Federal Tax Rates 2022 Business Web May 18 2022 nbsp 0183 32 What is the small business federal tax rate The amount of taxes small businesses have to pay to the federal government depends on several factors Your

Web Dec 29 2023 nbsp 0183 32 Janet Berry Johnson Edited by Kurt Adams Janet Schaaf Updated on December 29 2023 Why use LendingTree Small business taxes can be complicated as there isn t a single tax form or even a single Web Jan 15 2022 nbsp 0183 32 Corporate income tax rates for active business income 2022 Includes all rate changes announced up to January 15 2022 Saskatchewan7 Rates represent

Federal Tax Rates 2022 Business

Federal Tax Rates 2022 Business

Federal Tax Rates 2022 Business

https://files.taxfoundation.org/20220202142849/2022-sales-taxes-including-2022-sales-tax-rates-2022-state-and-local-sales-tax-rates-1200x1033.png

Web January 29 2024 Business Taxes Top marginal tax rate and income bracket for corporations

Templates are pre-designed documents or files that can be utilized for various purposes. They can conserve time and effort by supplying a ready-made format and design for producing various sort of material. Templates can be utilized for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Federal Tax Rates 2022 Business

2022 Tax Brackets Irs Calculator

IRS Tax Charts 2021 Federal Withholding Tables 2021

2022 Federal Tax Brackets And Standard Deduction Printable Form

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 2023 Tax Rates Federal Income Tax Brackets Top Dollar

https://www.irs.gov/publications/p542

Web For tax years beginning after 2022 the Inflation Reduction Act of 2022 amended section 55 of the Internal Revenue Code to impose a new corporate alternative minimum tax

https://taxfoundation.org/research/all/federal/...

Web Feb 24 2021 nbsp 0183 32 An increase in the federal corporate tax rate to 28 percent would raise the U S federal state combined tax rate to 32 34 percent highest in the OECD and among

https://en.wikipedia.org/wiki/Corporate_tax_in_the_United_States

Web Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 following the passage of the Tax Cuts and Jobs Act of 2017

https://www.irs.gov/publications/p334

Web SE tax rate The SE tax rate on net earnings is 15 3 12 4 social security tax plus 2 9 Medicare tax

https://taxfoundation.org/data/all/state/combined...

Web Sep 27 2022 nbsp 0183 32 The state with the highest combined state and federal corporate tax rate is New Jersey at 30 1 percent Corporations in Alaska California Illinois Iowa Maine

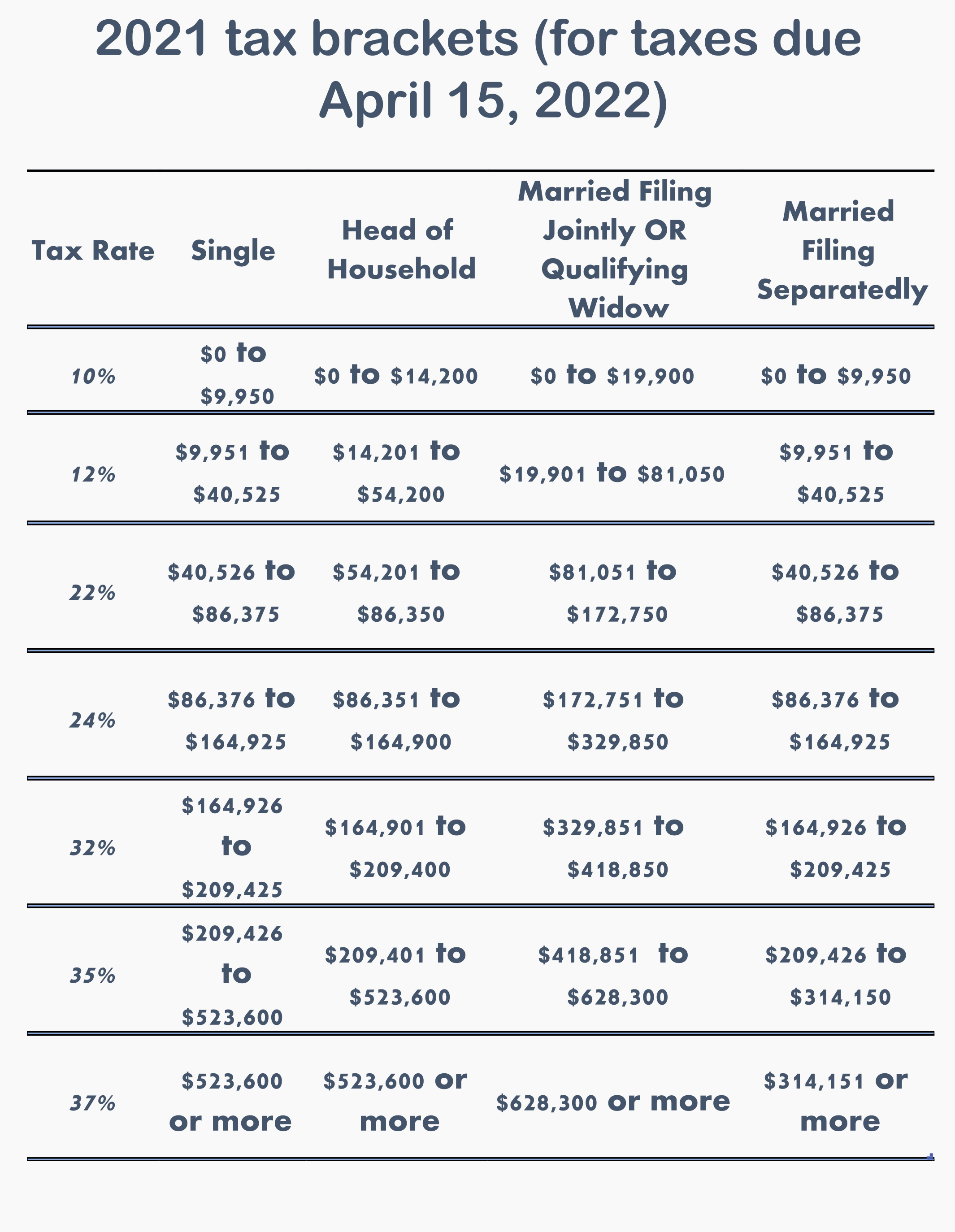

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal Web Jun 1 2022 nbsp 0183 32 Corporate income tax rates for active business income 2022 Includes all rate changes announced up to June 1 2022 Rates represent calendar year rates unless

Web Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates