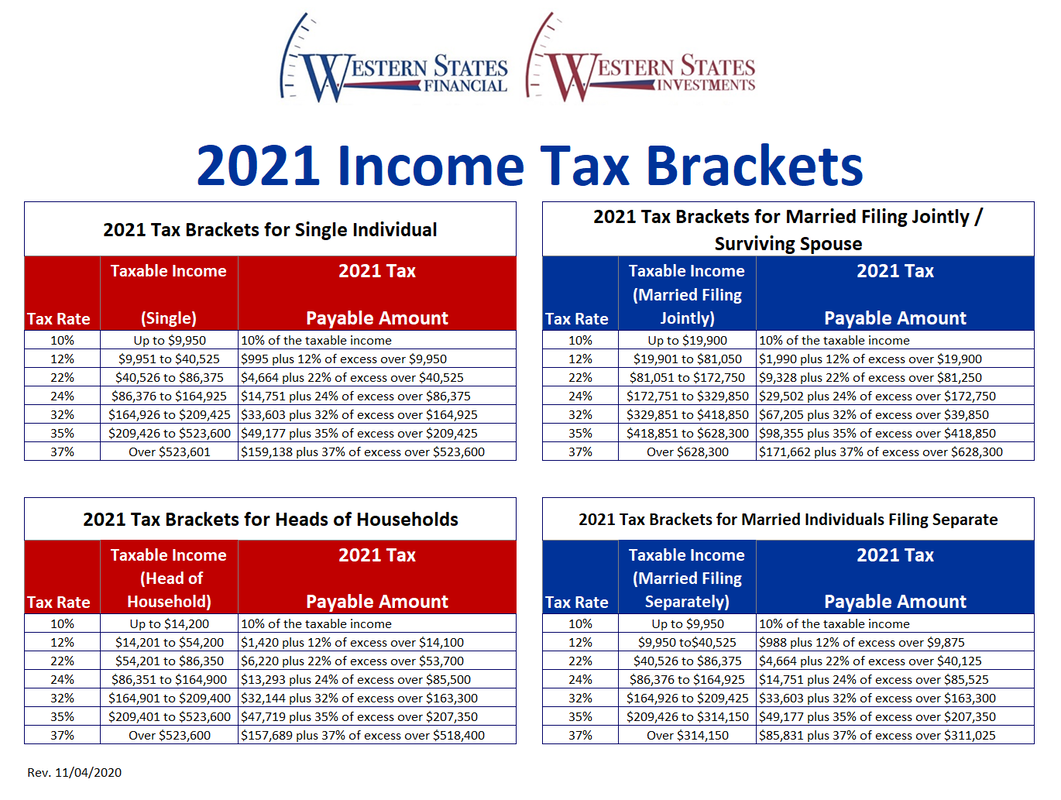

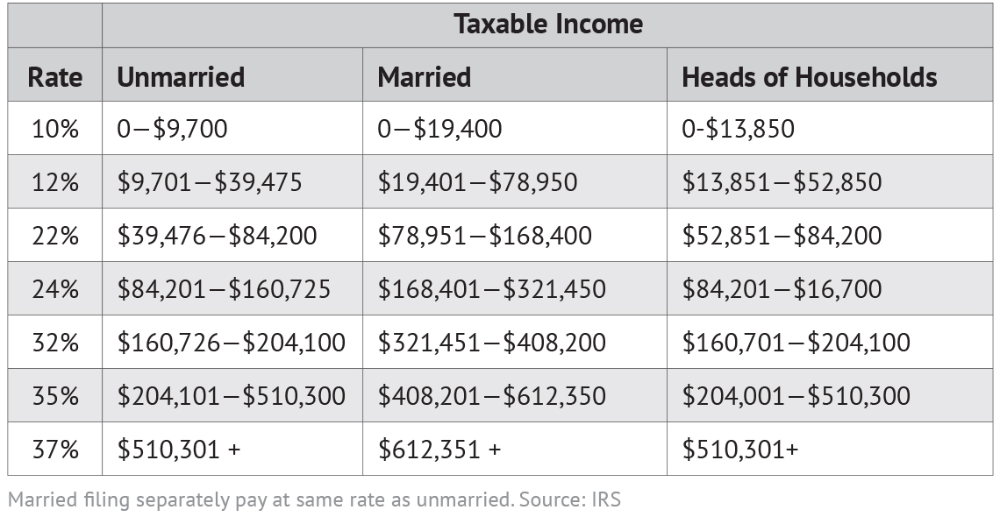

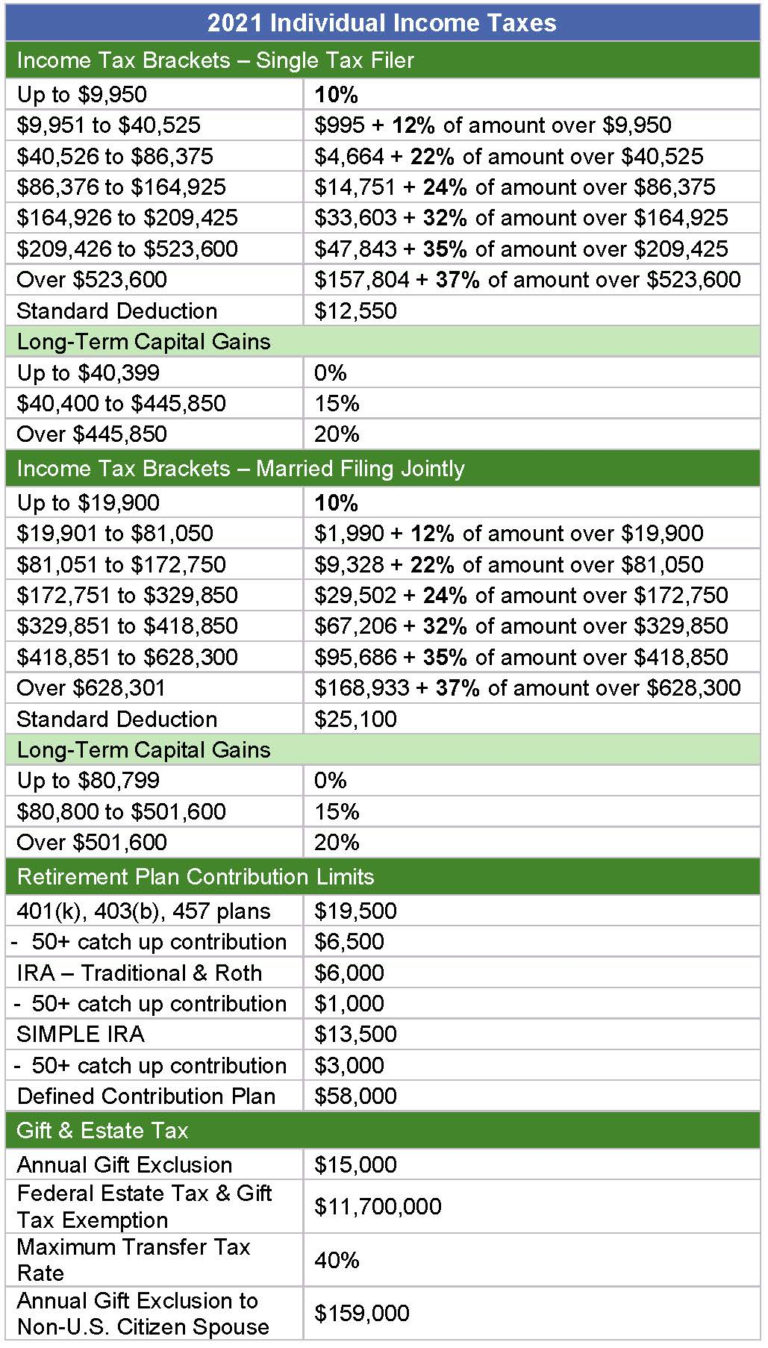

Federal Tax Tables For 2021 WEB This page shows Tax Brackets s archived Federal tax brackets for tax year 2021 This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022

WEB 2021 US Tax Tables with 2024 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator Compare your take home after tax an WEB Oct 26 2020 nbsp 0183 32 Here are the new brackets for 2021 depending on your income and filing status For married individuals filing jointly 10 Taxable income up to 19 900 12 Taxable income between 19 900 to

Federal Tax Tables For 2021

Federal Tax Tables For 2021

Federal Tax Tables For 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/06/2021-federal-tax-brackets-tax-rates-retirement-plans-1.png

WEB Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save effort and time by offering a ready-made format and design for developing different type of material. Templates can be utilized for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Federal Tax Tables For 2021

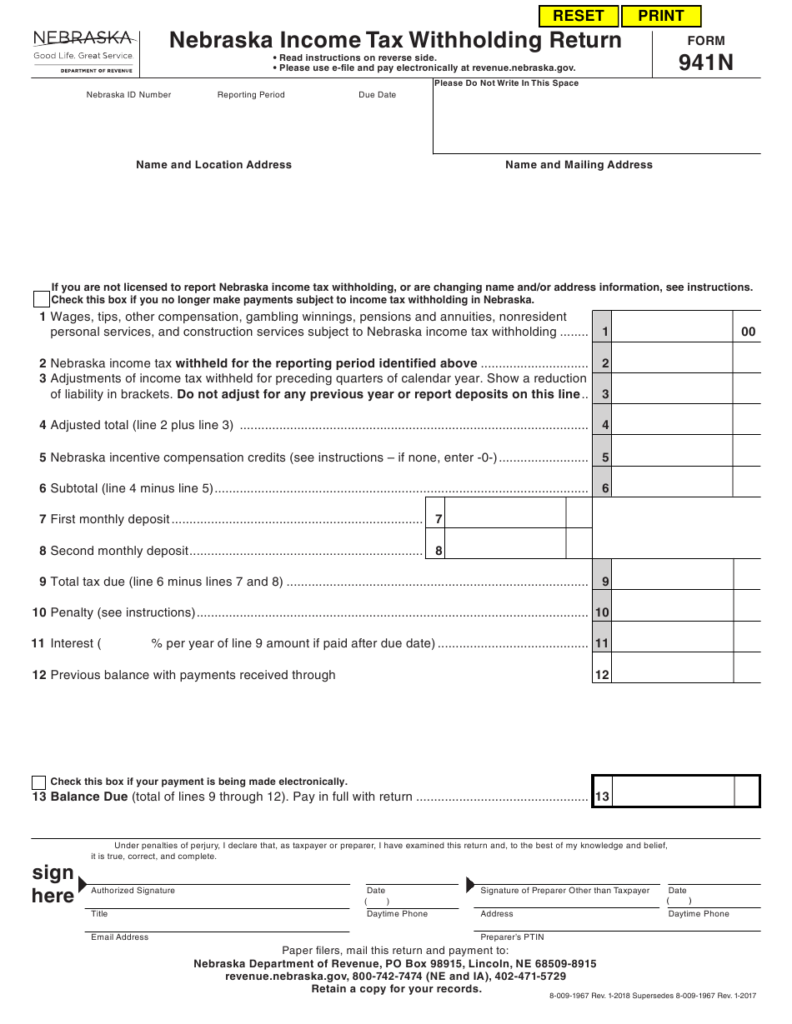

Nebraska Withholding Tax Form Federal Withholding Tables 2021

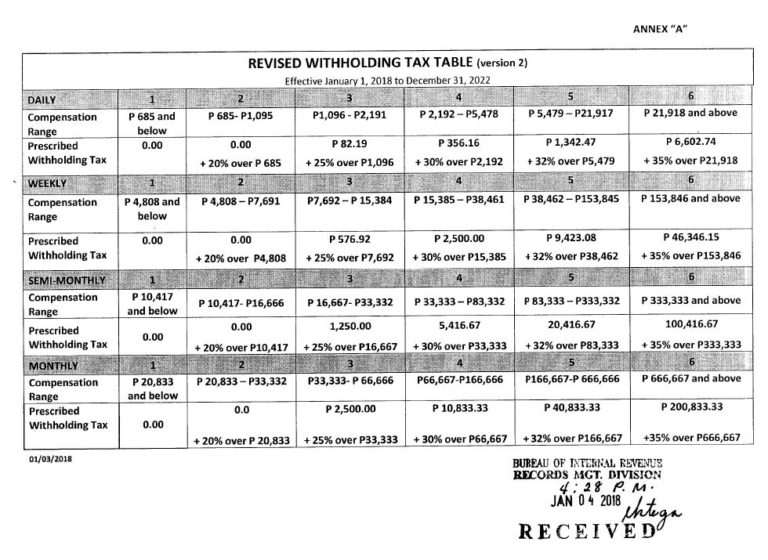

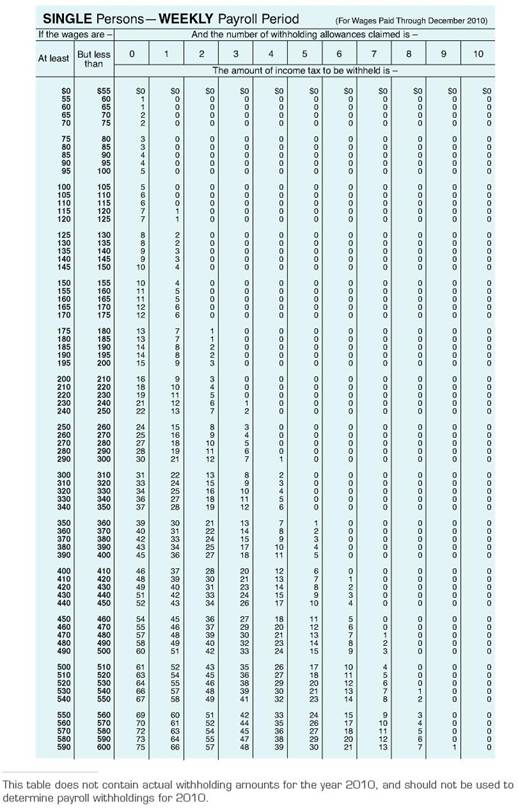

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

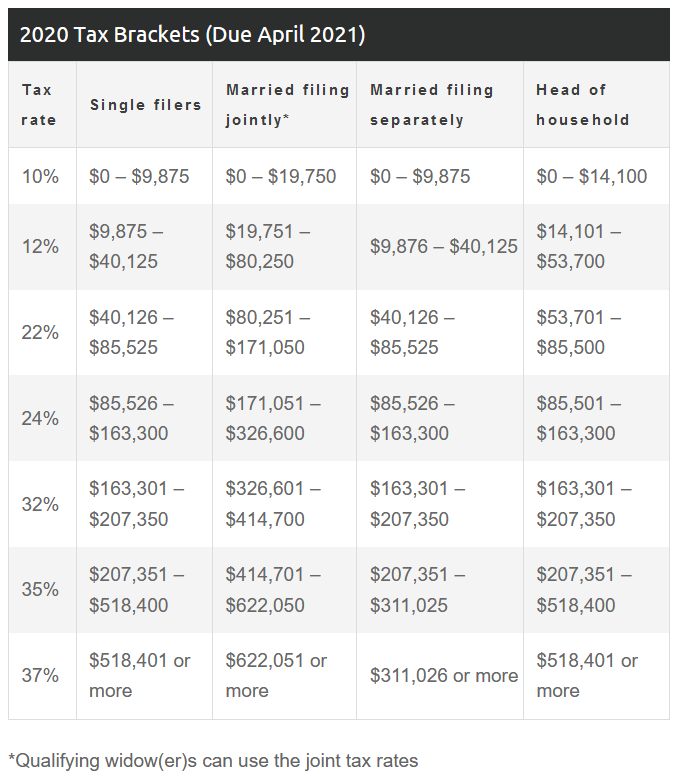

Missouri Income Tax Withholding Tables 2020 Federal Withholding

2021 Tax Tables For Australia

Weekly Federal Withholding Calculator Federal Withholding Tables 2021

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

https://www.irs.gov/pub/irs-prior/i1040gi--2021.pdf

WEB 2021 Tax Table General Information Refund Information Instructions for Schedule 1 Instructions for Schedule 2 Instructions for Schedule 3 Tax Topics Disclosure Privacy Act and Paperwork Reduction Act Notice Major Categories of Federal Income and Outlays for Fiscal Year 2020 Index

https://taxfoundation.org/data/all/federal/2021-tax-brackets

WEB Feb 22 2024 nbsp 0183 32 2021 Federal Income Tax Brackets and Rates In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples

https://www.irs.com/en/2021-federal-income-tax...

WEB 2021 Individual Income Tax Brackets The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status The tax rates for 2021 are 10 12 22 24 32 35 and 37

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Jun 21 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher

https://www.morganstanley.com/content/dam/msdotcom/...

WEB Jan 15 2021 nbsp 0183 32 Tax Tables 2021 Edition 2021 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2021 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax

WEB Oct 26 2020 nbsp 0183 32 The Internal Revenue Service IRS has announced the annual inflation adjustments for the tax year 2021 including tax rate schedules tax tables and cost of living adjustments These are the WEB Feb 16 2021 nbsp 0183 32 Federal Individual Income Tax Brackets Standard Deduction and Personal Exemption 1988 to 2021 This report tracks changes in federal individual income tax brackets the standard deduction and the personal exemption since 1988 All three have been indexed for inflation since 1981

WEB Jan 8 2021 nbsp 0183 32 The federal tables below include the values applicable when determining federal taxes for 2021 They are published in Revenue Procedure 2020 45 Federal Income Tax Schedules