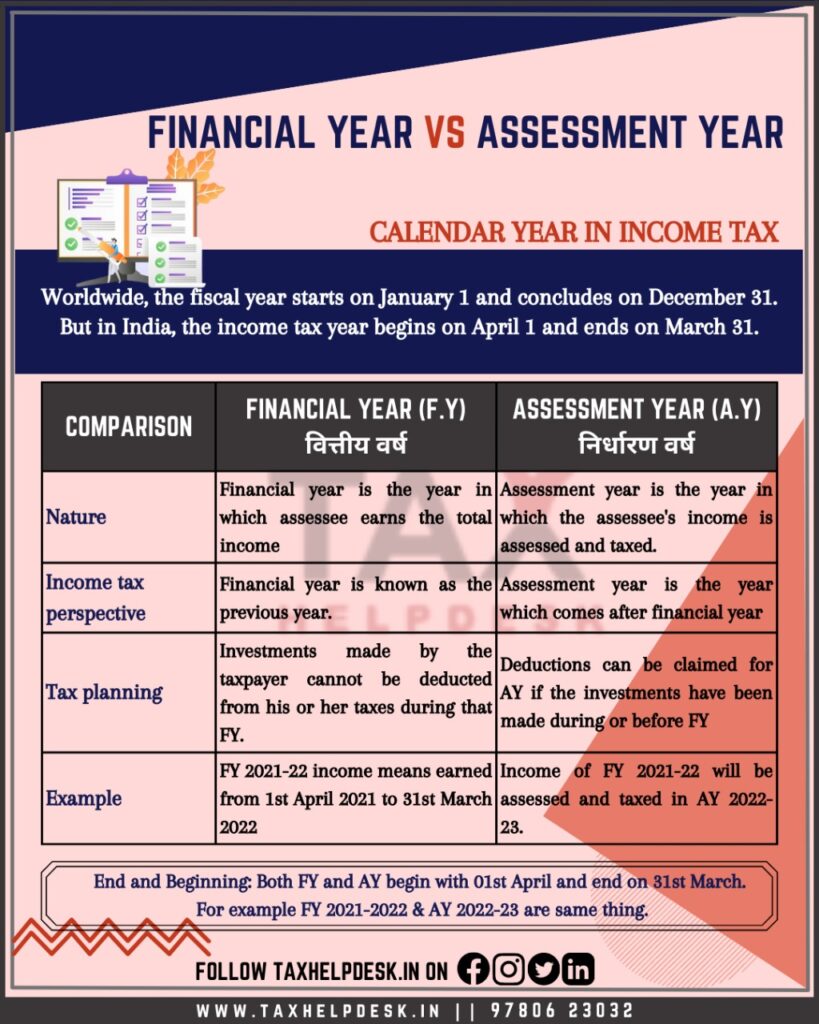

Financial Year 2021 22 Means Assessment Year WEB Apr 7 2022 nbsp 0183 32 Your income from April 1 2021 to March 31 2022 denotes your earnings in the financial year 2021 22 What is Assessment Year An assessment year refers to a year from April 1 to March 31 during which your income in a

WEB What is Assessment Year Assessment year is defined as the time during which the income earned during a specific financial year is assessed for tax purposes Abbreviated as AY the assessment year starts after end of the applicable financial year WEB Both Assessment Year and Financial Year begin on April 1 and finish on March 31 of a calendar year For example the Assessment Year for Financial Year 2021 22 is AY 2022 23 Recent Assessment Years and Financial Years

Financial Year 2021 22 Means Assessment Year

-preview.jpg) Financial Year 2021 22 Means Assessment Year

Financial Year 2021 22 Means Assessment Year

http://gojysk.com/sites/gojysk.com/files/images/news/2022-09/Jan Bøgh 2021 (3)-preview.jpg

WEB Mar 19 2024 nbsp 0183 32 Difference between Financial and Assessment Year The financial year usually comes before the equivalent assessment year in terms of income tax regulations For instance the fiscal year 2021 2022 and the

Pre-crafted templates provide a time-saving option for producing a diverse range of files and files. These pre-designed formats and layouts can be utilized for various personal and professional projects, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the material creation procedure.

Financial Year 2021 22 Means Assessment Year

We Thank You For Your Consistent Support And Cooperation In The

What Is Financial Year And Assessment Year

Printable Fiscal Year 2022 Calendar Printable World Holiday

Financial Year 2021 22 Begins You Need To Keep Tab On These Issues

Rajasthan Board 12th Model Paper 2022 Chemistry Download PDF RBSE

Tamilnadu GPF Interest Rate From Oct To Dec 2021

-preview.jpg?w=186)

https://tax2win.in/guide/what-is-financial-year-assessment-year

WEB 6 days ago nbsp 0183 32 The Assessment Year AY is the year in which your income is assessed and taxed while the Financial Year FY is the year in which you earn the income So for example if you earn income during the FY 2023 2024 it

https://groww.in/p/tax/financial-year-and-assessment-year

WEB Apr 1 2022 nbsp 0183 32 The assessment year is the period from April 1 to March 31 during which you are taxed on the money you receive in a given financial year In the relevant assessment year you must file your income tax return The year immediately after the Financial Year is known as the Assessment Year

https://www.thetaxheaven.com/blog/assessment-year-vs-financial-year

WEB Income earned in the financial year 2021 22 from 1st April 2021 to 31st March 2022 will become taxable in the assessment year 2022 23 As you can see the assessment year always follows the financial year

https://www.bhartiaxa.com/be-smart/tax-savings/...

WEB Jul 10 2024 nbsp 0183 32 Abbreviations for the financial year and Assessment Year Financial Year is often shortly termed as FY while assessment year is shortly termed as AY If you go through any company s annual year you will find instances like income or gains for FY 2022 2023 or revenue for FY 2021 22

https://www.taxnwealth.com/blog/difference-between...

WEB May 5 2024 nbsp 0183 32 Financial year is a 12 month period in which the income is earned while Assessment Year is the year in which taxpayers assess and file their income tax returns for the income earned in the preceding financial year

WEB Jul 7 2024 nbsp 0183 32 For instance if the year from 1st April 2021 to 31st March 2022 is the financial year the assessment year for this financial year would be from 1st April 2022 to 31st March 2023 In other words if the financial year is WEB Oct 18 2022 nbsp 0183 32 Simply put an assessment year 1st April to 31st March can be defined as a stipulated timeframe wherein the income you earn in one financial year is taxed Thus you have to file your income tax return in the relevant assessment year which is the year succeeding a financial year

WEB Mar 31 2021 nbsp 0183 32 The calendar year starts on January 1 and ends on December 31 but a Financial year is from April 1 to March 31 As per the Income Tax Act income earned by the individual company in a financial year FY is assessed checked verified in the next Financial Year