Federal Tax Rates 2022 Married Filing Separately WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your

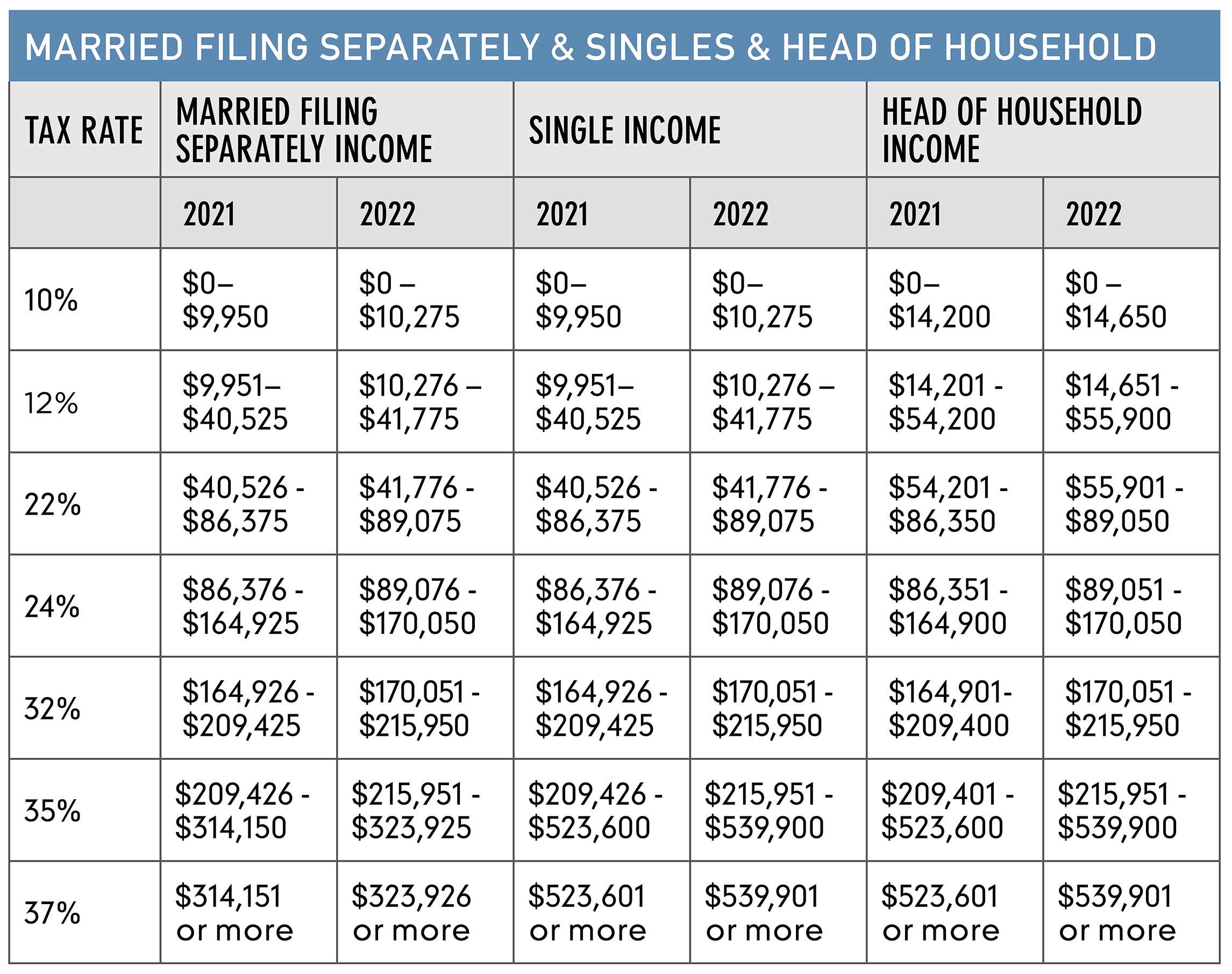

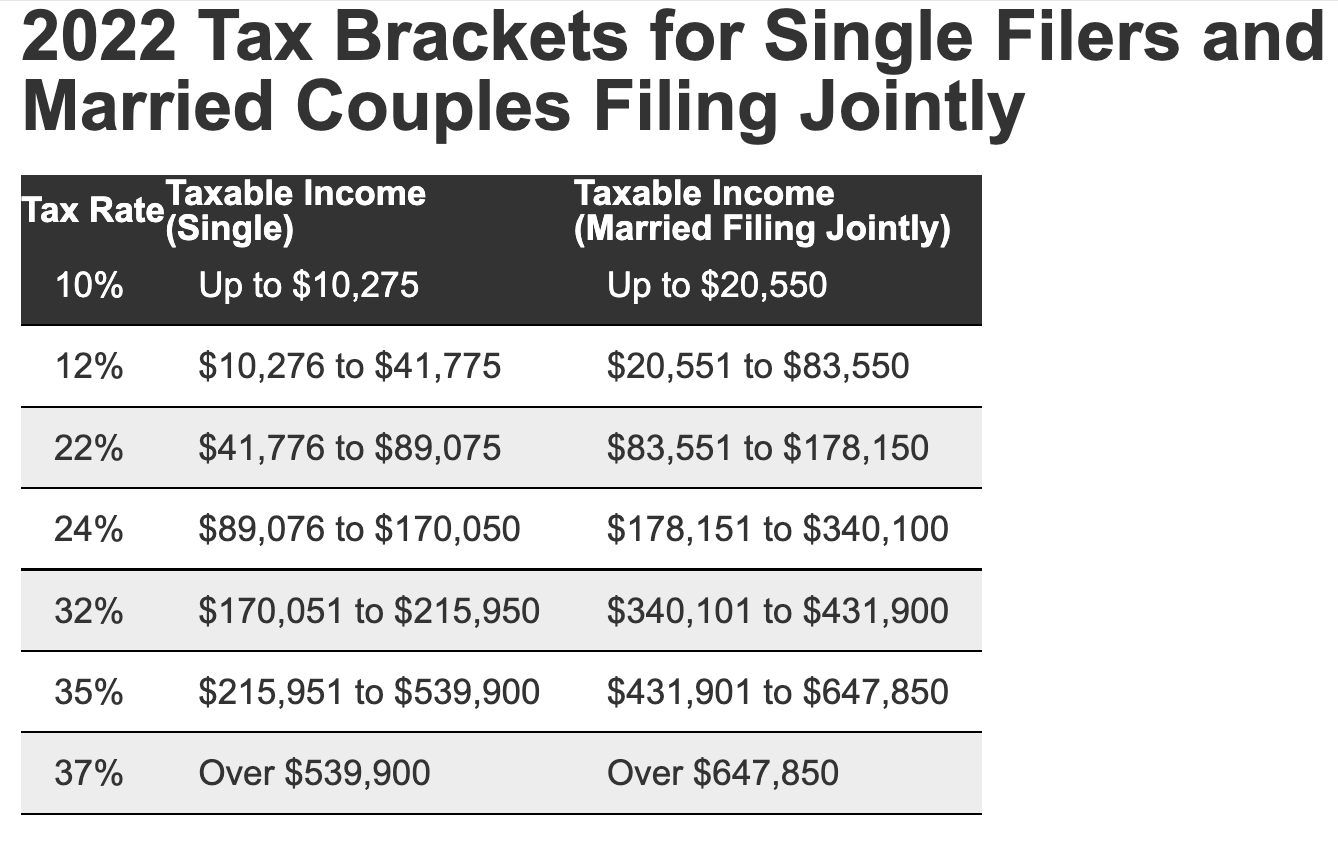

WEB Nov 11 2021 nbsp 0183 32 For single filers and married individuals who file separately the standard deduction will rise by 400 from 12 550 to 12 950 For heads of households the standard deduction will be WEB Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

Federal Tax Rates 2022 Married Filing Separately

Federal Tax Rates 2022 Married Filing Separately

Federal Tax Rates 2022 Married Filing Separately

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for

Pre-crafted templates use a time-saving option for developing a diverse series of files and files. These pre-designed formats and designs can be made use of for various personal and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the content creation procedure.

Federal Tax Rates 2022 Married Filing Separately

2022 Tax Brackets Single Head Of Household Printable Form Templates

10 2023 California Tax Brackets References 2023 BGH

Capital Gains Tax Rate 2021 And 2022 Latest News Update

2022 Tax Brackets Irs Married Filing Jointly Dfackldu

What Are The Income Tax Brackets For Long Term Capital Gains Post

2022 Tax Brackets Lashell Ahern

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Use tab to go to the next focusable element Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the Related

https://www.irs.gov/newsroom/irs-provides-tax...

WEB Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www.tax-brackets.org/federaltaxtable/...

WEB Tax Bracket Tax Rate 0 00 10 11 600 00 12 47 150 00 22 100 525 00 00 37 eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes File Now with TurboTax What is the Married Filing

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads of Households 10 0 to 10 275 0 to 20 550 0 to 14 650 12 10 275 to 41 775 20 550 to 83 550 14 650 to

https://bradfordtaxinstitute.com/Free_Resources/...

WEB Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1 Married Individuals Filing Joint Returns amp Surviving Spouses Heads of Households

WEB Jul 5 2023 nbsp 0183 32 When deciding how to file your federal income tax return as a married couple you have two filing status options married filing jointly or married filing separately Each choice has WEB Jan 18 2022 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately Standard Deductions amp

WEB Apr 1 2024 nbsp 0183 32 The lowest tax rate in 2022 is 10 applicable to filers with the lowest income bracket On the other hand the highest earners per filing status have a tax rate of 37 Use the tables below to see how the total tax owed varies per