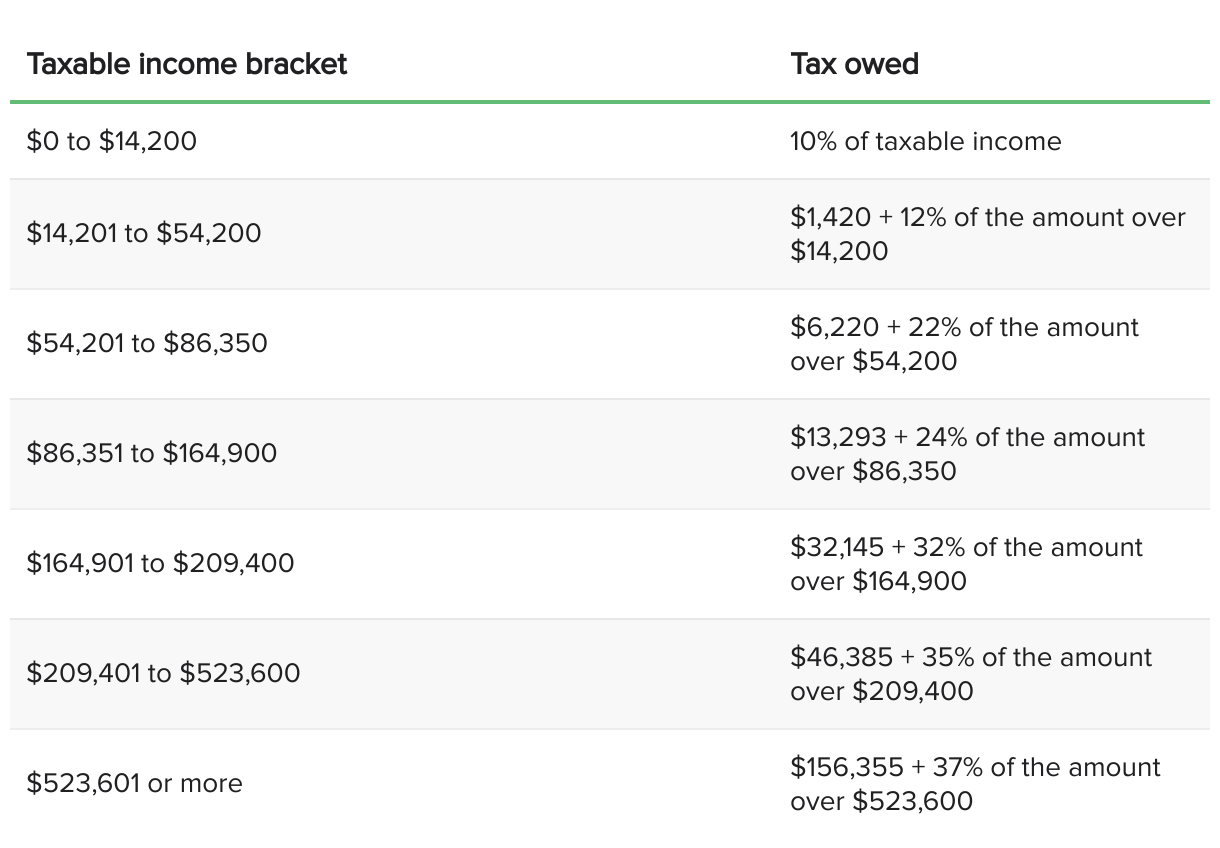

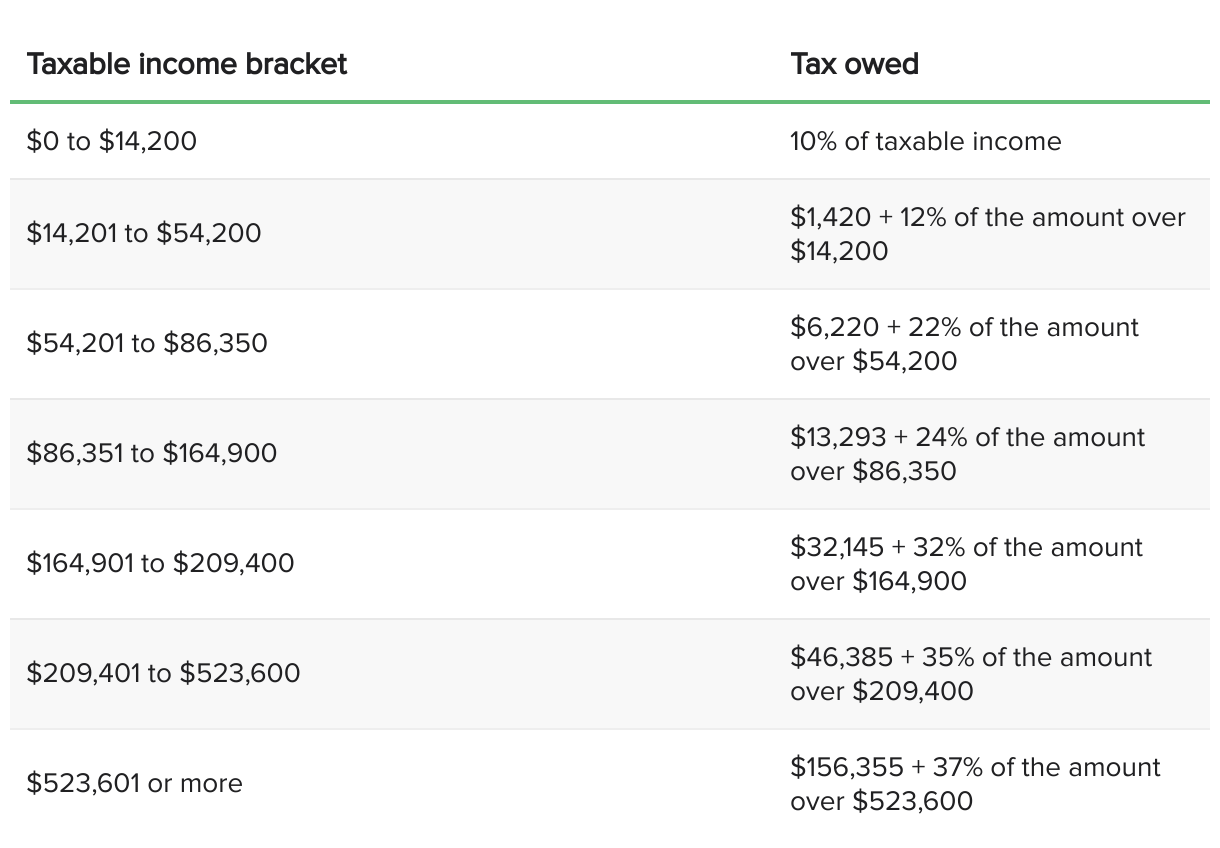

Federal Tax Rates 2022 Married Filing Jointly WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits

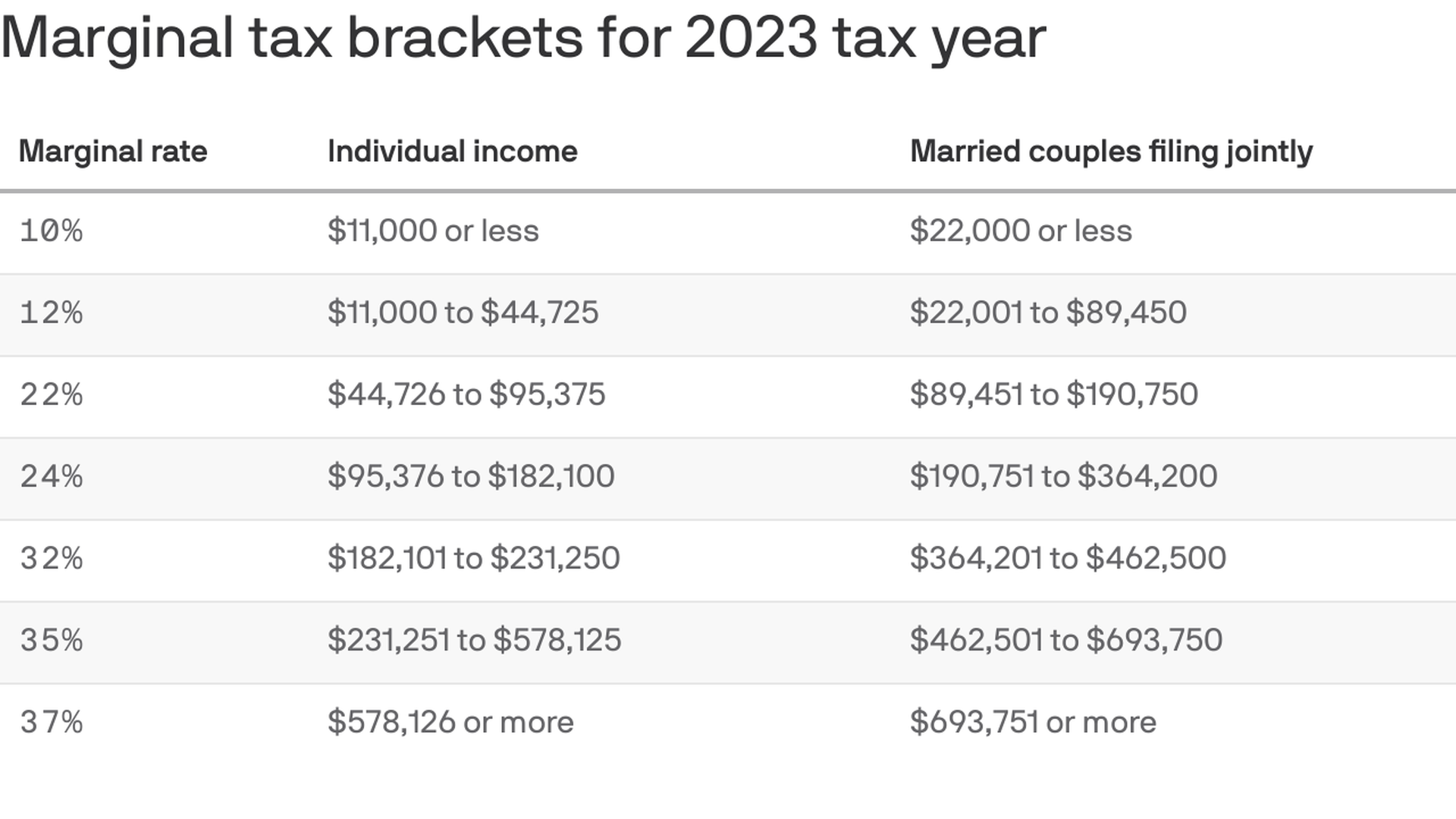

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 WEB Federal Married Filing Jointly Tax Brackets TY 2023 2024 What is the Married Filing Jointly Income Tax Filing Type Married Filing Jointly is the filing type used by

Federal Tax Rates 2022 Married Filing Jointly

Federal Tax Rates 2022 Married Filing Jointly

Federal Tax Rates 2022 Married Filing Jointly

https://img.datawrapper.de/b3zqU/plain.png

WEB Jan 27 2023 nbsp 0183 32 Married filing jointly or qualifying widow er with dependent child 250 000 or more Single or head of household 200 000 or more Married filing separately 125 000 or more

Pre-crafted templates provide a time-saving option for developing a diverse range of documents and files. These pre-designed formats and layouts can be used for different personal and expert projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, simplifying the material creation procedure.

Federal Tax Rates 2022 Married Filing Jointly

10 2023 California Tax Brackets References 2023 BGH

Incredible Us Tax Brackets 2021 References Finance News

2022 Tax Brackets Lashell Ahern

2022 Paye Tax Tables Brokeasshome

Federal Income Tax Rate 2020 21 Tax Brackets 2020 21

IRS Announces 2022 Tax Rates Standard Deduction

https://www.irs.com/en/2022-federal-income-tax...

WEB Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Page Last Reviewed or Updated 18 Mar 2024 See current federal tax brackets and rates based on your income and filing status

https://www.irs.gov/pub/irs-prior/i1040tt--2022.pdf

WEB married filing jointly and read down the column The amount shown where the taxable income line and filing status column meet is 2 628 This is the tax amount they should

https://www.investopedia.com/irs-announces-tax...

WEB Nov 11 2021 nbsp 0183 32 For 2022 the maximum zero rate taxable income amount will be 83 350 for married couples filing jointly and for surviving spouses The amount for heads of

WEB Calculator 2023 Estimate your 2023 taxable income for taxes filed in 2024 with our tax bracket calculator Want to estimate your tax refund Use our Tax Calculator How Many WEB Feb 21 2024 nbsp 0183 32 Knowing your federal tax bracket is essential as it determines your federal income tax rate for the year There are seven different income tax rates 10 12 22

WEB Income tax If taxable income is over But not over The tax is Of the amount over Married Filing jointly and qualifying widow er s 0 20 550 0 00 10 0 20 550