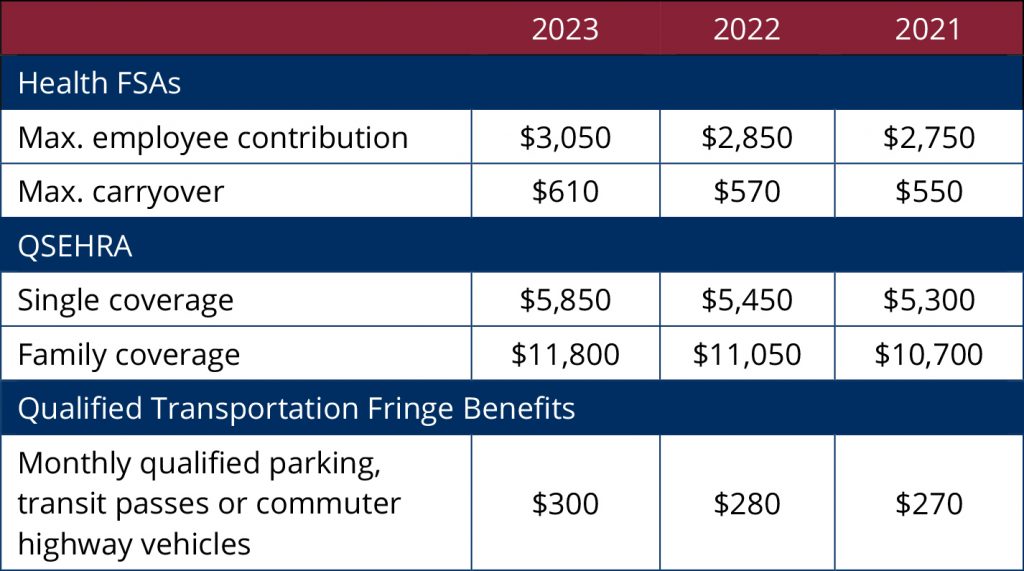

Fsa Contribution Limits 2022 Irs Web Nov 11 2021 nbsp 0183 32 The limit on annual employee contributions toward health FSAs for 2022 is 2 850 up from 2 750 in 2021 with the ability to carry over up to 570 up from 550 in 2021 The limit on monthly contributions toward qualified transportation and parking benefits for 2022 is increased to 280 up from 270 in 2021

Web Employees can elect up to the IRS limit and still receive the employer contribution in addition If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect Web Nov 11 2021 nbsp 0183 32 A prior client alert indicated that health Flexible Spending Account FSA contribution limits would also remain unchanged but on November 10 the IRS released updated FSA limits for 2022 increasing by 100 to 2 850 In light of the late release date many employers retained the 2021 limit of 2 750 to facilitate 2022 open enrollment

Fsa Contribution Limits 2022 Irs

Fsa Contribution Limits 2022 Irs

Fsa Contribution Limits 2022 Irs

https://myameriflex.com/wp-content/uploads/2022/05/HSA-Contribution-Limits.png

Web Nov 15 2021 nbsp 0183 32 Commuter Benefits FSA On November 10 2021 the IRS released Revenue Procedure 2021 45 which contains the 2022 limits for health flexible spending accounts FSAs and commuter and parking benefits among other limits The 2022 limits as compared to the 2021 limits are outlined below

Pre-crafted templates offer a time-saving option for producing a varied range of documents and files. These pre-designed formats and designs can be used for numerous individual and professional jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the material development procedure.

Fsa Contribution Limits 2022 Irs

IRS Announces 2023 HSA Limits Blog Medcom Benefits

Health FSA Contribution Max Jumps 200 In 2023 MedBen

2023 FSA Limits Commuter Limits And More Are Now Available WEX Inc

IRS Increases Health FSA Contribution Limit For 2020 Adjusts Other

The IRS Has Increased Contribution Limits For 2022 Human Investing

HSA DCAP Changes For 2022 Blog Medcom Benefits

https://www.shrm.org/.../2022-health-fsa-contribution-cap-rises-to-2850

Web Nov 11 2021 nbsp 0183 32 Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov 10 as the annual contribution limit rises to

https://www.irs.gov/pub/irs-pdf/p969.pdf

Web Health Flexible Spending Arrangement FSA contri bution and carryover for 2023 Revenue Procedure 2022 38 October 18 2022 provides that for tax years be ginning in 2023 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 3 050 If the

https://www.irs.gov/newsroom/irs-2024-flexible...

Web Dec 8 2023 nbsp 0183 32 For 2024 there is a 150 increase to the contribution limit for these accounts An employee who chooses to participate in an FSA can contribute up to 3 200 through payroll deductions during the 2024 plan year Amounts contributed are not subject to federal income tax Social Security tax or Medicare tax

https://www.goodrx.com/insurance/fsa-hsa/2022-fsa-contribution-limits

Web Jan 6 2022 nbsp 0183 32 Are FSA contribution limits changing for 2022 In November the IRS updated the annual contribution limits for FSAs The limits increased 100 from last year For 2022 you can contribute up to 2 850 in your health FSA Your spouse can make a maximum contribution too

.png?w=186)

https://www.griffinbenefits.com/blog/2022-irs-hsa...

Web Nov 11 2021 nbsp 0183 32 Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022 And if an employer s plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up 20 from 550 in 2021 to 570 in 2022

Web Nov 12 2021 nbsp 0183 32 Regulatory Updates Announcing 2022 FSA commuter and adoption contribution limits November 12 2021 The Internal Revenue Service IRS announced the official 2022 Flexible Spending Account FSA commuter and adoption limits It s good news for accountholders wanting to save money on their eligible expenses Web Nov 22 2021 nbsp 0183 32 The Internal Revenue Service recently released Revenue Procedure 2021 45 announcing the cost of living adjustments for calendar year 2022 The dollar limitation on voluntary employee salary reductions for contributions to health Flexible Spending Accounts FSA increased to 2 850 up from 2 750

Web Nov 12 2021 nbsp 0183 32 The IRS announced that the annual contribution limit for health care flexible spending accounts health FSAs will increase to 2 850 for 2022 from 2 750 and the maximum carryover amount will rise to 570 from 550 Health FSAs The chart below shows the adjustment in health FSA contribution limits for 2022