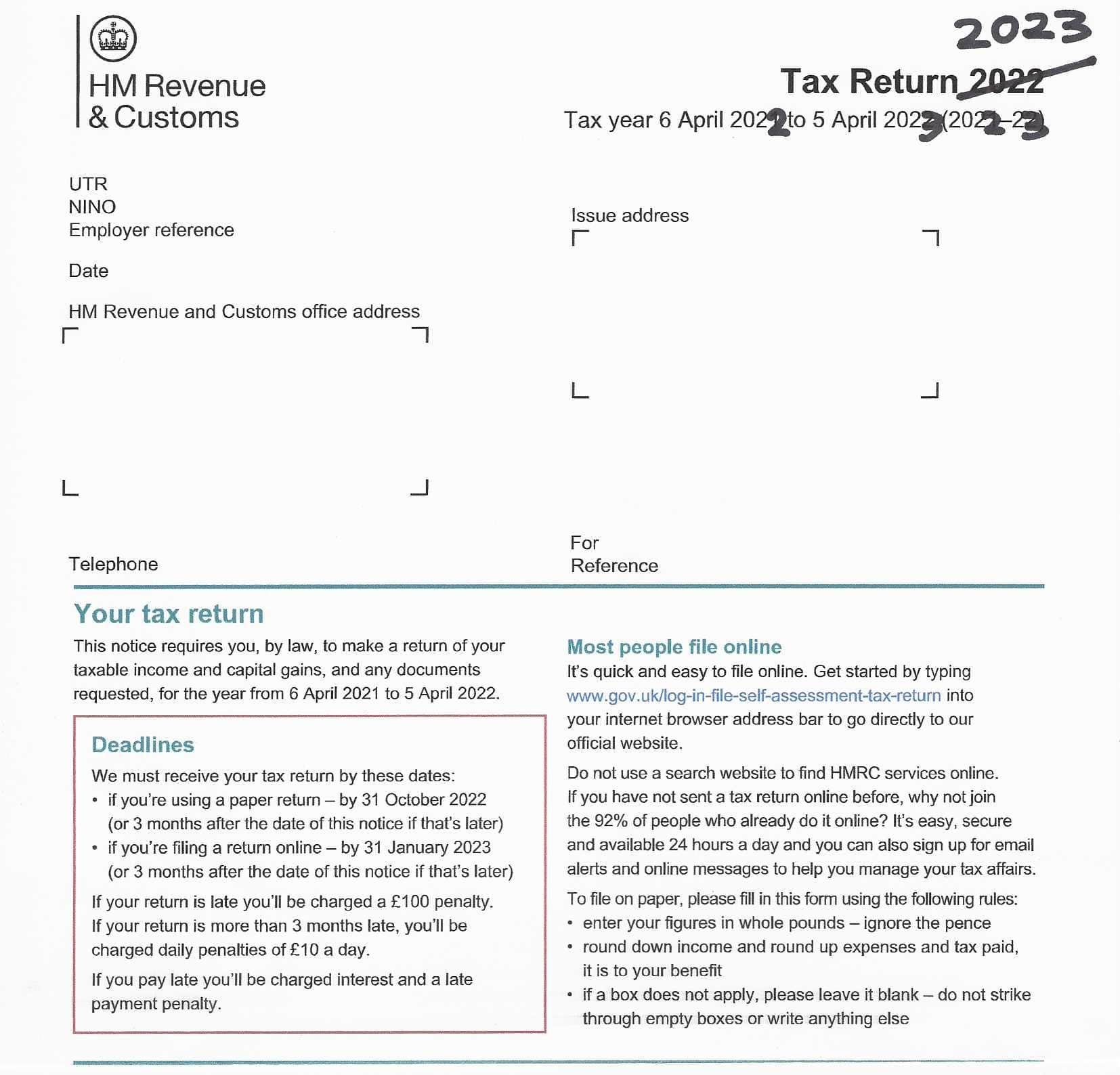

Trying To Locate The 2023 HMRC Paper Tax Return Form Online

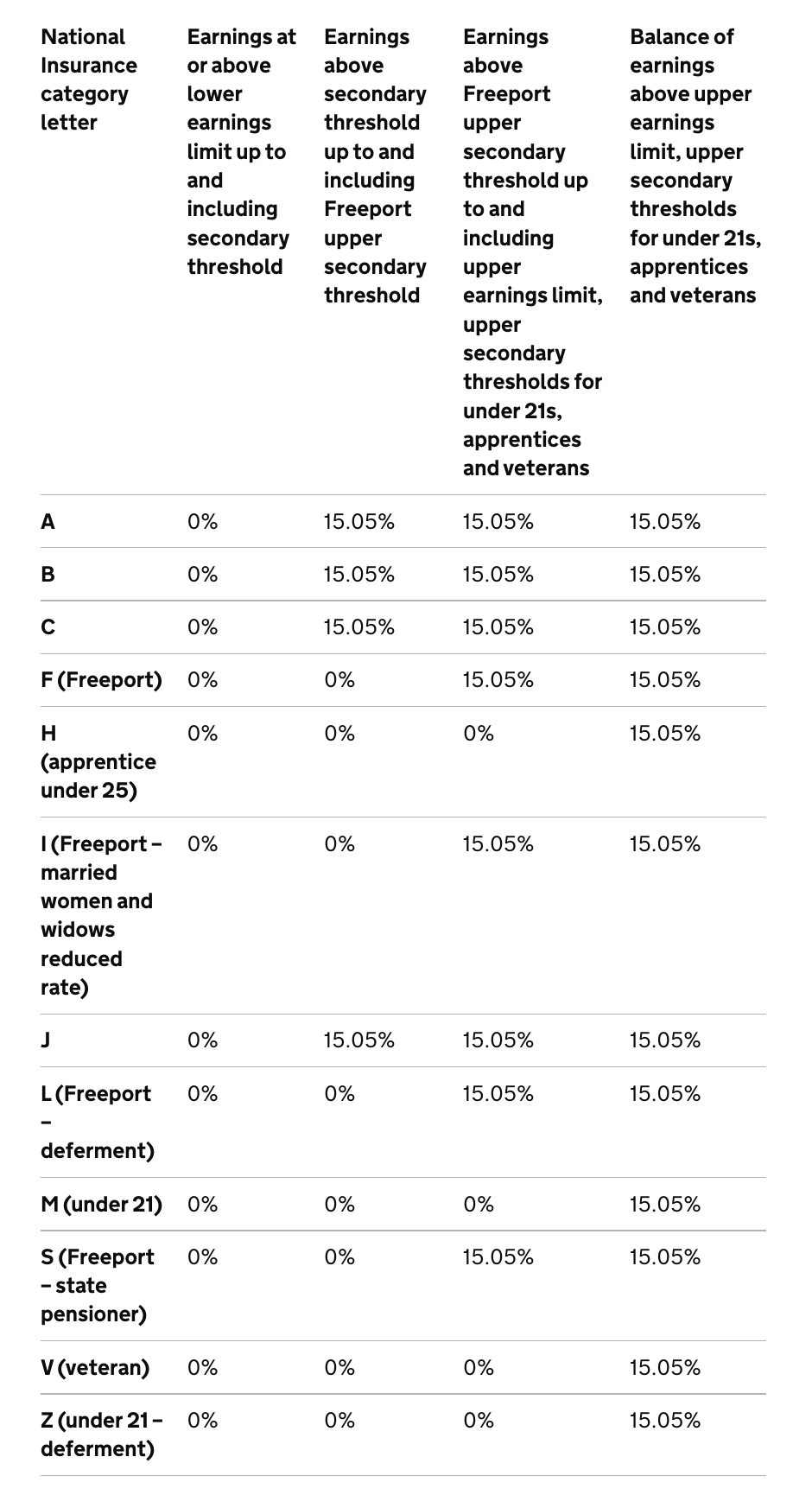

NIC Thresholds Rates For 2022 23 BrightPay Documentation

https://www.accountingweb.co.uk › community › industry-insights

May 20 2025 nbsp 0183 32 However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a complete guide on everything you need to know regarding HMRC mileage reimbursement rates in 2025 What is HMRC s mileage allowance

https://www.accountingweb.co.uk › any-answers

Apr 17 2025 nbsp 0183 32 From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 163 3 45 a week or 163 4 10 for share fishermen for 2024 to 2025 If your profits D12 are below 163 6 725 for 2024 to 2025 you can elect to pay Class 2 NICs voluntarily

https://www.accountingweb.co.uk › tax › hmrc-policy

Mar 11 2025 nbsp 0183 32 Entrepreneurial spirit Murray said the way HMRC works is changing in a bid to make it easier for Brits to make the very most of their entrepreneurial spirit Taking hundreds of thousands of people out of filing tax returns means less time filling out forms and more time for them to grow their side hustle he added

https://www.accountingweb.co.uk › tax › hmrc-policy › hmrc-unlocks-mul…

Apr 16 2025 nbsp 0183 32 HMRC previously released guidance for software developers in October last year to support multi agent access as part of the MTD IT programme It s now the turn for everyone else

https://community.hmrc.gov.uk › customerforums › sa

Sep 18 2023 nbsp 0183 32 Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access my UTR number I start work next week thank you

[desc-11] [desc-12]

[desc-13]