Financial Plan Sample Pdf Jun 11 2025 nbsp 0183 32 As long as this reimbursement is within the HMRC approved rate 163 6 per week and is specifically for work related costs John won t be taxed on this amount Are there

Mar 21 2007 nbsp 0183 32 Profit allocation In the case of a partnership the partnership as a body has no liability to tax on its profits In the situation you describe each partner would be taxed on his Jul 7 2023 nbsp 0183 32 Beer and spirits are taxed alcohol duty based on alcoholic strength which is measured by alcohol by volume ABV while the other types of alcohol are taxed on a specific

Financial Plan Sample Pdf

Financial Plan Sample Pdf

Financial Plan Sample Pdf

https://images.sampletemplates.com/wp-content/uploads/2016/03/08070843/Financial-Plan-Template-in-Excel.jpg

Jan 10 2025 nbsp 0183 32 Tax calculations of UK State Pension Arrears Does self assessment mean we have to do all the work I have a relatively new client and 23 24 is the first return I am doing for

Pre-crafted templates provide a time-saving option for producing a varied variety of files and files. These pre-designed formats and designs can be used for numerous personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the content production procedure.

Financial Plan Sample Pdf

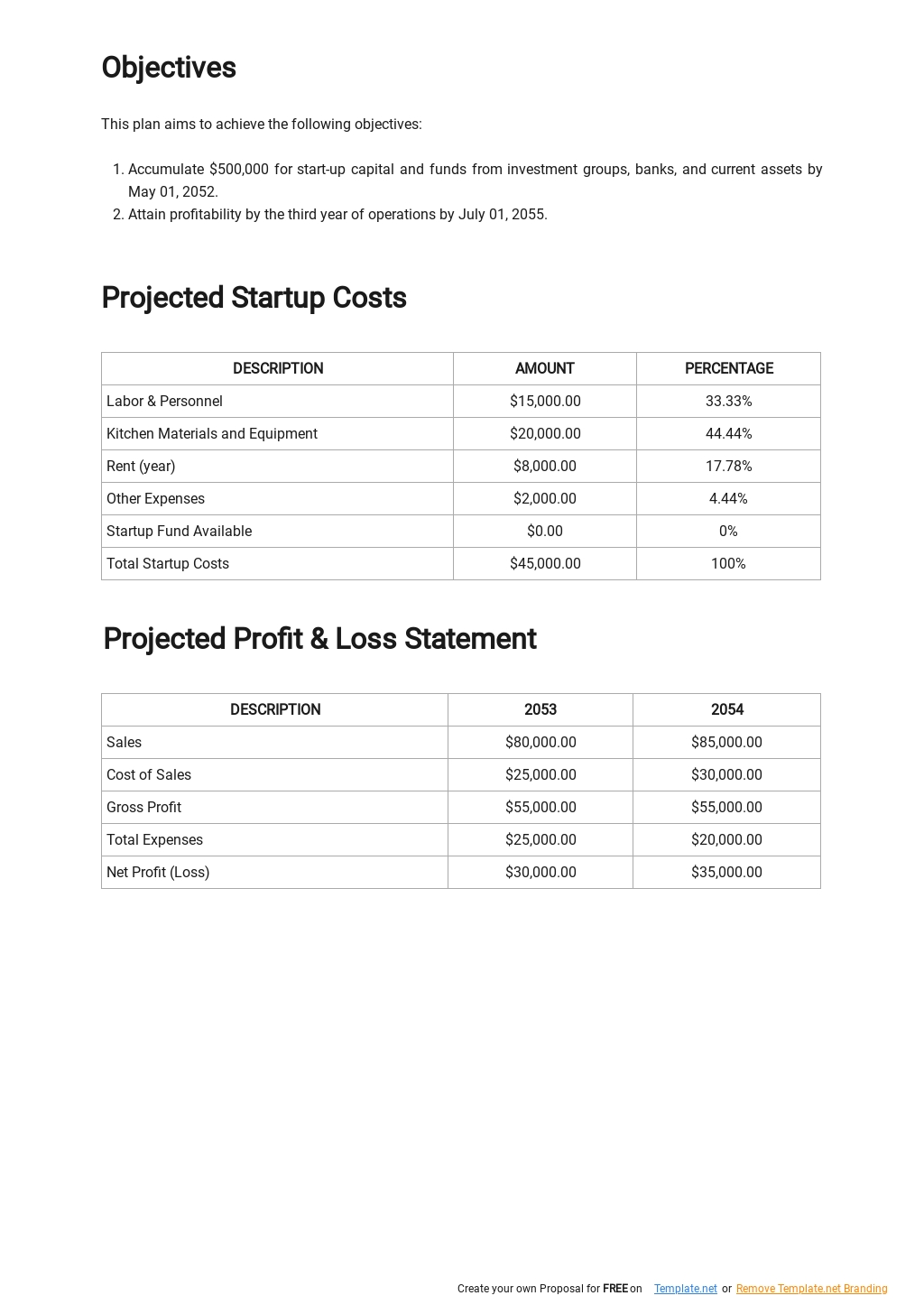

Business Plan Financial Projections Template Excel For Your Needs

Financial Aspect In Business Plan Buy Paper Online

FREE 13 Financial Plan Samples In PDF MS Word Excel Google Docs

Financial Plan 11 Examples Format Pdf Examples

Financial Plan Template 15 Word Excel PDF Documents Download

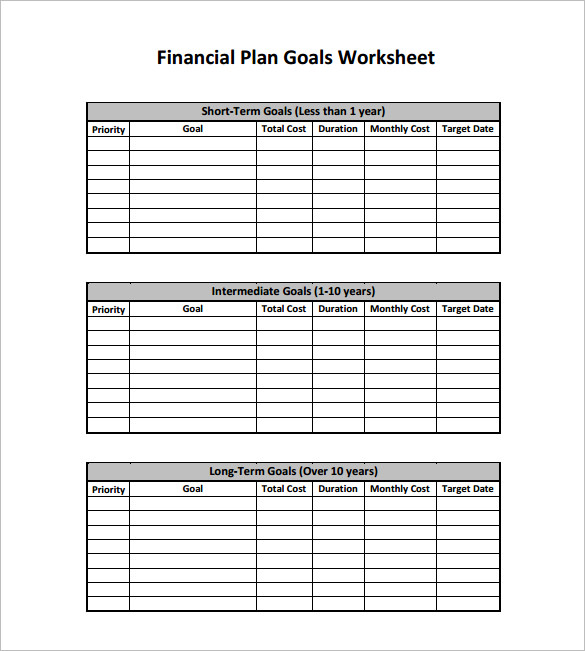

Free Personal Financial Plan Template Financial Plan Template

https://www.accountingweb.co.uk › tax › hmrc-policy

Jun 3 2025 nbsp 0183 32 Will free payroll software be available to report benefits taxed through the payroll At present the free HMRC software Basic PAYE tools is used by thousands of small

https://www.accountingweb.co.uk › any-answers › tax-residency-spain-a…

Jan 18 2025 nbsp 0183 32 Under Beckham s law you are taxed in Spain on your worldwide employment income and any source of income or capital generated in Spain Beckham s law does not

https://www.accountingweb.co.uk › any-answers › uk-resident-irish-pens…

Nov 23 2023 nbsp 0183 32 A UK resident receives a semi state Irish pension that has been subject to Irish Tax Is the pension taxable in the UK with a credit for the Irish Tax paid or is it non taxable in

https://www.accountingweb.co.uk › tax › business-tax › what-does-the-fu…

Jun 16 2025 nbsp 0183 32 Operational remuneration arrangements However 2017 welcomed the introduction of optional remuneration arrangement OpRA legislation which amended the

https://www.accountingweb.co.uk › any-answers › taxation-of-redeemabl…

Sep 5 2015 nbsp 0183 32 The disguised interest rules within Ch 2A s 486A et seq CTA 09 or Ch 6A s 521A et seq which deal with shares accounted for as liabilities are basically rules aimed at

[desc-11] [desc-12]

[desc-13]