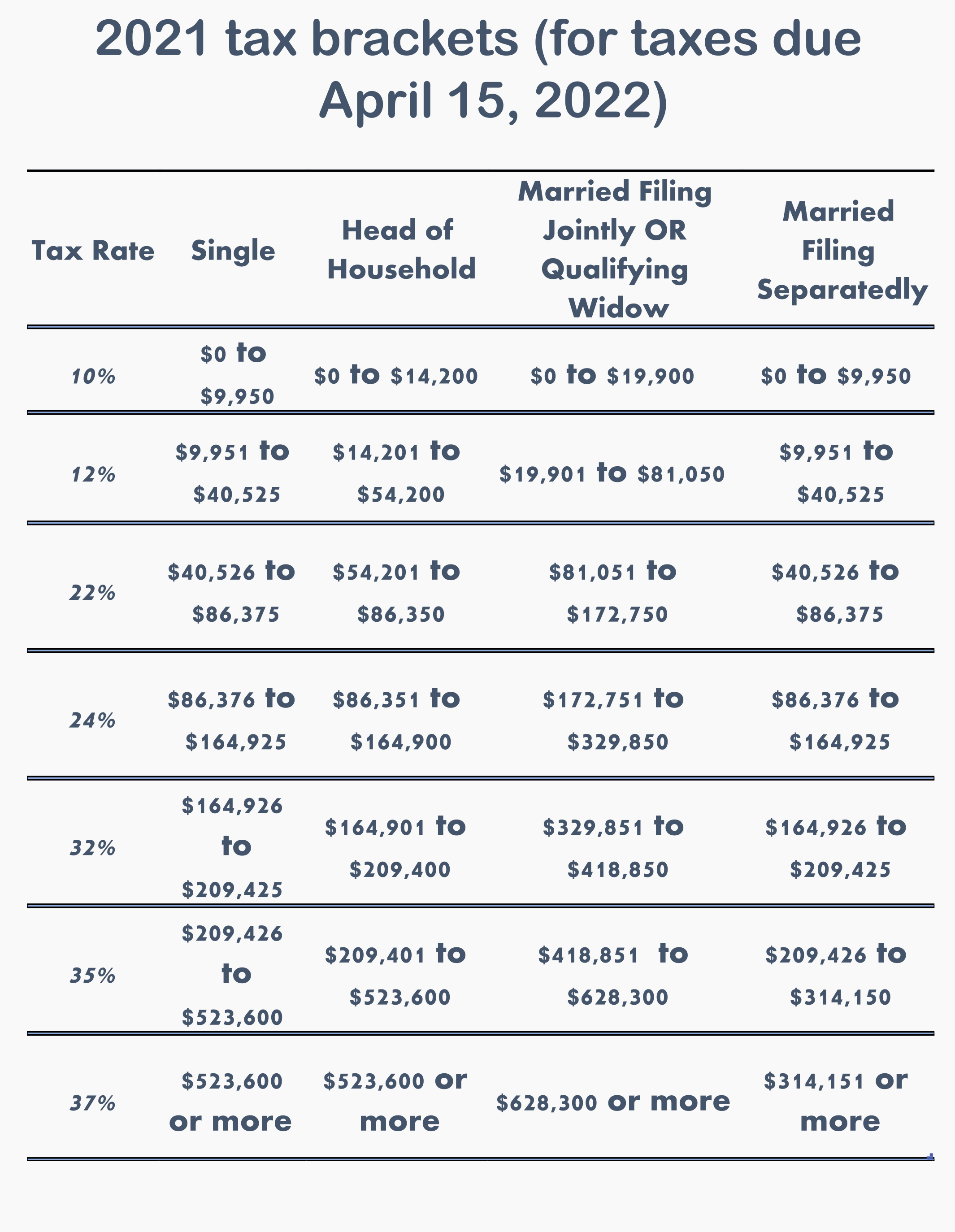

Federal Tax Rates 2022 Vs 2021 Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket depends on

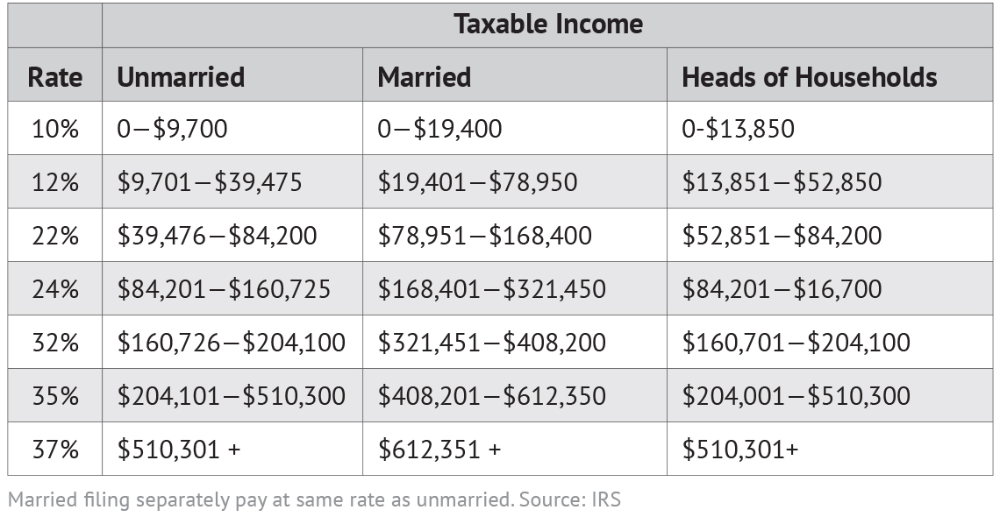

Nov 10 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes Revenue Procedure 2021 45 provides details about these annual adjustments There are seven brackets with progressive rates ranging from 10 up to 37 and they are the same over all three years Federal income tax rate brackets are indexed for inflation The brackets are adjusted using the chained Consumer Price Index CPI

Federal Tax Rates 2022 Vs 2021

Federal Tax Rates 2022 Vs 2021

Federal Tax Rates 2022 Vs 2021

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Jan 21 2022 nbsp 0183 32 Tax brackets are how the IRS determines which income levels get taxed at which federal income tax rates The higher the income you report on your tax return the higher your tax rate There are seven tax brackets for most ordinary income for the 2021 tax year 10 12 22 24 32 35 and 37

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve effort and time by supplying a ready-made format and layout for producing different sort of material. Templates can be utilized for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Federal Tax Rates 2022 Vs 2021

IRS Tax Charts 2021 Federal Withholding Tables 2021

2022 Tax Brackets Irs Calculator

TaxTips ca Business 2022 Corporate Income Tax Rates

2022 Federal Tax Brackets And Standard Deduction Printable Form

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

2022 Tax Brackets Lashell Ahern

https://www.ntu.org › publications › detail

Nov 12 2021 nbsp 0183 32 The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code See below for how these 2022 brackets compare to 2021 brackets

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

https://taxfoundation.org › data › all › federal

Oct 27 2020 nbsp 0183 32 In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly

https://www.irs.gov › filing › federal-income-tax-rates-and-brackets

See current federal tax brackets and rates based on your income and filing status

https://www.fidelity.com › insights › personal-finance

Depending on your taxable income you can end up in one of seven different federal income tax brackets each with its own marginal tax rate

Jan 4 2023 nbsp 0183 32 Tax rates and brackets fall into two categories that are often confused average tax rate and marginal tax rate Your average tax rate is the percentage of your overall income that you pay in taxes Say your taxable income is 50 000 and you owe 6 000 of that money in taxes to the U S government Nov 11 2021 nbsp 0183 32 Basic tax rates have not changed for 2022 although income levels brackets for each rate have Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket

Jun 8 2022 nbsp 0183 32 Social Security and Medicare tax rates are respectively 12 4 and 2 9 of earnings In 2022 Social Security taxes are levied on the first 147 000 of wages Medicare taxes are assessed against all wage income Federal excise taxes are levied on specific goods such as transportation fuels alcohol and tobacco