Fsa Limits For 2022 And 2023 Web By Kathryn Mayer October 21 2022 Spurred by soaring inflation which has been on an upward trajectory over the last year the Internal Revenue Service pushed the cap for flexible spending accounts next year above

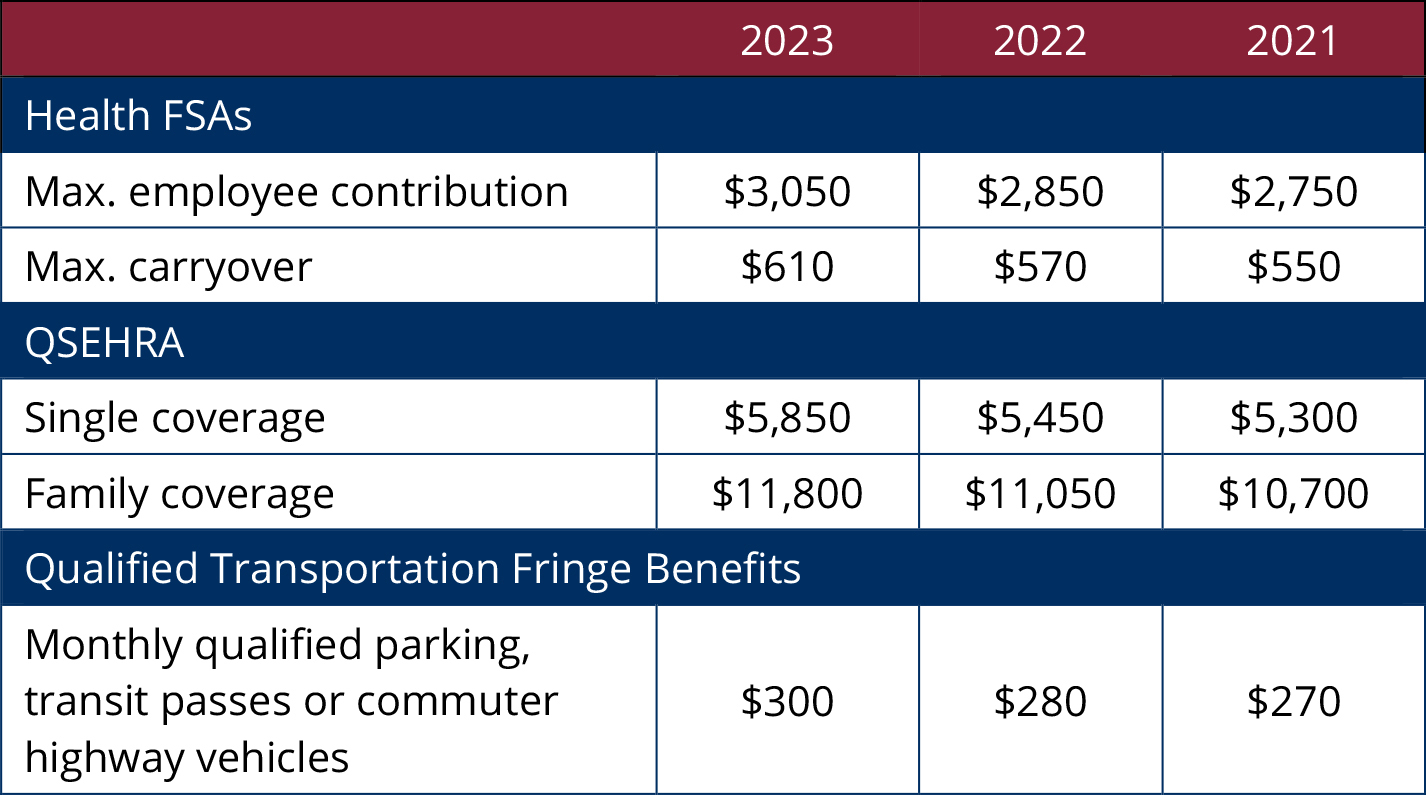

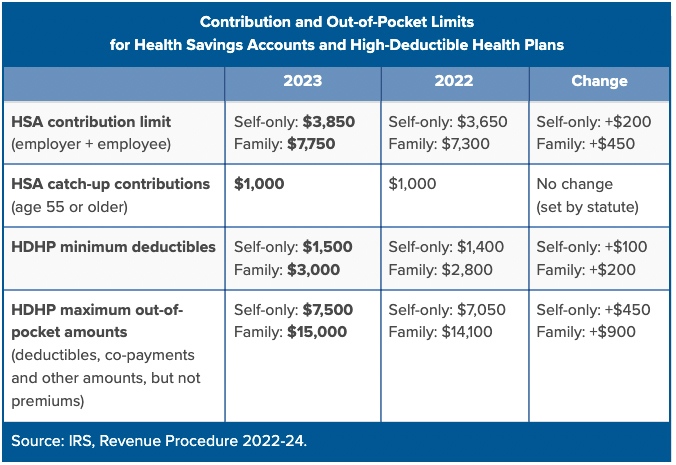

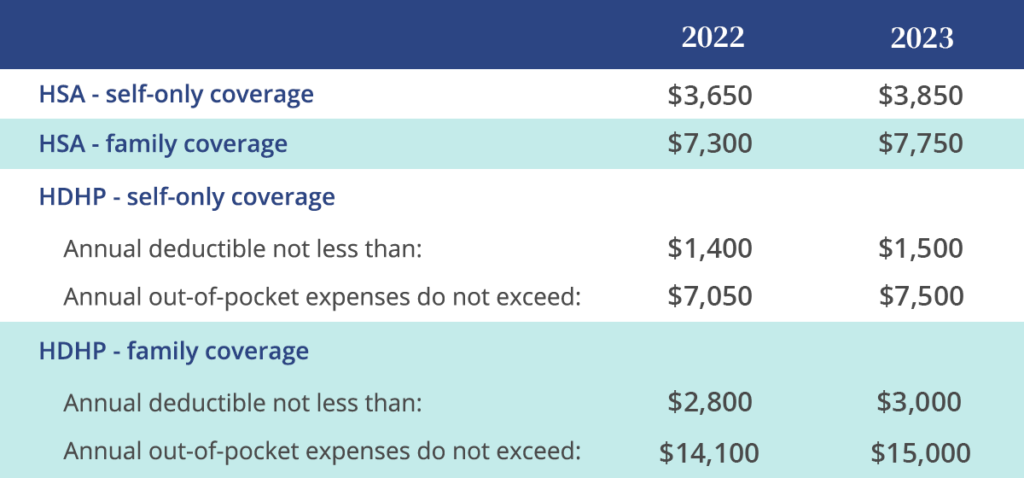

Web Nov 8 2022 nbsp 0183 32 The voluntary employee health FSA contribution limit for 2023 will be 3 050 a 200 increase over the 2022 limit This limit applies only to employees rather than Web by David Rook on Nov 01 2022 The IRS has finally announced adjustments to 2023 contribution limits on various tax advantaged health and dependent care spending accounts retirement plans and other

Fsa Limits For 2022 And 2023

Fsa Limits For 2022 And 2023

Fsa Limits For 2022 And 2023

https://associatedbenefits.com/wp-content/uploads/2022/05/kelvin-t-aeQmFodqvwk-unsplash.jpg

Web Oct 18 2022 nbsp 0183 32 Executive Summary The IRS has released Revenue Procedure 2022 38 confirming that for plan years beginning on or after January 1 2023 the health FSA

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by providing a ready-made format and design for producing various type of content. Templates can be used for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Fsa Limits For 2022 And 2023

2023 FSA Limits Commuter Limits And More Are Now Available WEX Inc

Health FSA Limits Will Increase In 2022 Blog Strategic Services Group

F S A Limits In 2022 You May Be Able To Carry Over More Money The

Health FSA Contribution Max Jumps 200 In 2023 MedBen

2023 New HSA Limits Claremont Insurance Services

2022 Limits For FSA Commuter Benefits And More Announced WEX Inc

https://www.shrm.org/topics-tools/news/benefits...

Web Oct 18 2022 nbsp 0183 32 Employees in 2023 can contribute up to 3 050 to their health care flexible spending accounts FSAs pretax through payroll deduction a 200 increase from

https://www.cbsnews.com/news/open-enrollment-irs...

Web Nov 7 2022 nbsp 0183 32 In 2023 employees can put away as much as 3 050 in an FSA an increase of about 7 from the current tax year s cap of 2 850 Meanwhile single workers who

https://www.wexinc.com/resources/blog/2023-fsa...

Web Oct 19 2022 nbsp 0183 32 The 2023 medical FSA contribution limit will be 3 050 per year which is a 200 increase from 2022 Employers can allow employees to carry over 610 from their

https://www.mercer.com/insights/law-and-pol…

Web IRS Rev Proc 2022 38 gives the 2023 contribution and benefit limits for health flexible spending arrangements FSAs qualified small employer health reimbursement arrangements QSEHRAs long term care LTC

https://hr.nih.gov/about/news/benefits-newsletter/...

Web You may enroll in an FSA for 2023 during the current Benefits Open Season which runs through December 12 2022 midnight EST If you want an FSA in 2023 you must enroll

Web Contact your employer for details about your company s FSA including how to sign up Get details from the IRS in this publication PDF 1 22 MB Facts about Flexible Spending Web Published on January 6 2022 Key takeaways A flexible spending account FSA is an employer sponsored benefit that helps you save money on many qualified healthcare

Web Dec 16 2022 nbsp 0183 32 For the 2022 plan year any remaining balance of up to 570 minimum 30 in your health care or limited purpose FSA will carry over into 2023 You will be able