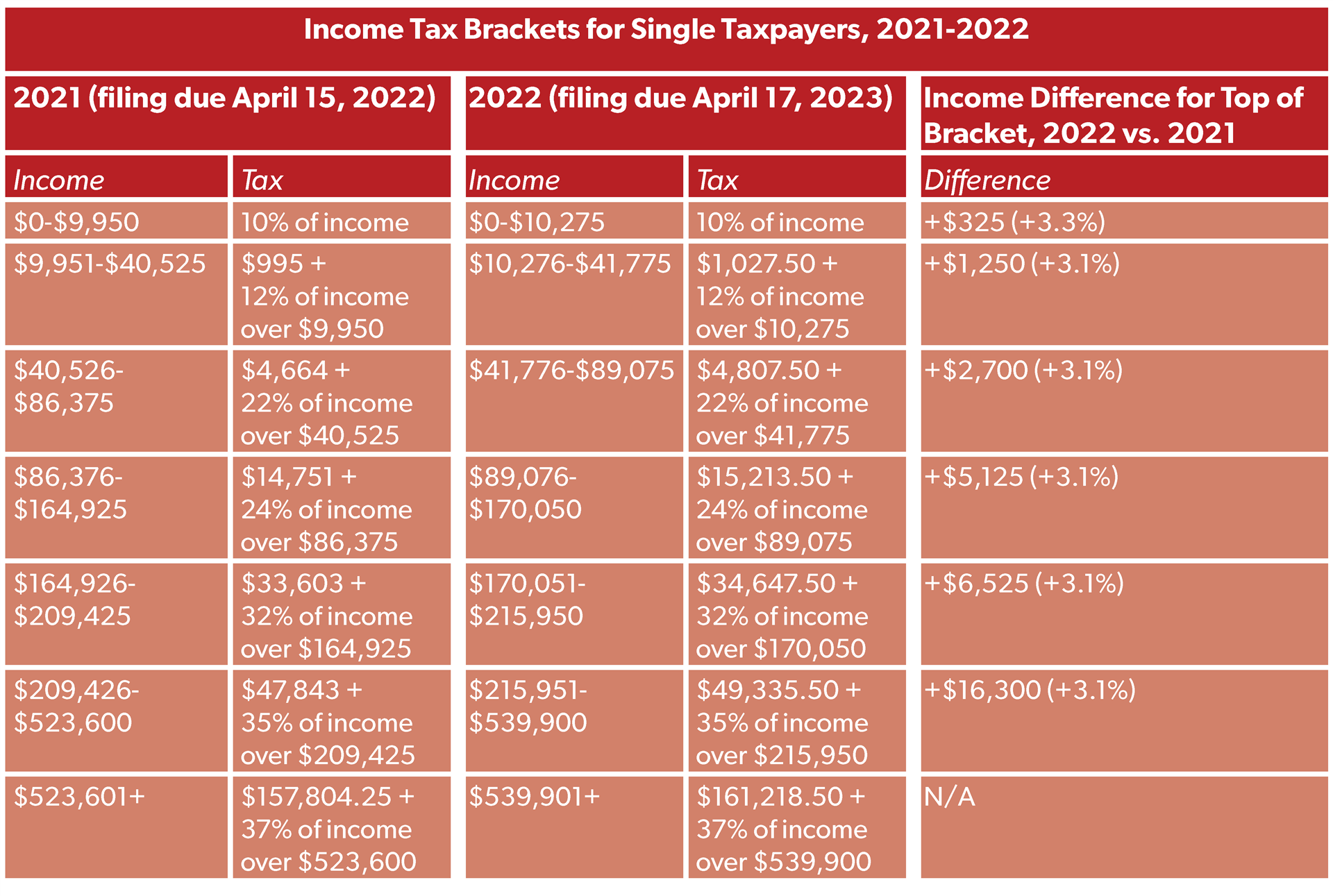

Federal Tax Brackets For 2022 Single Federal tax rate brackets Year 2022 The U S federal income tax system is progressive This means that income is taxed in layers with a higher tax rate applied to each layer Below are

The maximum Earned Income Tax Credit EITC in 2022 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 733 for one child 6 164 for two This page shows Tax Brackets s archived Federal tax brackets for tax year 2022 This means that these brackets applied to all income earned in 2022 and the tax return that uses these tax

Federal Tax Brackets For 2022 Single

Federal Tax Brackets For 2022 Single

Federal Tax Brackets For 2022 Single

https://hkglcpa.com/wp-content/uploads/2022/10/2022-Tax-Brackets-for-Single-Filers-and-Married-Couples-Filing-Jointly.png

2022 Tax Tables Individual Married Joint Head of Household Widower tax tables with annual deductions exemptions and tax credit amounts

Templates are pre-designed files or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and design for developing various type of content. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Federal Tax Brackets For 2022 Single

Capital Gains Tax Rate 2021 And 2022 Latest News Update

2022 Tax Brackets Lashell Ahern

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets PersiaKiylah

2022 Federal Tax Brackets And Standard Deduction Printable Form

2022 Paye Tax Tables Brokeasshome

https://www.irs.com › en

Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head

https://www.irs.gov › pub › irs-prior

Sep 27 2022 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040

https://www.cnbc.com

Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday as well as the new standard deduction

https://bradfordtaxinstitute.com › Free_Resources

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals

https://wealthvogue.com

There are seven federal tax brackets for the 2022 tax year 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income

There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit Nov 10 2021 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard

Oct 10 2022 nbsp 0183 32 Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10 275 is 10 percent and for joint married filers is 10 percent tax on income up