Fsa Contribution Limits 2024 Jan 11 2024 nbsp 0183 32 Dependent Care FSA Limits for 2024 The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA The 2023 dependent care FSA contribution

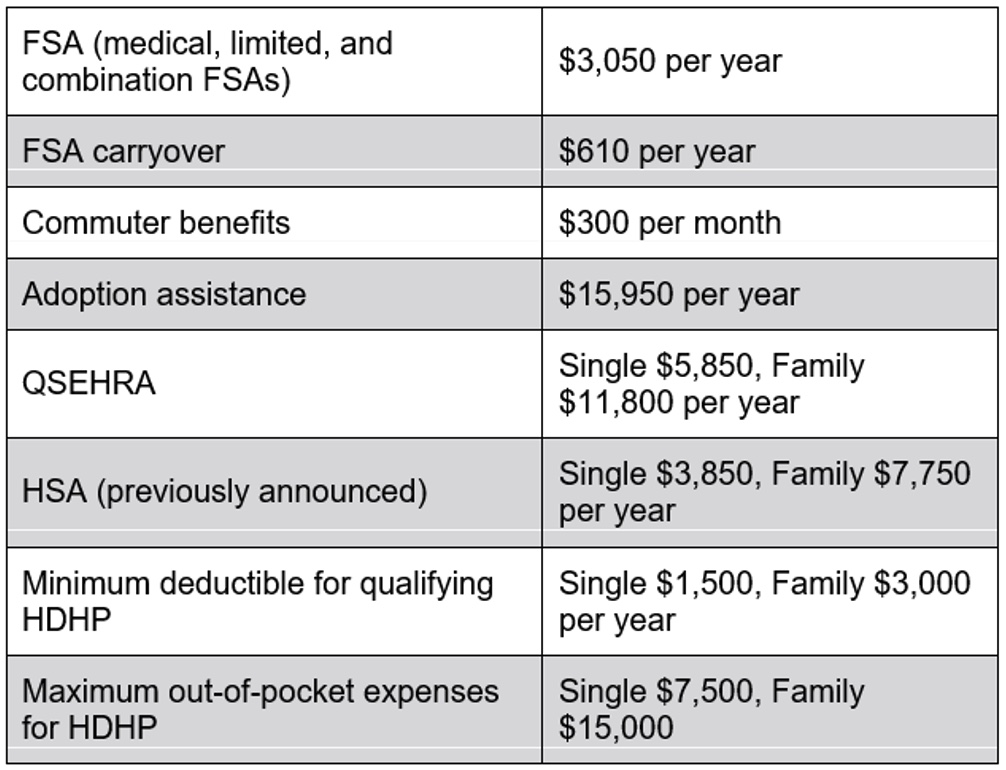

Dec 7 2023 nbsp 0183 32 What is the FSA contribution limit for 2024 The FSA contribution limit is going up In 2024 employees can contribute up to 3 200 to a health FSA If you don t use all your FSA funds by the end of the plan year you may be able to carry over 640 to 2025 Nov 9 2023 nbsp 0183 32 Previously announced 2024 health savings account HSA limits 2023 3 850 Self only 7 750 Family 2024 4 150 Self only 8 300 Family 2024 HDHP amounts limits HDHP self only coverage 2023 1 500 Minimum deductible 7 500 Maximum out of pocket limit 2024 1 600 Minimum deductible 8 050 Maximum out of pocket limit

Fsa Contribution Limits 2024

Fsa Contribution Limits 2024

Fsa Contribution Limits 2024

https://www.mercer.com/content/dam/mercer/assets/content-images/global/gl-2022-table-health-fsa.jpg

Dec 19 2023 nbsp 0183 32 The IRS recently reminded taxpayers IR 2023 234 that the FSA contribution limit for 2024 is 3 200 a 150 increase from the 2023 limit 3 050 Eligible employees of companies that offer a health FSA can take advantage of the 150 increase but self employed individuals remain ineligible

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by supplying a ready-made format and design for developing different type of content. Templates can be used for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Fsa Contribution Limits 2024

Significant HSA Contribution Limit Increase For 2024

IRS Announces HSA And High Deductible Health Plan Limits For 2023

IRS Announces 2023 HSA Limits Blog Medcom Benefits

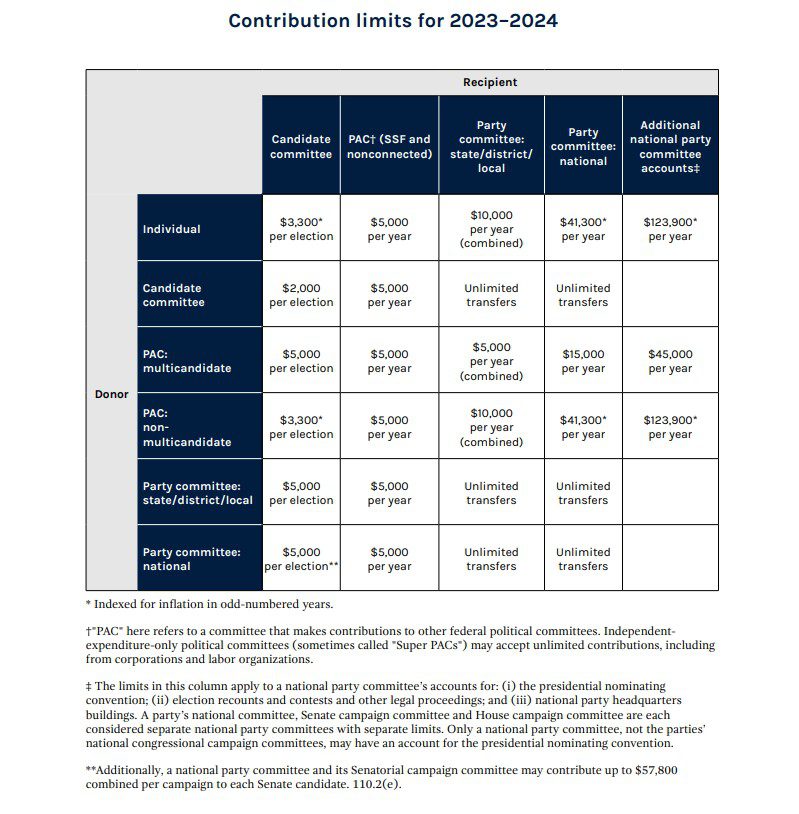

2023 Inflation Adjustments And FEC Contribution Limits Harmon Curran

The 2024 FSA Contribution Limits Are Here

2023 IRS Contribution Limits Corporate Benefits Network

https://hr.nih.gov/about/news/benefits-newsletter/...

For 2024 participants may contribute up to an annual maximum of 3 200 for a HCFSA or LEX HCFSA The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2024 It remains at 5 000 per household or 2 500 if married filing separately The minimum annual election for each FSA remains unchanged at 100

https://www.shrm.org/.../2024-Benefit-Limits-Chart.pdf

2024 Benefit Plan Limits amp Thresholds Chart Defined Contribution Plans Source IRS Notice 2023 75 Health Savings Accounts HSAs and High Deductible Health Plans HDHPs Source IRS

https://www.kiplinger.com/taxes/irs-new-msa-hsa-and-fsa-limits

Jan 9 2024 nbsp 0183 32 But if you do have an FSA in 2024 here are the maximum amounts you can contribute for 2024 tax returns normally filed in 2025 The 2024 maximum FSA contribution limit is 3 200

https://www.irs.gov/publications/p969

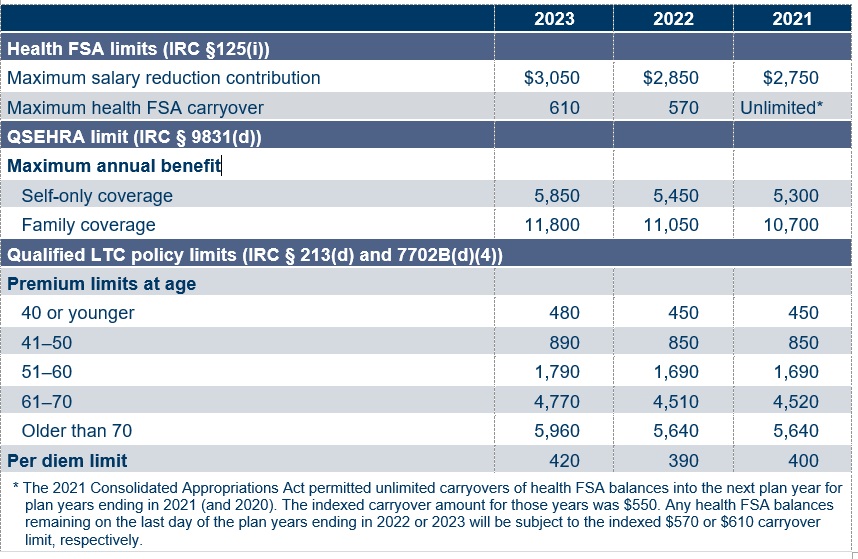

Health Flexible Spending Arrangement FSA contribution and carryover for 2023 Revenue Procedure 2022 38 October 18 2022 provides that for tax years beginning in 2023 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 3 050

https://assurance.com/health-insurance/fsa...

Feb 16 2024 nbsp 0183 32 Employees participating in an FSA can contribute up to 3 200 during the 2024 plan year reflecting a 150 increase over the 2023 limits For plans that allow a carryover of unused funds the maximum amount of 2024 contributions that can roll over into 2025 is 640 a 30 increase over the 2023 rollover amount

Nov 10 2023 nbsp 0183 32 IRS Rev Proc 2023 34 gives the 2024 contribution and benefit limits for health flexible spending arrangements FSAs qualified small employer health reimbursement a rrangements QSEHRAs long term care LTC policies transportation fringe benefits and adoption assistance programs The 2024 FSA contributions limit has been raised to 3 200 for employee contributions compared to 3 050 in 2023 FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 6 400

Nov 10 2023 nbsp 0183 32 The IRS announced that the health Flexible Spending Account FSA dollar limit will increase to 3 200 for 2024 up from 3 050 in 2023 Employers may impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACA s maximum