Fsa Rules For 2022 Web in 2021 to a plan year ending in 2022 A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year A health FSA may allow an individual who ceases participation in a health FSA during calendar year 2020 or 2021 to continue to receive reimbursements

Web Dec 15 2021 nbsp 0183 32 If your employer adopted any of these temporary rules there could be major implications for your FSA plan going into 2022 FSA carryover limits are expanding for 2022 and there are longer FSA grace periods which will give you more time to spend any FSA money you don t use by the end of 2021 Web Nov 11 2021 nbsp 0183 32 Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022 And if an employer s plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up 20 from 550 in 2021 to 570 in 2022 These new limits also apply to limited

Fsa Rules For 2022

Fsa Rules For 2022

Fsa Rules For 2022

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

Web Sept 16 2022 It s especially important this year to check the balance in your flexible spending account and know the deadline for using it on health costs because the elastic rules adopted in

Pre-crafted templates provide a time-saving solution for developing a varied range of documents and files. These pre-designed formats and designs can be used for various personal and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the material creation procedure.

Fsa Rules For 2022

Flexible Spending Accounts FSA The League City Official Website

Digitally Sell At FullSpeed Cisco DCloud Demos Help You Avoid Death

FSA COVID Relief Rules Provide Longer Periods To Spend Unused Balances

Fsa Health Care Limit 2022 Kittie Gale

IRS Announces 2022 COLAs For Transportation Fringes FSA Deferrals Part

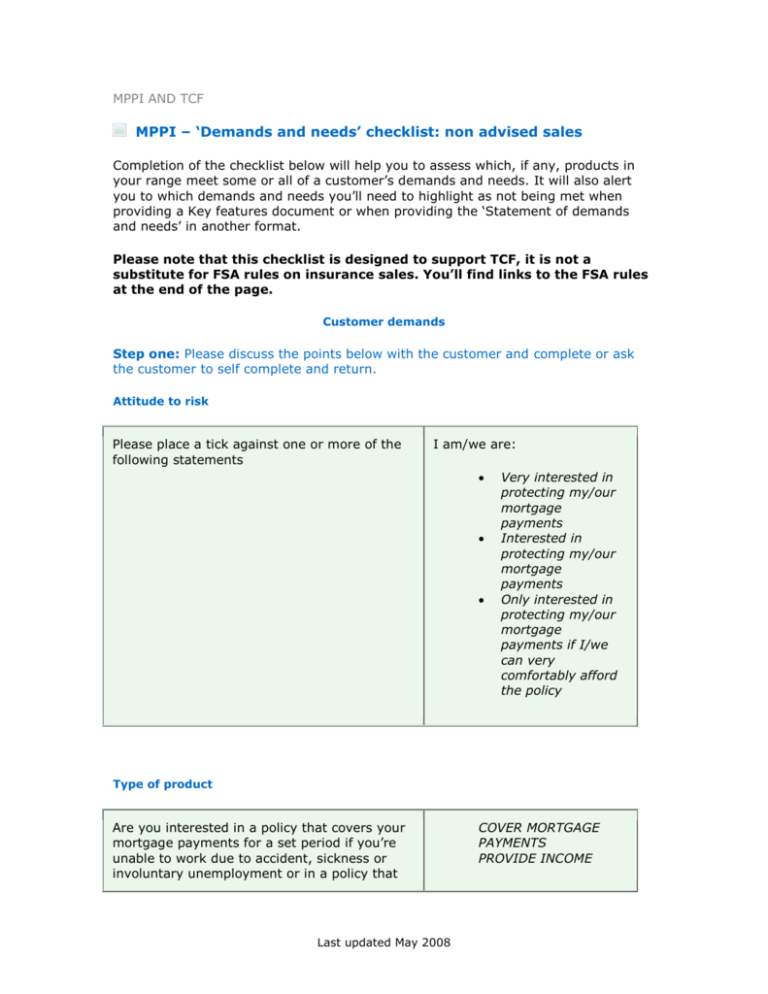

MPPI Demands And Needs Checklist Non Advised Sales

https://www.nytimes.com/2021/10/15/your-money/fsa-limits-2022.html

Web Oct 15 2021 nbsp 0183 32 The limit set by the Internal Revenue Service was 2 750 for 2021 but employers may set lower limits for their workers The I R S hasn t confirmed the maximum for 2022 Ms Myers said

https://www.irs.gov/publications/p969

Web Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 2 850

https://www.shrm.org/resourcesandtools/hr-topics/...

Web Nov 11 2021 nbsp 0183 32 The chart below shows the adjustment in health FSA contribution limits for 2022 Employers may set lower limits for their workers Health Flexible Spending Accounts Includes limited purpose

https://hr.nih.gov/about/news/benefits-newsletter/...

Web If you want an FSA in 2022 you must enroll for 2022 during the Open Season Open Season elections will be effective on January 1 2022 To enroll or make a change to your contribution amount for 2022 or if you have questions contact FSAFEDS by calling 877 372 3337 or visiting the FSAFEDS website

https://www.goodrx.com/insurance/fsa-hsa/2022-fsa-contribution-limits

Web Jan 6 2022 nbsp 0183 32 The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year The contribution limit is 2 850 up from 2 750 in 2021 Learn more from GoodRx about the increase in FSA contribution limits and how to make the most of your FSA

Web Apr 11 2022 nbsp 0183 32 With a health care FSA only employers can allow you to carry over up to 570 from 2022 to the following year Employers can offer either option for a health care FSA but not both Web Nov 10 2021 nbsp 0183 32 2022 FSA carryover limits 2021 2022 550 per year 570 per year The 2022 FSA carryover is 570 per year which is up 20 from 2021 Please note Under the CAA employers are allowed but not required to permit the following for either or both of medical and dependent care FSAs Carryover of all unused funds from plan year ending

Web Nov 7 2022 nbsp 0183 32 Among the biggest changes for 2023 concern two tax advantaged health savings accounts Flexible Spending Accounts FSA and Health Savings Accounts HSA