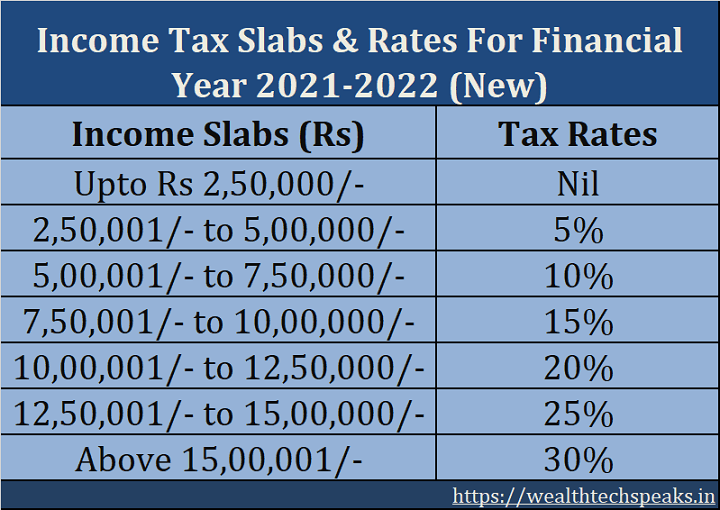

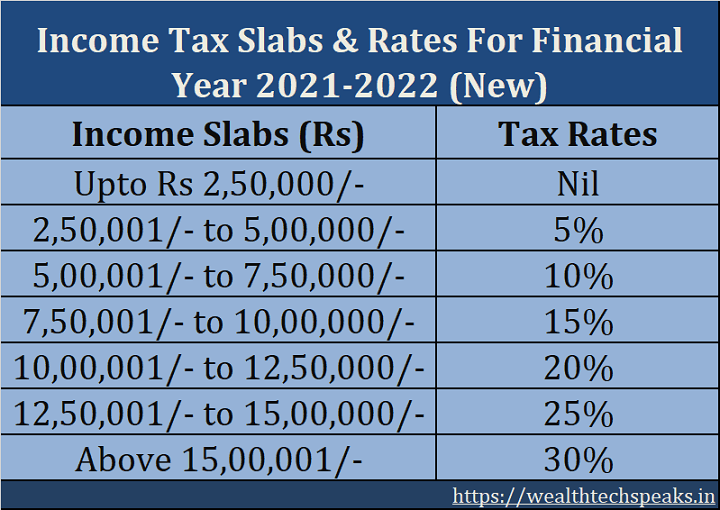

Financial Year 2021 22 Tax Slab WEB Feb 16 2021 nbsp 0183 32 Income Tax Slabs amp Rates remain unchanged for Financial Year 2021 22 AY 2022 23 Budget 2021 presented recently did not propose any change to the existing income tax slabs No changes in the income tax slabs or tax deductions amp exemptions has been introduced

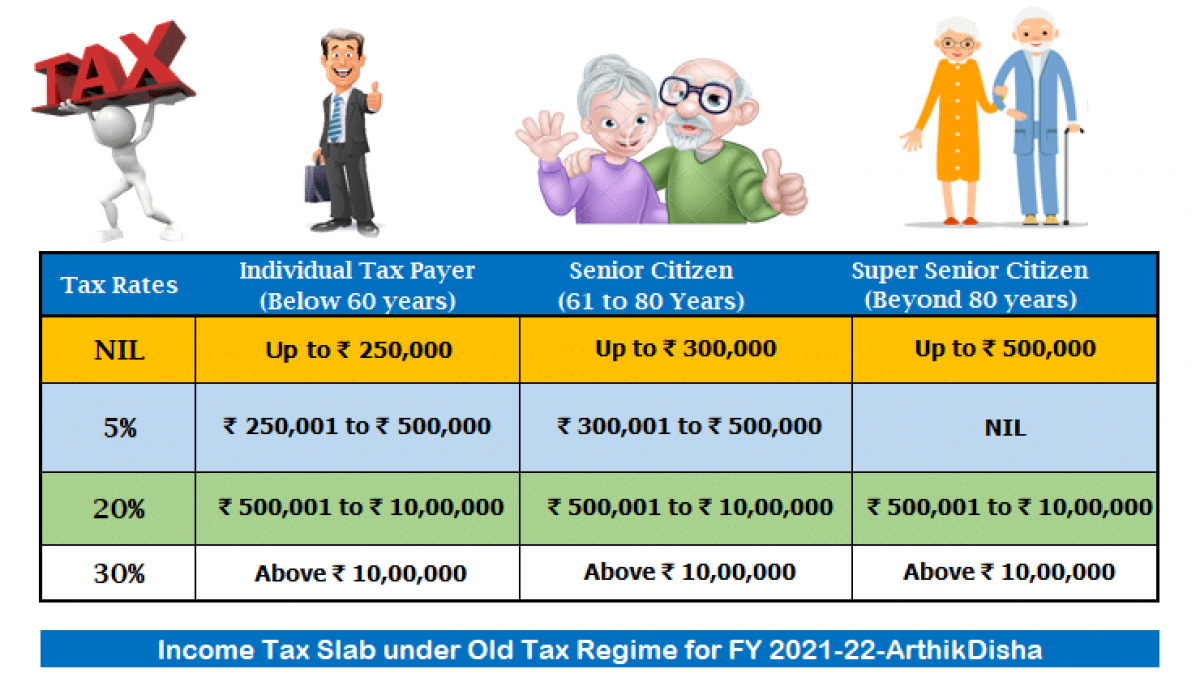

WEB Jul 15 2022 nbsp 0183 32 There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022 23 in Union Budget 2022 The income tax slabs and income tax rates have been kept unchanged since financial year FY 2020 21 Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes and FY 2022 WEB Individuals and HUFs can choose between the new or old tax regime and pay applicable income tax as per slabs and rates for FY 2021 22 AY 2022 23 This option to Individuals and HUF for payment of taxes at the reduced rates from Assessment Year 2021 22 and onwards are under the conditions that they don t claim the normal concessions available I

Financial Year 2021 22 Tax Slab

Financial Year 2021 22 Tax Slab

Financial Year 2021 22 Tax Slab

https://wealthtechspeaks.in/wp-content/uploads/2020/07/New-Income-Tax-Slab-Rates-FY-2021-22.png

WEB 24 Votes The following India income tax slabs tax tables are valid for the 2021 22 tax year which is also knows as Financial Year 21 22 and Assessment Year 2021 22 The 2021 tax tables are provided in support of the 2024 India Tax Calculator

Pre-crafted templates offer a time-saving service for developing a varied variety of files and files. These pre-designed formats and layouts can be utilized for numerous individual and expert projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material creation process.

Financial Year 2021 22 Tax Slab

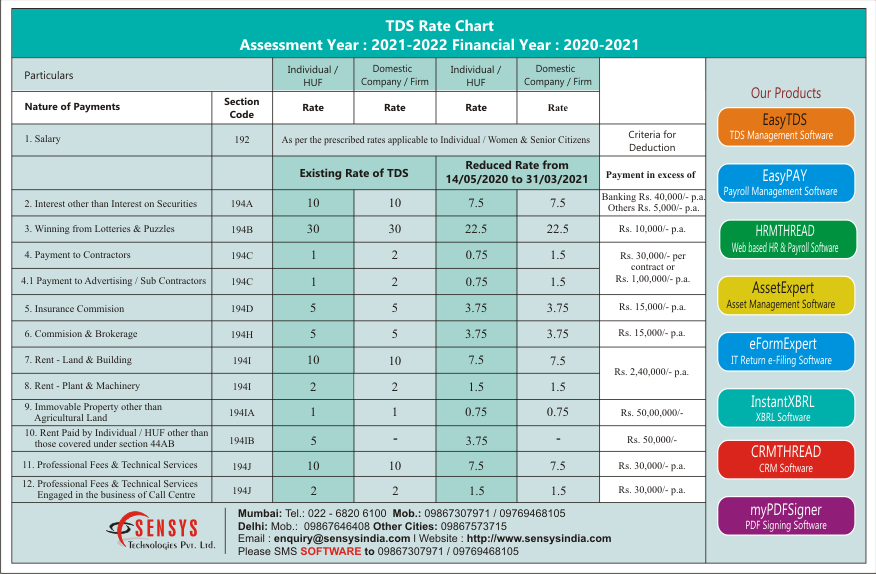

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay Mobile

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

Income Tax Calculation Fy 2020 21 Income Tax Calculator Ay 2020 21

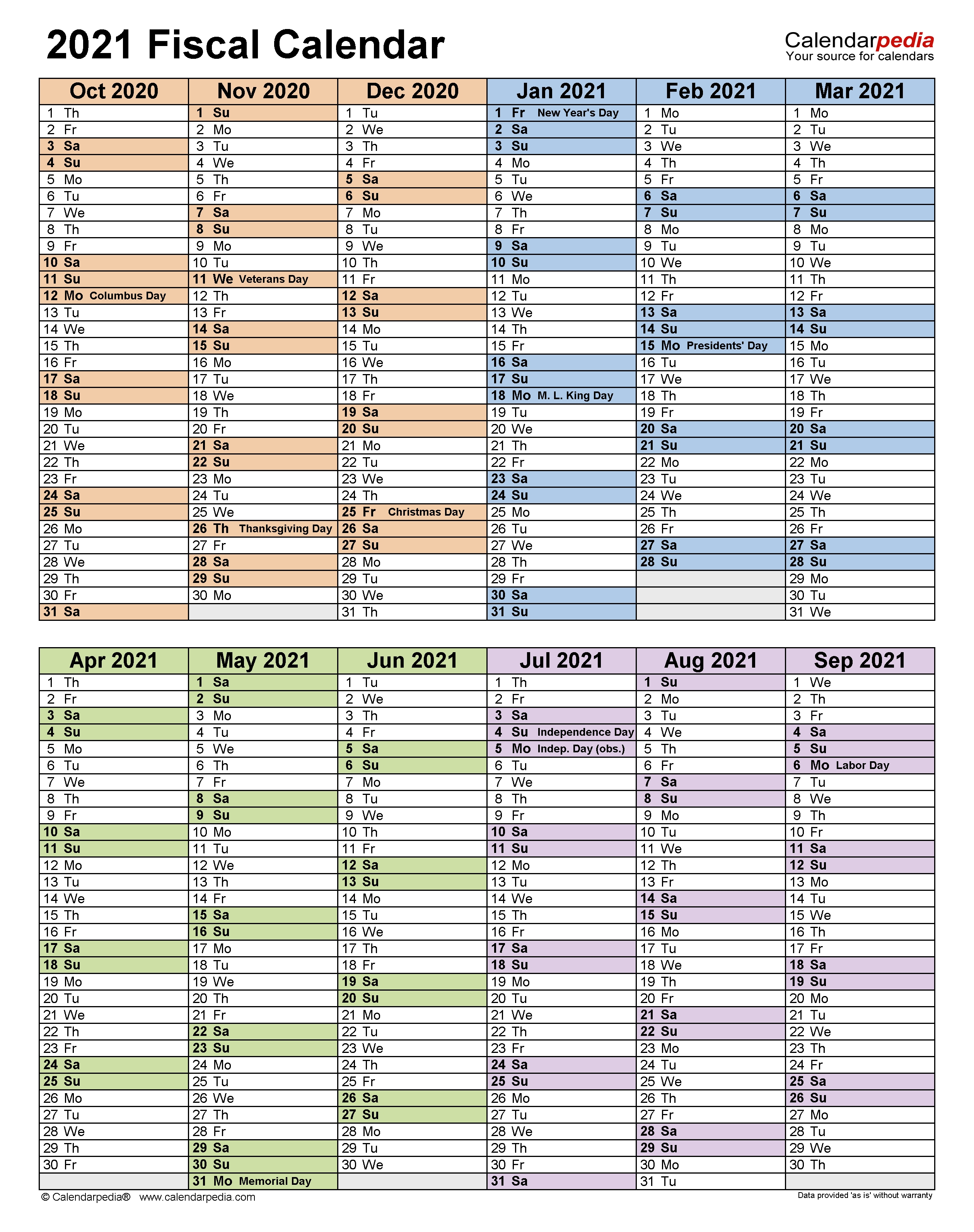

Rut Prediction 2021 Calendar Printables Free Blank

Tds Rate Chart Fy 2020 2021 Ay 2021 2022 Sensys Blog Gambaran

https://economictimes.indiatimes.com/wealth/tax/...

WEB Jul 22 2022 nbsp 0183 32 Tax slabs The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes

https://cleartax.in/s/income-tax-slabs

WEB Apr 1 2024 nbsp 0183 32 Income tax slab rates for FY 2019 20 FY 2020 21 FY 2021 22 and FY 2022 23 Income tax slab for Individual aged below 60 years amp HUF

https://www.relakhs.com/income-tax-slab-rates-for-fy-2021-22

WEB Feb 1 2021 nbsp 0183 32 Latest Income Tax Slab Rates for FY 2021 22 AY 2022 23 Effective from FY 2020 21 the individual tax assessee have an option to go for new Tax Slab Rates by forgoing the existing Income Tax Deductions and Exemptions like HRA Section 80C Home loan tax benefits etc

https://tools.quicko.com/income-tax-calculator

WEB The Income tax calculator is an online tool that helps you calculate your Income Tax liability for the current Financial year FY 2021 22 i e AY 2022 23 and the previous Financial Year FY 2020 21 i e AY 2021 22 Also compare your Income Tax Liability and the effective tax rate under both the Old and New Income Tax Regime

https://economictimes.indiatimes.com/wealth/tax/...

WEB Income tax slabs for FY 2020 21 AY 2021 22 FY 2021 22 AY 2022 23 FY 2022 23 AY 2023 24 under new tax regime Income tax slabs for FY 2024 25 AY 2025 26 FY 2023 24 AY 2024 25 under the new tax regime The income tax slabs in new tax regime will remain unchanged for FY 2024 25 AY 2025 26

WEB Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly WEB Jun 9 2022 nbsp 0183 32 Explore the latest Income Tax rates for Individuals HUFs Firms Domestic and Foreign Companies and Co operative Societies for FY 2021 22 and 2022 23 This comprehensive guide covers normal and special tax rates surcharges Health and Education Cess and important notes for taxpayers

WEB The Finance Act 2020 has provided an option to Individuals and HUF for payment of taxes at the following reduced rates from Assessment Year 2021 22 and onwards Note 1 A resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess